Crypto Shorting Explained: A Beginner's Guide to Profiting in a Bear Market

In the world of crypto, the mantra is usually "buy low, sell high." But what if you could flip that script? What if you could profit when prices are falling? Welcome to the world of crypto shorting.

While most investors are waiting for a bull run, a sophisticated group of traders uses falling prices to their advantage. Crypto shorting, or short-selling, is a powerful strategy for profiting during a bear market, but it comes with significant risks.

This guide will break down exactly what crypto shorting is, the easiest way to do it, the high-stakes risks involved, and how you can get started.

TL;DR: Crypto Shorting Explained

● Crypto shorting is a trading strategy where you profit from a cryptocurrency's price going down. You borrow a coin, sell it immediately, and buy it back later at a lower price to pocket the difference.

● What's the easiest way to short Bitcoin right now? The easiest and most common methods are through margin trading or by trading futures contracts on a major cryptocurrency exchange like Bitget. These platforms consolidate the entire process into a few clicks.

● Which platforms let you short crypto with the least risk? The safest platforms are those that provide robust risk management tools. Look for exchanges that offer flexible margin modes, easy-to-set stop-loss orders, and a demo account for risk-free practice.

● The critical risk of crypto shorting: Your potential profits are capped, but your potential losses are unlimited because there is no ceiling on how high a price can rise.

● Who is it for? This is an advanced strategy due to its complexity and high risk of significant financial loss. A stop-loss order is essential for every short trade.

What is Crypto Shorting?

The act of crypto shorting – also commonly referred to as “short-selling” – takes an opposite position of those buying and holding cryptocurrencies and waiting for its price to rise. In bear markets, prices go downwards, and short-sellers take advantage of this to profit by first borrowing a sum of cryptocurrencies and immediately selling them at their current price. Because shorting positions predict that prices will continue to fall, short-sellers will then wait until prices are lower to buy back the sum they owe the lender and return it.

How you can profit with crypto shorting:

1. Borrow: You borrow a crypto (like Bitcoin) that you believe will decrease in value.

2. Sell: You immediately sell the borrowed crypto at its current high price.

3. Wait: You wait for the price to drop as you predicted.

4. Buy back: You buy back the same amount of crypto at the new, lower price.

5. Return & Profit: You return the crypto to the lender and keep the difference as your profit.

This strategy allows traders and even crypto miners—who may short to hedge against price drops and cover their mining costs—to make money even when the market is pessimistic.

Risks of crypto shorting:

We will discuss the risks of crypto shorting more details in the next part, but here is a sneak peek:

Mathematically, unlike long positions, where losses are capped, and earnings can be infinite, short positions have these traits reversed. Because you’re predicting the price to fall, the most it can drop to is $0, meaning your potential profits are capped at 100%. On the other hand, because the maximum price of a cryptocurrency is infinite, your exposure to losses is, therefore, also infinite. If you’re using margin trading, your risk exposure will also increase significantly.

What's the Easiest Way to Short Bitcoin Right Now?

For most traders, the easiest and most direct way to short Bitcoin is through margin trading on exchanges like Bitget. This method allows you to borrow, sell, and buy back the asset all on one platform.

Another very common way to short is by trading crypto derivatives, such as Bitget Futures. With these, you are speculating on the future price of Bitcoin without ever owning the underlying asset. A "short" futures contract increases in value as Bitcoin's price falls.

3 easy steps to short Bitcoin on Bitget

Step 1 - Login to your Bitget account (Don't have an account yet? Sign up here);

Step 2 - If you trade futures, then transfer funds from your Bitget Spot account to your Bitget Futures account;

Step 3 - Head to the BTC futures / BTC margin page and place your short order.

The High-Stakes Game: Understanding the Risks of Crypto Shorting

While the process sounds simple, and the profit potential is clear, crypto shorting is a high-risk strategy. Here’s why:

1. Capped Profits vs. Unlimited Losses

● Capped profits: When you short a crypto, the most its price can fall to is $0. This means your maximum possible profit is capped at the price you sold it for. For example, you borrow one Bitcoin at $80,000 and sell it immediately. BTC subsequently drops to $60,000, and you decide to buy one back to return to the lender. Your profit will then be $20,000 minus transaction fees.

● Unlimited losses: There is no limit to how high a cryptocurrency's price can rise. If you short BTC at $50,000 and it unexpectedly surges to $100,000, you are already at a $50,000 loss—and it could keep climbing, exposing you to theoretically infinite losses.

2. Margin Calls and Liquidation

Shorting is typically done via margin trading, where you borrow funds from an exchange. This amplifies both gains and losses.

● Margin call: If the price moves against you (i.e., it goes up), the exchange will issue a "margin call," demanding you add more funds to your account to cover your potential loss.

● Liquidation: If you fail to meet a margin call or your losses exceed a certain threshold, the exchange will automatically close your position to prevent further losses. This is called liquidation, and it means you lose your collateral.

Which Platforms Let Me Short Cryptocurrency with the Least Risk?

