TRON Industry Weekly: "Increased Probability of a December Rate Cut?" Could This Ease Market Downturn? Detailed Analysis of the Privacy DA ZK Engine Orochi Network

TRON Industry Weekly Report Summary

I. Outlook

1. Macroeconomic Summary and Future Forecast

Last week, the U.S. macroeconomy continued to be under the combined pressure of "weak data + high uncertainty." Data collection interruptions caused by the government shutdown are still affecting the transparency of economic indicators, with the official release of October CPI and some employment data being formally canceled. As a result, the market's judgment of the economic situation has to rely on private institutions and high-frequency data. Consumer confidence has fallen to record lows, retail activity and manufacturing momentum are weak, and the market is increasingly concerned that the economy has entered a substantial slowdown phase. Meanwhile, Federal Reserve officials acknowledged in their speeches that growth is under pressure, but remain cautious about rate cuts, emphasizing the need to wait for data to recover before making policy decisions. The overall tone is "wait-and-see but not in a hurry to ease."

Looking ahead, as the government is expected to resume normal operations by the end of the month and key economic data are re-released, the market's focus will return to three core issues: "whether inflation will further cool, whether employment will start to deteriorate, and whether rate cuts will be brought forward." Overall, short-term volatility will remain heightened, and the trend direction will depend on the real economic performance after data recovery.

2. Crypto Industry Market Changes and Warnings

Last week, the cryptocurrency market continued to suffer heavy blows, especially as bitcoin fell below the $100,000 mark, triggering widespread panic. Bitcoin once dropped to around $80,000, hitting a multi-month low; the entire crypto market cap has evaporated by more than $1 trillion since the early October peak, and market sentiment has fallen to an extreme fear state. Most investors were forced to reduce positions, leveraged positions were heavily liquidated, the proportion of stablecoins and safe-haven assets increased, while altcoins and speculative sectors suffered even greater capital outflows.

Looking ahead, if bitcoin cannot quickly rebound above $100,000 and hold this psychological support, the market may fall into a deeper bear phase. Currently, three major risks need to be watched: first, if expectations for macro policy easing are delayed, it will suppress crypto liquidity; second, if capital continues to exit and the scale of leveraged liquidations expands, it will further drive declines; third, structural differentiation will intensify, with leading coins having some defense but small and medium projects possibly becoming the "focus of selling pressure."

3. Industry and Sector Hotspots

Grass, a decentralized data layer for AI led by Polychain with $10 million in funding, is built as a Sovereign Data Rollup; Better Payment Network (BPN), with a total funding of $50 million led by YZilabs, is a next-generation programmable cross-border payment layer natively built on BNB Chain, designed for borderless, multi-stablecoin/multi-currency cross-border payments.

II. Market Hot Sectors and Weekly Potential Projects

1. Overview of Potential Projects

1.1. Brief Analysis of Grass—A Decentralized Data Layer for All, Led by Polychain with $10 Million Funding

Introduction

Grass is a data layer specifically built for artificial intelligence (AI), constructed in the form of a Sovereign Data Rollup.

The network connects over 2 million users, who contribute their underutilized network resources by running Grass Nodes, helping AI developers efficiently access data.

