News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin ETFs rebound with $166.5M inflows despite BTC price dip2Crypto Allocation in Asia: BlackRock’s Stunning $2 Trillion Prediction Reveals Institutional Shift3Solana Extends Losses Below $88 as Crypto Market Downturn Deepens

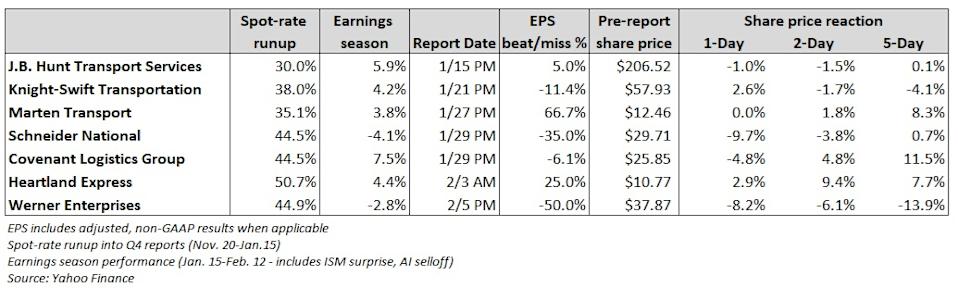

TL stocks experience dramatic swings entering and exiting Q4 earnings season

101 finance·2026/02/13 18:30

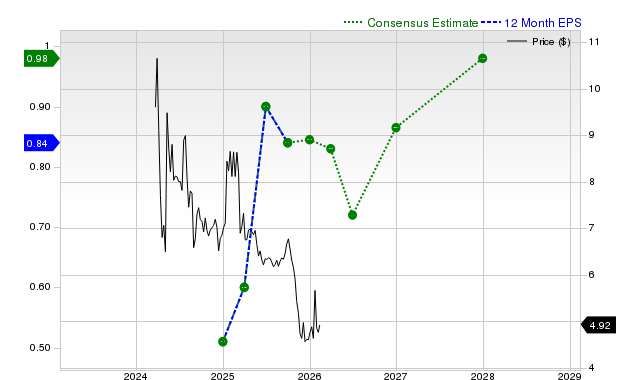

Earnings Estimates Moving Higher for Auna S.A. (AUNA): Time to Buy?

Finviz·2026/02/13 18:21

Nowhere to run (bonds are the only refuge)

101 finance·2026/02/13 18:18

Will American Eagle (AEO) Beat Estimates Again in Its Next Earnings Report?

Finviz·2026/02/13 18:12

Will Crescent Energy (CRGY) Beat Estimates Again in Its Next Earnings Report?

Finviz·2026/02/13 18:12

Marriott (MAR) Upgraded to Buy: Here's Why

Finviz·2026/02/13 18:03

MP Materials Backed By $110 DoD Price Floor As JPMorgan Sees 33% Upside

Finviz·2026/02/13 18:03

Coherent (COHR) Upgraded to Strong Buy: What Does It Mean for the Stock?

Finviz·2026/02/13 18:03

What Makes Aura Biosciences (AURA) a New Buy Stock

Finviz·2026/02/13 18:03

All You Need to Know About Silicon Labs (SLAB) Rating Upgrade to Buy

Finviz·2026/02/13 18:03

Flash

18:33

The Board of Directors of Chemed Corporation recently announced two significant capital allocation decisions: authorizing an additional stock repurchase program of up to $300 million, while maintaining the quarterly cash dividend at $0.60 per share.This move highlights the company's ongoing commitment to shareholder returns and reflects management's confidence in future cash flow generation. The expansion of the stock repurchase program will provide the company with greater flexibility to optimize its capital structure by timely repurchasing outstanding shares. Meanwhile, a stable dividend policy continues to offer investors predictable cash flow returns. The combination of these two decisions not only demonstrates the company's robust financial strength, but also conveys a positive outlook for its long-term growth prospects.

18:25

The Federal Reserve's reverse repo operation accepted $377 million from 3 counterparties.The Federal Reserve accepted $37.7 million from three counterparties in its fixed-rate reverse repurchase operations.

17:58

Daiwa Capital: CPI and employment data support the Federal Reserve keeping interest rates unchanged in MarchAccording to ChainCatcher, citing Golden Ten Data, Lawrence Werther, Chief Economist at Daiwa Capital Markets America, stated that the January CPI report showing slowing inflation and this week’s better-than-expected employment data provide ample reason for the Federal Reserve to keep interest rates unchanged at the March policy meeting. Year-on-year growth rates for overall and core inflation in January were 2.4% and 2.5%, respectively, reaching the minimum threshold for maintaining a patient policy. In addition, core services inflation jumped 0.6% month-on-month, which may attract the attention of regional Federal Reserve presidents.

News