The Person Who Made $69 Million with NFTs Four Years Ago Is Still Making Money

He Sent Out a Nearly Ten Million Dollar NFT at Art Basel

beeple, the man who sold a single NFT for a record-breaking $69 million, has always been seen as a symbol of the NFT golden age that once was.

Despite the fading glory of NFTs, beeple and his team have remained active in the NFT community. At this year's Basel Art Fair, he once again brought a "Golden Dog" — Regular Animals — to the currently lackluster NFT market.

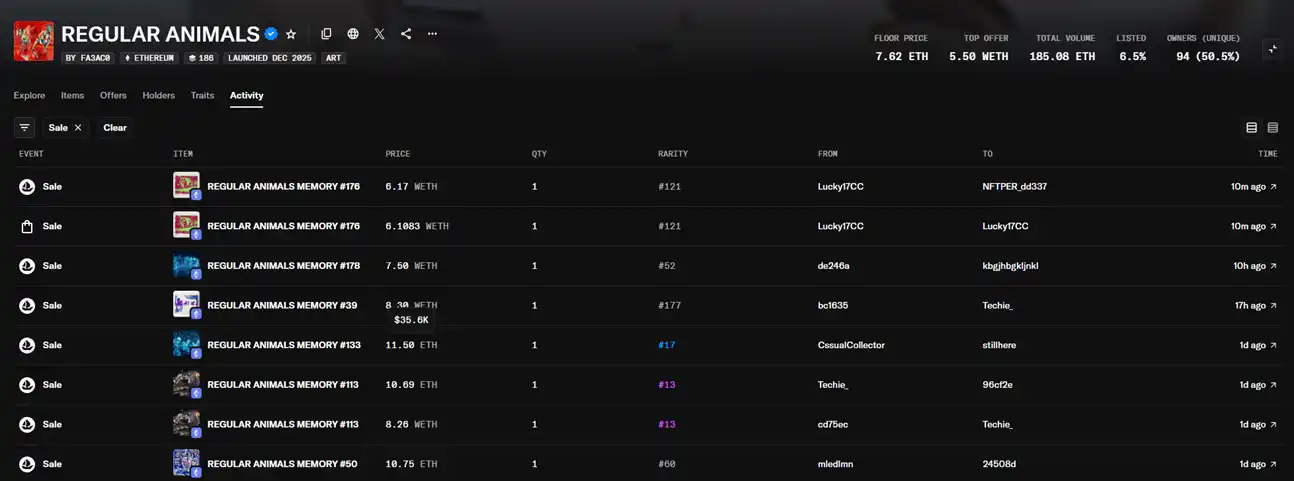

Yesterday, multiple pieces of Regular Animals were sold on OpenSea for over 10 ETH (around $35,000) each, even though this artwork was originally given out for free at the Basel Art Fair, with a total of 256 pieces distributed. By this calculation, beeple gave away NFTs worth millions of dollars at the Basel Art Fair.

