Bitcoin News Update: Canaan's Shift Toward Bitcoin Mining Drives 18% Increase and Sets New Record in Holdings

- Canaan Inc. shares surged 18% pre-market after Q3 revenue jumped 104.4% to $150.5M, surpassing estimates. - Bitcoin mining revenue soared 241% to $30.6M, driven by 267 BTC mined and 10 EH/s computing power sold. - Company boosted crypto holdings to 1,610 BTC/3,950 ETH by October 2025 and secured a 50,000-unit mining machine order. - Q4 revenue guidance ($175-205M) exceeds $148. 3M estimates, but risks include U.S. tariffs and regulatory shifts. - Analysts maintain "buy" ratings with a $3.00 price target

Canaan Inc. (NASDAQ: CAN) saw its shares jump 18% in pre-market trading on Tuesday, fueled by a sharp improvement in its financial results and an unprecedented increase in its

The improvement in gross profit signaled a major turnaround for

Looking forward, Canaan

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Turmoil and AI Breakthroughs: Grok 4.1, Gemini 3, Cloudflare Outage

AI Confidence and Economic Concerns Set Crypto Strength Against Market Downturn

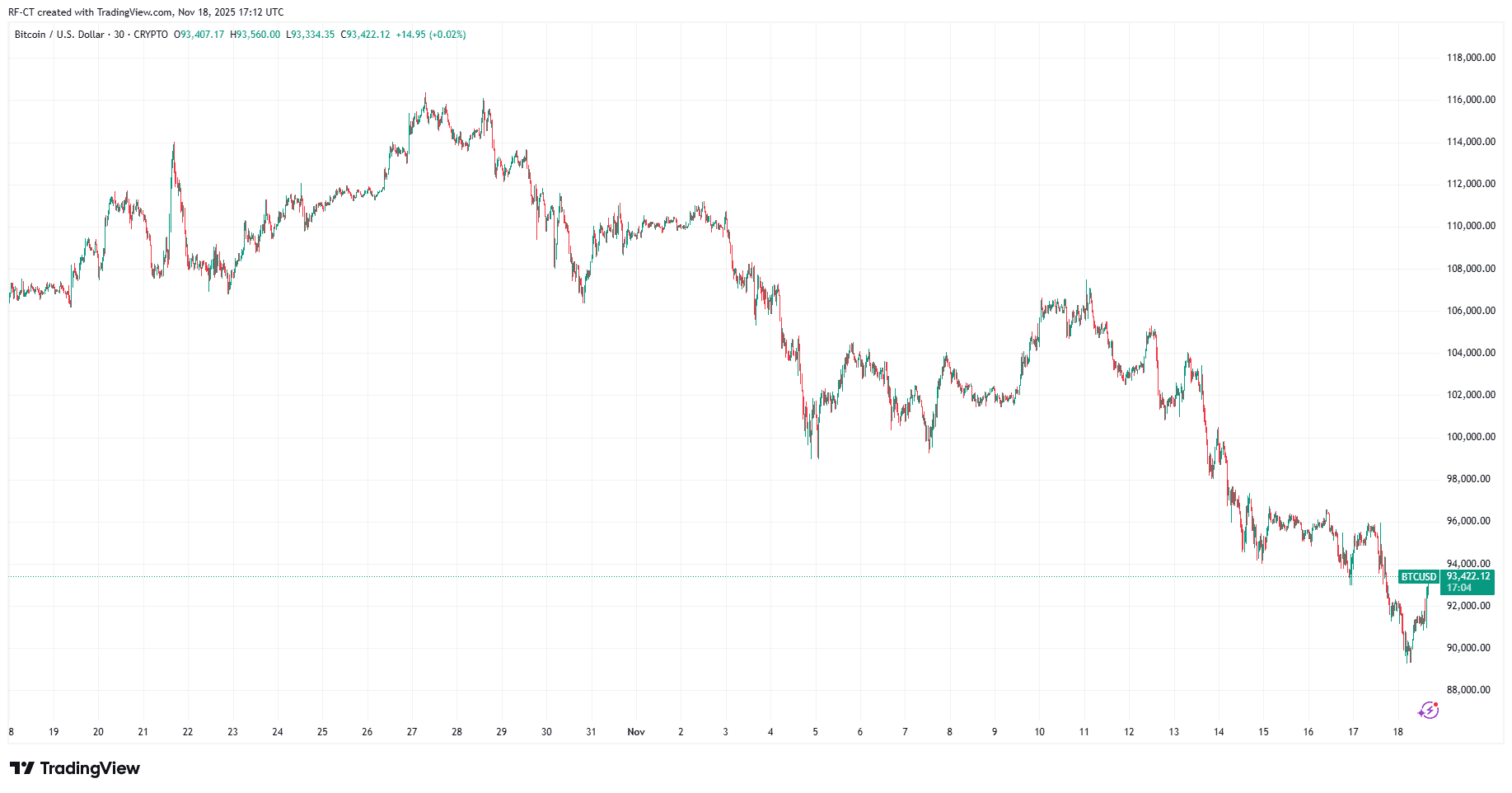

- U.S. stock indexes fell on Nov. 18, 2025, while crypto and AI-linked stocks showed resilience amid broader market weakness. - Nvidia's upcoming earnings and 54% YOY EPS forecast fueled gains in correlated stocks like TSMC (+41% YTD) and SMCI (+15% YTD). - Bitcoin rebounded 1% temporarily, but analysts warned crypto remains vulnerable to inflation fears and $1B+ leveraged liquidations. - Home Depot's 3% premarket drop dragged on the Dow after missing Q3 earnings and slashing profit forecasts amid housing

Solana's Breakthrough: Ushering in a New Age of Fast and Scalable Smart Contracts?

- Solana's 2025 upgrades (Firedancer, Alpenglow) achieved 1M TPS and sub-150ms latency, outperforming Ethereum and Sui . - Enterprise partnerships with Visa , PayPal , and Stripe leverage Solana's speed and low fees for payments and remittances. - Institutional ETF inflows and energy-efficient proof-of-history consensus boost Solana's appeal for green finance. - Challenges include competition from Ethereum upgrades, stablecoin liquidity declines, and regulatory risks.

Trump’s Federal Reserve Shakeup Raises Concerns Over Stagflation and Divides Within GOP

- Trump announced his Fed chair pick but withheld the name, criticizing resistance to removing Powell before his 2026 term ends. - Shortlisted candidates include Waller, Bowman, and Rieder, with Trump hinting at a "standard" choice amid political tensions. - The dispute with Rep. Greene over Epstein files highlights GOP fractures, as Trump accused her of betraying party loyalty. - Critics warn politicizing the Fed risks stagflation, while the Epstein files debate underscores transparency vs. loyalty tensio