News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Oil Prices Briefly Break 110 USD; US Stock Futures Fall Across the Board; Iran's New Leader Takes Office (March 09, 2026)2The US dollar overtakes gold as the top safe haven: Asian stocks plunge, market enters "mini black swan" mode3On the Eve of the Oil Crisis

Bitcoin’s true message is not decentralization; it’s emancipation

Cointelegraph·2026/03/06 11:30

WAR Token Distinguishes Itself from Western Asset Fund Amid Rising Geopolitical Crypto Trading

101 finance·2026/03/06 11:30

Ether is 60% down from its 2025 high, but TradFi keeps betting on ETH: Here’s why

Cointelegraph·2026/03/06 11:30

XRP price breakout targets $1.95 amid five-day ETF inflow streak

Cointelegraph·2026/03/06 11:30

Ether price again rejected at $2K: How low can ETH go in March?

Cointelegraph·2026/03/06 11:27

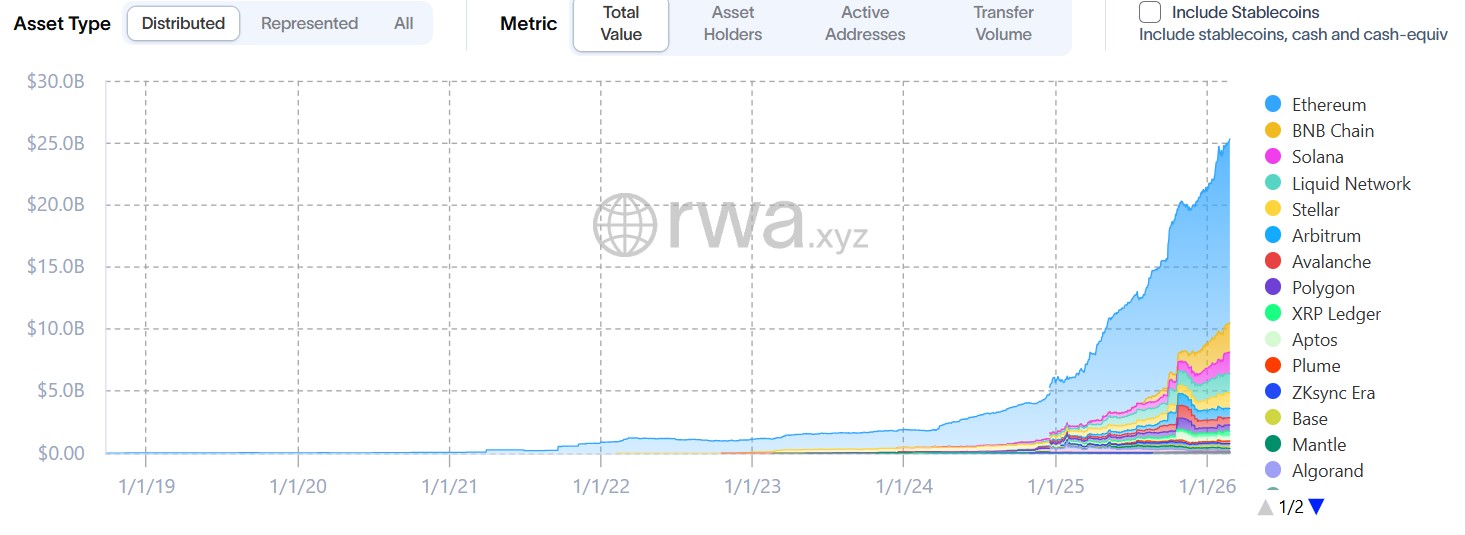

Why institutions still prefer Ethereum despite faster blockchains

Cointelegraph·2026/03/06 11:27

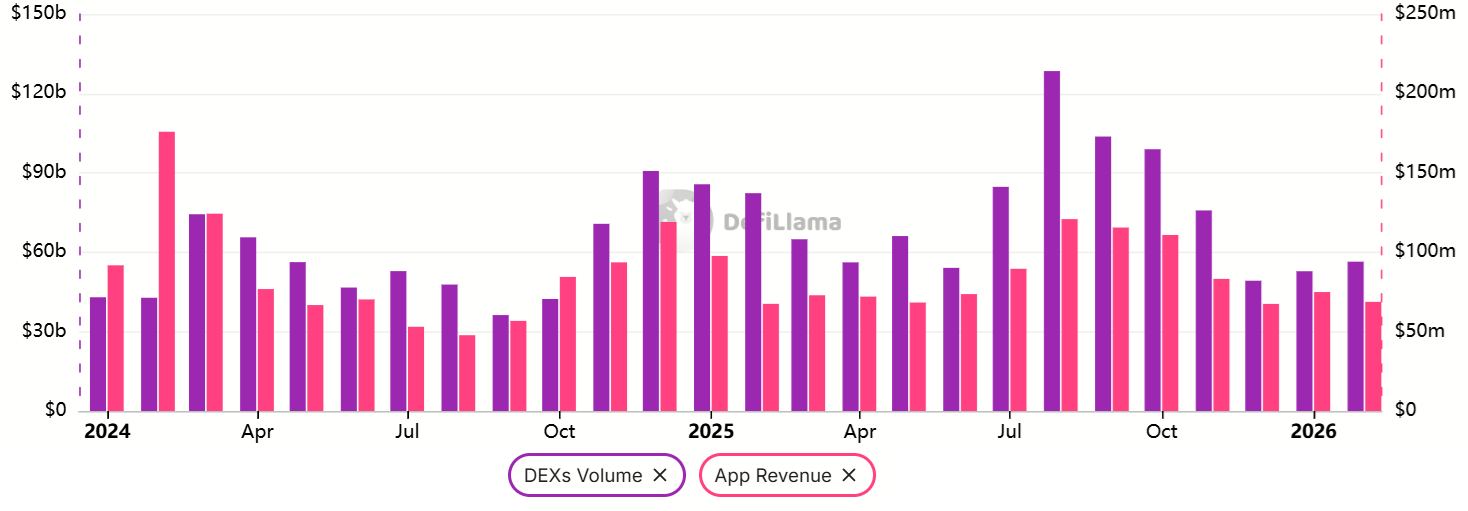

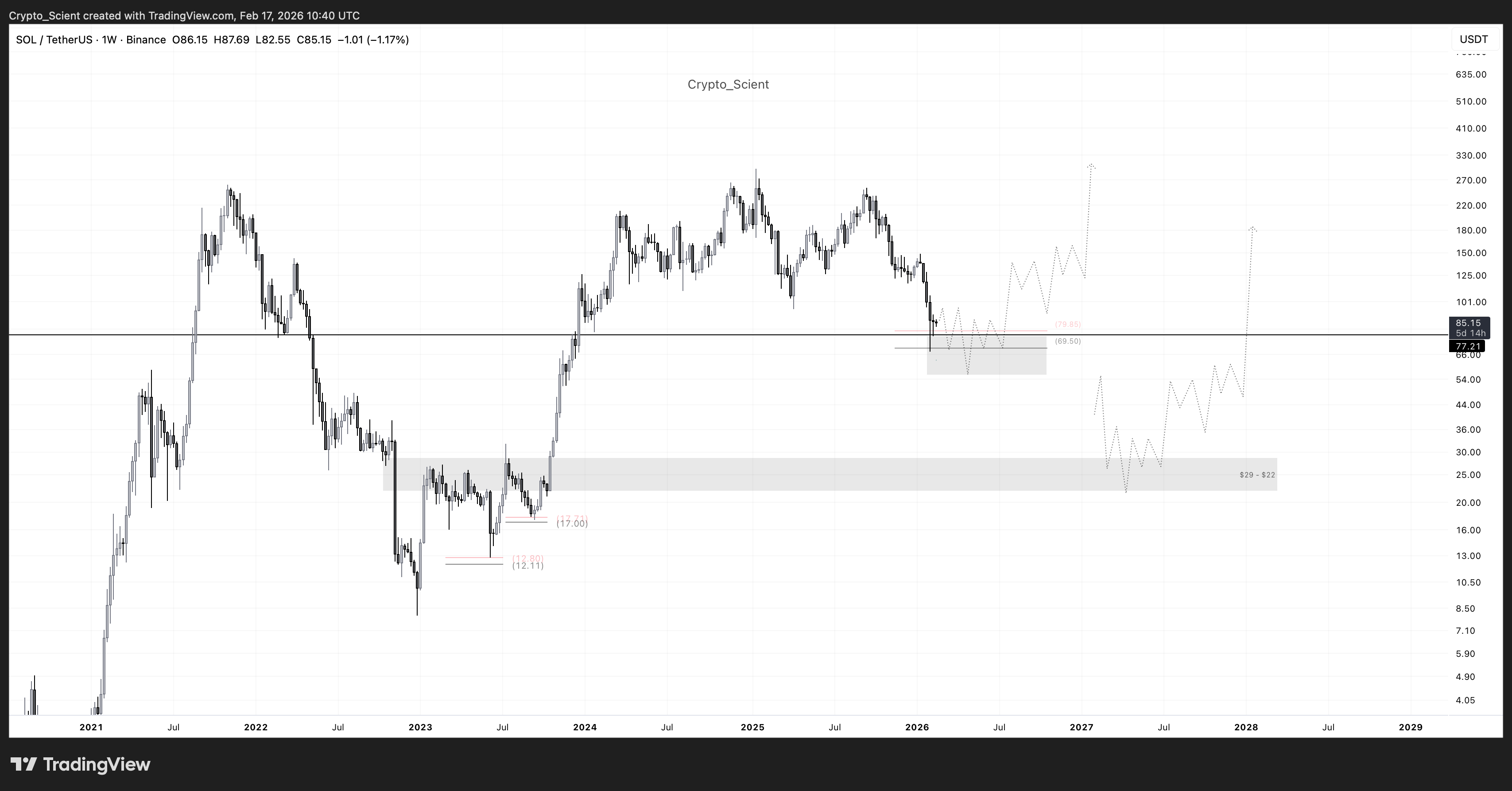

