News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Spot Gold & Silver Continue to Drop, Bitcoin Crashes; Amazon’s $200 B Capital Expenditure Raises Concerns; U.S. Job Openings Fall to 2020 Lows — Feb 6, 2026 (English Translation)2Weekend Trading Playbook: High-Impact Macro Events & Earnings for Feb 9-15, 2026 – Tech & Crypto Volatility Plays3 Is the “Perfect Storm” Here? Liquidations Explode as Bitcoin Bleeds Below $70K & DXY Rises

Arkham Finds $5 Billion In Bitcoin That Germany Could Still Claim

Arkham's new discovery has renewed scrutiny on Germany’s earlier liquidation of nearly 50,000 seized Bitcoin at $57,900 each.

BeInCrypto·2025/09/06 03:49

Ethena token rallies over 12% following StablecoinX’s $530 million capital raise

CryptoSlate·2025/09/06 03:46

Bitcoin Analyst Challenges Q4 2025 Peak Predictions Based On Statistics

BTCPEERS·2025/09/06 03:06

MicroStrategy’s Bitcoin Play Misses Out On S&P 500

Strategy, the world’s largest corporate holder of Bitcoin, was left out of the S&P 500 in the latest rebalancing.

BeInCrypto·2025/09/06 01:11

Ethereum bull alert: ETH exchange ‘flux’ turns negative for the first time

Cointelegraph·2025/09/06 00:40

Market Interpretation and Outlook Behind Ethereum's Sharp Volatility

AICoin·2025/09/05 23:58

AiCoin Daily Report (September 5)

AICoin·2025/09/05 23:57

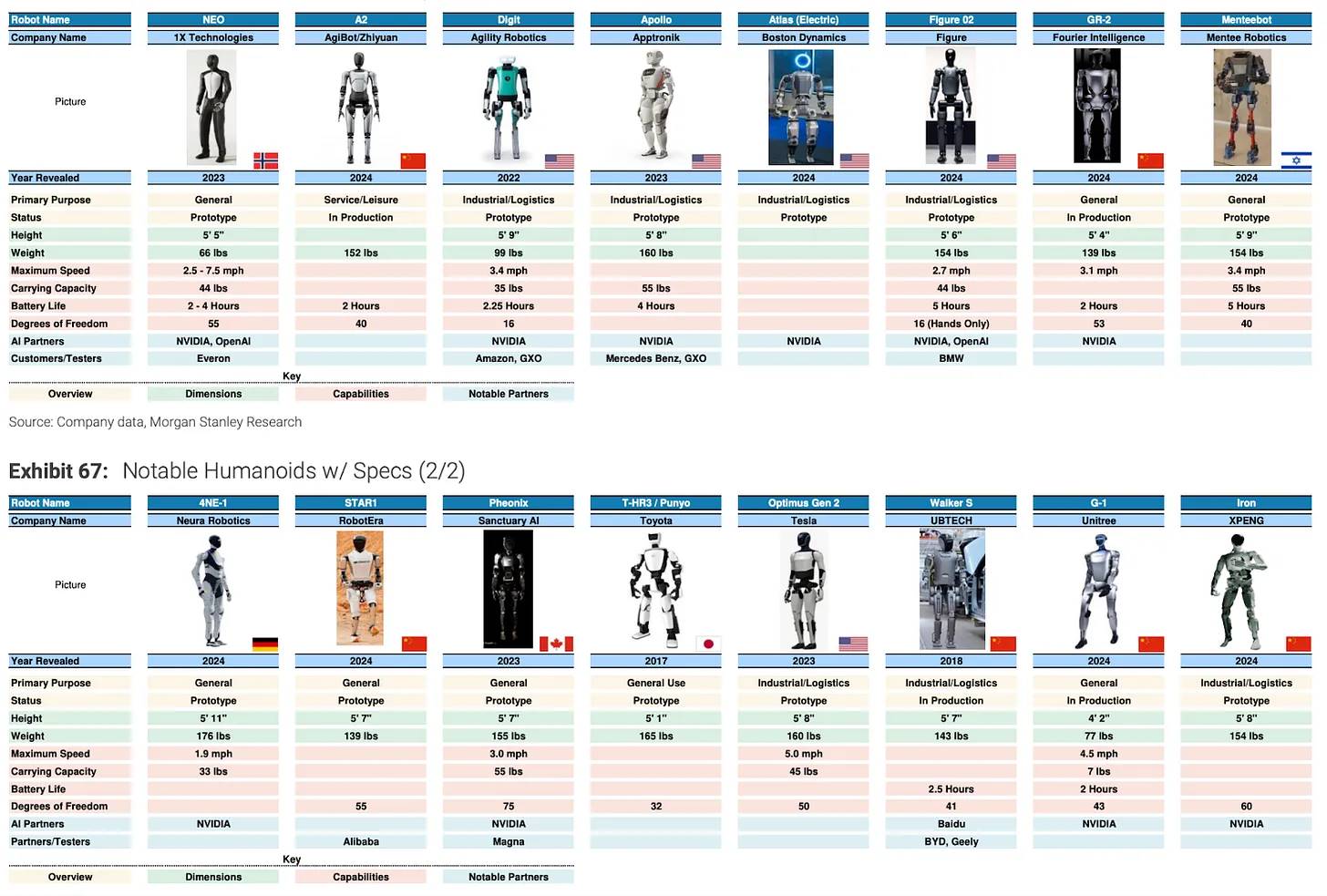

On the Eve of a 5 Trillion Market: Where Are the Investment Opportunities in Embodied Intelligence × Web3?

