Are Deepening Macroeconomic Structural Contradictions a Good Timing for Risk Assets?

In the short term, bullish on risk assets due to AI capital expenditure driving profits supported by affluent consumption. In the long term, caution is advised against structural risks from sovereign debt, demographic crisis, and geopolitical reshaping.

Original Title: My Current Bias, in One Line

Original Author: @arndxt_xo, Crypto KOL

Original Translation: AididiaoJP, Foresight News

One-Liner Summary: I am currently bullish on risk assets in the short term due to AI capital expenditure, consumer spending driven by the affluent class, and still high nominal growth, all of which structurally favor corporate profits.

In simpler terms: When the cost of borrowing is low, "risk assets" typically perform well.

However, at the same time, I am skeptical of the story we are currently telling about what all of this means for the next decade:

· Sovereign debt issues that cannot be resolved without some combination of inflation, financial repression, or a black swan event.

· Fertility rates and demographic structures that will invisibly limit real economic growth and quietly magnify political risks.

· Asia, especially China, will increasingly become the core definer of opportunity and tail risks.

So the trend continues, holding on to those profit engines. But to construct a portfolio, it is imperative to recognize that the path to currency debasement and demographic adjustment will be full of twists and turns, not smooth sailing.

The Illusion of Consensus

If you only read the views of major institutions, you would think we are living in the most perfect macro world:

Economic growth is "resilient," inflation is sliding toward targets, artificial intelligence is a long-term tailwind, and Asia is the new engine of diversification.

The latest outlook for the first quarter of 2026 from HSBC is a clear manifestation of this consensus: stay in the stock market bull run, overweight tech and communication services, bet on AI winners and Asian markets, lock in investment-grade bond yields, and smooth volatility with alternative and multi-asset strategies.

I actually partially agree with this view. But if you stop there, you will miss the truly important story.

Beneath the surface, the reality is:

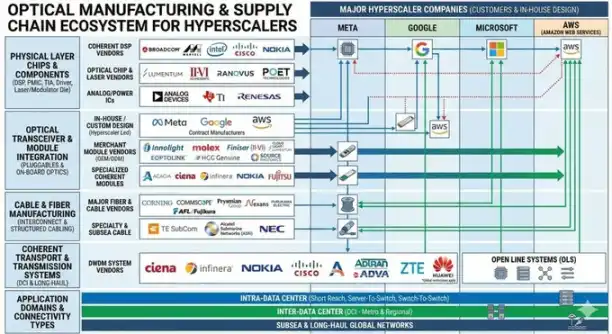

· An earnings cycle driven by AI capital expenditure, the intensity of which far exceeds people's imagination.

· A monetary policy transmission mechanism partially impaired by the accumulation of massive public debt on private balance sheets.

· Some structural time bombs — sovereign debt, collapsing birth rates, geopolitical realignment — may not matter for this quarter, but are crucial for what “risk assets” themselves mean a decade from now.

This piece is my attempt to reconcile these two worlds: one a shiny, marketable story of “resilience,” the other a messy, path-dependent macro reality.

1. Market Consensus

Let’s start with the prevailing view among institutional investors.

Their logic is straightforward:

· The stock market bull run continues, but with increased volatility.

· Industry styles should be diversified: overweight in tech and communications, while also holding utilities (power demand), industrials, and financials for value and diversification.

· Utilize alternative investments and multi-asset strategies to hedge against downturns — such as gold, hedge funds, private credit/equity, infrastructure, and volatility strategies.

Focus on yield opportunities:

· With spreads already tight, shift funds from high-yield bonds to investment-grade bonds.

· Increase exposure to emerging market hard currency corporate bonds and local currency bonds for yield spread and equity market low correlation.

· Use infrastructure and volatility strategies as inflation hedges.

Position Asia at the core of diversification:

· Overweight in China, China Hong Kong, Japan, Singapore, South Korea.

· Focus on themes: Asian data center boom, innovative leading Chinese companies, Asian corporate returns enhanced through buybacks/dividends/mergers, and high-quality Asian credit bonds.

In fixed income, they are explicitly bullish on:

· Global investment-grade corporate bonds for their higher spread and opportunity to lock in yields before policy rates fall.

· Overweighting emerging market local currency bonds for spread, potential currency gains, and low correlation with stocks.

· Slightly underweighting global high-yield bonds due to overvaluation and individual credit risks.

This is a textbook example of a "late-cycle but not yet over" configuration: go with the flow, diversify your investments, and let Asia, AI, and yield strategies drive your portfolio.

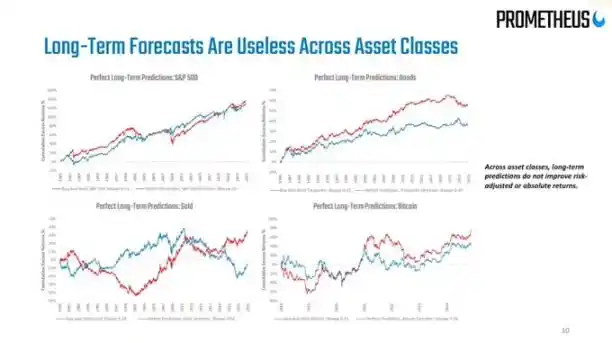

I think this strategy is broadly correct for the next 6-12 months. But the problem is that most macro analysis stops here, and the real risks only start from here.