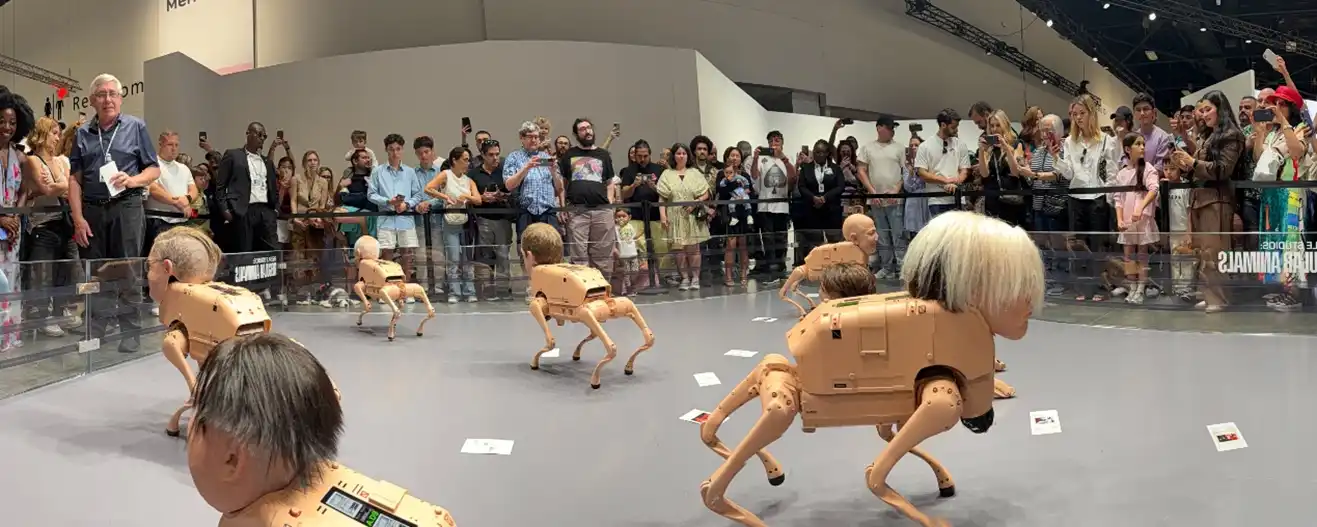

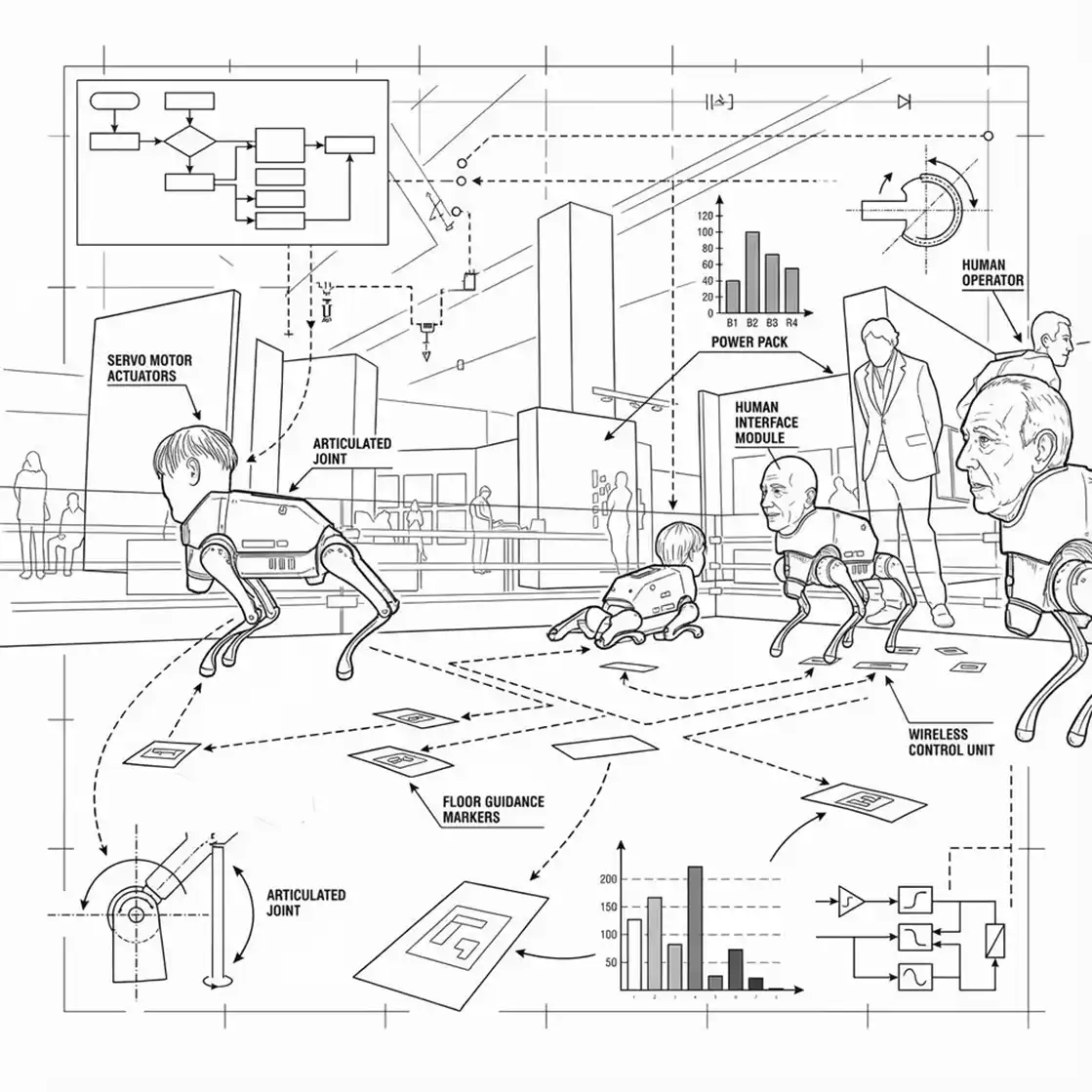

For the Basel Art Fair project, beeple and his team presented Regular Animals, a collection of "regular animals." These are a bunch of robotic dogs, as shown in the image below, with somewhat eerie human faces resembling well-known personalities such as Musk, Andy Warhol, Zuckerberg, Picasso, and even beeple himself.

However, the visual effect of these somewhat eerie robotic dogs is not the only feature; these robotic dogs observe their surroundings through cameras in their heads and use a continuously evolving visual algorithmic logic to create art.

The selection of these celebrity personas embodied by the robotic dogs is not arbitrary. These personalities were chosen because they have influenced the way humans perceive the world, whether through algorithms, art, or politics. As humans, we view the world through these perspectives, and so do these robotic dogs. At the Basel Art Fair, these robotic dogs and humans observe each other, and each moment of observation becomes an artwork created by these robotic dogs, which serve as their autobiographies.

