Grayscale’s Dogecoin and XRP ETFs Set for Monday Launch

Grayscale just secured the green light from the New York Stock Exchange to list two new ETFs tied to Dogecoin and XRP . Both products begin trading Monday, marking another step in the rapid expansion of crypto ETFs in the United States. Here’s what’s going on and why it matters.

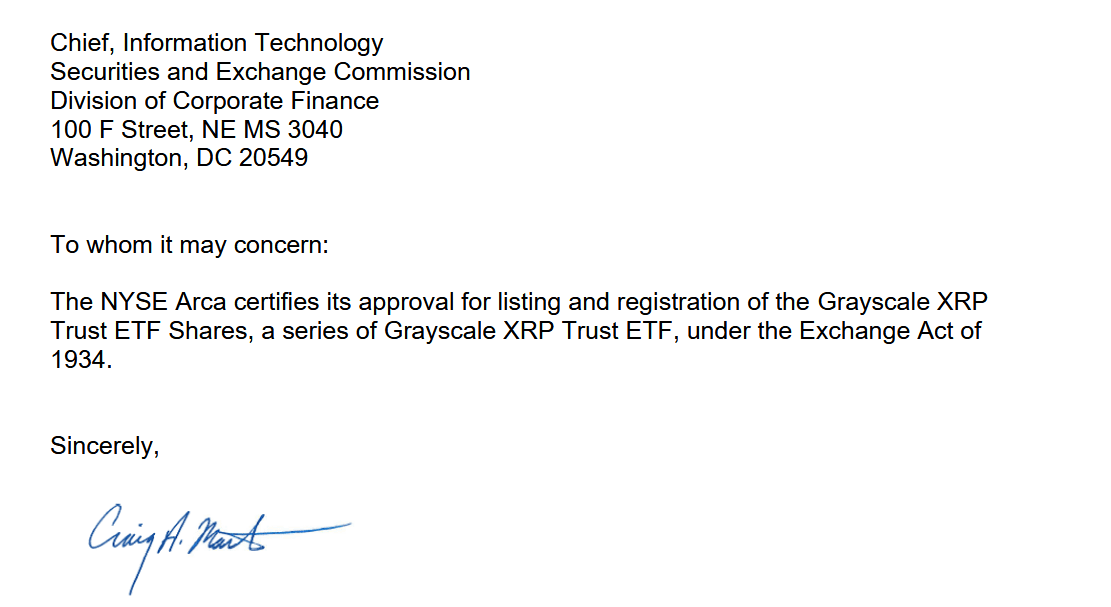

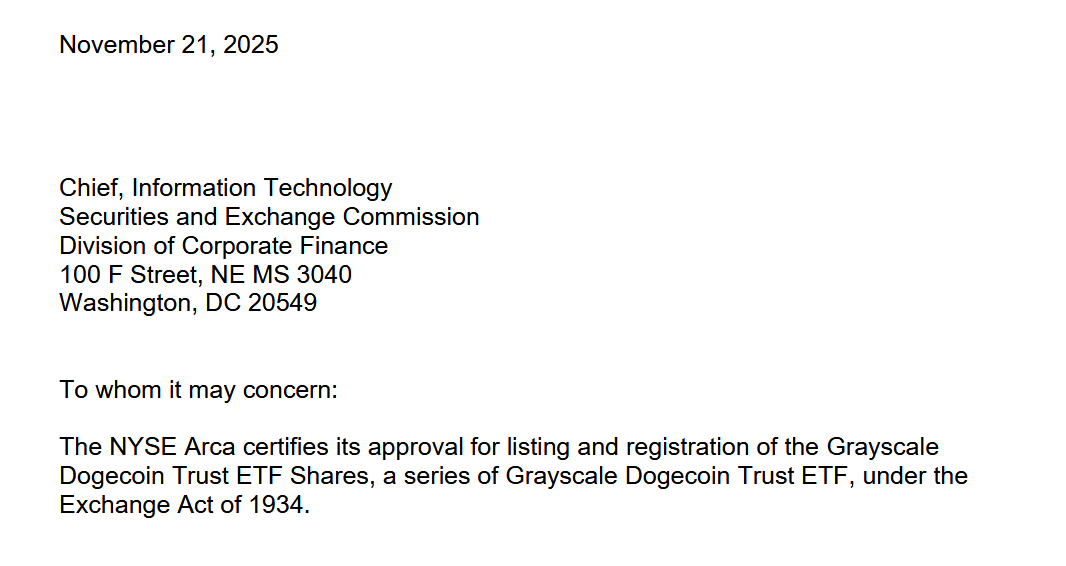

What Exactly Did the NYSE Approve?

