Bitget: Ranked top 4 in global daily trading volume!

BTC dominance57.97%

Current ETH GAS: 0.1-1 gwei

Hot BTC ETF: IBIT

Bitcoin Rainbow Chart : Accumulate

Bitcoin halving: 4th in 2024, 5th in 2028

BTC/USDT$67109.04 (+3.75%)Fear and Greed Index14(Extreme fear)

Altcoin season index:0(Bitcoin season)

Total spot Bitcoin ETF netflow -$27.5M (1D); +$709.7M (7D).Welcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app.Download now

Bitget: Ranked top 4 in global daily trading volume!

BTC dominance57.97%

Current ETH GAS: 0.1-1 gwei

Hot BTC ETF: IBIT

Bitcoin Rainbow Chart : Accumulate

Bitcoin halving: 4th in 2024, 5th in 2028

BTC/USDT$67109.04 (+3.75%)Fear and Greed Index14(Extreme fear)

Altcoin season index:0(Bitcoin season)

Total spot Bitcoin ETF netflow -$27.5M (1D); +$709.7M (7D).Welcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app.Download now

Bitget: Ranked top 4 in global daily trading volume!

BTC dominance57.97%

Current ETH GAS: 0.1-1 gwei

Hot BTC ETF: IBIT

Bitcoin Rainbow Chart : Accumulate

Bitcoin halving: 4th in 2024, 5th in 2028

BTC/USDT$67109.04 (+3.75%)Fear and Greed Index14(Extreme fear)

Altcoin season index:0(Bitcoin season)

Total spot Bitcoin ETF netflow -$27.5M (1D); +$709.7M (7D).Welcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app.Download now

Fidelity Wise Origin Bitcoin Fund

FBTC

Learn more about Fidelity Wise Origin Bitcoin Fund's (FBTC) price performance, volume, premium rate, inflows and outflows, and other key data indicators.

FBTC price today and history

$57.15 -1.59 (-2.71%)

1D

7D

1Y

Open price$57.58

Day's high$57.81

Close price$57.15

Day's low$56.72

YTD % change-26.17%

52-week high$110.25

1-year % change-31.4%

52-week low$54.21

The latest price of FBTC is $57.15 , with a change of -2.71% in the last 24 hours. The 52-week high for FBTC is $110.25 , and the 52-week low is $54.21 .

Today's FBTC premium/discount to NAV

Shares outstanding216.5M FBTC

BTC holdings238.27K BTC

NAV per share$57.12

BTC change (1D)

0.00 BTC(0.00%)

Premium/Discount-0.17%

BTC change (7D)

0.00 BTC(0.00%)

FBTC volume

Volume (FBTC)3.15M (FBTC)

10-day average volume (FBTC)61.08K (FBTC)

Volume (USD)$180.63M

10-day average volume (USD)$3.49M

FBTC net flow

| Time (UTC) | Net flow (USD) | Net flow (BTC) |

|---|---|---|

2026-02-27 | $0.00 | 0.00 BTC |

2026-02-26 | -$51.5M | -763.55 BTC |

2026-02-25 | +$30.1M | +442.96 BTC |

2026-02-24 | +$82.8M | +1.29K BTC |

2026-02-23 | -$27.9M | -431.72 BTC |

2026-02-20 | +$23.6M | +347.16 BTC |

2026-02-19 | $0.00 | 0.00 BTC |

2026-02-18 | -$49.1M | -739.2 BTC |

2026-02-17 | +$5.9M | +87.44 BTC |

2026-02-13 | +$12M | +174.36 BTC |

2026-02-12~2024-01-11 | +$10.97B | +186.75K BTC |

Total | +$11B | +187.16K BTC |

What is Fidelity Wise Origin Bitcoin Fund (FBTC)

Trading platform

BATS

Asset class

Spot

Assets under management

$16.08B

Expense ratio

0.25%

Issuer

Fidelity

Fund family

Fidelity

Inception date

2024-01-10

ETF homepage

FBTC homepage

Fidelity is committed to innovation, which has helped drive growth during shifting market conditions and consumer preferences. With a firm-wide focus on digital assets, Fidelity is developing a blockchain ecosystem with the goal of becoming a holistic solutions provider.