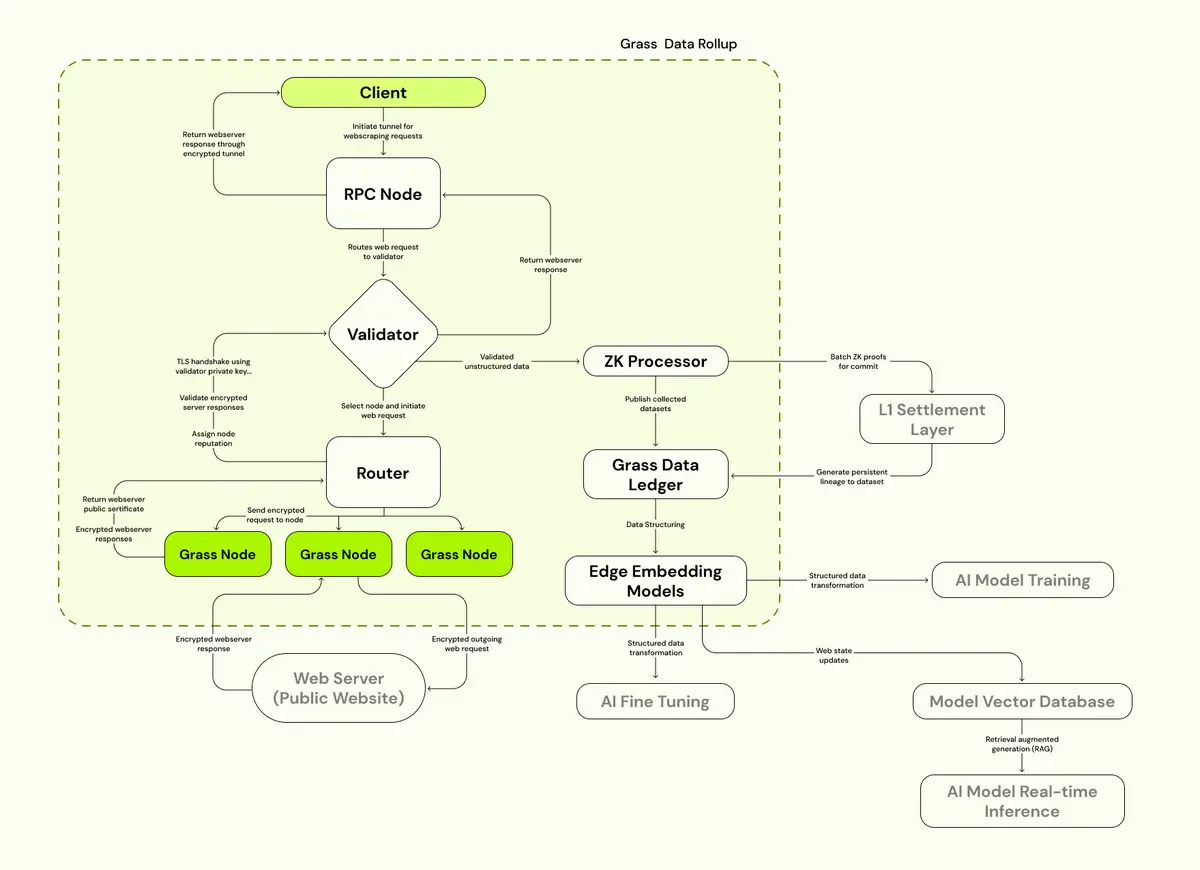

The Sovereign Data Rollup consists of Nodes, Routers, Validators, and ZK Processors, transforming unstructured network data into structured datasets, providing verifiable and high-quality data foundations for AI.

This decentralized data aggregation approach effectively prevents the centralization of AI power, allowing ordinary people to benefit from AI development and promoting a fairer and more open AI ecosystem.

Protocol Architecture Brief

Grass is building the world's first Sovereign Data Rollup.

Through a globally distributed Grass Node network, Grass automates and structures the data acquisition and transformation process, enabling AI to universally and efficiently access organized network data.

Sovereign Data Rollup Architecture

1. Validator

Validators are responsible for receiving, verifying, and batch processing network transactions from routers.

They then generate zero-knowledge proofs (ZK Proofs), recording checkpoints of session data on the blockchain.

On-chain proofs can be referenced in datasets to verify data provenance and track the full lifecycle of data.

The validator set initially adopts a centralized framework (with only a single validator), but will gradually transition to a decentralized multi-validator committee structure for greater security and autonomy.

2. Router

Grass Routers are the intermediary layer connecting Grass Nodes and Validators.

Routers are responsible for:

-

Maintaining the traceability and reliability of the node network;

-

Forwarding network bandwidth;

-

Receiving incentives and rewards based on the proportion of verified bandwidth relayed through them.

This mechanism ensures that traffic and data transmission in the network are verifiable and settleable, and incentivizes routers to operate stably over the long term.

3. Grass Node

Grass Nodes utilize users' underused network bandwidth to help the network crawl public web data (excluding personal privacy data).