Three Solana data points highlight resilience, but is SOL undervalued?

Cointelegraph·2026/03/06 11:27

Blockchain-based identity could empower or imprison us

Cointelegraph·2026/03/06 11:27

Flash

03:34

Offshore RMB interbank offered rates mostly rise, overnight rate hits highest level in over a weekAccording to Golden Ten Data on March 9, a key indicator measuring offshore RMB liquidity—the offshore RMB Hong Kong Interbank Offered Rate (CNH HIBOR)—showed on Monday that most major term rates increased; among them, the overnight HIBOR rose by 4 basis points to 1.47424%, reaching a new high since February 27. The one-week HIBOR slightly fell to 1.43606%, the two-week HIBOR remained unchanged at 1.50000%, and the one-year HIBOR edged up to 1.85818%. Click the link to view historical data>>

03:34

Japanese stock panic index surges, Goldman Sachs warns of possible major correctionGelonghui, March 9|The surge in oil prices has dampened optimism about Japan's economic outlook and corporate profits, pushing Japan's stock market fear index to its highest level since the COVID-19 crisis in 2020. The one-year implied volatility of the Nikkei 225 index rose above 30 points on Monday, reaching its highest level since March 2020. This index measures the magnitude of price fluctuations investors expect over the next year and has already surpassed the recent peak of around 28 points, which was reached after the US tariff shock in April 2025 and the Bank of Japan's interest rate hike in September 2024. Goldman Sachs Japan strategists, including Bruce Kirk, warned that the risk of a "sharp correction" in Japanese stocks is increasing, given the relative calm since the so-called "Liberation Day" volatility in April last year. They wrote that this high volatility may persist until the region's geopolitical situation becomes clearer.

03:34

ETH Whales Sell Off Recently Purchased ETH, Only Make $3,375 ProfitBlockBeats News, March 9th, according to on-chain analyst Ai Auntie (@ai_9684xtpa), the whale address 0x54d…e6029 liquidated 5064 ETH accumulated on 03.07 in the past 15 minutes, worth $9.989 million; entry price was $1971.99, exit price was $1972.69, gaining only $3375 in one transaction, which can be said to be a breakeven trade.

News