Zcash (ZEC) Price Faces Uphill Battle to Close Gap With November Peak

Zcash price is struggling to regain its bullish momentum after a steep decline that pushed the altcoin below $350 earlier this week. While ZEC has shown minor signs of stabilization, its broader trend remains weak, and the distance from November’s highs leaves a significant recovery challenge ahead. Zcash Is Lacking On All Fronts The RSI

Zcash price is struggling to regain its bullish momentum after a steep decline that pushed the altcoin below $350 earlier this week.

While ZEC has shown minor signs of stabilization, its broader trend remains weak, and the distance from November’s highs leaves a significant recovery challenge ahead.

Zcash Is Lacking On All Fronts

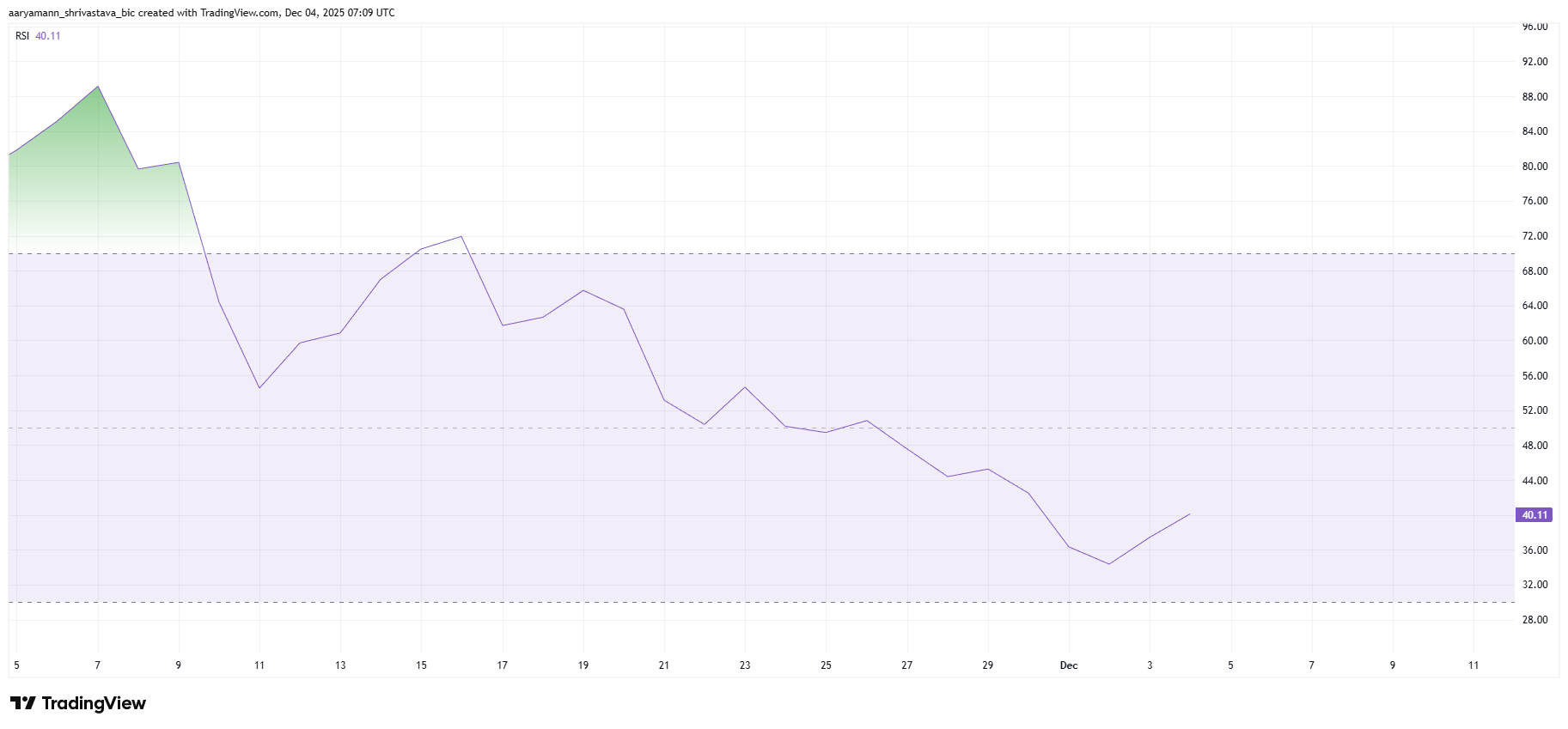

The RSI indicates that Zcash continues to face persistent bearish pressure. The indicator remains in the negative zone, reflecting a lack of upward momentum and highlighting that buyers are not yet regaining control. This signals that broader market conditions are not aligned with a meaningful rebound.

Unless the RSI improves, ZEC may struggle to attract fresh demand.

The bearish sentiment is reinforced by declining participation across the market, with risk appetite remaining low. ZEC’s failure to push back toward key resistance levels in recent sessions suggests traders are prioritizing safer assets while waiting for clearer signals.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

ZEC RSI. Source:

TradingView

ZEC RSI. Source:

TradingView

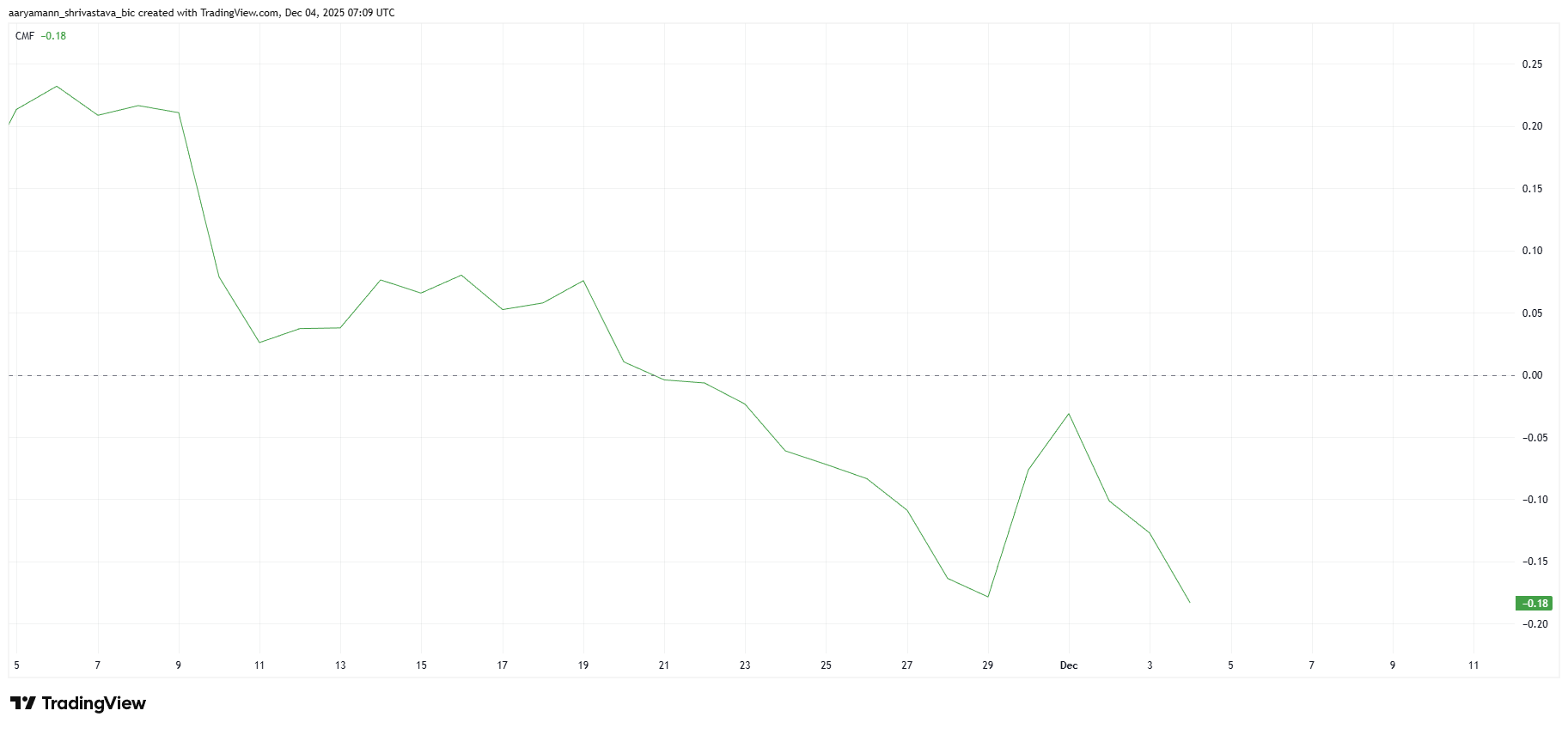

The CMF shows persistent outflows, highlighting a decline in investor confidence. Capital continues leaving ZEC, and the indicator remains firmly in the negative zone. This pattern is concerning because Zcash is already lacking broader market support, and sustained outflows could prevent any meaningful rally. For ZEC to regain strength, inflows must return.

Given the current macro backdrop, ZEC’s path to recovery appears challenging. Market volatility remains high, and investors are cautious amid fear-driven activity. Without a shift in sentiment, ZEC may find it difficult to build the momentum required to revisit higher levels.

ZEC CMF. Source:

TradingView

ZEC CMF. Source:

TradingView

ZEC Price Has A Long Way To Go

ZEC is trading at $363 at the time of writing, sitting just above the $344 support level. Holding this support is essential for any near-term recovery attempt toward $442. However, revisiting November’s highs remains a distant objective.

If bearish conditions persist, ZEC could fail to hold its support, potentially falling below $344 again and sliding to $300 or even $260. Such a move would extend the current downtrend and deepen investor concerns.

ZEC Price Analysis. Source:

TradingView

ZEC Price Analysis. Source:

TradingView

Conversely, a shift in investor sentiment could support a recovery. Yet even in that scenario, ZEC would need to rally by 101% to reclaim its November peak near $750. That would require flipping $442 into support and climbing toward $520, which remains a substantial challenge for the altcoin’s current momentum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The ZK Transformation: Evaluating How Zero-Knowledge Technology Influences the Future Development of Blockchain

