Harvard trims bitcoin ETF holdings by 21%, builds $87 million ether position

Harvard Management Company pared its bitcoin exchange-traded fund holdings by more than a fifth during the fourth quarter while establishing its first position in an ether ETF, a shift disclosed in a quarterly filing that shows the endowment held a combined $352.6 million in exposure to the two largest digital assets.

The Ivy League endowment's investment manager held 5.35 million shares of BlackRock's iShares Bitcoin Trust (IBIT), valued at $265.8 million as of Dec. 31, according to a filing with the Securities and Exchange Commission on Friday. The position represents a 1.48 million share reduction from the prior quarter, when Harvard reported 6.81 million shares worth $442.8 million.

Harvard simultaneously opened a new $86.8 million position in BlackRock's iShares Ethereum Trust (ETHA) during the quarter, acquiring 3.87 million shares, the filing shows. The ether investment marked the endowment's first publicly disclosed position in a fund tracking the second-largest cryptocurrency.

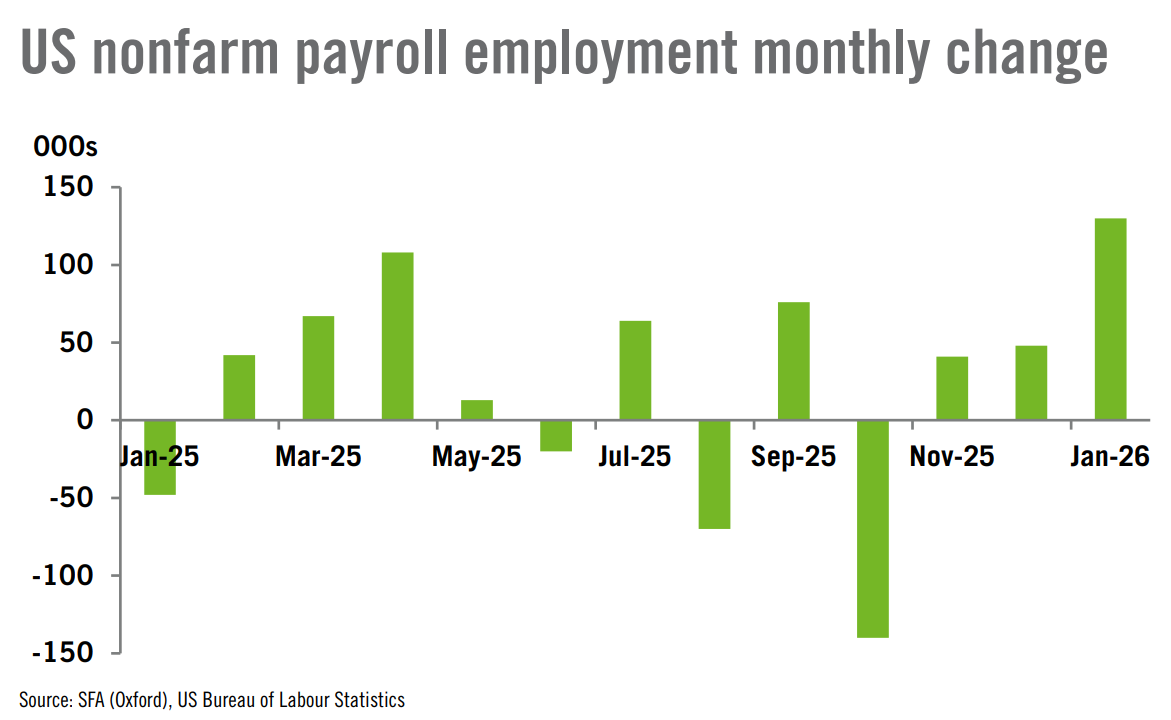

The changes came during a volatile quarter for cryptocurrency markets. Bitcoin (BTC) peaked at roughly $126,000 in October 2025 before falling to $88,429 by Dec. 31, while ether (ETH) declined about 28% over the same period. As of this week, bitcoin and ether are trading near $68,600 and $1,900, respectively.

Despite the reduction, bitcoin remained Harvard's largest publicly disclosed equity holding as of Dec. 31, with the $265.8 million position exceeding the endowment's stakes in Alphabet, Microsoft, and Amazon, according to the filing.

Meanwhile, Harvard’s crypto strategy has drawn scrutiny from academic observers, according to reporting by The Harvard Crimson on Monday.

Andrew F. Siegel, emeritus professor of finance at the University of Washington, described the bitcoin investment as “risky” and noted it was down 22.8% year-to-date. Siegel added that the risk of bitcoin is “partly due to its lack of intrinsic value.”

Avanidhar Subrahmanyam, a professor of finance at UCLA, wrote that the addition of ether amplifies his reservations about the endowment's digital asset strategy. Subrahmanyam said he considers cryptocurrency an unproven asset class where valuation methodology remains unclear, adding that his prior skepticism toward Harvard's bitcoin investment had been validated by subsequent performance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

EXPE Q4 Earnings Beat on Strong B2B and Advertising Growth

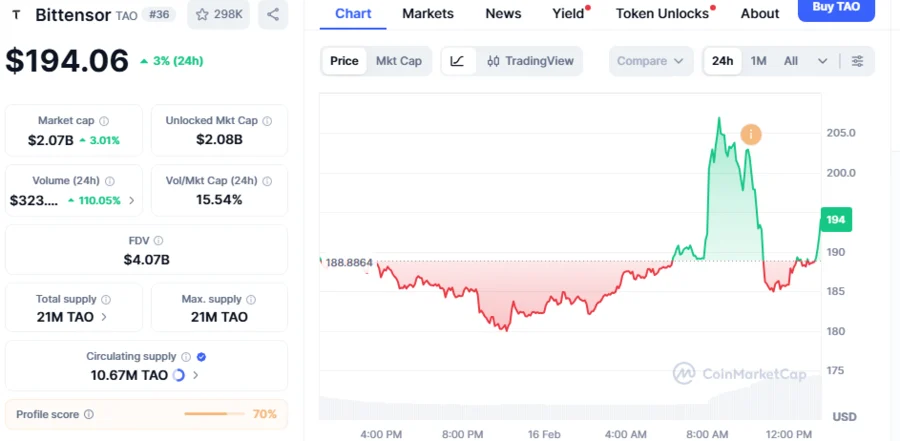

TAO Takes Lead In Crypto Market with 9.18% As Demand for Intelligence Capability Increasing: Analyst

What’s driving the euro to outperform USD for 2nd year in a row?