After a five-year exploration and a $1 billion valuation, why did it finally "give up"?

After five years since its founding, raising a total of about 180 millions USD and once approaching a valuation of 1 billions USD, Farcaster has officially admitted: the path of Web3 social networking has not succeeded.

Recently, Farcaster co-founder Dan Romero posted consecutively on the platform, announcing that the team will abandon its “social-first” product strategy and instead fully focus on the wallet direction. According to his statements, this is not a proactive upgrade, but a choice forced by reality after a long period of attempts.

“We tried social-first for 4.5 years, but it didn’t work.”

This judgment not only signals Farcaster’s transformation, but also once again puts the structural challenges of Web3 social networking under the spotlight.

The Gap Between Ideal and Reality: Why Farcaster Failed to Become the “Decentralized Twitter”

Farcaster was born in 2020, right at the rise of the Web3 narrative. It aimed to solve three core problems of Web2 social platforms:

-

Platform monopoly and censorship

-

User data not belonging to themselves

-

Creators unable to monetize directly

Its design philosophy was quite idealistic:

-

Decentralization at the protocol layer

-

Clients can be freely built

-

Social relationships are on-chain and portable

Among the many “decentralized social” projects, Farcaster was once considered the closest product to achieving PMF. Especially after Warpcast went viral in 2023, with a large number of KOLs from Crypto Twitter joining, it seemed like the prototype of the next-generation social network.

But problems soon emerged.

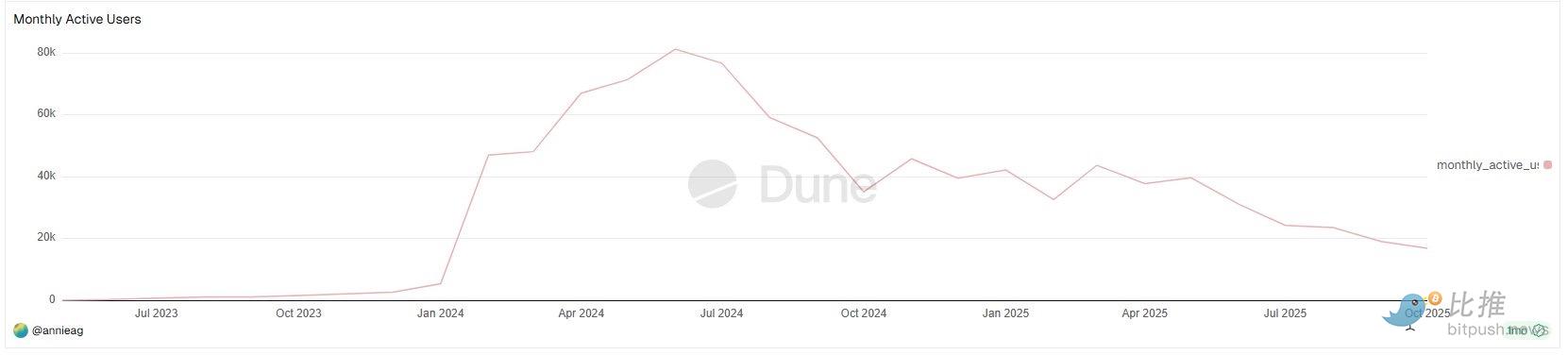

According to Dune Analytics’ statistics on Farcaster’s monthly active users (MAU), Farcaster’s user growth trajectory shows a very clear but not optimistic pattern:

For most of 2023, Farcaster’s monthly active users were almost negligible;

The real inflection point for growth appeared at the beginning of 2024, with MAU rapidly rising from a few thousand to about 40,000–50,000 in a short period, and once approaching 80,000 monthly active users in mid-2024.

This was the only truly large-scale growth window since Farcaster’s founding. It’s especially noteworthy that this growth did not occur during a bear market, but rather during a period of high activity in the Base ecosystem and a surge of SocialFi narratives.

But this window did not last long.

From the second half of 2024, monthly active user data began to decline significantly, and in the following year showed a volatile downward trend:

-

MAU rebounded several times, but the highs kept getting lower

-

By the second half of 2025, monthly active users had fallen back to less than 20,000

In fact, Farcaster’s growth has never truly “broken out of the circle,” and its user structure remains highly homogeneous:

-

Crypto practitioners

-

VCs

-

Builders

-

Crypto Native users

For ordinary users:

-

High registration threshold

-

Social content is highly “inward-looking”

-

User experience is not better than X / Instagram

This has made it so that Farcaster has never been able to form a true network effect.

