Date: Wed, Dec 10, 2025 | 06:05 AM GMT

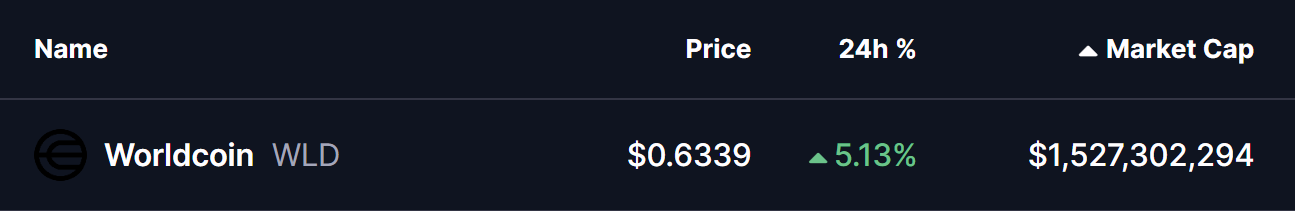

The cryptocurrency market has made a sharp bullish move in the past 24 hours as the prices of both Bitcoin (BTC) and Ethereum (ETH) jumped by 3% & 6%, allowing major altcoins to regain ground including Worldcoin (WLD).

WLD has surged more than 5%, and beyond the price strength, its chart is signaling the development of a bullish structure — one that may soon open the door for trend reversal momentum.

Source: Coinmarketcap

Source: Coinmarketcap

Descending Channel in Play

On the daily timeframe, WLD continues to trade inside a well-defined descending channel, compressed between two parallel falling trendlines. While the structure has held price captive for weeks, it has also acted as a controlled corrective environment rather than a breakdown phase.

The token recently retested the lower boundary near $0.5619, where buyers once again reacted with absorption, pushing price back toward the channel’s upper resistance. That rebound has brought WLD to trade around $0.6330, placing it directly below the breakout confluence zone formed by the channel top and the 50-day MA sitting at $0.7202.

Worldcoin (WLD) Daily Chart/Coinsprobe (Source: Tradingview)

Worldcoin (WLD) Daily Chart/Coinsprobe (Source: Tradingview)

This cluster now becomes the immediate technical gate that bulls must clear to shift momentum.

What’s Next for WLD?

If buyers successfully lift WLD above the descending channel ceiling near $0.66 and secure continuation beyond the 50-day MA at $0.7202, the corrective phase would likely be considered complete. In such a breakout scenario, the chart reveals upside potential toward the $0.9303 zone — a previous structural target aligned with channel measured expansion.

But until that breakout materializes, the descending channel remains active. A rejection from current levels could guide the price back inside the formation, with $0.5514 standing as the next downside defense zone. So long as that support continues to hold, bullish structure remains intact rather than failing into further capitulation.

At present, WLD’s positioning leans constructive: downside momentum has eased, support reaction continues to show strength, and the channel boundaries are tightening toward resolution. A confirmed breakout, especially reclaiming the 50-day MA, would mark the clearest shift in trend and signal that WLD is preparing for its next expansion phase.