XRP Price Awaits Volatility Explosion That Could Save It From Slipping Below $2

XRP is struggling to recover as its price action continues to mirror Bitcoin’s weakness. The altcoin has failed to establish momentum over the last few days, pushing it closer to the critical $2.00 threshold. This correlation-driven decline has kept XRP from reclaiming key levels, raising concern among holders. XRP Investors’ Losses Rise The Net Unrealized

XRP is struggling to recover as its price action continues to mirror Bitcoin’s weakness. The altcoin has failed to establish momentum over the last few days, pushing it closer to the critical $2.00 threshold.

This correlation-driven decline has kept XRP from reclaiming key levels, raising concern among holders.

XRP Investors’ Losses Rise

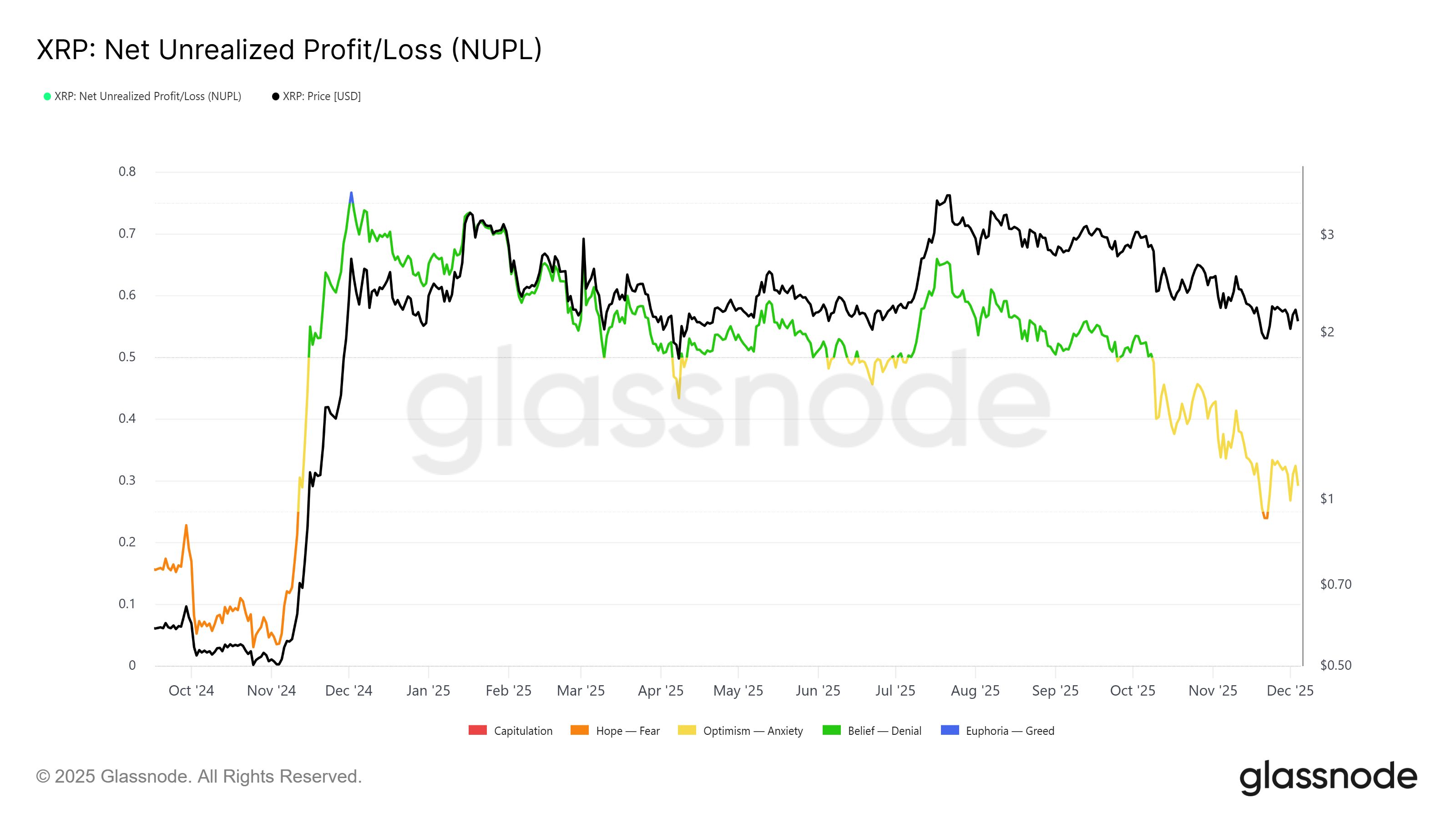

The Net Unrealized Profit/Loss (NUPL) indicator highlights the growing pressure on XRP. NUPL recently slipped from the mildly bearish zone to below 0.25, entering the Fear zone for the first time in over a year. This signals that unrealized profits have significantly eroded, leaving many holders at or near losses.