2. Cracks Beneath the Surface

On a macro level:

· U.S. nominal spending is growing at around 4-5%, directly supporting corporate revenues.

· But the key question is: who is doing the spending? Where is the money coming from?

Mere discussions of a declining savings rate ("consumers are out of money") miss the point. If affluent households dip into savings, increase credit, or realize asset gains, they can continue to spend even if wage growth slows and the job market softens. The portion of consumption exceeding income is supported by the balance sheet (wealth), not the income statement (current income).

This means that a significant part of the marginal demand comes from affluent households with strong balance sheets, rather than broad-based real income growth.

That's why the data looks so contradictory:

· Overall consumption remains strong.

· The labor market is gradually weakening, especially in low-end jobs.

· Income and asset inequality worsen, further reinforcing this pattern.

Here, I diverge from the mainstream "resilience" narrative. The macro aggregates look good because they are increasingly dominated by the small group at the top of the income, wealth, and capital acquisition pyramid.

For the stock market, this is still a positive (profits don't care if income comes from one rich person or ten poor people). But for social stability, the political environment, and long-term growth, this is a slow-burning hazard.

3. The Stimulus Effect of AI Capital Expenditure

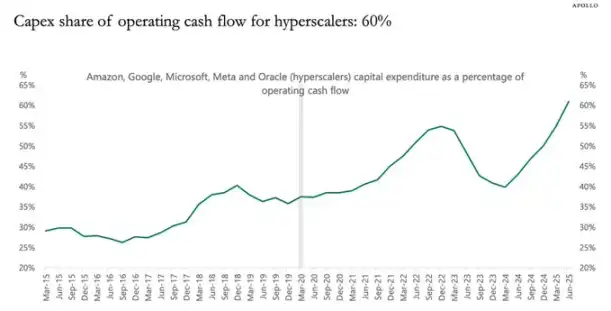

The most underestimated dynamic currently is artificial intelligence (AI) capital expenditure and its impact on profits.

In simple terms:

· Investment spending is someone else's income today.

· The associated costs (depreciation) will slowly manifest over the next few years.

Therefore, when AI super-scale companies and related firms significantly ramp up total investments (e.g., growing by 20%):

· Revenue and profit will receive a significant and upfront boost.

· Depreciation will slowly rise over time, roughly in line with inflation.

· Data shows that at any point in time, the best single indicator of profit explanation is total investment minus capital consumption (depreciation).

This leads to a very simple but consensus-different conclusion: during the ongoing AI capital expenditure surge, it stimulates the business cycle and maximizes corporate profits.

Don't try to stop this train.

This aligns perfectly with HSBC's overweight in tech stocks and its theme of the "evolving AI ecosystem." Essentially, they are also pre-positioning based on the same profit logic, albeit in a different narrative.

What I am more skeptical about is the narrative regarding its long-term impact:

I do not believe that relying solely on AI capital expenditure can usher us into a new era of 6% real GDP growth.

Once the corporate free cash flow financing window narrows and balance sheets saturate, capital expenditure will decelerate.

As depreciation catches up, this "profit stimulus" effect will fade away; we will revert to the potential trend of population growth + productivity gains, which is not high in developed countries.

Therefore, my stance is:

· Tactically: Stay optimistic for beneficiaries of AI capital expenditure (chips, data center infrastructure, power grids, niche software, etc.) as long as total investment data continues to soar.

· Strategically: See this as a cyclical profit boom rather than a permanent reset of trend growth rates.

4. Bonds, Liquidity, and the Semi-Failure Transmission Mechanism

This part has become somewhat eerie.

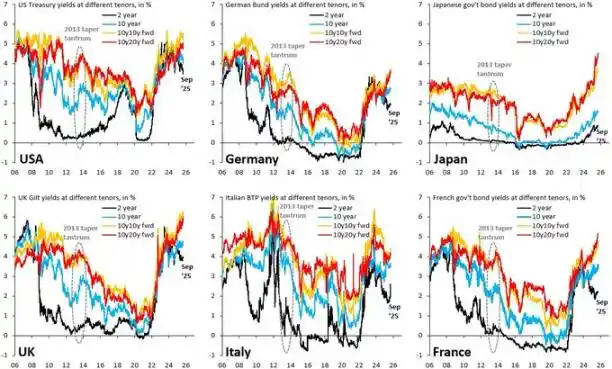

Historically, a 500 basis point rate hike would severely hit the private sector's net interest income. But today, trillions in public debt sit on private balance sheets as safe assets, distorting this relationship:

· Rising rates mean higher interest income for holders of government bonds and reserves.