DeFi KOL Ignas stated bluntly on X (@DeFiIgnas) that Farcaster “just admitted what everyone has felt for a long time”:

The network effect strength of X (formerly Twitter) is almost impossible to break head-on.

This is not a problem of crypto narrative, but a structural barrier of social products. From a product path perspective, the problems on Farcaster’s social side are very typical:

-

User growth is always locked within the crypto-native crowd

-

Content is highly self-circulating and difficult to spill over

-

Creator monetization and user retention have not formed positive feedback

This is why Ignas summed up Farcaster’s new strategy in one sentence:

“It’s easier to add social to a wallet than to add a wallet to a social product.”

This judgment essentially acknowledges that “social is not the first-principle demand of Web3.”

“The bubble is comfortable, but the numbers are cold”

If MAU data answers “how is Farcaster doing,” then another question is: how big is this market itself?

Crypto creator Wiimee provided a set of striking comparative data on X.

After accidentally breaking out of the crypto content circle, Wiimee created content for the general public for four consecutive days. His analytics showed that in about 100 hours, he received 2.7 million impressions, more than double his total crypto content views in a year.

He stated:

“Crypto Twitter is a bubble, and it’s very small. Four years talking to insiders is not as good as four days talking to the public.”

This is not a direct criticism of Farcaster, but rather reveals a deeper issue:

Crypto social itself is a highly self-circulating ecosystem with extremely weak spillover capability. When content, relationships, and attention are all confined to the same group of native users, no matter how refined the protocol design, it is difficult to break through the market size ceiling.

This means that the problem Farcaster faces is not “the product isn’t good enough,” but “there simply aren’t enough people in the space.”

Wallets, on the Other Hand, Achieved PMF

What truly changed Farcaster’s internal judgment was not reflection on social, but the unexpected validation of wallets.

Earlier in 2024, Farcaster launched a built-in wallet in its app, originally just as a supplement to the social experience. But usage data showed that the wallet’s growth slope, usage frequency, and retention performance were clearly different from the social module.

Dan Romero emphasized in his public response:

“Every new and retained wallet user is a new user of the protocol.”

This statement itself already reveals the core logic behind the strategic shift. Wallets are not about “the desire to express,” but about real, rigid on-chain behavioral needs: transfers, trading, signing, and interacting with new applications.

In October, Farcaster acquired Clanker, an AI Agent-driven token issuance tool, and gradually integrated it into the wallet system. This move was also seen as the team’s clear bet on the “wallet-first” path.

From a business perspective, this direction has obvious advantages:

-

Higher usage frequency

-

Clearer monetization path

-

Closer binding with the on-chain ecosystem

In contrast, social seems more like the icing on the cake, rather than the engine driving growth.

Although the wallet strategy is supported by data, it has also sparked community controversy.

Many long-term users have made it clear that they do not oppose wallets themselves, but are uncomfortable with the accompanying cultural shift: from “users” being redefined as “traders,” and “co-builders” being labeled as the “old guard.”

This exposes a real issue: when the product direction changes, community sentiment is often harder to migrate than the roadmap. Farcaster’s protocol layer remains decentralized, but the choice of product direction is still concentrated in the hands of the team. This tension is amplified during the transformation.

Romero later admitted there were communication issues, but also made it clear that the team had made its choice.

This is not arrogance, but a common reality-based decision for startups in the later stages of their lifecycle. In this sense, Farcaster is not abandoning the social ideal, but giving up the fantasy of scaling it up.

Perhaps, as one observer put it:

“Let users stay for the tool first, then social will have room to exist.”

Farcaster’s choice may not be the most romantic, but it is perhaps the closest to reality. Deeply integrating native financial tools (wallets, trading, issuance) is the practical path to converting into sustainable business value.

Author: Bootly

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitwise: My Most Confident Investment in the Crypto Space

Buy market cap-weighted crypto index funds to invest in the entire market.

Bitcoin ETFs Defend the $90,000 Price Level Against All Odds

In Brief Bitcoin ETFs maintain significant support despite falling prices. Fed's upcoming rate cut decision could impact crypto markets. Ethereum and Solana show positive developments amidst market corrections.

Do Kwon’s Sentencing Nears as U.S. Judge Assesses South Korea’s Potential Custody Role

The CFTC approves Bitcoin Ethereum and USDC as new financial guarantees