News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

XRP Falls as US-Israel Strikes Iran Spark Market Risk Off

CryptoNewsNet·2026/02/28 17:15

Caterpillar (CAT)'s Growth is Remarkable, Says Jim Cramer

Finviz·2026/02/28 17:15

Jim Cramer Discusses Crowdstrike (CRWD)'s Share Price Performance

Finviz·2026/02/28 17:15

Why one analyst believes DocuSign shares could surge by more than 170% in 2026

101 finance·2026/02/28 17:12

Heathrow’s third runway expected to cost nearly £1 million for every metre

101 finance·2026/02/28 17:12

Soligenix's EMA Designation: A Near-Term Catalyst for a High-Risk Biotech

101 finance·2026/02/28 17:06

Analyst: XRP Can Easily Hit $100, But $10,000 Is Impossible

TimesTabloid·2026/02/28 17:06

Why Crypto Is Not Pointless: A Third Worlder's Perspective

CryptoNewsNet·2026/02/28 17:03

No Matter Your Feelings, XRP Chart Says $50 Is Possible: Analyst

CryptoNewsNet·2026/02/28 17:03

XRP Price Analysis: What To Expect In March 2026?

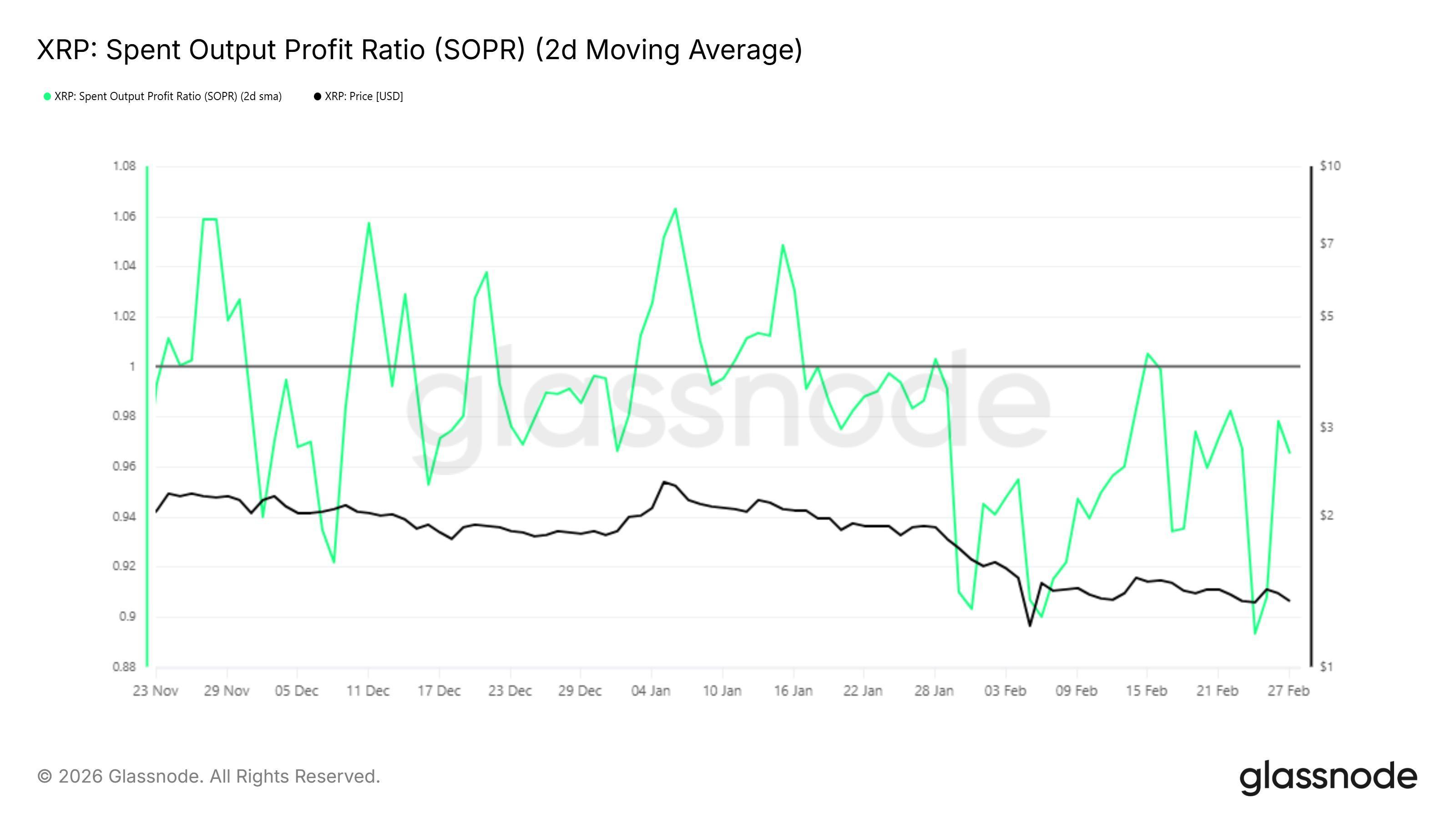

CryptoNewsNet·2026/02/28 17:03

Flash

18:23

The cryptocurrency market surged and then retreated on Sunday.MarketVectorTM Digital Assets 100 Mid-Cap Index rose by 2.00%, closing at 2717.02 points, and reached 2830.33 points at 10:07 (UTC+8). MarketVector Digital Assets 100 Index increased by 2.67%, closing at 13431.13 points, and peaked at 13784.24 points at 10:46 (UTC+8). Currently, Solana is up 0.38%, Dogecoin is down 1.11%, and XRP is down 0.39%. Bitcoin is down 0.68%, currently quoted at $66,395; Ethereum is up 1.06%, currently quoted at $1,982.

18:22

ECB's Nagel: The US dollar's safe-haven status is being questioned, and currency weakness will persistChainCatcher news, according to Golden Ten Data, European Central Bank Governing Council member Nagel stated that the role of the US dollar as the preferred traditional currency during uncertain times is increasingly being questioned, leading to its weakened exchange rate. He pointed out that doubts about the US dollar's status as a safe-haven currency have increased, and it is expected that the weakness of the dollar will continue, as the decline in international investors' confidence may persist.

18:12

Iran warns that if its energy facilities are attacked, oil and gas facilities in all countries of the region will be destroyed.Jinse Finance reported that on March 1 local time, the Islamic Revolutionary Guard Corps of Iran issued a warning that if Iran's oil and gas facilities are attacked, in response, all oil and gas facilities in the region will be destroyed. (CCTV)