Andrew Tate’s Bitcoin Post Sparks MicroStrategy Debate

Andrew Tate’s post questioning why MicroStrategy’s 10,000 BTC purchase did not move Bitcoin’s price has triggered a heated debate across the crypto community. Analysts point to OTC execution, market depth, and unseen liquidity flows as key reasons large buys remain invisible on charts despite their scale.

Bitcoin Community Divided as MicroStrategy’s Latest 10,000 BTC Buy Fails to Move Price — OTC Liquidity and Market Structure Under Scrutiny

Andrew Tate’s post questioning why MicroStrategy’s ~10,000 BTC purchase did not move Bitcoin’s price has triggered widespread debate across the crypto community. The exchange highlights a persistent point of confusion among retail traders: how can a buy of this scale take place without producing a visible market reaction?

Community Debate Exposes Misunderstanding of Bitcoin OTC Market Depth

Andrew Tate’s discussion comes days after MicroStrategy added more than 10,600 BTC — a purchase worth nearly one billion dollars — taking its total holdings above 660,000 coins.

Despite the size of the acquisition, Bitcoin barely moved at the time, remaining locked between 88,000 and 92,000 dollars before breaking out only today.

I’m huge on BTC but micro strat buy 10k btc ina single day and the price doesn’t move. Explain that to me.

— Andrew Tate (@Cobratate) December 8, 2025

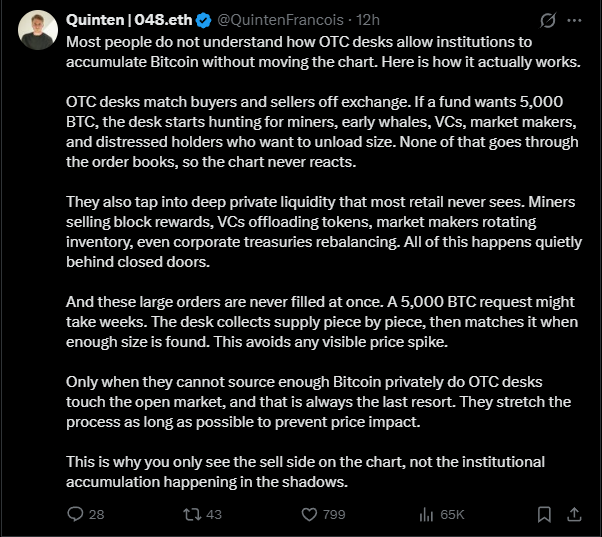

Multiple industry participants responded by pointing out that large institutional purchases rarely execute through spot order books. Instead, they are routed via Over-The-Counter (OTC) desks, which match buyers and sellers off-exchange.

Because these trades do not pass through public liquidity pools, they avoid slippage and leave no immediate footprint on candles, charts, or price indices.

This means a billion-dollar purchase can settle quietly across miners, early wallets, market makers, and distressed sellers without triggering upward movement.

Only when OTC inventory cannot meet demand do buyers spill into spot exchanges — and that is when prices react. MicroStrategy’s ability to absorb coins privately reflects Bitcoin’s liquidity depth at current supply levels.

Bitcoin Price Movement Depends Less on Size, More on Execution Route

Several analysts highlight that MicroStrategy’s buys may look huge but represent a small fraction of active supply.

Buying 10,000 BTC is still only ~0.05% of circulating supply, and when sourced through negotiated block trades rather than public spot books, the effect becomes nearly invisible.

This illustrates how corporate accumulation can continue even during sideways markets, without retail noticing until after settlement.

Binance Founder CZ Commenting on Andrew Tate’s Post

Binance Founder CZ Commenting on Andrew Tate’s Post

Critics, however, argue that MicroStrategy’s strategy relies on perception more than impact. Some suggest the company’s promotional announcements are designed to create bullish sentiment rather than directly shift price.

The lack of immediate reaction fuels speculation that headline buys are less influential than investors assume.

This discussion lands at a moment of heightened sensitivity. The market only broke out today after a week of stagnation — a move driven not by MicroStrategy but by a mix of whale accumulation, short liquidations, and regulatory developments.

The contrast reinforces a key takeaway: visible price movement often reflects late-stage order flow, not the originating buy itself.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Astar 2.0: Institutional Embrace and On-Chain Data Point to a DeFi Surge

- Astar 2.0's Tokenomics 3.0 and deflationary model attract institutional investors, aligning with ESG priorities and boosting ASTR's value retention. - Strategic partnerships with Sony , Toyota , and Japan Airlines demonstrate blockchain's real-world utility in logistics and enterprise integration. - Q3 2025 on-chain data shows $1.399B TVL and $27.7B daily trading volume, driven by cross-chain platform Plaza and 150,000 TPS throughput. - Technological upgrades like Astar zkEVM and LayerZero integration en

Informed Traders Edge Out Retail Risk-Takers on Prediction Markets

Is Stellar (XLM) Poised for a Breakout? Key Pattern Formation Suggests So!

Is Worldcoin (WLD) on the Verge of a Breakout? This Key Bullish Structure Suggests So