News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

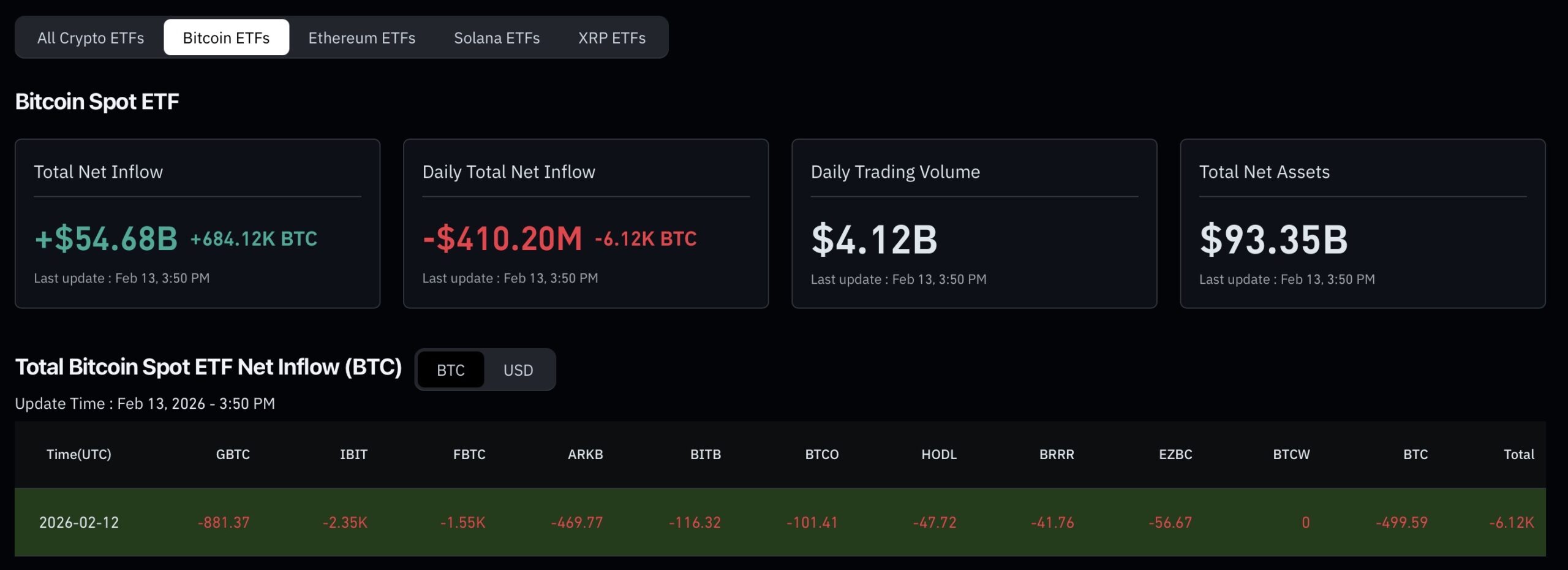

1Bitcoin ETFs rebound with $166.5M inflows despite BTC price dip2Crypto Allocation in Asia: BlackRock’s Stunning $2 Trillion Prediction Reveals Institutional Shift3Solana Extends Losses Below $88 as Crypto Market Downturn Deepens

Bitcoin Hits ‘Deep Value’ as RSI Plummets to 23: Is the High-Conviction Bottom In?

Coinspeaker·2026/02/13 17:24

Why Trupanion (TRUP) Shares Are Trading Lower Today

Finviz·2026/02/13 17:24

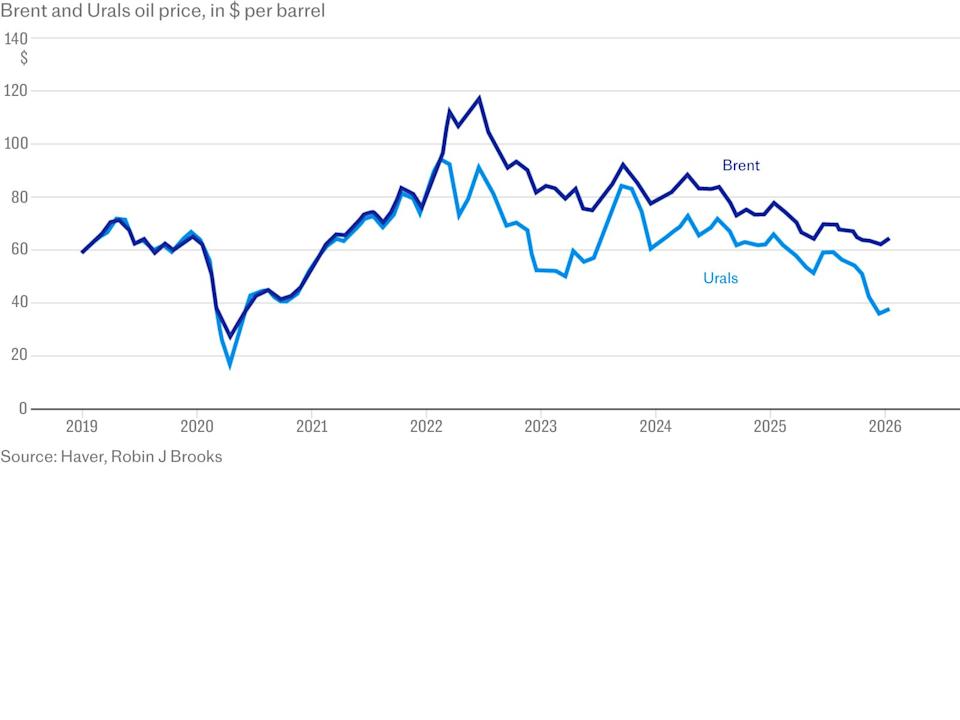

Record-breaking price cuts on Russian oil deal a heavy blow to Putin’s military efforts

101 finance·2026/02/13 17:21

What's Going On With Advance Auto Parts Friday?