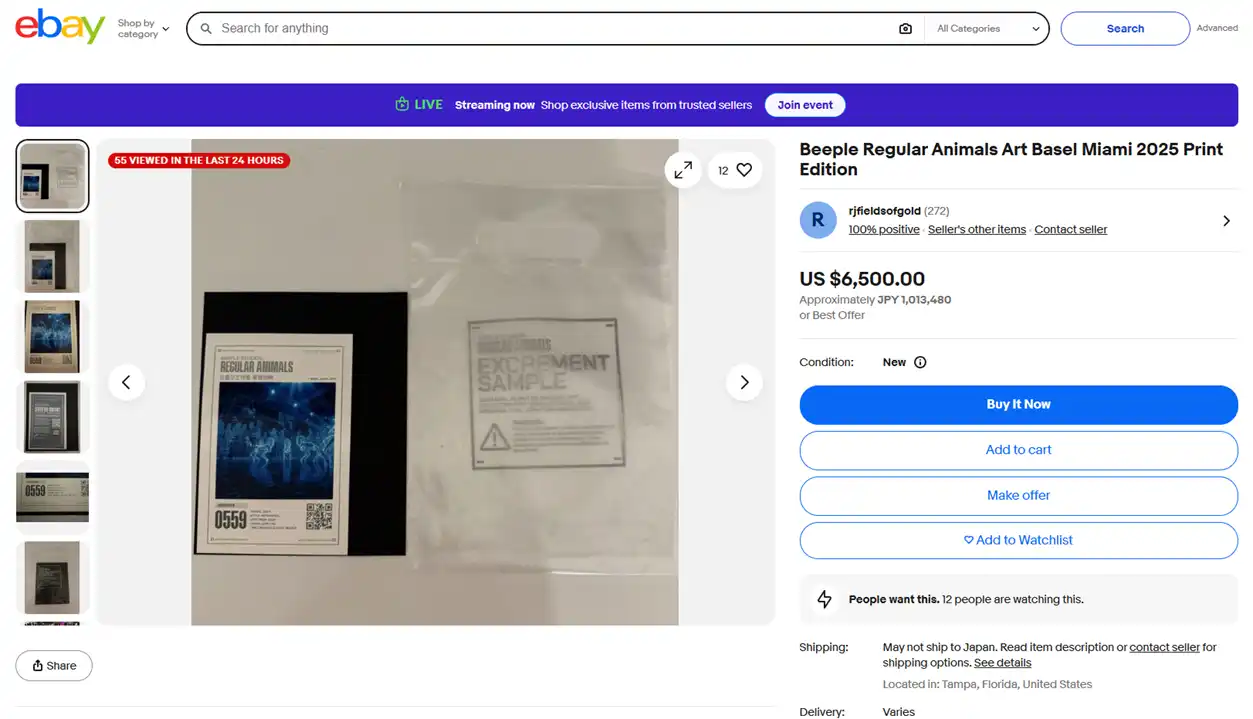

Interestingly, Regular Animas also has a physical series, totaling 1024 pieces. On eBay, someone has already listed it for a fixed price of $6500. The market pricing suggests that the NFT is far more valuable than the physical artwork, reminiscent of Damien Hirst's "The Currency" series from years ago, forcing owners to choose between physical and NFT.

Before achieving great success in the NFT space, beeple had been creating art every day since 2007, with none selling for over $100. After gaining fame and fortune, beeple did not splurge like some artists or crypto project founders. Instead, he acquired a roughly 460-square-meter studio/gallery, assembled a team of dozens of 3D artists, engineers, and researchers (including a former Boeing engineer), invited Carolyn Christov-Bakargiev, former director of the Castello di Rivoli contemporary art museum, as an advisor, continuously exhibited his work at art shows around the world, and created new art pieces.

Beeple's recent exhibition featuring robotic dogs has garnered attention not only in the crypto community due to its prices but also received coverage from traditional media outlets like the WSJ.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Short the dip and buy the rip? What FOMC outcomes reveal about Bitcoin price action

Bitcoin Leverage Liquidation: Does It Pose a Systemic Threat to Retail Crypto Investors?

- October 2025's Bitcoin crash triggered $19B in leveraged liquidations, exposing crypto derivatives' fragility amid extreme retail leverage and thin liquidity. - High leverage (up to 1,001:1) and perpetual futures dominated by platforms like Hyperliquid amplified volatility, creating self-reinforcing downward spirals. - Behavioral biases (FOMO, overconfidence) and social media echo chambers drove irrational leveraged bets, while regulators paused risky ETFs and warned of systemic risks. - The crisis highl

LUNA up 46.13% in 24 hours as network improvements increase investor optimism

- LUNA surged 46.13% in 24 hours, driven by a pending network upgrade and rising investor confidence. - Futures open interest for LUNC rose to $25.55M, signaling new capital inflows and bullish momentum. - The terrad v3.6.1 upgrade, set for Dec 18, aims to enhance security and resolve legacy contract issues after successful testnet trials. - Technical indicators and analyst projections suggest continued upward momentum, targeting $0.000098 weekly if the 50-week EMA is sustained.

LUNA up 24.4% in 24 hours: Surge Fueled by Upgrades and Increased Inflows

- LUNA surged 24.4% in 24 hours on Dec 10, 2025, driven by rising on-chain activity, capital inflows, and anticipation of a major network upgrade. - The terrad v3.6.1 upgrade, set for Dec 18, aims to resolve legacy contract issues and enhance security, with successful testnet trials and rollback options in place. - Futures open interest rose to $25.55M, while technical indicators suggest continued bullish momentum, targeting $0.000098 resistance if the 50-week EMA is sustained. - Legal proceedings against