· Many corporate and household debts are fixed-rate (especially mortgages).

· The end result: the net interest burden of the private sector has not deteriorated as macro forecasts predicted.

So here we are facing:

· A Fed in a bind: inflation still above target, while labor data softens.

· A volatile rate market: this year's best trade has been bond mean reversion, buying the panic sell-off, selling the rapid rallies as the macro landscape refuses to clarify into a clear "big rate cut" or "hiking again" trend.

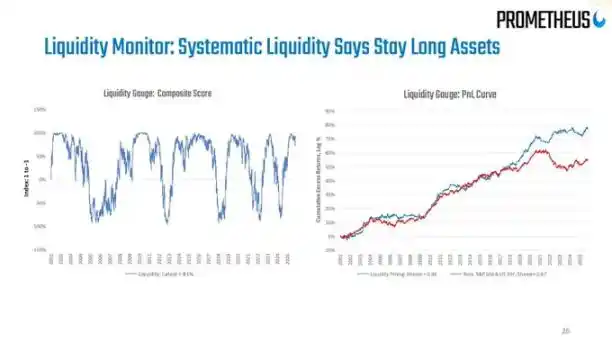

On "liquidity," here's my blunt take:

· The Fed's balance sheet now reads more like a narrative device; its net changes are too slow, too small relative to the entire financial system to be a useful trading signal.

· The real liquidity shifts happen on the private sector's balance sheets and in the repo market: who's borrowing, who's lending, and at what spread.

5. Debt, Demographics, and China’s Long Shadow

Sovereign Debt: Known Outcome, Unknown Path

The issue of international sovereign debt is the defining macro topic of our era, and everyone knows the "solution" boils down to:

Devalue through inflation to bring the debt/GDP ratio back to a manageable level.

The lingering question is the path:

Orderly Financial Repression:

· Maintain nominal growth > nominal rates

· Tolerate slightly above-target inflation

· Slowly erode the real debt burden

Disorderly Crisis Scenario:

· Markets panic over fiscal trajectory

· Term premia spike suddenly

· Weaker sovereigns experience currency crises.

Earlier this year, when market nerves about the fiscal pathway sent U.S. long-end yields spiking, we got a taste. HSBC itself noted that the narrative of "fiscal worsening" peaked around relevant budget discussions, only to fade as the Fed pivoted to growth concerns.

I believe this act is far from over.

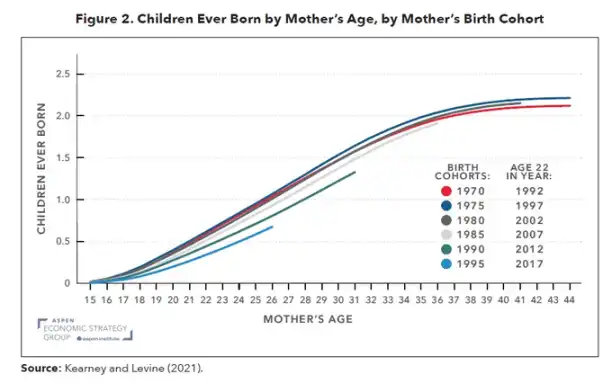

Fertility Rate: The Slow-Motion Macro Crisis

The global fertility rate has dropped below replacement levels, not only in Europe and East Asia but now also spreading to Iran, Turkey, and gradually affecting parts of Africa. This is essentially a profound macro shock masked by population statistics.

Low fertility rates mean:

· Higher dependency ratios (increased proportion of people needing care).

· Lower long-term potential for economic growth.

· Long-term societal allocation pressures and political tensions due to capital returns persistently outpacing wage growth.

When you combine AI capital expenditure (a form of capital deepening shock) with declining fertility rates (a labor supply shock),

you get a world where:

· Capital owners excel nominally.

· Political systems become more unstable.

· Monetary policy faces a dilemma: to support growth while avoiding wage-price spiral inflation when labor finally gains bargaining power.

This will not show up in institutions' next 12-month outlook slideshows, but it is absolutely crucial for a 5-15 year asset allocation perspective.

China: The Overlooked Key Variable

HSBC's Asian view is optimistic: bullish on policy-driven innovation, AI cloud computing potential, governance reforms, higher corporate returns, attractive valuations, and the tailwind from the region-wide easing.

My view is:

· Looking at a 5-10 year horizon, the risk of zero allocation to China and North Asia markets is greater than the risk of a modest allocation.

· Looking at a 1-3 year horizon, the main risk is not macro fundamentals but policy and geopolitics (sanctions, export controls, capital flow restrictions).

Consider simultaneously allocating to China AI, semiconductor, data center infrastructure-related assets, as well as high dividend, high-quality credit bonds, but you must determine the allocation size based on a clear policy risk budget, not just relying on historical Sharpe ratios.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Figma unveils innovative AI-driven features for removing objects and expanding images

AI startup Tavus founder claims that users spend hours each day conversing with its AI-powered Santa

Google introduces managed MCP servers, enabling AI agents to easily connect with its suite of tools