Node operation is free and simple; anyone can contribute bandwidth to the network by running a node and receive corresponding rewards based on relayed data traffic.

This mechanism enables millions of ordinary users to participate in the AI data ecosystem as "micro-nodes," becoming direct beneficiaries of the data economy.

4. ZK Processor

The ZK Processor is responsible for batching validity proofs for all web request session data and submitting these proofs to a Layer 1 blockchain.

This operation creates a permanent record on-chain for every data crawling action.

It lays the foundation for AI training data provenance and total visibility, ensuring that all data sources and usage are verifiable and auditable.

5. Grass Data Ledger

The Grass Data Ledger is the bridge connecting "crawled data" and the "L1 Settlement Layer." This ledger is an immutable data structure,

-

carrying complete datasets;

-

and linking data to their corresponding on-chain zero-knowledge proofs.

Essentially, it is the data storage and tracking warehouse of the Grass network, ensuring the verifiability and non-forgeability of data provenance.

6. Edge Embedding Models

Edge embedding is the process of converting unstructured network data into structured models. This includes all necessary steps for preprocessing raw data:

-

Cleaning

-

Normalization

-

Structuring

Ultimately, it generates data formats that meet AI model requirements, enabling the collected data to directly serve AI training and inference tasks.

Tron Comments

The advantage of Grass lies in its innovative proposal of the "Sovereign Data Rollup" concept. Through a decentralized node network, it transforms scattered internet resources into structured data usable by AI, achieving a fully on-chain verifiable process for data collection, verification, storage, and provenance. It not only improves the quality and transparency of AI data but also allows ordinary users to directly participate in and benefit from the AI economy, combining technological innovation with social inclusiveness.

The disadvantage is that its ecosystem is still in the early stage, and node quality, data compliance, ZK processing performance, and cost control still need to be verified; in addition, regulatory uncertainty regarding data crawling and privacy boundaries may become a major risk for future expansion.

1.2.Interpretation of Better Payment Network (BPN)—A Next-Generation Programmable Cross-Border Payment Layer Built on BNB Chain, with $50 Million Total Funding Led by YZilabs

Introduction

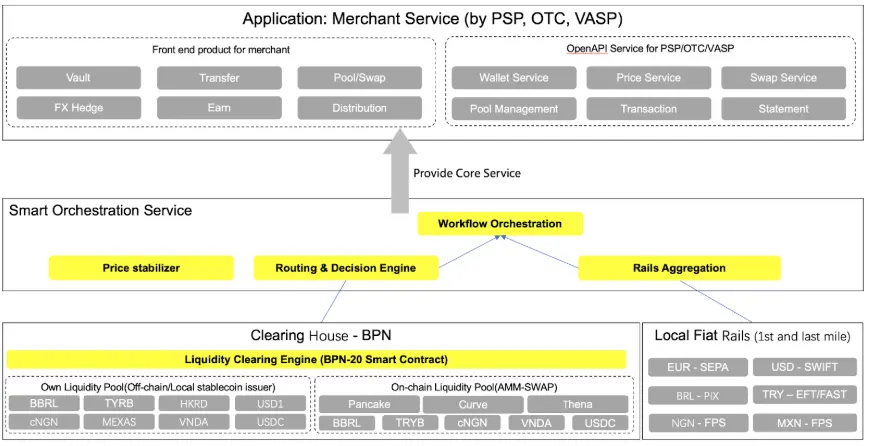

Better Payment Network (BPN) is a programmable payments layer natively built on BNB Chain, designed for borderless, multi-stablecoin/multi-currency cross-border payments.

Unlike traditional bridge-based networks, BPN interacts directly with native stablecoin liquidity and combines on-chain & off-chain clearing capabilities to support real-world forex exchange and global payment orchestration.

This architecture enables BPN to achieve efficient, low-cost, and scalable cross-border capital flows while maintaining decentralized security, providing smarter and more open payment infrastructure for the global financial network.