Embodied intelligence x Web3: Structurally driven solutions create investable opportunities.

深潮·2025/09/05 23:45

$40 million financing, Vitalik participates, Etherealize aims to be Ethereum’s “spokesperson”

The goal of transforming traditional finance with Ethereum does not necessarily have to be achieved through DeFi.

深潮·2025/09/05 23:41

BTC Data Reveals September as the Toughest Trading Month

Cryptotale·2025/09/05 22:52

Flash

15:58

Bitcoin mining difficulty drops significantly by 11.16% to 125.86 TJinse Finance reported that, according to data from CloverPool, Bitcoin mining difficulty was adjusted today at 21:56 at block height 935,424, with the mining difficulty dropping to 125.86 T, a decrease of 11.16%, marking the largest decline since May 2021. The current total network hashrate is 948.13 EH/s. Analysis indicates that the next Bitcoin mining difficulty adjustment is also expected to decrease further.

15:49

Next Week's Macro Outlook: Nonfarm Payrolls and CPI Combined with US-Iran Talks and Japanese Elections, Crypto Market Faces the Ultimate TestBlockBeats News, February 7th — This week, the crypto market accelerated its decline. Although there was a brief rebound on Friday, fragile market sentiment will continue to be tested next week. Next week will see a dense schedule of important macro events and data, including US-Iran negotiations, the Japanese election, US nonfarm payrolls, CPI, and other major events. The specific preview is as follows: Macro Data and Federal Reserve Officials’ Speeches: Tuesday 00:00, US January New York Fed 1-Year Inflation Expectations; Tuesday 02:30, Federal Reserve Governor Waller delivers a speech on digital assets; Tuesday 04:15, 2027 FOMC voting member and Atlanta Fed President Bostic speaks on monetary policy and economic outlook; Tuesday 21:30, US December Retail Sales MoM, US Q4 Labor Cost Index QoQ, US December Import Price Index MoM; Wednesday 01:00, 2026 FOMC voting member and Cleveland Fed President Mester delivers a speech on "Banking and Economic Outlook"; Wednesday 02:00, 2026 FOMC voting member and Dallas Fed President Logan delivers a speech; Wednesday 21:30, US January Unemployment Rate, Seasonally Adjusted Nonfarm Payrolls, Average Hourly Earnings YoY/MoM, US 2025 Nonfarm Payroll Benchmark Revision Final Value (Not Seasonally Adjusted); Thursday 15:00, UK Q4 GDP YoY Preliminary, UK December Three-Month GDP MoM, UK December Manufacturing/Industrial Production MoM, UK December Seasonally Adjusted Goods Trade Balance; Friday 08:00, 2026 FOMC voting member and Dallas Fed President Logan delivers a welcome speech at an event, with Federal Reserve Governor Milan attending by invitation; Friday 21:30, US January Unadjusted CPI YoY, US January Seasonally Adjusted CPI MoM, US January Seasonally Adjusted Core CPI MoM, US January Unadjusted Core CPI YoY; US-Iran Negotiations: On February 6th local time, Trump stated that the US had "very good talks" with Iran, and that Iran was "very eager" to reach an agreement. He said the US would negotiate with Iran again next week. He reiterated that Iran cannot possess nuclear weapons. Trump also authorized his administration to impose tariffs on countries trading with Iran, but has not immediately imposed any new tariffs. Japanese Election: Sanae Takaichi announced that Japan will hold a general election on February 8th. The election results may signal a meaningful shift in Japan towards more accommodative fiscal policies, including tax cuts and increased government spending, at a time when Japan is already one of the most heavily indebted countries in the world. Market analysts say a more expansionary policy stance could put pressure on Japanese government bonds, weaken the yen, and complicate the Bank of Japan's efforts to normalize monetary policy.

15:27

Bloomberg Analyst: Misjudging Bitcoin ETF as Reducing Market Volatility Is Incorrect; High Volatility and High Risk Will PersistAccording to Odaily, Bloomberg Senior ETF Analyst Eric Balchunas stated on the X platform that his previous assessment—that the investor structure of bitcoin ETFs would be stronger than market expectations—still largely holds true. However, his earlier prediction that ETF inflows would reduce market volatility has proven to be incorrect. Eric Balchunas explained that he initially believed retail ETF inflows would replace the highly speculative retail investors from before the FTX incident, thereby increasing market stability. However, he did not fully consider the selling pressure caused by early holders (OGs) offloading their positions at higher prices. He also pointed out that bitcoin's approximately 450% increase over two years is itself a potential risk signal, as rapid price surges are often accompanied by high volatility. Therefore, the characteristic of bitcoin as a high-volatility, high-risk asset is likely to persist for the foreseeable future.

News