News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Quick Take Summary is AI generated, newsroom reviewed. Solana recorded $2.25 billion USDC Mint during September 2025 Institutions prefer Solana for speed, liquidity, and regulatory clarity GENIUS Act rules boost compliance trust for institutional stablecoin adoption Public companies increasingly use Solana treasuries for staking and yield Circle expands USDC Mint globally under MiCA and e-money frameworksReferences $2.25B $USDC Minted on Solana This Month

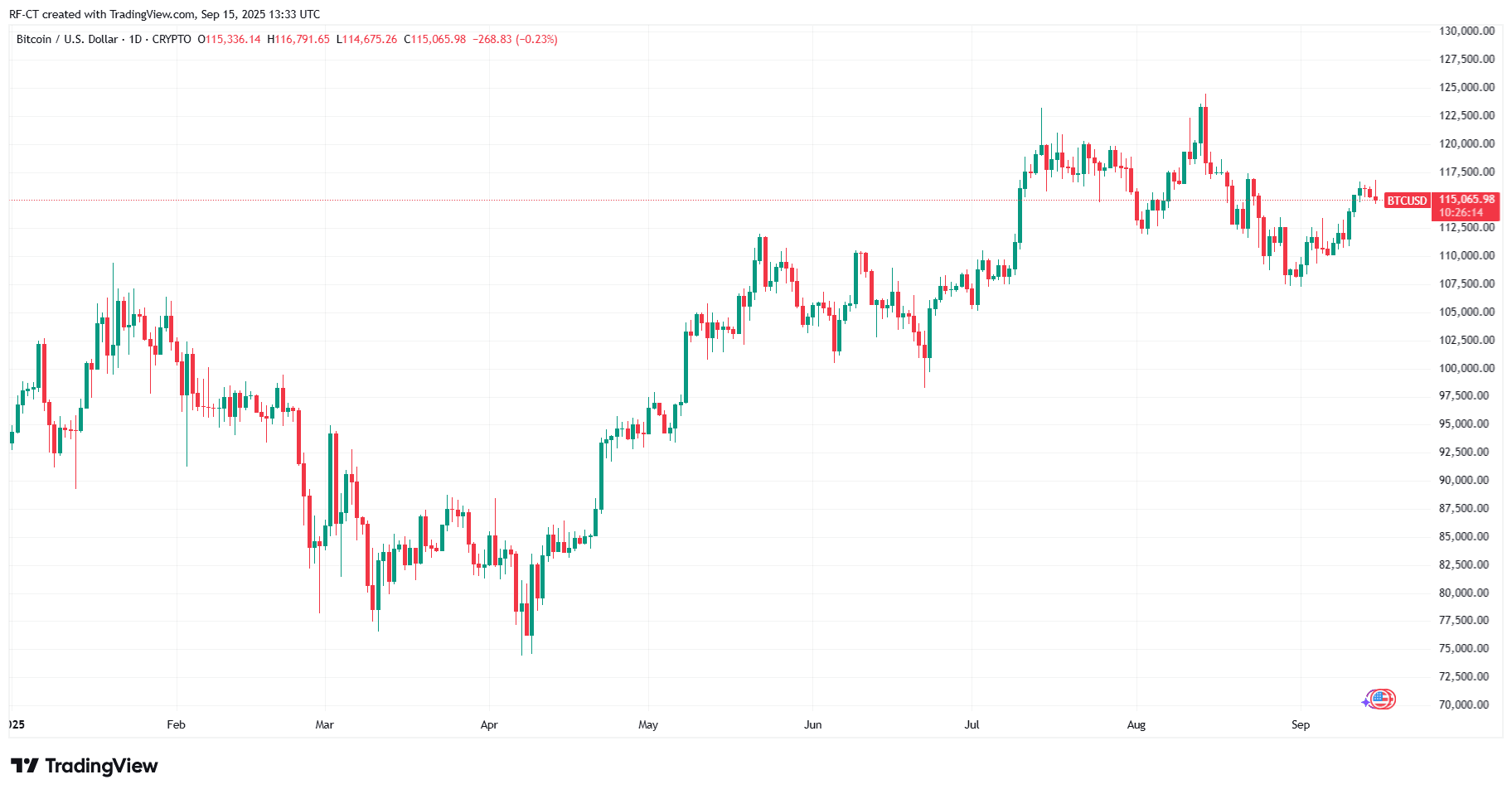

Digital asset treasuries (DATs) fueling 2025’s crypto rally are now losing purchasing power. September brought collapsing mNAVs, stock declines, and renewed doubts over the sustainability of treasury-led accumulation.

Sui is gaining momentum with Google’s AP2 partnership and an ETF filing, fueling bullish narratives. Yet with record-tight consolidation and bearish technical risks, the next price move could be decisive.

PayPal has launched peer-to-peer payments for Bitcoin and Ethereum, allowing users to send and receive cryptocurrencies directly through its platform more easily than before.