Better Payment Network (BPN) Ecosystem

One Layer · One API Suite · Multiple Tokens and Use Cases

BPN is built with the concept of "lightweight but infinitely scalable":

-

One Layer:

Using BNB Chain as the core base layer, ensuring industry-leading security, unified settlement logic, and minute-level operational efficiency. -

One API Suite:

Modular functional interfaces that can be assembled as needed, providing flexible payment solutions for users, wallets, PSPs, and e-commerce plugins. -

Multiple Tokens and Use Cases:

Redefining global payment, fund management, and forex trading experience through a local stablecoin network, achieving borderless digital asset circulation.

1. The Dual-Layer Clearing House

2. The Liquidity Superhighway

BPN will transform the current fragmented liquidity landscape into a unified and deep liquidity system.

Its core driving mechanisms include:

-

Canonical Pools:

Protocol-owned major stablecoin trading pair liquidity pools, providing a stable and deep capital base for the network. -

Institutional Order Flow:

Direct deep integration with TradFi market makers, enhancing liquidity and trading depth. -

Cross-Chain Aggregation:

Aggregating liquidity from BNB Chain, Ethereum, and other public chains to achieve a truly multi-chain interoperable payment base layer.

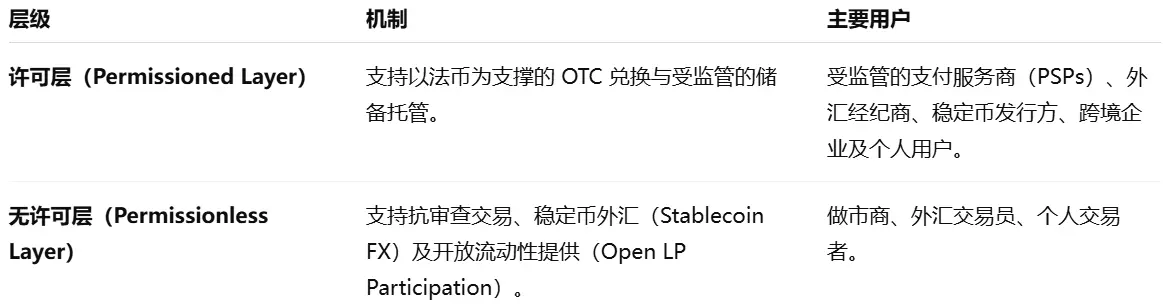

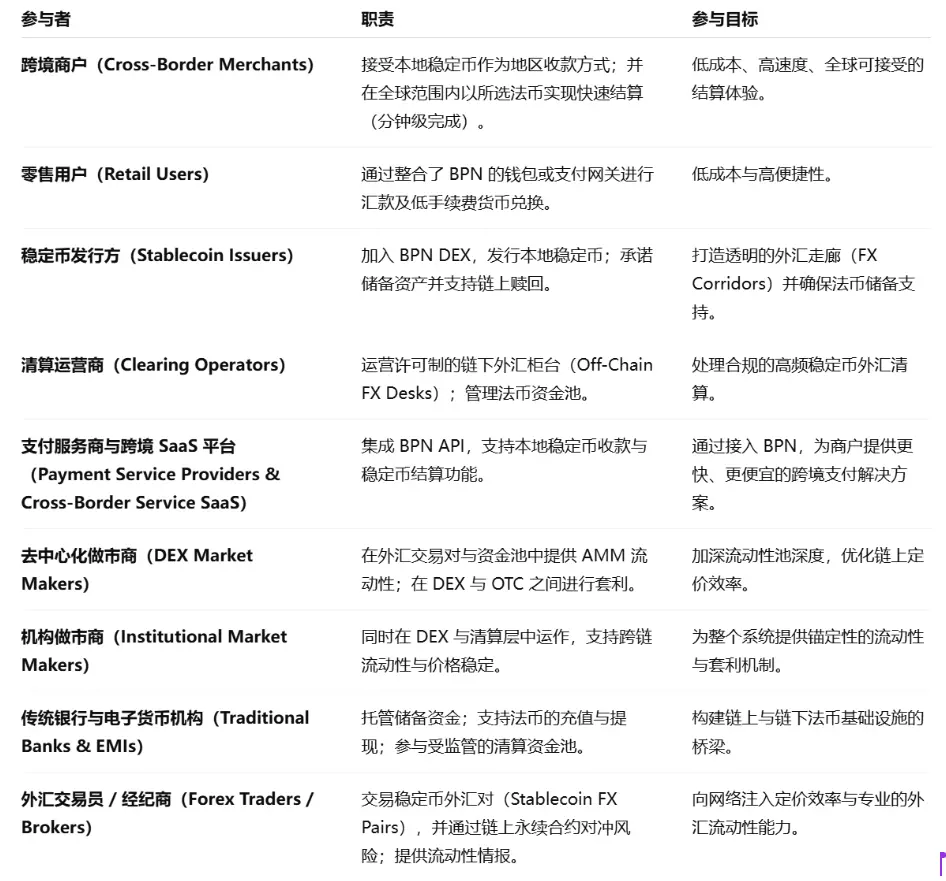

3. Better Payment Network (BPN) Participants

BPN is permissionless at the protocol layer, but also provides regulated compliance entry points where required.

Economic Efficiency

1. Economic Flywheel

Cross-border payment demand → Stablecoin exchange → Forex trading → Derivatives layer

↑ ↘

More derivatives demand ← Better price discovery ← Higher liquidity ← More market participation

This flywheel mechanism forms a self-reinforcing economic cycle:

-

Cross-border payment activity drives stablecoin usage;

-

Stablecoin exchange generates forex trading demand;

-

Forex trading drives the development of the derivatives market;

-

Deeper liquidity and price transparency in turn attract more participants into the network, further expanding the economic scale and stability.

2. Value Capture

BPN's revenue sources include the following:

-

Base Fee:

Charging a base fee for all on-chain and off-chain stablecoin transactions. -

Premium Charges:

Charging a premium for advanced features such as Earn, Hedge, Distribute, etc. -

Liquidity Leasing:

Leasing protocol liquidity to external protocols or institutions for returns. -

Stable Pairs Arbitrage:

Profiting from arbitrage operations on stablecoin trading pairs (Stable Pairs Trading).

