ETF Greenlight? Government Shutdown Deal Could Trigger Massive XRP Rally

DTCC lists nine spot XRP ETFs, with a November 2025 launch eyed. Price peaks at $2.45, but SEC approval and US Senate deal are critical factors.

The US Depository Trust & Clearing Corporation (DTCC) has listed nine spot XRP Exchange-Traded Funds (ETFs), intensifying expectations of a November launch pending US SEC approval.

With the potential US Senate deal to end the government shutdown, this could speed up SEC reviews and push XRP’s price to a high of $2.46.

DTCC Listing Expands XRP ETF Landscape

The list includes Bitwise XRP ETF and Franklin XRP ETF, among nine spot XRP ETFs—Canary XRP ETF (XRPC), Volatility Shares XRP ETF (XRPI), ETF Opportunities T-REX 2x Long XRP (XRPK), CoinShares XRP ETF (XRPL), Amplify XRP 3% Monthly ETF (XRPM), ETF Opportunities T-REX Osprey XRP (XRPR), Volatility Shares 2x XRP ETF (XRPT), and Franklin XRP ETF (XRPZ)—indicating market readiness.

🚨 BREAKING:Nine XRP Spot ETFs are now listed on the DTCC signaling readiness ahead of a possible launch this month. 👀🤯📊 Listed ETFs:↪️Bitwise XRP ETF (XRP)↪️Canary XRP ETF (XRPC)↪️Volatility Shares XRP ETF (XRPI)↪️ETF Opportunities T-REX 2x Long XRP (XRPK)… pic.twitter.com/00usToMVhX

— Xaif Crypto🇮🇳|🇺🇸 (@Xaif_Crypto) November 10, 2025

The Senate’s progress in halting a 40-day shutdown may restore SEC staffing, aiding approval. However, Ripple’s unresolved SEC litigation since 2020, with a year-end decision expected, poses risks. Over the past week, XRP’s trading volume increased to approximately $27.3 billion.

XRP’s trading volume:

CoinGecko

XRP’s trading volume:

CoinGecko

Global Markets Monitor Regulatory Progress

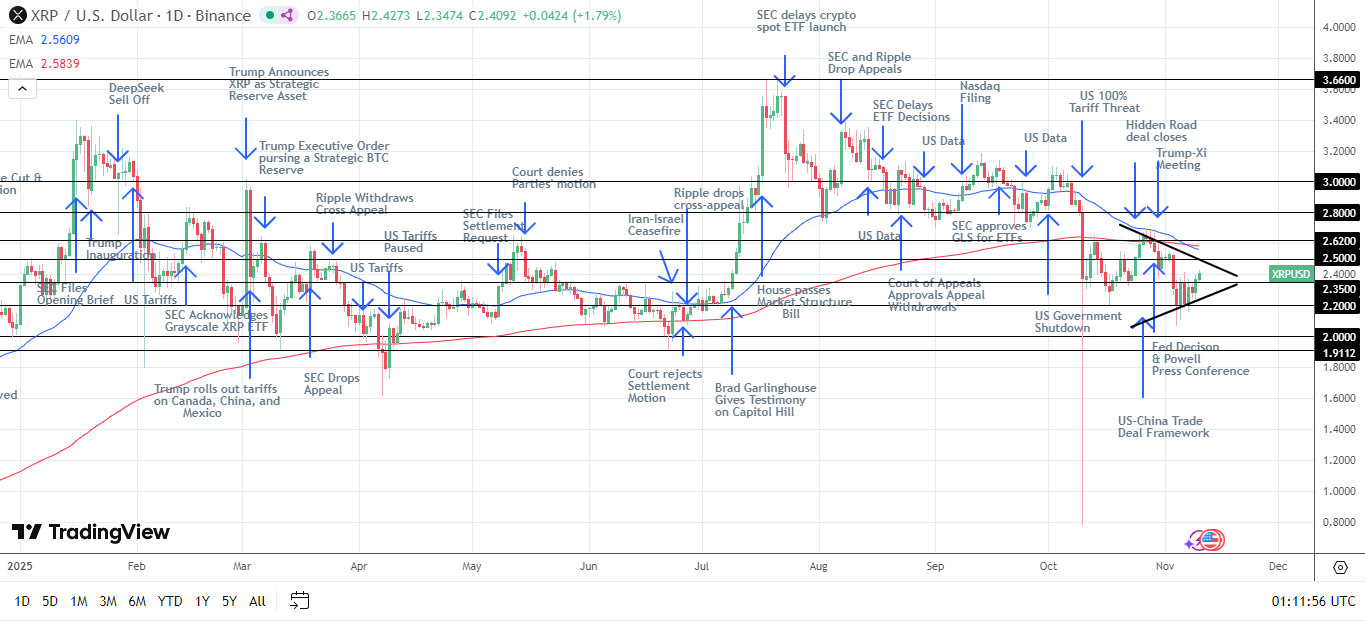

The XRP price surge to $2.45 follows a breakout above the 50-day moving average, with analysts targeting $3 by Q1 2026.

XRP price chart: BeInCrypto

XRP price chart: BeInCrypto

Technical analysis indicates that near-term support levels lie at $2.0 and $1.9, while key resistance lies at $2.5 and $2.62.

This movement occurs as XRP ETP success contrasts with Asia’s cautious stance. Asian exchanges like Bitget are awaiting clarity from US regulators. Analysts caution that a delay in the SEC’s regulatory approval could push prices down to $1.80.

the 50-day moving average, targeting $3 by Q1 2026 :

FXEmpire

the 50-day moving average, targeting $3 by Q1 2026 :

FXEmpire

JP Morgan estimates a launch could draw $3-5 billion in inflows, similar to Bitcoin ETFs, enhancing XRP’s institutional appeal. The Senate deal, if finalized, may accelerate this, though uncertainty persists. Europe’s success offers a global adoption model, but investors await clarity from the SEC and legislators.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SOL Price Forecast and Key Drivers in Late 2025: Evaluating Solana’s Core Improvements and Ecosystem Growth

- Solana's 2025 upgrades (Firedancer, Alpenglow) enhance scalability, achieving 870.6 TPS and 16-month uptime, boosting institutional confidence. - Ecosystem growth accelerates with $10.2B DeFi TVL, 17,708 developers, and partnerships like Western Union expanding real-world use cases. - Price analysis shows SOL near $133 support level, with bullish indicators and ETF inflows suggesting potential $150–$500 range by late 2025. - Historical correlations link upgrades to 400%+ price surges, positioning Solana

Bitcoin Leverage Liquidations Spike in Early December 2025: An Important Lesson on Managing Risks in Unstable Markets

- Early December 2025 saw over $1B in leveraged Bitcoin bets liquidated as prices dropped below $86,000, with major exchanges reporting losses exceeding $160M each. - Sharp price swings and macroeconomic pressures like Japan's hawkish signals triggered cascading liquidations, exposing systemic risks in high-leverage crypto trading. - Institutional investors remained resilient amid the selloff, contrasting retail traders' margin calls and highlighting crypto ETF inflows as stabilizing factors during market

Hyperliquid's Growing Popularity and Trading Volume: Evaluating Its Potential as a Lasting DeFi Investment

- Hyperliquid dominates 2025 DeFi perpetuals with $2.74T volume, rivaling Coinbase via HyperBFT's 200k TPS and sub-second finality. - Market share dropped from 73% to 38% as competitors like Aster emerged, though Hyperliquid maintains 62-63% Perp DEX open interest. - Governance innovations (HIP-1/3) enable permissionless listings while 93% fee buybacks and $5B TVL boost HYPE token value. - Regulatory risks and $4.9M security loss highlight vulnerabilities despite BlackRock/Stripe partnerships and SEC ETF a

PENGU Token's Latest Price Rally and Technical Evaluation

- PENGU token surged past $0.0100 in late 2025, driven by Bitcoin rebound, whale accumulation, and Pudgy Penguins' project developments. - Technical analysis shows overbought RSI (73.76) and key support/resistance levels at $0.012-$0.0135, signaling potential volatility. - Market psychology blends speculative FOMO with strategic utility growth through "Pudgy Party" and NHL partnerships, though macro risks like Fed policy remain critical. - Analysts caution investors to balance short-term momentum with long