FAQ

Can I withdraw my investment from the Fidelity Wise Origin Bitcoin Fund at any time?

Withdrawal terms depend on the specific regulations and structure of the fund. Generally, there may be lock-up periods or restrictions, so it's essential to consult the fund policy for withdrawal details.

Does the Fidelity Wise Origin Bitcoin Fund use derivatives or leverage?

The investment strategy of the Fidelity Wise Origin Bitcoin Fund primarily focuses on direct exposure to Bitcoin, but details about the use of derivatives or leverage should be referenced in the fund's offering documents.

What are the benefits of investing in the Fidelity Wise Origin Bitcoin Fund?

Investing in the Fidelity Wise Origin Bitcoin Fund offers institutional investors professional management, custodial security, and a regulated investment framework for Bitcoin exposure.

Can I trade the Fidelity Wise Origin Bitcoin Fund on an exchange?

The Fidelity Wise Origin Bitcoin Fund is not traded like a typical cryptocurrency on an exchange. It is a private fund that is not listed on trading platforms like Bitget Exchange.

What is the minimum investment amount for the Fidelity Wise Origin Bitcoin Fund?

The minimum investment amount for the Fidelity Wise Origin Bitcoin Fund can vary; it's typically set high to align with institutional investor standards. Refer to the fund documentation for specifics.

How does the Fidelity Wise Origin Bitcoin Fund handle custody of Bitcoin?

The Fidelity Wise Origin Bitcoin Fund employs secure custodial solutions to safeguard the Bitcoin assets held in the fund, leveraging Fidelity's established custody services.

Is the Fidelity Wise Origin Bitcoin Fund open to retail investors?

Currently, the Fidelity Wise Origin Bitcoin Fund is primarily targeted at institutional investors and may not be available to retail investors.

What are the fees associated with the Fidelity Wise Origin Bitcoin Fund?

The fees for the Fidelity Wise Origin Bitcoin Fund can vary, but they usually include management fees. It's best to consult the fund's offering documents for detailed information on fees.

How can I invest in the Fidelity Wise Origin Bitcoin Fund?

Investors can participate in the Fidelity Wise Origin Bitcoin Fund typically through accredited investor channels. It's advisable to check with Fidelity or financial advisors for specific participation details.

What is the Fidelity Wise Origin Bitcoin Fund?

The Fidelity Wise Origin Bitcoin Fund is an investment vehicle launched by Fidelity that allows institutional investors to gain exposure to Bitcoin through a managed fund.

Fidelity Wise Origin Bitcoin Fund news

Bitcoin ETFs rebound with $166.5M inflows despite BTC price dip

AMBCrypto2026-02-11

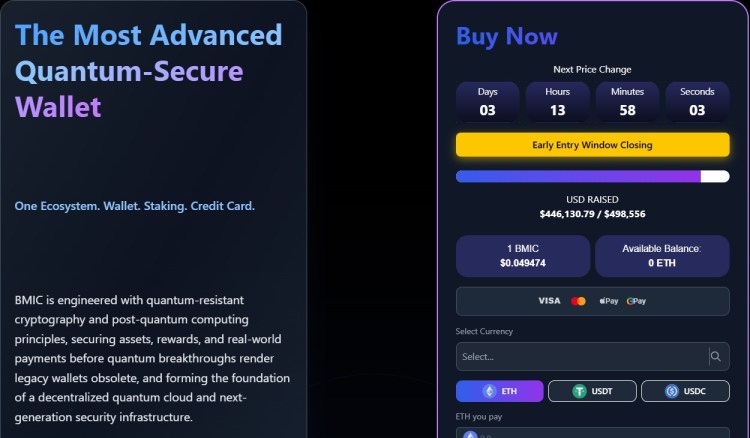

Goldman Sachs Adjusts Bitcoin ETF Holdings as Spotlight Shifts to BMIC

Newsbtc2026-02-11

Bitcoin ETF inflows slow down, narrowing basis becomes the main reason

Chaincatcher2026-02-11

Over $167 million flows into the US spot BTC ETF market

AIcoin2026-02-11

Goldman Sachs cuts bitcoin ETF holdings by 40% in Q4

The Block2026-02-11

Bitcoin ETFs Record $616 Million in Back-to-Back Gains as Diamond Hand Holders Refuse to Sell

