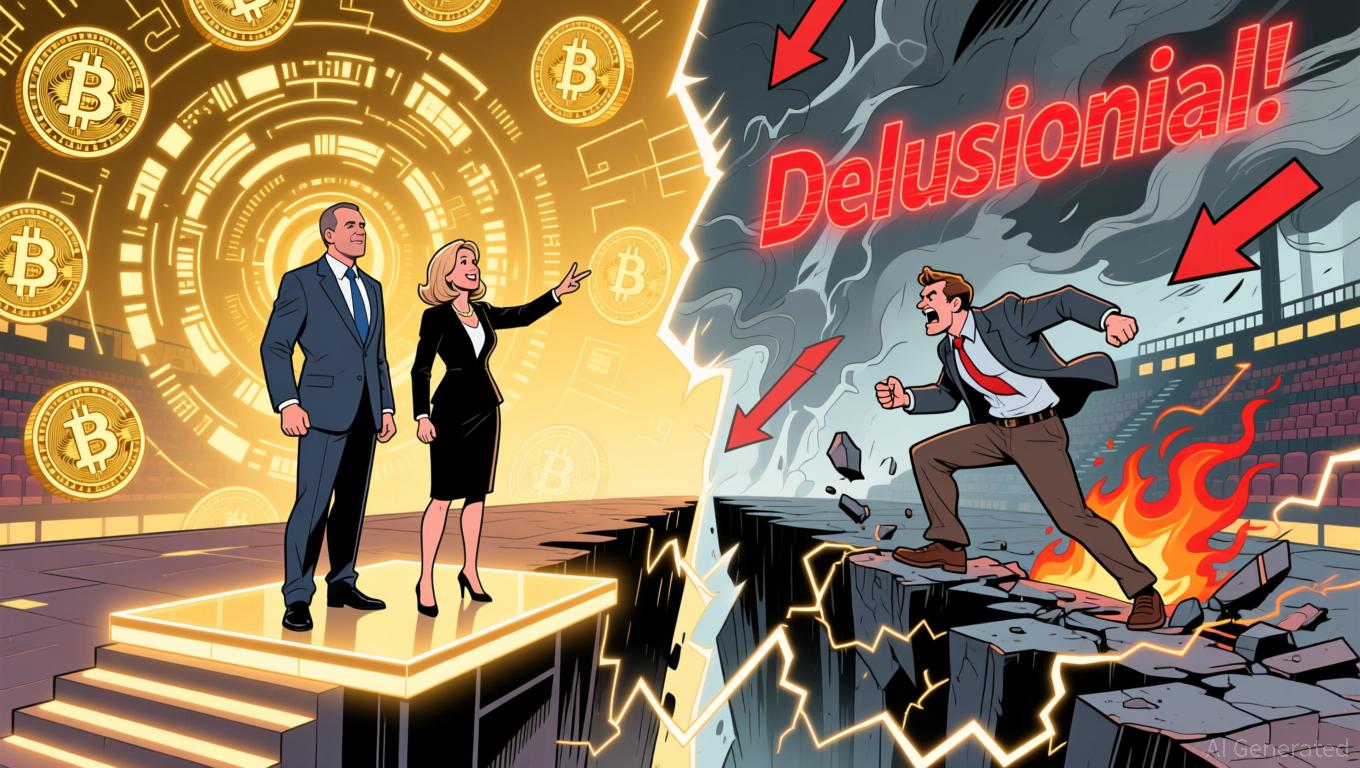

Bitcoin Updates: Crypto Enthusiasts and Conventional Experts Debate $1 Million Bitcoin Projection

Jim Cramer, who has long been critical of Bitcoin's lofty price targets, has intensified his doubts, ridiculing optimistic forecasts that claim the cryptocurrency could be valued at $1 million per coin by 2030. The CNBC anchor singled out Michael Saylor, the CEO of MicroStrategy, whose persistent support for Bitcoin's future has made him a central figure in crypto discussions. "The usual crypto bulls are gearing up for another round of hype, throwing out numbers like $1 million per

Saylor, a prominent Bitcoin advocate, has stuck to his viewpoint despite recent market swings. At the Money20/20 event in October,

This ongoing debate highlights the growing divide between staunch crypto supporters and traditional finance experts. Saylor and his supporters point to Bitcoin’s limited supply and increasing institutional interest as positive factors, while skeptics like Cramer argue that such predictions overlook broader economic challenges. "They always have to justify their stance," Cramer remarked,

At the same time, blockchain data shows Bitcoin’s lasting impact. A strategy linked to the asset

As the discussion continues, the $1 million Bitcoin prediction remains unverified—a goal that,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Markets Brace for Volatility as Traders Await Delayed U.S. Jobs Report

Securitize Leverages Plume’s Nest Protocol to Expand Institutional Real-World Asset Reach and DeFi Footprint

The MMT Token Price Rally: Is This a Shift in Blockchain Functionality?

- Momentum Finance's MMT token surged 224% post-Binance listing, sparking debates over speculative hype versus sustainable blockchain utility . - Strategic Sui blockchain integration and $10M+ institutional backing from Coinbase Ventures/OKX validate MMT's role as a decentralized finance liquidity hub. - Tokenomics allocate 42.72% supply to community, with vesting schedules and ve(3,3) DEX incentives designed to align long-term holder interests. - $265M TVL and LRT integrations highlight utility, though vo

MMT Value Forecast and Changes in Market Sentiment: Evaluating Trustworthiness and Actions of Retail Investors

- MMT's 1,300% Q3 2025 price surge was driven by institutional investments, airdrops, and exchange listings like Binance and Upbit. - Price forecasts remain contentious as technical indicators clash with behavioral biases, while macroeconomic uncertainty from the 2025 government shutdown complicates valuation. - Retail investors face liquidity risks amid FOMO-driven demand, with MMT's volatility highlighting the disconnect between short-term hype and long-term utility requirements. - Analysts stress the ne