With the inherent risks of crypto shorting in mind, the next logical question is: Which platforms let me short cryptocurrency with the least risk?

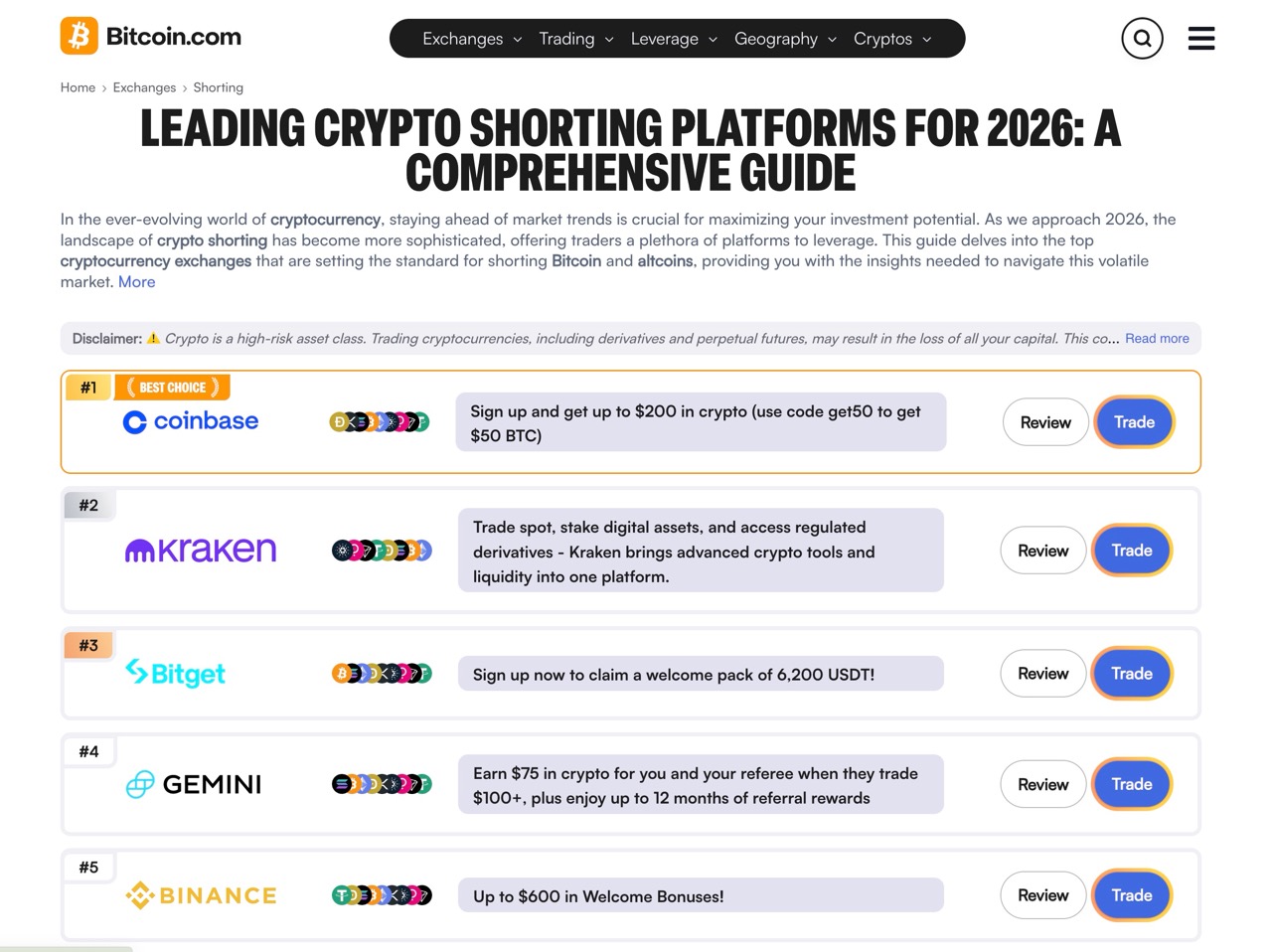

The crucial thing to understand is that no platform can eliminate risk. Instead, the best platforms provide robust tools to help you manage that risk effectively. To help you choose, we’ve compared four industry leaders known for their robust derivatives offerings, focusing on security, margin options, and regulatory standing.

Comparison: Top Crypto Shorting Platforms for 2026

| Platform |

Key Features & Strengths |

Maximum Leverage |

Security & Trust Signals |

Ideal For |

| Coinbase |

• Publicly Traded (NASDAQ: COIN). • Exceptionally user-friendly interface. • Coinbase Earn rewards users for learning. |

Up to 50x (on derivatives via Coinbase International Exchange) |

• Industry-leading security practices. • Custodial insurance for USD balances. • Transparent and highly regulated in the US. |

US-based beginners who prioritize regulatory compliance and ease of use above all else. |

| Kraken |

• One of the oldest & most respected exchanges (since 2011). • Kraken Pro for advanced trading. • Offers staking and a wide asset selection. |