These revenues together form BPN's sustainable income loop, supporting protocol operation, ecosystem development, and incentive distribution.

3. Value Reinvest

80% of protocol revenue will be redistributed for ecosystem incentives and sustainable growth:

-

Liquidity Providers:

Rewarding participants who provide stablecoin pair and forex market liquidity, ensuring market depth. -

Validators:

Incentivizing nodes that maintain network consensus and clearing security. -

Ecosystem Development:

Supporting partner programs, product innovation, user growth, and developer grants to promote BPN's long-term ecosystem construction.

Tron Comments

BPN's advantage lies in its innovative combination of programmable payment layers and dual-layer clearing mechanisms, natively built on BNB Chain. It has the flexibility of decentralization and can connect with the fiat world through compliance on-ramps. Its design offers significant efficiency advantages in cross-border payments, stablecoin forex, liquidity aggregation, and multi-currency settlement, and achieves scalable global payment infrastructure through unified APIs and shared liquidity pools.

The disadvantage is that the ecosystem is still in its early stages, with uncertainties in integrating with traditional financial systems, compliance implementation, and multi-country regulatory coordination; in addition, the network needs to balance security, liquidity depth, and user adoption to ensure long-term sustainable value capture.

2. In-Depth Analysis of Key Projects of the Week

2.1. In-Depth Analysis of Orochi Network—A Zero-Knowledge Engine for Verifiable Data Infrastructure, with $20 Million Total Funding Led by Ethereum Foundation and Followed by MEXC

Introduction

Orochi Network is a verifiable data infrastructure that ensures data integrity and privacy protection through advanced cryptographic technologies.

Orochi Network provides a secure underlying architecture that enables data processing and verifiable proofs without disclosing confidential information.

This mechanism, composed of cutting-edge cryptographic primitives, allows users to trust the system's output while protecting sensitive information.

Therefore, Orochi Network becomes a powerful solution that balances transparency and confidentiality, especially suitable for application scenarios with high trust and privacy requirements.

Orochi Network is an innovative verifiable data infrastructure that is redefining data processing in the digital age.

With security and trustlessness as core principles, Orochi Network employs advanced cryptographic technologies including zero-knowledge proofs (ZKP), fully homomorphic encryption (FHE), and trusted execution environments (TEE) to fundamentally ensure data integrity and privacy.

