Pump.fun Repurchase Exceeds $150 Million Mark

- The buybacks involved utilizing more than 763,500 SOL.

- Immediate effects include increased investor confidence and market stability.

- Insights suggest potential regulatory scrutiny and technological outcomes.

Pump.fun’s PUMP token repurchase program has exceeded $150 million, reducing the circulating supply by 9.5%. Funded by platform fees using SOL, this milestone surpasses similar buyback initiatives like LayerZero’s and Raydium’s, based on official dashboard data.

Points Cover In This Article:

TogglePump.fun’s cumulative repurchased PUMP token value has exceeded US$150 million as of late October 2025, confirmed through direct on-chain data and the official Pump.fun dashboard.

Pump.fun surpasses $150 million in PUMP token buybacks , confirming via on-chain data. Event involves 763,500 SOL in transactions, enhancing market stability. Community sees positive sentiment and potential future buybacks.

Pump.fun’s Impact on the Solana Ecosystem

Pump.fun’s milestone underscores its significant influence within the Solana ecosystem, enhancing token scarcity and stability. The buyback event reflects larger industry trends, supporting market confidence without triggering regulatory reactions.

PUMP buybacks now total over 763,000 SOL, worth roughly $151 million since launch. That’s an enormous figure for a project that’s still relatively young.

Financial Strategies and Market Implications

The cumulative repurchase value of Pump.fun’s PUMP token, a Solana-based memecoin, has exceeded $150 million. On-chain data from fees.pump.fun verifies this milestone, indicating substantial market activity. Leadership remains pseudonymous, with data representing primary confirmation.

The buybacks involved utilizing more than 763,500 SOL, impacting the circulating supply by over 9%, reinforcing price stability. Key actors like Crypto Patel highlight the project’s substantial market footprint, contrasting its growth with other Layer 1 token activities.

From a financial perspective, reliance on SOL rather than institutional grants indicates Pump.fun’s self-sustaining funding model. The broader implications include enhanced position in future financial discussions and market strategies among similar entities.

Future Outlook and Technological Outcomes

Insights suggest potential regulatory scrutiny and technological outcomes in similar financial mechanisms. With historical trends as context, Pump.fun’s buyback activity can inspire further innovations. Data-driven insights offer foresight into how such actions may unfold in tokenized economies and practices.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Does DeFi's security dilemma have to compromise with "unlimited authorization" and "trusted third parties"?

The security challenges faced by DeFi have never been unsolvable problems.

TRON Industry Weekly: "Increased Probability of a December Rate Cut?" Could This Ease Market Downturn? Detailed Analysis of the Privacy DA ZK Engine Orochi Network

TRON Industry Weekly Report Summary

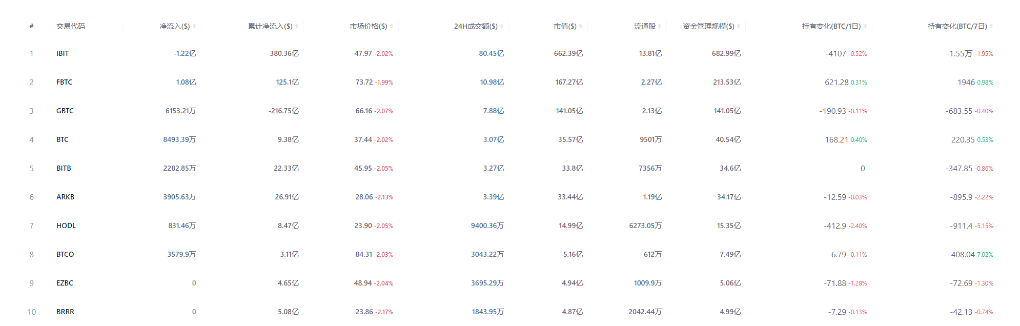

Crypto ETF Weekly Report | Last week, US Bitcoin spot ETFs saw a net outflow of $1.216 billion; US Ethereum spot ETFs saw a net outflow of $500 million

BlackRock has registered the iShares Ethereum Staking ETF in Delaware.

CEX suffers massive outflows: Who is draining the liquidity?