Equities Rally on Rising Risk Appetite as Bitcoin Awaits Institutional Moves

Investor risk appetite has strengthened noticeably over the past six months, reflecting a boost in confidence across financial markets. U.S. equities are seeing particularly strong bullish activity, with investors positioning themselves for further gains. Bitcoin, by contrast, has yet to show the same level of institutional conviction, as capital inflows remain modest compared with the assertive moves in the stock market.

In brief

- Investor risk appetite has surged in U.S. equities while Bitcoin lags with low institutional demand.

- Bitcoin’s market structure indicates caution, with ETF flows fluctuating and the Coinbase Premium remaining weak.

Stock Market Optimism vs Crypto Hesitation

Data from CryptoQuant highlights a clear difference between traditional markets and cryptocurrencies in both spot trading and derivatives activity. In U.S. equities, call options dominate, showing that investors are focused on potential gains rather than hedging for downside risk, while implied volatility remains subdued, reflecting market stability and robust liquidity.

This positive investor sentiment is backed by broader economic signals. Inflation has eased, with headline CPI at 2.4% year-over-year and core CPI at 2.5%, easing pressure on real yields and reinforcing expectations for future monetary easing. These factors support risk assets, and equity markets have responded with confidence, showing stability rather than defensive caution.

Bitcoin Struggles to Gain Institutional Support

Bitcoin’s market structure, however, remains uncertain. Demand from U.S.-based investors appears muted, as reflected in the Coinbase Premium Index. In past cycles, strong rallies were often accompanied by lasting positive premiums, a sign of steady institutional buying. By contrast, the current conditions suggest that recent price moves are not being driven by consistent spot purchases from large investors.

Supporting this cautious view, key market indicators highlight ongoing investor hesitation:

- ETF activity continues to fluctuate between inflows and outflows without forming a clear accumulation trend, indicating tentative investor behavior.

- Bitcoin remains in the bear phase; however, it has not yet reached the deepest stage identified by CryptoQuant’s Bull-Bear Market Cycle Indicator, a stage historically signalling the start of extended bottoming periods.

Meanwhile, the market is in a recovery phase, and momentum is being tested. Over the next 30 days, several indicators will be key to determining if the rally can hold. A sustained positive Coinbase Premium would signal renewed U.S. spot demand, while repeated ETF inflows would point to growing institutional interest. Price gains supported by actual spot purchases rather than leveraged trades would further strengthen the move. With these factors yet to align, upward momentum may remain subdued.

Bitcoin Accumulation Signals Hint at a Potential Rally

Despite these cautious signals, data from CryptoRank.io shows Bitcoin inflows to accumulation addresses rising to levels not seen since early 2022 as prices continue to dip. Large holders are taking advantage of the pullback to add more coins, fueling a wave of steady accumulation. Historically, periods of increased buying during market caution have often preceded strong rallies, suggesting that renewed institutional activity could help propel further price gains.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

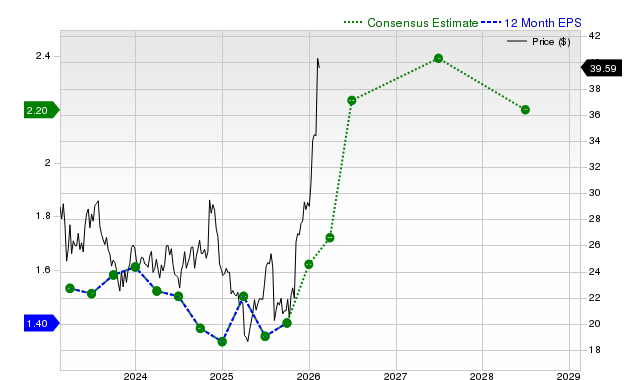

Surging Earnings Estimates Signal Upside for BCB Bancorp (BCBP) Stock

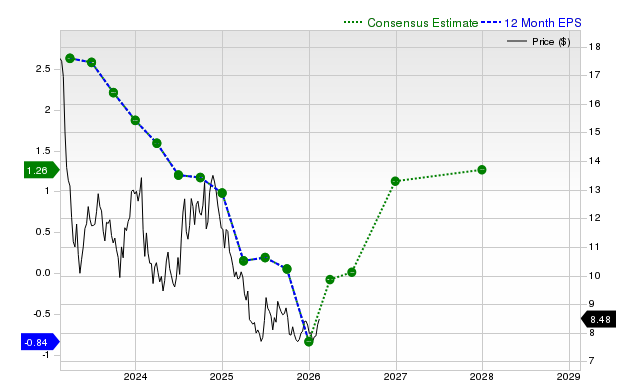

Can Bank of NT Butterfield & Son (NTB) Run Higher on Rising Earnings Estimates?

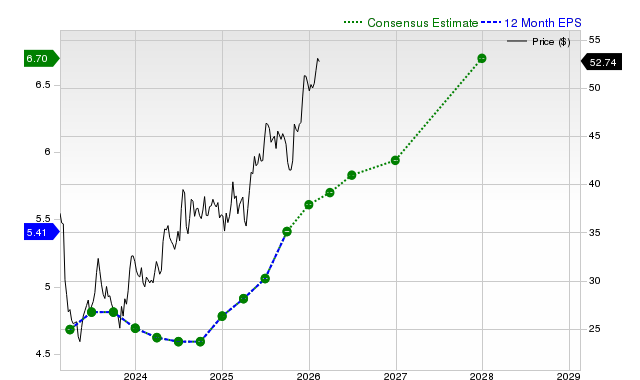

Surging Earnings Estimates Signal Upside for nLight (LASR) Stock

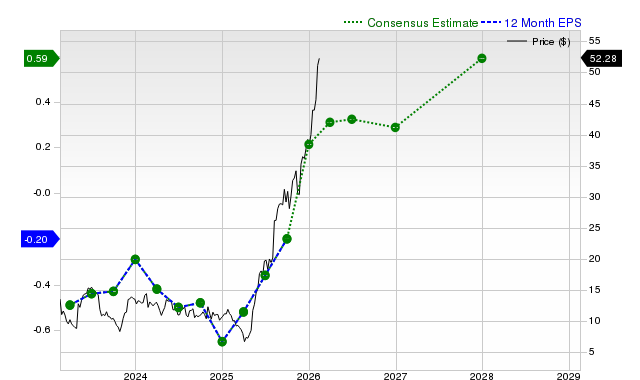

Surging Earnings Estimates Signal Upside for Kennametal (KMT) Stock