News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily Report | US-Japan-EU-Mexico Collaborate on Key Minerals Development; Nasdaq Introduces Fast Inclusion Rules; Software Stocks Continue Under Pressure (February 5, 2026)2Hyperliquid treasury seeks revenue boost using HYPE holdings as options collateral3Bitcoin drops following Treasury Secretary Bessent's statement that the US government cannot require banks to rescue crypto

Pokémon Card Craze: The Cognitive Gap Between Crypto Players and Collectors

Bitpush·2025/09/04 18:22

Tom Lee: ETH is experiencing its "1971 moment," a $60,000 valuation is reasonable

Bitpush·2025/09/04 18:20

Speculation on the New Fed Chair: How Would Waller Influence the Crypto Wallet?

Bitpush·2025/09/04 18:19

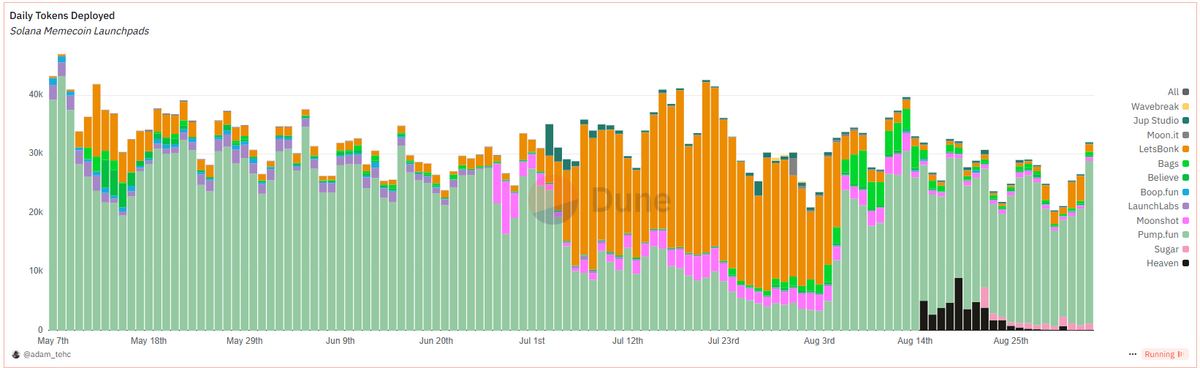

New On-chain Creation Model: Will Pump.fun's CCM Reshape the Solana Creator Ecosystem?

Bitpush·2025/09/04 18:19

Pump.fun’s Upgrade Pays Creators Millions. Will It Spark New Memecoin Boom?

DailyCoin·2025/09/04 18:18

Gary Yang: The Trend of Asset On-Chainization under Stablecoin Pricing Models

Bitpush·2025/09/04 18:17

WLFI Token Drops 50% After Justin Sun Blacklist: Centralization Risk?

The WLFI token from World Liberty Financial once fell to $0.16—cutting its value in half—after developers blacklisted Justin Sun’s wallet and froze billions of tokens associated with him. This move has deepened divisions in the community and raised concerns about centralization and the outsized influence of large investors in new token launches. WLFI Blacklisting: What

BeInCrypto·2025/09/04 18:16

New Progress in "Stock Tokenization": Galaxy Launches Native U.S. Stock Tokens, Achieving On-Chain Equal Rights

"Equal rights between tokens and stocks" is a prerequisite for the large-scale adoption of stock tokenization, but an even bigger issue lies on the circulation side.

BlockBeats·2025/09/04 18:14

$40 million financing, with participation from Vitalik Buterin, Etherealize aims to become the "spokesperson" for Ethereum

It is rare for both Vitalik and the Ethereum Foundation to get directly involved.

BlockBeats·2025/09/04 18:12

Flash

11:19

BitMine's Ethereum portfolio has fallen to $9.1 billion. According to market sources: Ethereum treasury company BitMine's Ethereum portfolio value has dropped to 9.1 billion USD, recording a book loss of nearly 7.3 billion USD. Holding cost: The average purchase price of Ethereum for this treasury company is 3,825 USD.

11:18

UBS reportedly increases 2025 bonus pool for certain investment banking divisions by nearly 20%Glonghui, February 5th|According to sources cited by the media, the bonus pool for certain divisions of UBS Group’s investment bank will be raised by up to 20% in 2025. The relevant bonus allocations have already been announced internally. UBS’s fourth-quarter results released on Wednesday showed that the investment banking division made a significant contribution to the group’s overall profit of $1.2 billion. Driven by market volatility triggered by Trump’s tariff offensive in the second quarter, UBS’s investment banking operating profit grew by 34% last year. UBS Chief Financial Officer Todd Tuckner said on an analyst conference call on Wednesday: “This was the strongest revenue performance in the history of the investment bank.” According to sources, within the investment banking business, the bonus pool for the Asia Global Banking division increased by about 18%. Another source said that some U.S. dealmakers underperformed last year.

11:18

Goldfish will launch the GFIN airdrop to mark the official launch of the gold-backed protocol's governance layer.According to a report by Bijie Network: Goldfish is an institutional-grade on-chain gold platform that is currently preparing for the $GFIN governance token airdrop to expand community participation in its existing protocol. This airdrop prioritizes active users over short-term speculators, and $GFIN will be used for the governance of an existing ecosystem, which includes the gold-backed stablecoin $GGBR, with a total value locked of approximately $5 million. The newly launched social task leaderboard has already attracted over 15,000 registered users.

News