Whether for enterprises, developers, or individual users, Orochi Network provides a secure and robust platform for processing and verifying data without disclosing privacy, achieving a perfect balance between transparency and confidentiality. It offers a future-oriented foundational solution for a world increasingly reliant on trusted and private data systems.

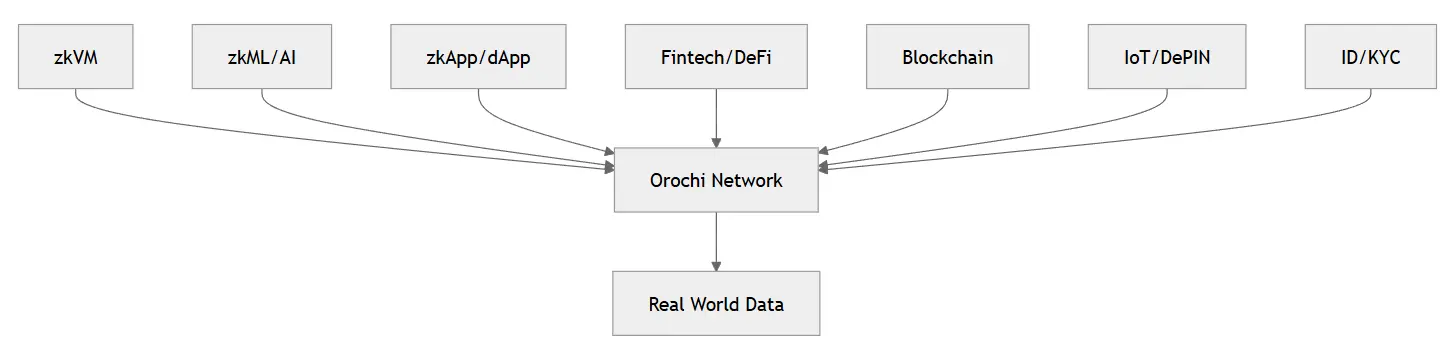

Image: Orochi Network transforms data into verifiable data, becoming the core support of the next-generation Internet