Up to 50x (on futures contracts) |

• Proof of Reserves (PoR) audits. • Regulated as a US Special Purpose Depository Institution (SPDI) in Wyoming. • Strong reputation for security and reliability. |

Security-conscious traders looking for a reliable, regulated platform with a long, proven track record. |

| Bitget |

• Launched the industry's first USDT-margined futures and was the first to support USDC as margin. • Industry-leading Copy Trading feature. • Massive selection of cryptocurrencies. • High-performance platform built for quick execution. |

Up to 125x |

• Protection Fund & Proof of Reserves (PoR). • Multi-signature wallets & advanced encryption. • Holds licenses in numerous countries. |

Global traders seeking advanced features, high leverage, and innovative tools. |

| Gemini |

• "Security-first" exchange widely available in the US. • ActiveTrader platform for advanced users. • Strong emphasis on institutional-grade compliance. |

Up to 5x (for margin trading) |

• SOC 1 & SOC 2 Certified (for Gemini Custody). • Regulated by the strict NYDFS. • Founded by the Winklevoss twins. |

Institutions and traders who require the absolute highest level of security and regulatory assurance. |

| Binance |

• World's largest exchange by trading volume. • Massive selection of cryptocurrencies. • Comprehensive ecosystem with Binance Earn & Launchpool. |

Up to 125x |

• SAFU Fund. • Proof of Reserves (PoR). • Holds licenses in numerous countries. |

Non-US traders who prioritize the deepest liquidity and the widest possible selection of trading pairs. |

This comparison reveals a clear divide in the market. On one side, you have highly regulated, US-centric platforms like Coinbase, Kraken, and Gemini, which prioritize compliance and security, often with more conservative leverage options. On the other side are global derivatives giants like Binance and Bitget, which offer higher leverage, a wider array of features, and a history of market-leading innovation. Your choice depends entirely on your priorities.

If you are a global trader seeking advanced functionality and innovation, a platform like Bitget offers a compelling advantage. As a pioneer in the derivatives space—having launched the industry's first USDT-margined futures—its focus on user-centric tools is clear. Its industry-leading Copy Trading system provides a powerful gateway into derivatives, while its vast asset selection and robust Protection Fund make it a top choice for those looking to expand beyond basic shorting.

Regardless of your choice, it is essential to use a Demo Trading Account—a feature offered by top platforms like Bitget—to practice your strategy before risking real capital.

Why Bitget?

● Robust risk management tools: Bitget’s design makes all the difference here. For example, Bitget allows users to switch between Isolated Margin and Cross Margin modes. This lets you either wall off the risk to a single trade (protecting the rest of your portfolio) or use your entire account balance to support all open positions and prevent liquidation.

● Real-time and transparent systems: You need accurate data to make quick decisions. Bitget settles profits and losses in real-time, gives you a constantly updated and precise picture of your account's health. Furthermore, in the event of a margin call, Bitget provides clear options to minimize losses—such as deleveraging or selectively canceling orders—giving you more control when you need it most.

● High liquidity and volume: A platform with high liquidity ensures that you can enter and exit trades quickly at your desired price. As one of the top 3 global exchanges in terms of volume and liquidity, Bitget provides a reliable trading environment.

● Security and stability: Look for exchanges with a proven track record. Bitget is recognized as a leader in the crypto derivatives market, backed by top-tier security ratings (including 12 A+ ratings from SSL Labs and a top 10 cybersecurity ranking from CER). Moreover, the Bitget Protection Fund shows our commitment to protecting user assets and operating with transparency and integrity.

● Educational resources and demo accounts: Before risking real capital, practice is essential. Bitget offers educational resources, like Bitget Academy, Bitget Help Center, and Demo Trading Account allow you to experience trading with zero risk.

Top Beginner-Friendly Trading Strategies to Profit in a Bear Market

Shorting isn't the only way to navigate a downturn. Here are a few other strategies to consider:

● Buying the Dip (DCA): Instead of betting against the market, you can use Dollar-Cost Averaging (DCA) to buy assets at progressively lower prices. The DCA is one of the best trading strategies for beginners. You can automate this discipline with Bitget’s DCA toolkit: Recurring Buy, Spot Auto-Invest+, Spot Martingale.

● Trading ranges: In a bear market, prices often bounce between a support and a resistance level. Tools like Bitget Grid Trading can automate this process.

● Arbitrage: This involves finding small price discrepancies for the same asset on different exchanges and profiting from the difference.

● Diversification: Never put all your eggs in one basket. A balanced portfolio can help mitigate losses.

Conclusion: A Powerful Tool for the Prepared Trader

Crypto shorting is a powerful strategy that allows savvy traders to find opportunity in any market condition. However, its potential for unlimited losses makes it a double-edged sword that should be handled with extreme care. Before attempting your first short, make sure you have done extensive research, practiced on a demo account, and have a rock-solid risk management plan—starting with a stop-loss on every single trade.

Understand the risks and ready to proceed? Sign up and create a short trade on Bitget today!

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

- Best Crypto Trading Strategies for Beginners2026-01-27 | 5m