News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily Report | US-Japan-EU-Mexico Collaborate on Key Minerals Development; Nasdaq Introduces Fast Inclusion Rules; Software Stocks Continue Under Pressure (February 5, 2026)2Hyperliquid treasury seeks revenue boost using HYPE holdings as options collateral3Bitcoin drops following Treasury Secretary Bessent's statement that the US government cannot require banks to rescue crypto

Wildcat Labs Raises $3,5 Million to Expand DeFi Credit

Portalcripto·2025/09/05 20:10

MARA reaches 52.477 BTC and consolidates US$5,9 billion in treasury

Portalcripto·2025/09/05 20:10

SEC and CFTC Align on DeFi Regulation and Plan Roundtable

Portalcripto·2025/09/05 20:10

Nasdaq Demands Shareholder Vote in Crypto Treasury Races

Portalcripto·2025/09/05 20:10

SWIFT executive defends banks' role in the blockchain era

Portalcripto·2025/09/05 20:10

XRP Breakout Pattern Signals 70% Surge — Traders Eye the Altcoin as a Top Performer Into 2025

XRP shows a breakout pattern signaling a potential 70% surge. Traders are eyeing the altcoin as a top performer heading into 2025. Discover the factors fueling this bullish momentum.Ripple Forecast: XRP Technical AnalysisXRP Bulls Spot New GemConclusion

Coinomedia·2025/09/05 20:05

Ripple Price Analysis: XRP’s Failure to Break Out of Consolidation Spells Trouble Ahead

CryptoNewsNet·2025/09/05 20:00

Crypto News: XRP Tops Sentiment Charts, Outshines Bitcoin and Ethereum

CryptoNewsNet·2025/09/05 20:00

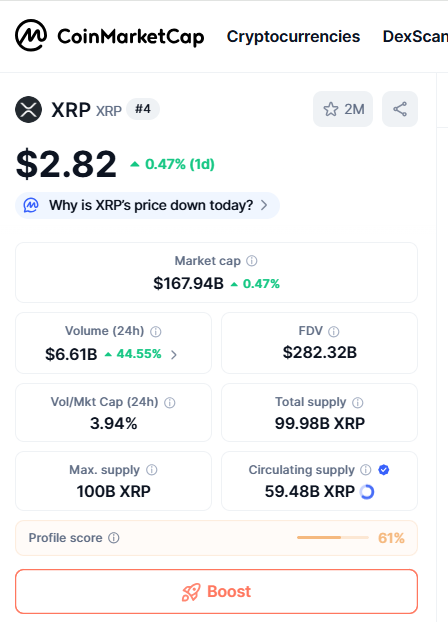

$5,940,000,000 XRP Activity Surge Shocks Market as Price Flips Direction

CryptoNewsNet·2025/09/05 20:00

SOL Strategies Wins Nasdaq Listing, Shares to Trade Under ‘STKE’

CryptoNewsNet·2025/09/05 20:00

Flash

21:57

Tether acquires a 12% stake in Gold.com to promote XAUT distributionTether has acquired a 12% stake in Gold.com for $150 million, with plans to expand the global distribution of its gold-backed token XAUT and support the purchase of gold bars using Tether stablecoins. Currently, the tokenized gold market has exceeded $5 billion. In addition, Tether has also invested in the US-regulated crypto bank Anchorage Digital to support its US-regulated stablecoin USAT.

21:39

Earnings Report Live: Strategies Impacted by Bitcoin Crash, Amazon Stock Plummets, Reddit Stock VolatileAccording to CoinWorld, on Thursday, MicroStrategy's stock price plummeted by 17%, with losses widening in after-hours trading, after the company released its fourth-quarter financial report revealing significant unrealized losses on its massive bitcoin holdings. The company reported an operating loss of $17.4 billion in the fourth quarter and a net loss of $12.4 billion, or a loss of $42.93 per share, far below its expectations in December. MicroStrategy holds 713,502 bitcoins, with an average purchase price of $76,052 per bitcoin; as the spot price of bitcoin fell to around $63,000, the company's unrealized losses amounted to approximately $8.9 billion. CEO Michael Saylor responded on Twitter: "HODL".

21:37

CME raises margin requirements for gold and silver futuresJinse Finance reported that the Chicago Mercantile Exchange (CME) issued a notice on February 5 local time, announcing adjustments to the margin requirements (Outright Rates) for certain gold, silver, and aluminum futures contracts. According to the document, the new margin ratio for gold has been raised to 9%, while the margin level for silver has been increased to 18%. The new standards will take effect after the close of trading on February 6 local time.

News