Ripple’s XRP Decreases by 7%, Trades Around $2.25

- XRP declines 7%, trading at $2.25 as of November 4.

- Analysts examine potential bear market risk.

- Ripple’s executives remain silent on the price drop.

On November 4, 2025, Ripple’s XRP experienced a 7% decline, trading around $2.25, amid increased analyst scrutiny and Ripple’s Swell event.

The drop reflects broader market sentiment and historical trading patterns, leaving investors and analysts focusing on potential support or further downside for XRP.

Ripple’s XRP decreased by approximately 7% on November 4, trading around $2.25. This decline aligns with increased industry scrutiny and occurs during the Ripple Swell event, although no direct remarks from executives have emerged regarding the price change.

The XRP drop features leaders such as Brad Garlinghouse and David Schwartz, but no official statements from them address the situation. Analysts like Jason Pizzino suggest historical XRP trends hint at possible bear cycles, emphasizing caution among investors.

Analysts view the ongoing decline as part of a broader market trend. XRP trading between $2.20–$2.26 represents a 12-month low in realized profits. Failing support at $2.27 may lead to further corrective phases, potentially impacting investor sentiment.

Financial impacts include no notable spillover into other digital assets like BTC or ETH. On-chain data indicates rising new investor interest, suggesting recovery potential later in November, although careful market observation is advised.

While the XRP price drop has not triggered direct institutional actions, the situation demands cautious monitoring by stakeholders. Historic patterns underscore potential extended bear phases, with $1.79 as the last significant price floor seen in April 2025.

Expert analysis reflects on XRP’s historical volatility and potential bear cycles, with Jason Pizzino noting multi-year trends. Earlier, Pizzino remarked, “Every major trend in XRP history has resulted in a 12–13 month move, or a multiple of this time frame, like 2018–2020, which saw a 26-month bear market. History is rhyming again.” The ongoing Swell event isn’t seen as a catalyst in past years, but investor behavior and technical patterns warrant close attention.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Aster DEX’s Latest Protocol Update and What It Means for DeFi Liquidity Providers

- Aster DEX's 2025 protocol upgrade enables ASTER token use as 80% margin collateral for perpetual trading, enhancing capital efficiency and reducing liquidation risks. - LPs benefit from 5% fee discounts and reduced impermanent loss risks via leveraged positions, potentially outperforming competitors like Uniswap V3 in yield generation. - CZ's $2M ASTER purchase triggered 800% trading volume surge, while TVL rebounded to $1B post-upgrade despite earlier declines, highlighting cross-chain appeal. - The hyb

DASH Aster DEX: Transforming DeFi Liquidity with Hybrid Innovations and AI-Powered Approaches

- DASH Aster DEX combines DEX transparency with CEX performance via a hybrid AMM-CEX model, addressing liquidity inefficiencies and institutional hesitancy in DeFi. - Its AI-driven liquidity routing aggregates cross-chain assets, boosting trade efficiency and attracting $1.399B TVL and 2M users by Q3 2025. - Aster Chain’s ZKP integration ensures privacy and scalability, securing $50B in value while processing 10,000 TPS. - The ASTER token’s airdrop incentives and 1,650% price surge reflect strong community

The Transformation of Trust Wallet Token’s Value: Institutional Integration and Key Alliances Towards the End of 2025

- Trust Wallet Token (TWT) surged in late 2025 due to governance upgrades and institutional partnerships enhancing its utility. - Trust Premium's tiered rewards created recurring demand, stabilizing TWT's price through on-chain activity incentives. - RWA integrations with platforms like Ondo expanded TWT's use cases, attracting institutional capital despite regulatory risks. - The Onramper partnership enabled global crypto access for 210M users, bridging traditional finance and DeFi ecosystems. - These dev

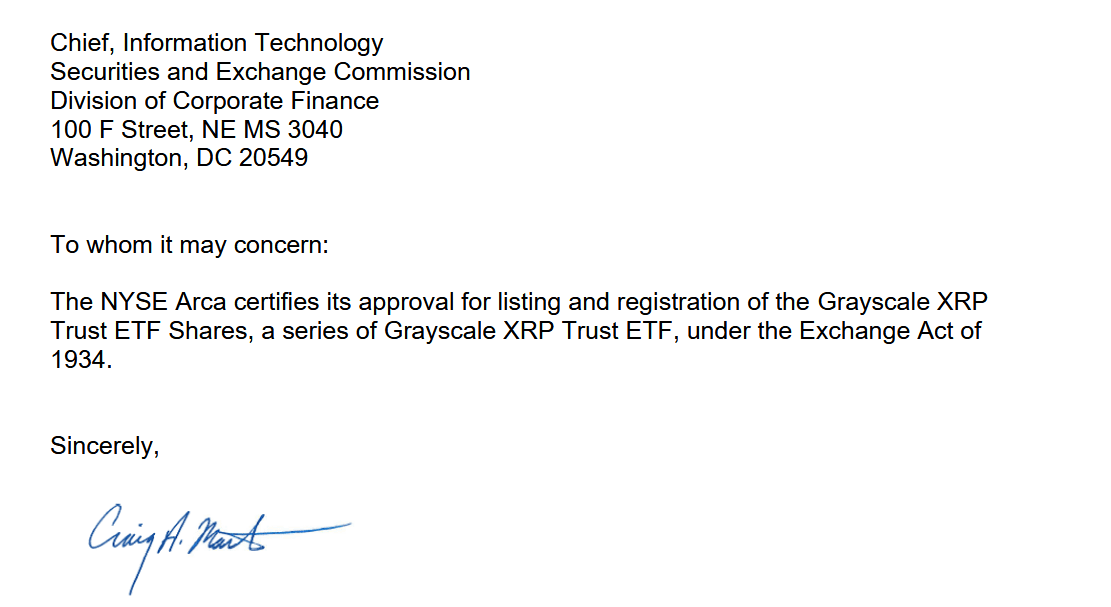

Grayscale’s Dogecoin and XRP ETFs Set for Monday Launch