Rootstock plans unlock $260b in idle institutional Bitcoin

RootstockLabs launched Rootstock Institutional, aiming to deploy $260 billion in institutional Bitcoin into DeFi.

- RootstockLabs launched Rootstock Institutional to explore institutional Bitcoin uses

- Major institutions currently own $260B in BTC that remains idle

- Institutions could deploy this idle BTC in DeFi, earning yield for investors

Over 2.6 million Bitcoin ( BTC ) held by institutions remains idle, but this could soon change. On Tuesday, October 14, RootstockLabs, a key contributor to Rootstock, the first Bitcoin layer-2, announced the launch of Rootstock Institutional.

The new team will focus on ways that institutions can tap into BTC’s DeFi potential. Namely, institutions could use Rootstock, a DeFi layer for Bitcoin, to obtain yield on their BTC. Specifically, institutions can use BTC for lending and borrowing, together with other on-chain yield strategies.

“The market has evolved beyond simple Bitcoin holding. Institutions managing significant Bitcoin treasuries are seeking sustainable, transparent on-chain frameworks without compromising their long-term position,” said Richard Green, Managing Director of Rootstock Institutional and Ecosystem at RootstockLabs.

99% of institutional Bitcoin generates negative returns

According to RootstockLabs’ Institutional BTCFi Report , institutions hold 2.6 million BTC in ETFs, corporate treasuries, and mining reserves. However, 99% of this BTC generates negative returns, as firms have to pay custody fees, which range from 0.1% to 0.5% annually.

Despite this, these reserves present a significant financial opportunity for holders. By March 2025, Bitcoin-native DeFi grew 2,700% year over year to $8.6 billion in total value locked. However, this figure still amounts to just 0.79% of the BTC supply, compared to 50% for Ethereum.

“Bitcoin’s evolution from pure store of value to productive financial asset represents one of the most significant opportunities in digital finance,” said Richard Green. “We’re already seeing this firsthand, family offices, web3 funds, exchanges, and bitcoin-first firms are actively working with us to deploy their Bitcoin on Rootstock.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Crash Reasons: Here is why Cryptos are Crashing

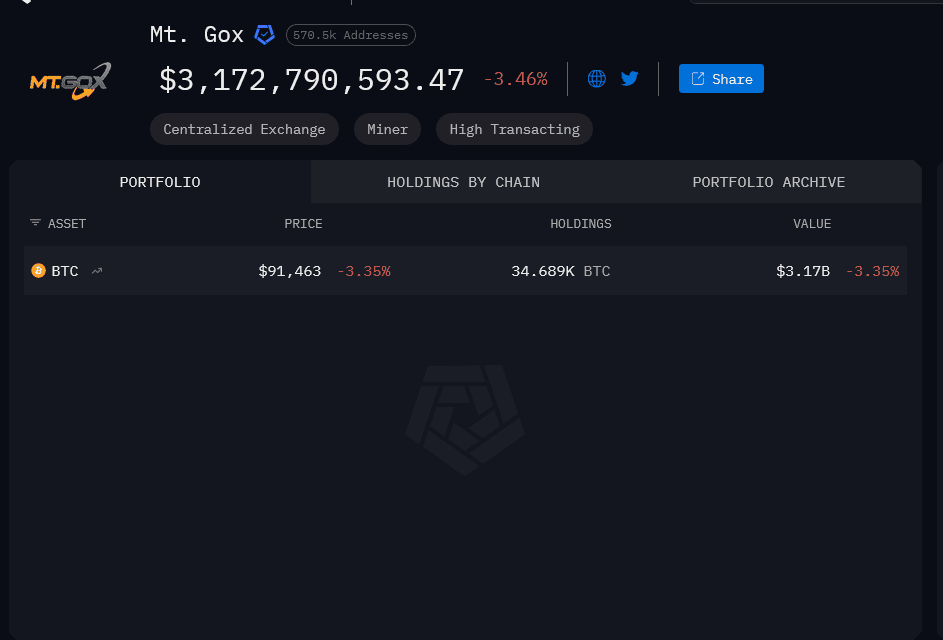

Mt. Gox Just Moved Nearly $1B in Bitcoin. Should You Be Worried?

Bitcoin News Update: Canaan's Shift Toward Bitcoin Mining Drives 18% Increase and Sets New Record in Holdings

- Canaan Inc. shares surged 18% pre-market after Q3 revenue jumped 104.4% to $150.5M, surpassing estimates. - Bitcoin mining revenue soared 241% to $30.6M, driven by 267 BTC mined and 10 EH/s computing power sold. - Company boosted crypto holdings to 1,610 BTC/3,950 ETH by October 2025 and secured a 50,000-unit mining machine order. - Q4 revenue guidance ($175-205M) exceeds $148. 3M estimates, but risks include U.S. tariffs and regulatory shifts. - Analysts maintain "buy" ratings with a $3.00 price target

BCH Climbs 5.6% Over 24 Hours as Institutions Adjust Their Portfolios

- BCH surged 5.6% in 24 hours to $514.6 amid mixed 1-month (-3.14%) and 1-year (19.29%) performance. - Institutional investors reshaped holdings: Itau Unibanco cut 21.3% stake, while Goldman Sachs and Robeco increased positions. - Analysts raised price targets to $33-$35 with "neutral" ratings, though Zacks upgraded to "strong-buy" amid improved long-term outlook. - BCH maintains 1.24% institutional ownership, 12.92 P/E ratio, and stable financial metrics (quick ratio 1.53, debt-to-equity 2.00).