Aster introduces Machi mode, rewarding users for liquidation events

Key Takeaways

- Aster, a decentralized crypto exchange, launched Machi Mode to reward users with points for liquidation events.

- The new feature gamifies trading losses by introducing leaderboards and points for users who are liquidated on leveraged positions.

Share this article

Aster, a decentralized crypto exchange platform, today introduced Machi Mode, a new feature that rewards users with points for experiencing liquidation events on leveraged positions.

The gamified feature transforms trading losses into competitive opportunities by awarding liquidation points and creating leaderboards for users who get liquidated. Aster designed the mode to turn what are traditionally considered negative trading outcomes into rewarding experiences.

Machi Mode draws inspiration from Machi Big Brother, a prominent crypto trader known for frequent position liquidations on platforms like Hyperliquid. The trader’s activity pattern influenced Aster’s decision to gamify liquidation events.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

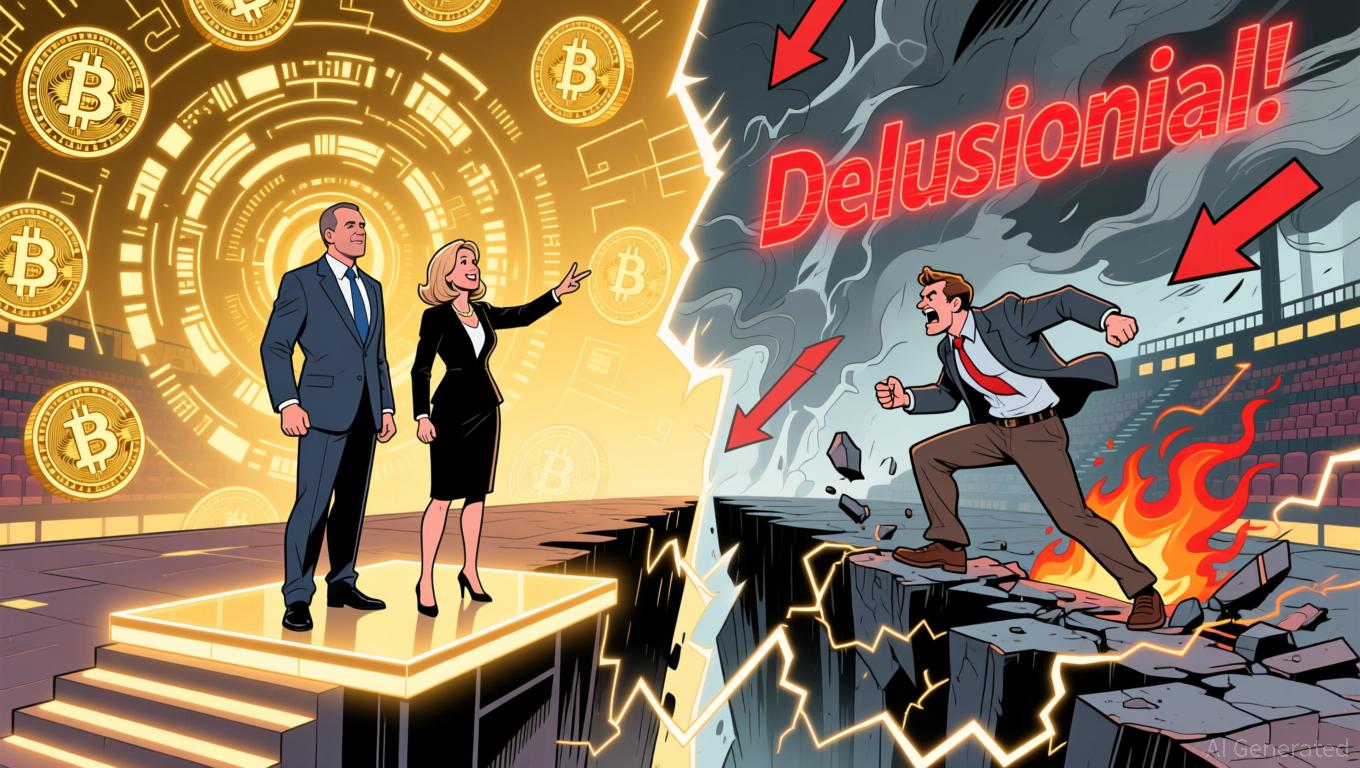

Bitcoin Updates: Crypto Enthusiasts and Conventional Experts Debate $1 Million Bitcoin Projection

Berkshire’s Wager on Alphabet: Fresh Leadership Challenges Buffett’s Doubts About Tech

- Warren Buffett's Berkshire Hathaway made its first major $4.3B Alphabet investment in 27 years, signaling leadership transition and strategic shift under incoming CEO Greg Abel. - The move contrasts Buffett's historical tech skepticism, reflecting growing influence of managers like Todd Combs who steered recent tech bets including Amazon shares. - Simultaneous 15% Apple stake reduction and Bank of America divestment highlight risk diversification, while Alphabet's valuation and cash flow justify cautious

The Emergence of ICP Caffeine AI and Its Impact on Decentralized Computing Markets

- ICP Caffeine AI, developed by DFINITY, redefines decentralized compute by enabling AI app development via natural language and reducing inference costs by 20–40%. - Its reverse-gas token model and "chain-of-chains" architecture boost scalability while creating deflationary incentives, attracting $237B TVL but facing 22.4% dApp activity declines. - Competitors like Palantir ($1.18B Q3 revenue) and struggling BigBear .ai highlight ICP's unique censorship-resistant niche, though centralized rivals maintain

Hyperliquid News Today: Reduced Fees or Doubts? Hyperliquid’s Bold Strategy for Expansion

- Hyperliquid, a top-20 DeFi exchange, faces a 25% HYPE token price drop to $25 amid market volatility and declining investor confidence. - Its HIP-3 Growth Mode initiative slashes trading fees by 90% to attract new markets but has yet to reverse downward trends or boost liquidity. - Analysts warn fee cuts may not address long-term user retention challenges in a crowded DeFi landscape dominated by centralized rivals like Binance. - Market skepticism persists as traders await volume explosions and tighter s