NYSE Arca certified the listing and registration of the Grayscale XRP Trust ETF Shares and the Grayscale Dogecoin Trust ETF Shares. This certification is the final administrative step that allows both products to debut on the open market.

These ETFs are not brand-new funds. They’re conversions of existing private-placement products that Grayscale has offered for years. Once they switch over into ETFs, they become easier to access for retail investors and institutions that prefer exchange-listed, regulated instruments.

Why These Two ETFs Are a Big Deal

Dogecoin isn’t just a meme coin anymore. It’s the original and largest memecoin by market value, with a community that behaves more like a movement than a fanbase. XRP, meanwhile, is one of the most established altcoins, sitting among the top assets by market cap and enjoying worldwide liquidity.

Adding both coins to Grayscale’s ETF lineup strengthens its already broad shelf, which includes bitcoin, Ethereum, Solana, and Dogecoin products. For the market, this signals something bigger: U.S. crypto ETFs are expanding beyond the usual majors and moving into a diversified multi-asset era.

Part of a Much Larger ETF Wave

These approvals didn’t happen in isolation. Over the past year, the U.S. has seen a consistent push toward altcoin-based ETFs. Litecoin, HBAR, SOL, and XRP ETFs have all appeared recently. Many of these launched during the government shutdown, when the SEC issued special guidance explaining how firms could go public without waiting for direct approval. The funds still had to meet strict listing standards, which the SEC signed off on in September.

That opened the door for Grayscale to move quickly with its own trust conversions.

Dogecoin ETF: Grayscale Joins a Small but Growing Club

Grayscale’s Dogecoin ETF will be only the second DOGE ETF to hit the U.S. market. The first was launched by REX Shares and Osprey Funds in September. Their DOGE product took a different regulatory route, listing under the Investment Company Act of 1940. That makes it more similar to an actively managed mutual fund structure, whereas Grayscale’s ETF conversion follows the traditional exchange-listed path.

The takeaway: the DOGE ETF space is small, experimental, and growing. Adding Grayscale’s scale and brand power could accelerate adoption.

Why Monday’s Launch Matters for Crypto Investors

Every time a new XRP ETF or any ETF goes live, liquidity deepens. Price discovery improves. More traditional capital flows into crypto without investors needing to self-custody or touch an exchange. With Dogecoin and XRP getting ETFs, two coins with massive communities and high global turnover suddenly get a new pipeline of institutional money.

This isn’t just another pair of products. It’s a sign that altcoin ETFs are steadily becoming a mainstream asset class.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Polkadot Latest Updates: ECB Raises Concerns: Cryptocurrency and Stock Market Downturns Resemble Dot-Com Bubble Threats

- ECB warns U.S. equity/crypto corrections threaten stability, urging central banks to retain rate-cut flexibility amid market volatility. - JPMorgan links crypto ETF outflows to retail investor behavior, noting $4B November sales contrast with $96B equity ETF inflows. - U.S. Treasury downplays recession risks, citing 2026 growth optimism despite shutdown impacts and services-driven inflation. - MSCI highlights tech valuation risks akin to dot-com era, while DeFi faces $12B liquidity crisis with 95% capita

Novartis Increases 2030 Growth Projections Despite Analysts' Concerns About Patent Threats

- Novartis raised 2030 sales growth targets to 5-6% annually, driven by high peak sales expectations for oncology drugs Kisqali and Scemblix. - CEO Vas Narasimhan highlighted eight de-risked drugs with $3-10B peak potential, but analysts warned of patent expirations and uncertain pipeline progress beyond 2030. - Shares rose 0.5% post-announcement, while Exact Sciences surged 17% on its $105/share acquisition by Abbott and Samsung Biologics saw a 71% valuation re-rating after spin-off. - J.P. Morgan caution

Institutional Blockchain Integration: Blockdaemon and 21shares Bridge Traditional Finance and Web3 through the Canton Network

- Blockdaemon's Institutional Vault now supports Canton Coin, enabling secure custody and tokenization for institutions on the Canton Network. - 21shares launched a Canton Coin ETP on Euronext, offering investors institutional-grade exposure to privacy-focused blockchain innovation. - Canton Network's architecture, backed by J.P. Morgan and Goldman Sachs , facilitates secure, interoperable transactions while maintaining regulatory compliance. - Partnerships between blockchain infrastructure providers and t

LINK Price Moves to $13.90 as Market Tracks Tight Short-Term Structure