This dip in sentiment may also act as a reversal trigger. Historically, NUPL falling into Fear has preceded periods of accumulation, as prices reach psychologically appealing levels. If investors interpret current conditions as oversold territory, XRP may benefit from renewed buy-side interest.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

XRP NUPL. Source:

Glassnode

XRP NUPL. Source:

Glassnode

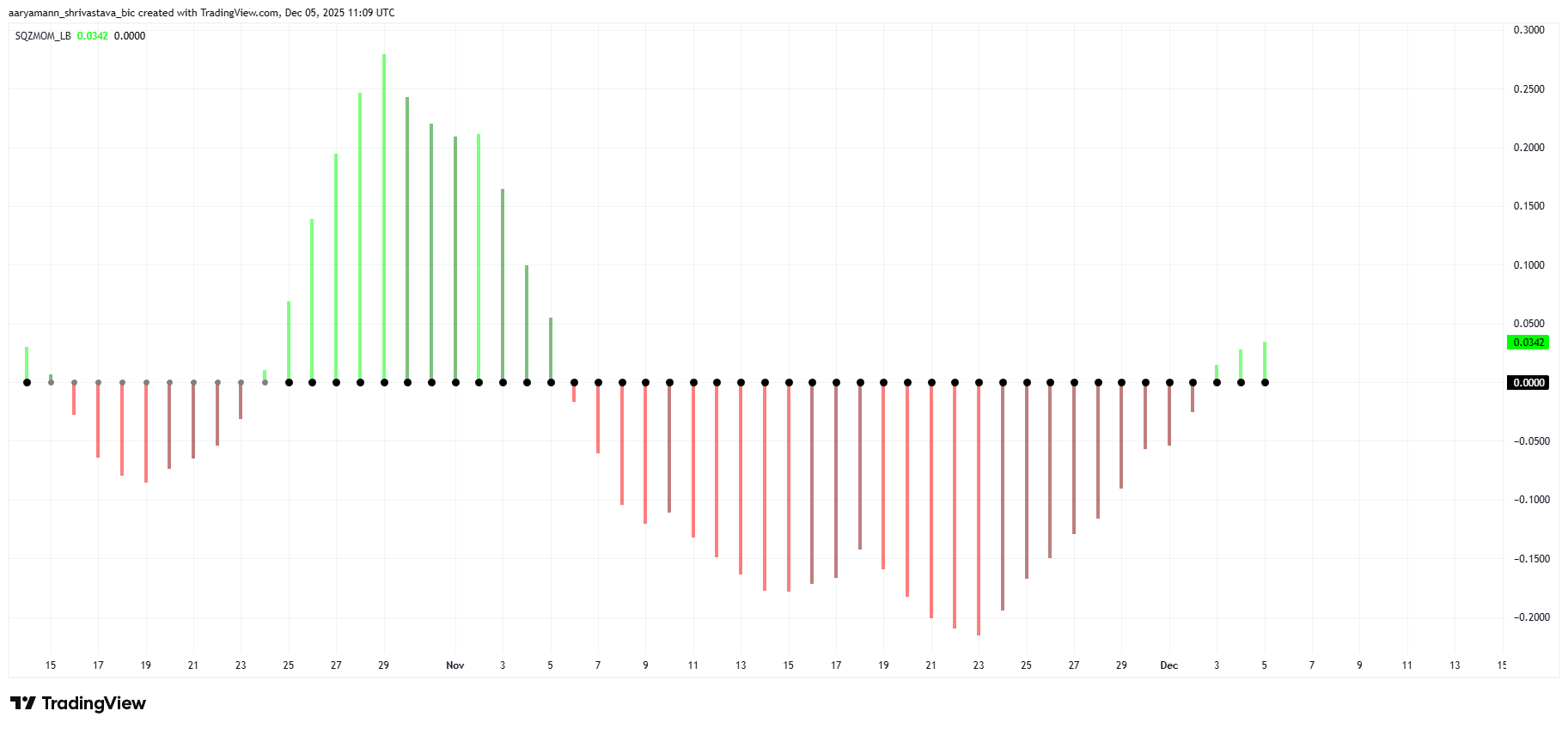

XRP is also witnessing important macro shifts. The Squeeze Momentum Indicator shows a tightening squeeze that has been developing for nearly a month. A squeeze reflects a period of low volatility as pressure builds within the price structure, often leading to a strong directional breakout once it releases.

At present, the indicator suggests a potential tilt toward bullish momentum. If the squeeze resolves upward, XRP could experience a sharp volatility expansion, giving the asset the boost it needs to escape its recent stagnation.

XRP Squeeze Momentum Indicator. Source:

TradingView

XRP Squeeze Momentum Indicator. Source:

TradingView

XRP Price Needs To Escape

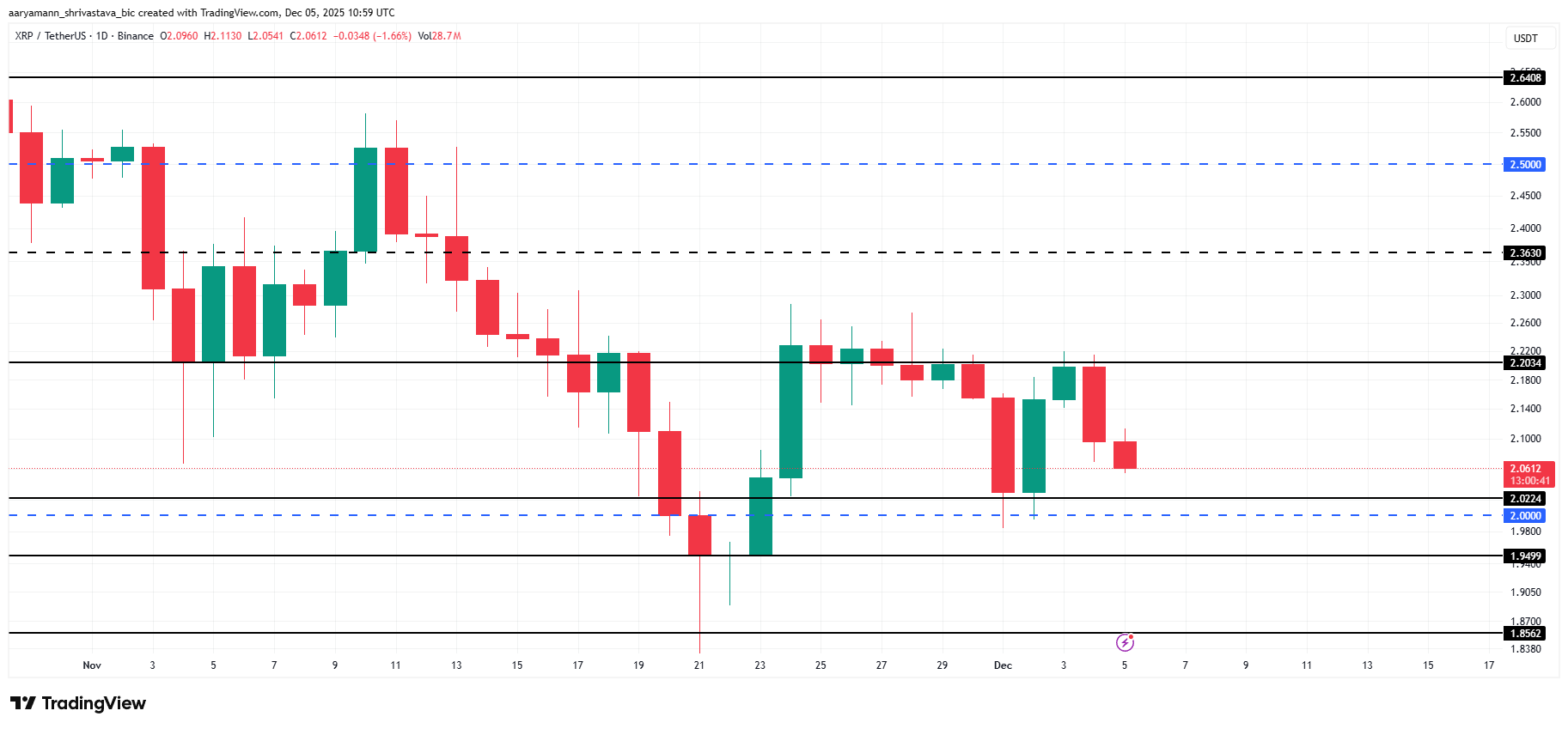

XRP is trading at $2.06 after two failed attempts to break the $2.20 resistance this week. The altcoin is now drifting toward the familiar $2.02 support level, which previously acted as a strong rebound point.

If XRP sees renewed investor confidence and a bounce from $2.02, the price could climb back to $2.20. A successful breakout above this resistance may open the door to $2.26, supported by the potential volatility surge indicated by the squeeze.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

However, a breakdown remains a risk. Losing the $2.02 support would place $2.00 in immediate danger. A fall below that threshold could push XRP toward $1.94 or even $1.85, invalidating the bullish outlook and signaling deeper correction potential.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zcash Halving 2025: Key Factors Investors Need to Monitor Today

- Zcash's 2025 halving reduced block rewards by 50%, cutting annual supply growth and reinforcing its deflationary model. - The event coincided with a 1,172% YTD price surge, driven by institutional adoption like Grayscale's 5% ZEC supply acquisition. - Privacy features (28% shielded transactions) and ZIP 1015's liquidity drain ($337K/day) amplified Zcash's scarcity-driven appeal. - Post-halving volatility saw ZEC peak at $641 before a 96% correction, highlighting liquidity risks despite institutional conf

Zcash (ZEC) Experiences Price Rally as Privacy Coins Gain Momentum: Privacy Tokens Serve as Safe Havens During Market Declines—Is ZEC Ready for Institutional Embrace?

- Zcash (ZEC) surged 919% in 2025 as privacy coins gained traction amid inflation and surveillance concerns. - Institutional adoption accelerated, with Grayscale's Zcash Trust growing 228% and regulators like the SEC engaging with privacy advocates. - Zcash's hybrid privacy model, combining shielded transactions with compliance-friendly transparency, attracted regulated investors and tech integrations. - Macroeconomic factors like Fed rate cuts and technological upgrades (e.g., ZK proofs) drove ZEC's outpe

Figma unveils innovative AI-driven features for removing objects and expanding images