News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin ETFs rebound with $166.5M inflows despite BTC price dip2Crypto Allocation in Asia: BlackRock’s Stunning $2 Trillion Prediction Reveals Institutional Shift3Solana Extends Losses Below $88 as Crypto Market Downturn Deepens

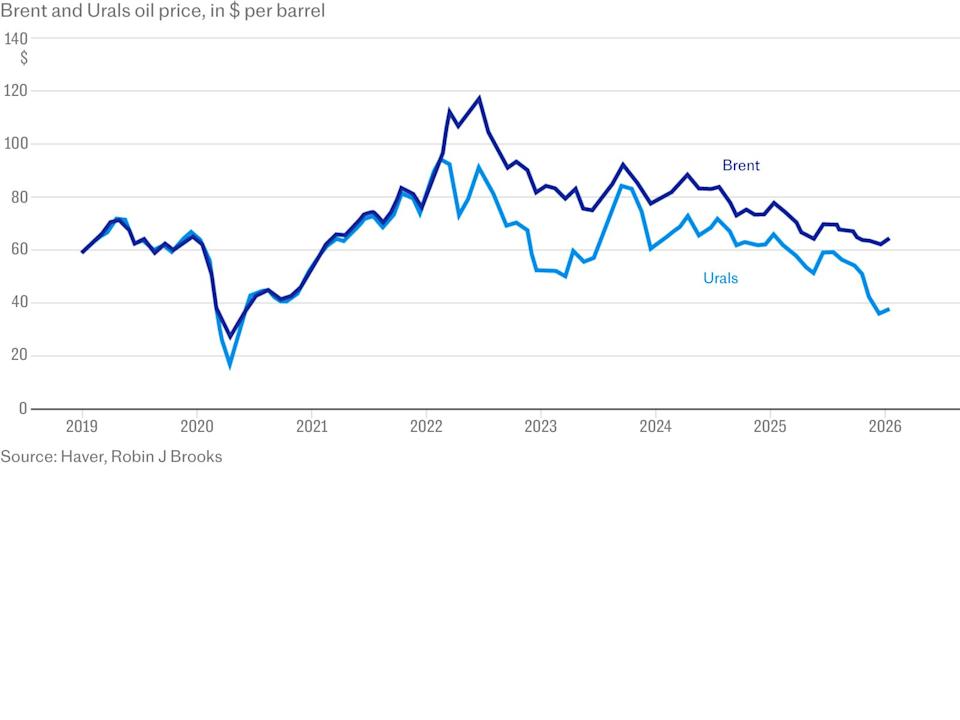

Record-breaking price cuts on Russian oil deal a heavy blow to Putin’s military efforts

101 finance·2026/02/13 17:21

What's Going On With Advance Auto Parts Friday?

Finviz·2026/02/13 17:03

Roku to launch streaming bundles as part of its efforts to continue growing its profitability

