A Quick Guide to Understanding Stock Futures

[Estimated reading time: 5 mins]

Stock futures are Bitget's innovative perpetual futures based on tokenized real-world asset (stock) indices. The underlying asset is a composite index of tokenized shares of U.S. stocks that are already circulating in the market. Each index includes at least one stock token and may combine tokens from multiple issuers. Bitget calculates and publishes the index weights according to trading volume and liquidity. For example, NVDA RWA perpetual futures on Bitget may track a composite index made up of NVDA stock tokens issued by xStock, ONDO, and others. Trading is available 24 hours a day, five days a week.

Bitget may add or remove tokens or markets from the index based on market activity and trading volume, and will update the index sources as needed.

Key difference between stock futures and perpetual futures

|

Feature

|

Stock futures

|

USDT perpetual futures

|

|

Trading period

|

24/5, Monday 12:00 AM to Saturday 12:00 AM (UTC–0). Stock futures trading may be suspended during special periods, with users notified separately.

|

24/7

|

|

Settlement currency

|

USDT

|

USDT

|

|

Quote currency

|

USDT

|

USDT

|

|

Underlying asset

|

Composite index of tokenized assets issued across multiple platforms (multi-token index)

|

A single designated token

|

|

Position mode

|

Isolated margin, cross margin, and unified trading account

|

Isolated margin, cross margin, and unified trading account

|

|

Max leverage

|

25x

|

125x

|

|

Index price

|

Composite index of token prices from markets such as xStock and ONDO

|

Spot market price of the designated token

|

|

Mark price

|

Standard method

|

Standard method

|

|

Open interest (OI) limits

|

Both individual and platform-wide OI limits apply

|

Individual OI limits only

|

|

Funding rate

|

Every 4h

|

Every 1h, 2h, 4h, or 8h

|

Risk management in stock futures

Liquidation mechanism

1. Same as conventional futures: liquidation risk is determined by the liquidation price or margin ratio.

2. Positions are not liquidated while the market is closed. However, if the underlying asset opens significantly higher or lower when trading resumes, users may face liquidation. Traders are advised to monitor prices and add margin before the market reopens.

Insurance fund

1. Each stock futures has auto-deleveraging (ADL) enabled by default. At launch, 50,000 USDT is allocated to the initial risk fund.

