GoPlus: October Web3 security incident caused over $45.84 million in losses.

GoPlus monitoring shows that in October, Web3 suffered a total loss of over $45.84 million due to security incidents such as smart contract vulnerabilities, social engineering attacks, phishing attacks, fake token scams, and Rugpulls, including:

· GMGN users fell victim to a phishing attack, with attackers creating a fake third-party token website to induce unauthorized transactions, resulting in over $700,000 in losses for 107 users;

· The Twitter account @OracleBNB, which was previously followed by KOLs such as CZ, changed its name and pretended to collaborate with @four_meme_ to launch a token, then profited 34 BNB through a Rugpull.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

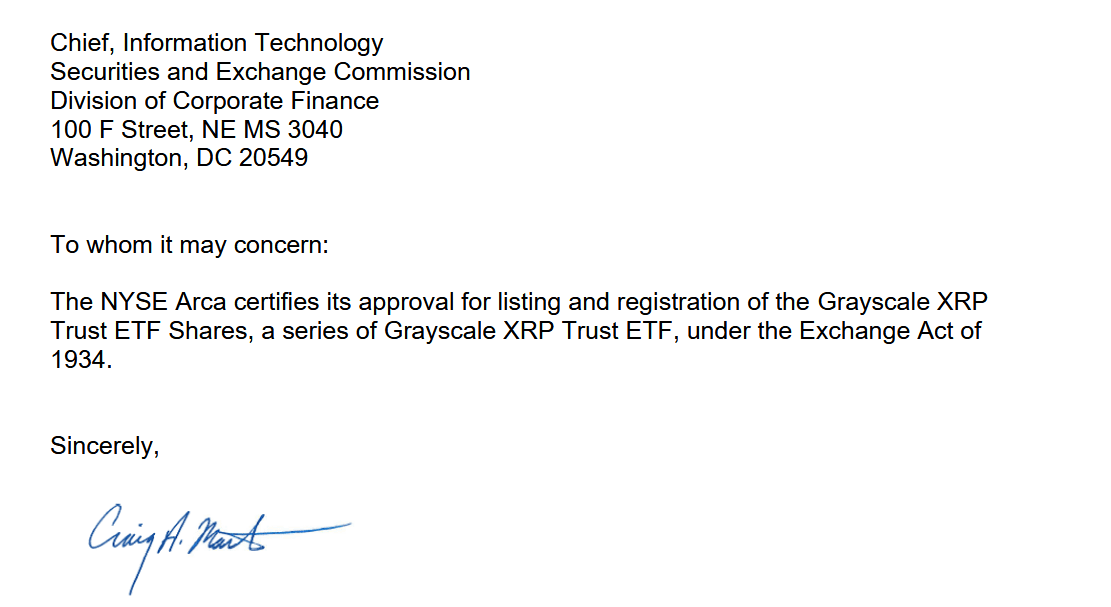

Grayscale’s Dogecoin and XRP ETFs Set for Monday Launch

Crypto Price Today: Bitcoin, Ethereum, XRP and Solana Attempt a Weak Rebound

ZK Technology's Price Rally: An In-Depth Analysis of On-Chain Usage and Protocol Enhancements

- ZKsync's Q3 2025 protocol upgrades (OS v0.0.5) achieved 15,000 TPS and 1-second block times, enabling high-frequency trading and institutional compliance via Merkle-proof verification. - November 2025 saw ZK rollups process 15,000 TPS, $3.3B TVL in ZKsync, and $2.98B derivatives volume, driven by enterprise adoption from Goldman Sachs and major banks . - Developer activity surged 230% with solx Compiler beta and LLVM-based tooling, while 35+ institutions tested ZKsync's Prividium for confidential cross-b

Bitcoin News Today: "Institutions See Bitcoin as the New Gold Amid Market Downturn"

- Institutional investors like Abu Dhabi’s ADIC and KindlyMD are buying Bitcoin amid its 29% price drop, viewing it as a long-term store of value akin to gold . - ADIC tripled its stake in BlackRock’s IBIT to $518M, while KindlyMD raised $540M to hold 5,398 Bitcoin at $118K average cost, signaling strategic crypto bets. - Despite $3.1B ETF outflows and regulatory risks, Harvard and El Salvador added to Bitcoin holdings, with analysts forecasting potential 2026 recovery if macroeconomic stability returns.