Tipranks2026-02-10

Alternative ETFs

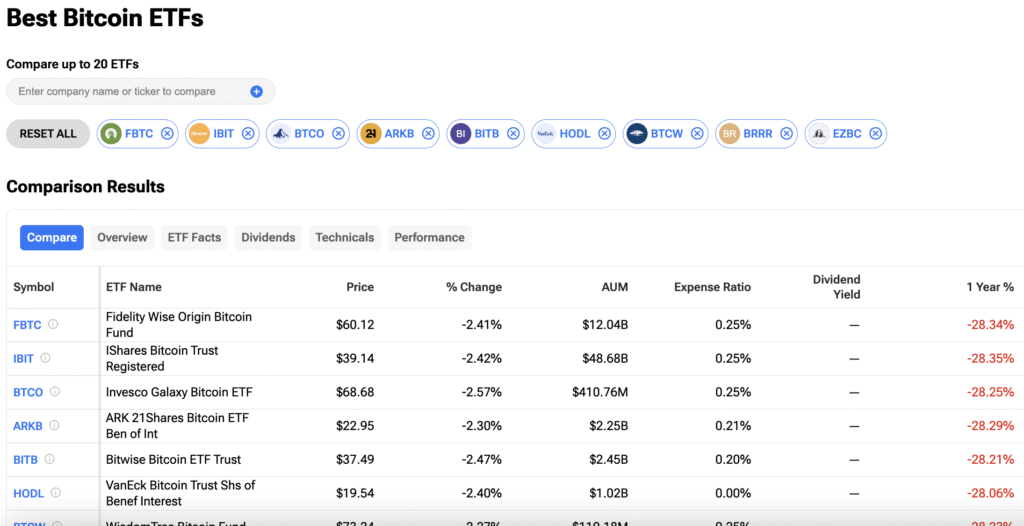

| Symbol/ETF name | Asset class | Volume (USD | Share) | Assets under management | Expense ratio |

|---|---|---|---|---|

IBIT iShares Bitcoin Trust | Spot Active | $1.81B 48.59M IBIT | $50.98B | 0.25% |

BITO ProShares Bitcoin ETF | Futures Active | $848.45M 93.43M BITO | $1.77B | -- |

GBTC Grayscale Bitcoin Trust ETF | Spot Active | $186.66M 3.64M GBTC | $10.29B | 1.5% |

BTC Grayscale Bitcoin Mini Trust ETF | Spot Active | $176.74M 6.08M BTC | $3.33B | 0.15% |

BITB Bitwise Bitcoin ETF | Spot Active | $86.52M 2.42M BITB | $2.56B | 0.2% |

ARKB ARK 21Shares Bitcoin ETF | Spot Active | $64.18M 2.94M ARKB | $2.41B | 0.21% |

Prefer buying cryptocurrencies directly? You can trade all major cryptocurrencies on Bitget

Bitget—The world's leading crypto exchange

Looking to buy or sell cryptocurrencies like Bitcoin? Choose Bitget, the cryptocurrency exchange offering top-tier liquidity, an exceptional user experience, and unmatched security!

Bitget app

Trade anytime, anywhere with the Bitget app. Join over 30 million users trading and connecting on our platform.

Cryptocurrency investments, including buying Bitcoin online via Bitget, are subject to market risk. Bitget provides easy and convenient ways for you to buy Bitcoin, and we strive to fully inform our users about each cryptocurrency we offer on the exchange. However, we are not responsible for the results that may arise from your Bitcoin purchase. This page and any information included are not an endorsement of any particular cryptocurrency. Any price and other information on this page is collected from the public internet and cannot be considered as an offer from Bitget.