2. ADL is triggered once the insurance fund balance drops to zero.

Stock index calculation logic

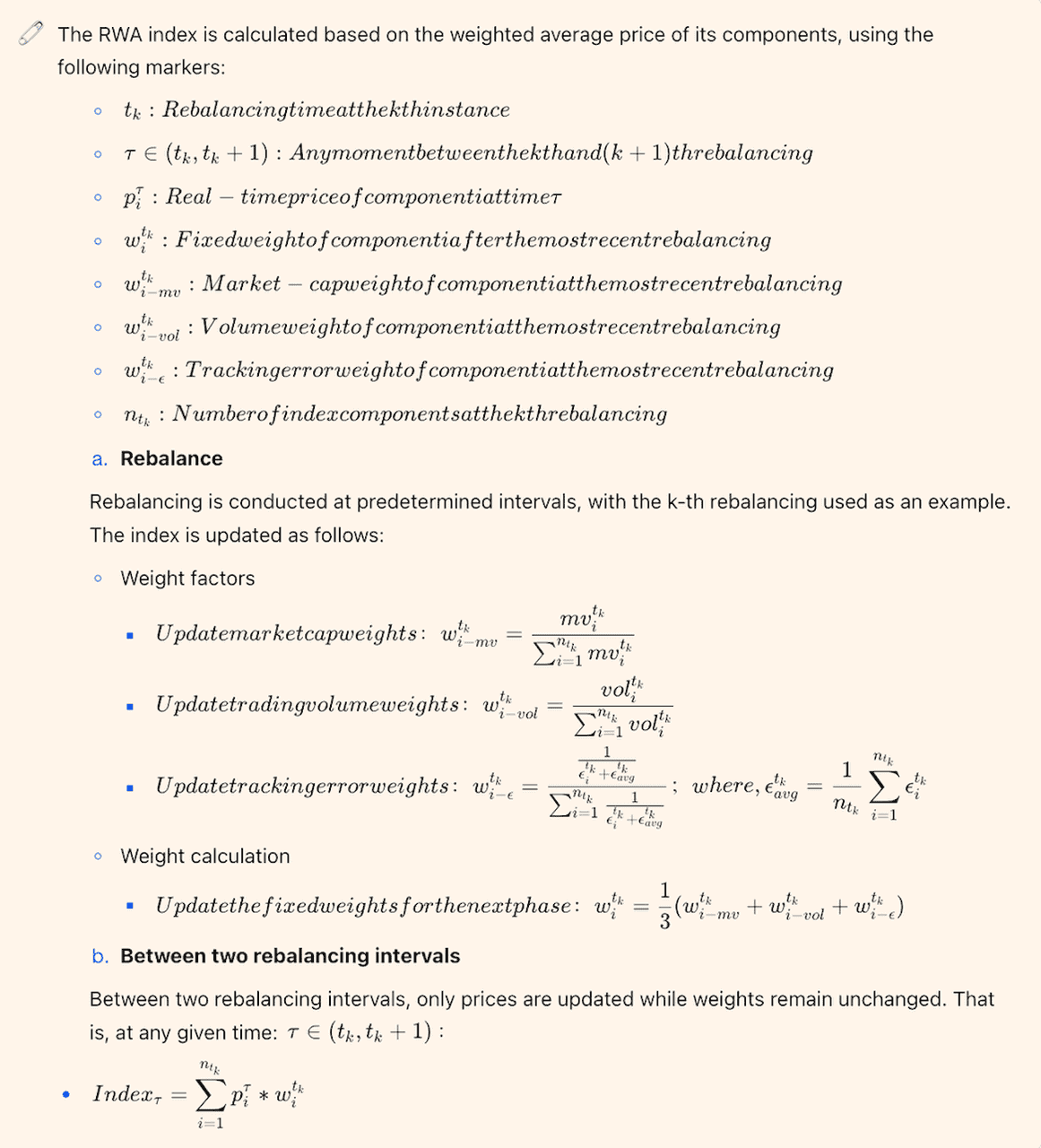

The stock index is a weighted composite based on the prices of circulating tokenized U.S. equity shares from multiple issuers. It reflects the weighted value of a basket of stock tokens for a given stock. The index does not directly track the underlying stock itself; instead, it serves as a pricing benchmark for tokenized stock assets.

Index rules

Components include USDT-quoted RWA tokens issued on platforms such as xStock and ONDO. The calculated index price serves as the anchor for stock futures pricing. Index weights are recalculated periodically (or upon rebalancing events), but stay constant until the next rebalance.

Index calculation

Index rebalancing

1. Regular rebalancing

The index components and their weights are rebalanced daily at 8:01:00 AM (UTC) to reflect market changes.

2. Special adjustments

Special adjustments are triggered when any component faces delisting, liquidity issues, or extreme volatility. These include:

• Removing the affected components and updating the weights and divisor.

• Replacing them with alternate components, with weights and divisor adjusted accordingly.

3. Hard forks/Airdrops/Token mapping adjustments

Adjustments to blockchain asset price indices in the event of hard forks, airdrops, or token mappings follow these principles:

• No adjustment is required for soft forks or for hard forks that do not generate new tokens.

• If a hard fork or airdrop generates new tokens, they are added to the index according to the original component weights. If the new tokens fail to meet the component selection criteria, they will be removed at the next scheduled rebalance.

• For components resulting from airdrops or token mappings, if a token split or reverse split occurs, the original component is replaced by the new token, with its weight adjusted to reflect the split ratio.

Important notes for trading stock futures

• To ensure fair pricing, Bitget stock futures are suspended on weekends (Sat–Sun) and may also be halted during certain special periods. Any additional suspensions will be announced in advance.

• Mark prices do not update while the market is closed, so positions cannot be liquidated during that time. However, if the underlying asset reopens with a significant price gap, positions may still be at risk of liquidation. Traders are advised to add margin beforehand to reduce this risk.

• During closures, users may cancel existing orders but cannot place new ones.

• Funding fees do not accrue during closures, so holding positions over these periods does not incur additional funding costs.

How to trade stock futures on Bitget

1. Stock futures are listed under the same product type as standard USDT futures. Users can search by ticker name or find them under the stock tab in USDT futures.

2. Stock futures are available on the website, app, and API.

FAQs

1. What are Bitget stock futures?

Stock futures on Bitget are perpetual futures based on tokenized real-world asset (RWA) stock indices. They track composite indices of tokenized U.S. stocks that are already circulating in the market.

2. How is the underlying asset for stock futures determined?

Each stock futures contract is based on a composite index of tokenized shares of stocks from multiple issuers. Bitget calculates index weights using trading volume and liquidity.

3. When can stock futures be traded?

Stock futures are available 24 hours a day, five days a week (from Monday 12:00 AM to Saturday 12:00 AM UTC–0). Trading may be suspended during special periods, with prior notice.

4. How do stock futures differ from standard USDT perpetual futures?

Key differences include: stock futures use a composite multi-token index as the underlying asset, have a maximum leverage of 25x, are traded 24/5, and have both individual and platform-wide open interest limits.

5. What is the liquidation mechanism for stock futures?

Liquidation is based on margin ratio or liquidation price. Positions are not liquidated when the market is closed, but a price gap on reopening may trigger liquidation. Adding margin before reopening can reduce risk.

6. What is the insurance fund and auto-deleveraging (ADL) in stock futures?

Each stock futures contract has an insurance fund with an initial allocation (e.g., 50,000 USDT). ADL may be triggered when the fund balance reaches zero to cover trading losses.

7. How does index rebalancing work?

Rebalancing occurs daily at 8:01 AM UTC or during special events such as delisting, liquidity issues, or extreme volatility. New components may be added or old ones replaced, with weights and divisors adjusted.

Disclaimer and Risk Warning

All trading tutorials provided by Bitget are for educational purposes only and should not be considered financial advice. The strategies and examples shared are for illustrative purposes and may not reflect actual market conditions. Cryptocurrency trading involves significant risks, including the potential loss of your funds. Past performance does not guarantee future results. Always conduct thorough research and understand the risks involved. Bitget is not responsible for any trading decisions made by users.

Join Bitget, the World's Leading Crypto Exchange and Web3 Company

Share