Finviz·2026/02/13 17:03

Roku to launch streaming bundles as part of its efforts to continue growing its profitability

101 finance·2026/02/13 17:03

Crypto investor sentiment will rise once CLARITY Act is passed: Bessent

Cointelegraph·2026/02/13 17:03

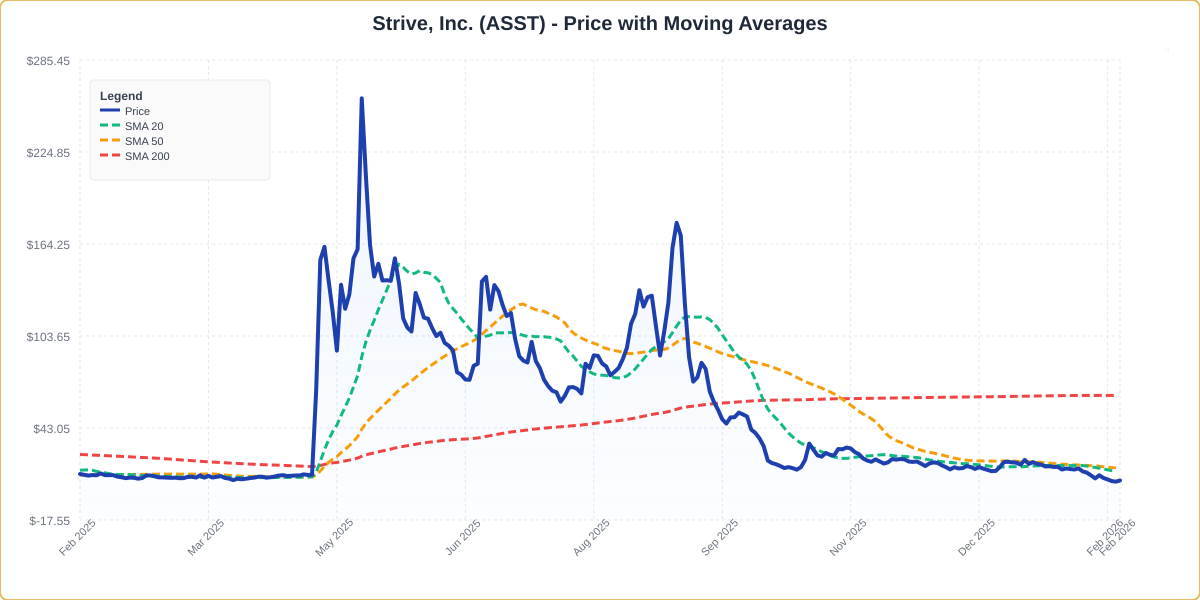

Strive (ASST) Pops As Bitcoin Surges Near $69,000

Finviz·2026/02/13 16:57

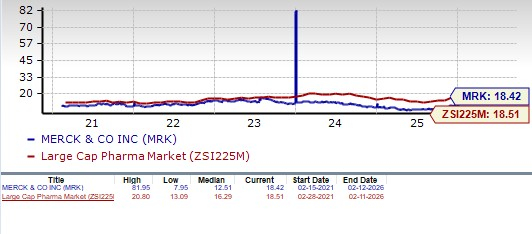

MRK Up More Than 7% on Improved Long-Term Prospects: Still a Sell?

Finviz·2026/02/13 16:51

Poland’s problematic crypto law rejected in new presidential veto

Cryptopolitan·2026/02/13 16:48

Flash

17:25

Gold price surpasses $5,000 again as mild inflation strengthens expectations of a Fed rate cutGold prices strengthened as traders further bet on a Federal Reserve rate cut following the release of mild inflation data, while some investors chose to buy the dip after a sharp decline in gold prices on Thursday. The relatively mild U.S. January inflation data effectively eased market concerns about rapidly rising inflation, boosting market expectations for a Fed rate cut. After the data was released, the yield on the U.S. 10-year Treasury note fell, and interest rate swap market traders estimated about a 50% chance that the Fed would implement a third rate cut before December. As a result, gold prices rose as much as 2.3% intraday. Generally, falling interest rates are favorable for non-yielding assets like gold. Spot gold rose 1.9% intraday to $5,016.90 per ounce. Silver rose 3.4% to $77.81 per ounce, while platinum and palladium prices also climbed, and the U.S. dollar index fluctuated within a limited range.

17:22

Data: 661.19 BTC were transferred out of an exchange, routed through an intermediary, and then flowed into another exchange.According to ChainCatcher, Arkham data shows that at 01:13, 661.19 BTC (worth approximately $16.74 million) were transferred from an exchange to an anonymous address (starting with bc1q05xs6...). Subsequently, this address transferred part of the BTC (243.82 coins) to an exchange.

17:19

Mike McGlone predicts near-zero inflation in 2026, with bitcoin potentially leading the recessionMike McGlone from Bloomberg Intelligence stated that historical CPI patterns indicate that inflation could approach zero in 2026, and bitcoin may play a dominant role in a deflation-driven economic recession. (Cointelegraph)

News