- ZK-rollups scale blockchain networks by bundling transactions, achieving 43,000 TPS and 30% lower gas fees, attracting institutions like Goldman Sachs and JPMorgan . - ZK technology resolves privacy-scalability paradox by enabling verifiable transactions without data exposure, adopted by EU regulators and enterprises like Nike and Sony . - Challenges persist: ZK-SNARKs require heavy computation, trusted setup risks exist, and privacy conflicts with AML regulations in some jurisdictions. - $725M+ VC inves

The Influence of Vitalik Buterin's Support for ZKsync on the Advancement of Scalable Blockchain Technologies: Evaluating the Prospects for Long-Term Investment in Pr

- Vitalik Buterin's 2025 endorsement of ZKsync accelerated its rise as a scalable Ethereum Layer-2 solution with 30,000 TPS and $3.3B TVL. - ZKsync's EVM compatibility and institutional partnerships contrast with StarkNet's quantum-resistant STARK proofs and Aztec's privacy-first architecture. - Analysts project ZK token prices at $0.40–$0.60 by 2025, while StarkNet faces adoption barriers and Aztec navigates regulatory challenges in privacy-focused DeFi. - The $7.59B ZKP market (2033 forecast) hinges on b

ZK Atlas Enhancement: Transforming Blockchain Scalability and Paving the Way for Institutional Integration

- ZKsync’s 2025 Atlas Upgrade achieves 15,000–43,000 TPS with $0.0001/transaction costs, boosting blockchain scalability for institutions. - Deutsche Bank , Sony , and Citi adopt ZKsync for tokenized assets and privacy-driven transactions, citing compliance and efficiency gains. - Market forecasts predict 60.7% CAGR for ZK Layer-2 solutions through 2031, with Fusaka upgrade targeting 30,000 TPS to solidify ZKsync’s leadership.

Hinge’s latest AI tool assists singles in skipping dull introductory conversations