101 finance·2026/02/13 17:03

Crypto investor sentiment will rise once CLARITY Act is passed: Bessent

Cointelegraph·2026/02/13 17:03

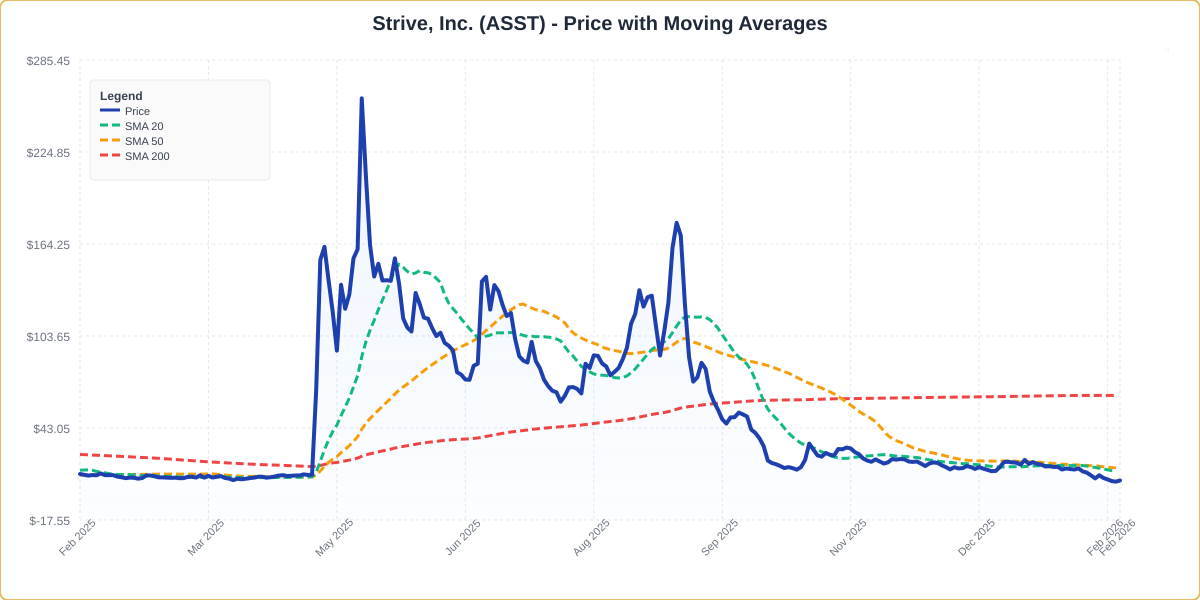

Strive (ASST) Pops As Bitcoin Surges Near $69,000

Finviz·2026/02/13 16:57

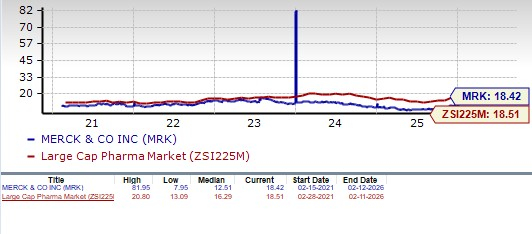

MRK Up More Than 7% on Improved Long-Term Prospects: Still a Sell?

Finviz·2026/02/13 16:51

Poland’s problematic crypto law rejected in new presidential veto

Cryptopolitan·2026/02/13 16:48

Alliance Global Cuts PT on Rezolve AI PLC (RZLV) to $13 From $14 - Here's Why

Finviz·2026/02/13 16:48

Strength Seen in Akamai Technologies (AKAM): Can Its 10.4% Jump Turn into More Strength?

Finviz·2026/02/13 16:42

Flash

17:22

Data: 661.19 BTC were transferred out of an exchange, routed through an intermediary, and then flowed into another exchange.According to ChainCatcher, Arkham data shows that at 01:13, 661.19 BTC (worth approximately $16.74 million) were transferred from an exchange to an anonymous address (starting with bc1q05xs6...). Subsequently, this address transferred part of the BTC (243.82 coins) to an exchange.

17:19

Mike McGlone predicts near-zero inflation in 2026, with bitcoin potentially leading the recessionMike McGlone from Bloomberg Intelligence stated that historical CPI patterns indicate that inflation could approach zero in 2026, and bitcoin may play a dominant role in a deflation-driven economic recession. (Cointelegraph)

17:14

The yields on 10-year and 30-year German bonds have fallen by at least 8 basis points this week.The yield on the two-year German bond fell by 2.3 basis points to 2.036%, with a cumulative decline of 4.9 basis points this week, trading overall in the range of 2.095%-2.026%. The yield on the 30-year German bond fell by 1.7 basis points to 3.432%, with a cumulative decline of 8.0 basis points this week. The yield spread between the 2-year and 10-year German bonds fell by 0.016 basis points to +71.641 basis points, with a cumulative decline of 3.803 basis points this week.

News