Crypto Crash Reasons: Here is why Cryptos are Crashing

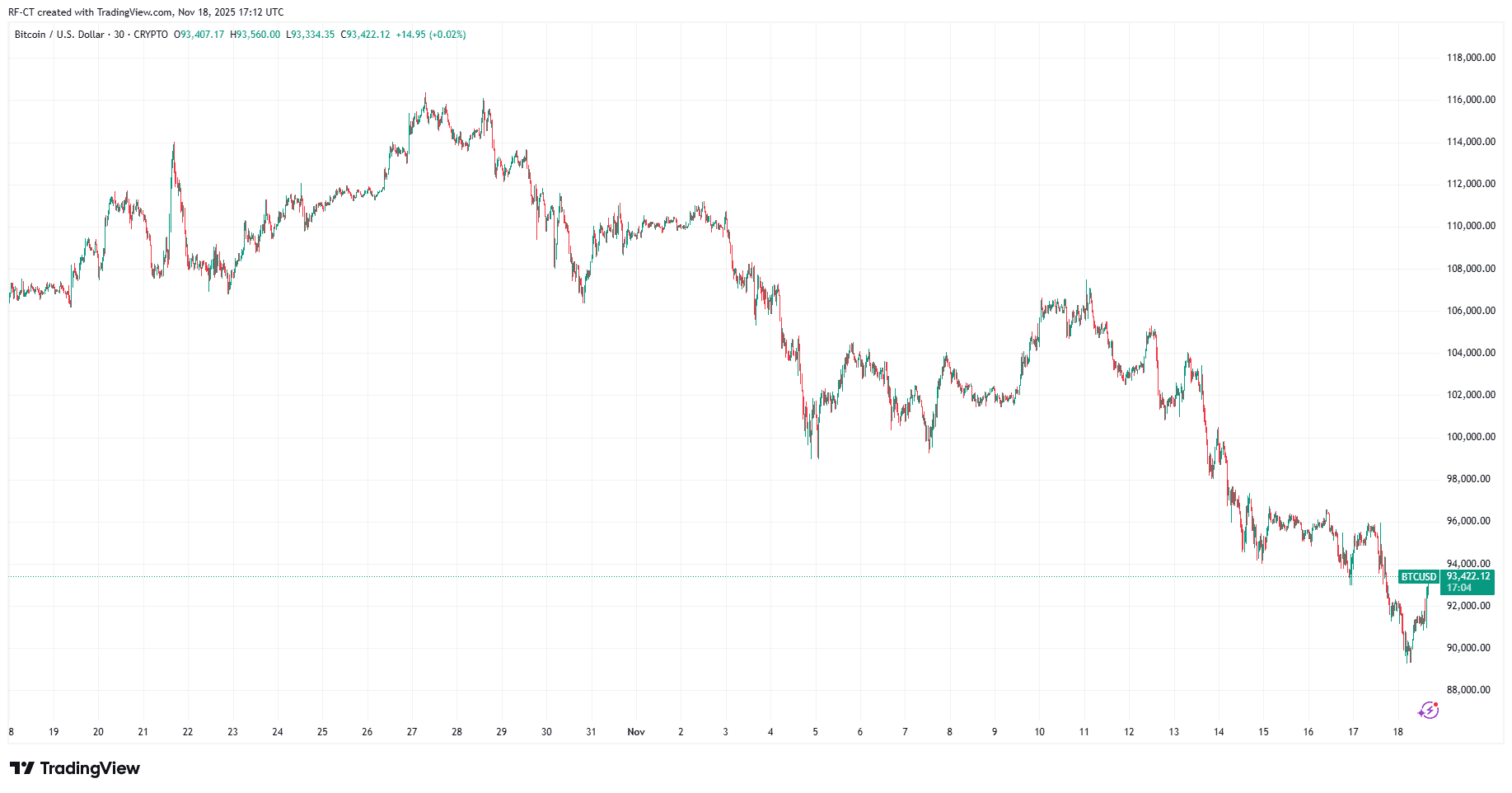

The entire crypto market is bleeding after $Bitcoin dropped to $89,300.46, dragging altcoins into double-digit losses. If Bitcoin fails to reclaim 90K, analysts now warn of a deeper market-wide correction with a potential slide toward $82,000.

BTC/USD price chart over the past 24 hours - TradingView

Crypto Crash Reasons: Why are Cryptos Crashing

1. Massive ETF Outflows Trigger Liquidity Shock

The first and biggest driver of the crypto crash is the $869 million in Bitcoin ETF outflows in a single day, with $622 million leaving over the week.

This caused a chain reaction across the entire market:

- BTC liquidity thinned dramatically

- Volatility spiked

- Altcoins became more vulnerable to sharp moves

- Institutions pulled back risk exposure

Because ETFs now dominate market structure, when they sell, all cryptos fall — not just Bitcoin.

2. Long-Term Holders Sell 815,000 BTC, Pressuring the Whole Market

Long-term holders offloaded 815,000 BTC (~$79B) over the past 30 days — the biggest selling wave since early 2024.

Why this matters for crypto:

- “Diamond hands” turning into sellers signals peak uncertainty

- Market absorbs huge supply quickly → prices drop

- Altcoins follow BTC liquidity trends and crash even harder

This supply flush didn’t just hit Bitcoin — it cascaded into Ethereum, Solana, XRP, and every major altcoin.

3. Market Sentiment Collapses Into Extreme Fear

The Bitcoin Fear Greed Index dropped to Extreme Fear, a level typically associated with:

- Panic selling

- Forced liquidations

- Sharp declines in altcoin valuations

- Traders exiting positions to avoid deeper losses

When fear spikes, liquidity dries up, and altcoins are the first to bleed. This sentiment collapse accelerated the crypto-wide crash.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Turmoil and AI Breakthroughs: Grok 4.1, Gemini 3, Cloudflare Outage

AI Confidence and Economic Concerns Set Crypto Strength Against Market Downturn

- U.S. stock indexes fell on Nov. 18, 2025, while crypto and AI-linked stocks showed resilience amid broader market weakness. - Nvidia's upcoming earnings and 54% YOY EPS forecast fueled gains in correlated stocks like TSMC (+41% YTD) and SMCI (+15% YTD). - Bitcoin rebounded 1% temporarily, but analysts warned crypto remains vulnerable to inflation fears and $1B+ leveraged liquidations. - Home Depot's 3% premarket drop dragged on the Dow after missing Q3 earnings and slashing profit forecasts amid housing

Solana's Breakthrough: Ushering in a New Age of Fast and Scalable Smart Contracts?

- Solana's 2025 upgrades (Firedancer, Alpenglow) achieved 1M TPS and sub-150ms latency, outperforming Ethereum and Sui . - Enterprise partnerships with Visa , PayPal , and Stripe leverage Solana's speed and low fees for payments and remittances. - Institutional ETF inflows and energy-efficient proof-of-history consensus boost Solana's appeal for green finance. - Challenges include competition from Ethereum upgrades, stablecoin liquidity declines, and regulatory risks.

Trump’s Federal Reserve Shakeup Raises Concerns Over Stagflation and Divides Within GOP

- Trump announced his Fed chair pick but withheld the name, criticizing resistance to removing Powell before his 2026 term ends. - Shortlisted candidates include Waller, Bowman, and Rieder, with Trump hinting at a "standard" choice amid political tensions. - The dispute with Rep. Greene over Epstein files highlights GOP fractures, as Trump accused her of betraying party loyalty. - Critics warn politicizing the Fed risks stagflation, while the Epstein files debate underscores transparency vs. loyalty tensio