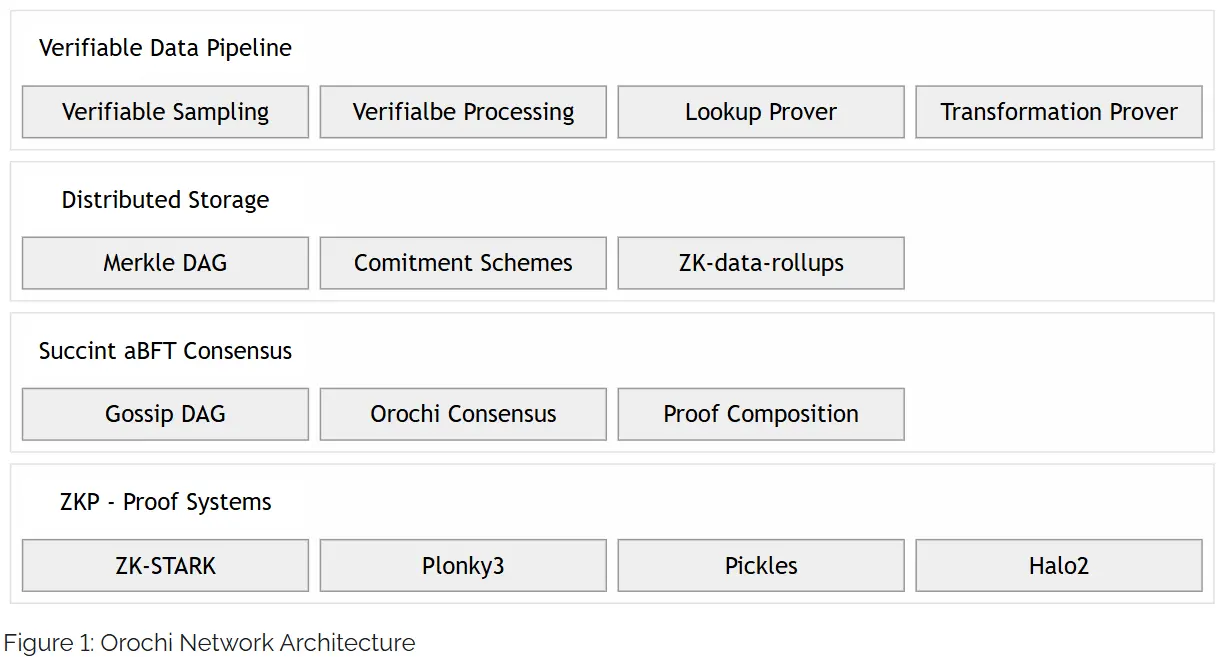

Architecture Brief

Orochi Network provides strong support for various commitment schemes and proof systems, making it unique in the secure data infrastructure field.

The system adopts mechanisms such as Merkle trees and polynomial commitments to ensure the efficiency and verifiability of data processing.

In addition, Orochi Network integrates multiple advanced zero-knowledge proof systems, including Halo2, Pickles, ZK-STARK, and Plonky3.

These systems feature succinctness, scalability, and even post-quantum security.

This diversity and flexibility greatly enhance the system's privacy, interoperability, and efficiency, making Orochi Network a powerful underlying solution for blockchain ecosystems and dApps using cutting-edge cryptographic tools.

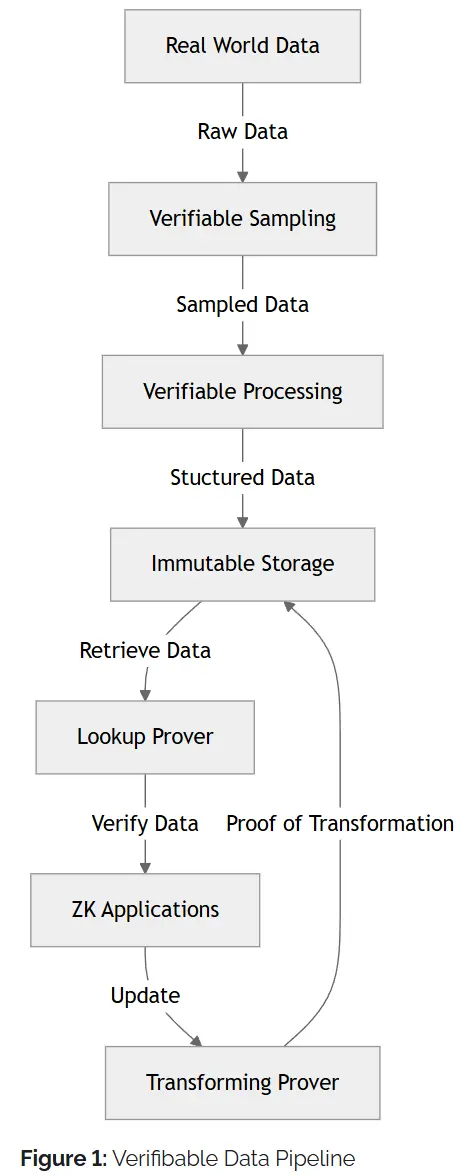

Verifiable Data Pipeline

Orochi Network not only provides data availability but also offers cryptographic proofs for every stage of data processing—from sampling to storage and retrieval—through its verifiable data pipeline.

This end-to-end verifiability greatly enhances trust and transparency in blockchain applications.

1. Verifiable Sampling

Proves the authenticity of data samples, which can originate from blockchains, APIs, or databases. The prover generates succinct proofs to verify the integrity of data samples (such as TLS certificate verification) and their compliance with specific sampling algorithms.

2. Verifiable Processing

In the steps following sampling, it proves that raw data has been accurately transformed into structured data according to predefined algorithms.

3. Lookup Prover

Verifies the correctness of lookup operations in BTree data structures and combines them with membership proofs of commitment schemes (such as Merkle trees). Ensures that the retrieved key-value pairs do exist in the committed dataset and generates succinct proofs that simultaneously verify lookup correctness and data inclusion.

4. Transformation Prover

Verifies the correctness of data updates and structural transformations. Ensures that data records are accurately modified (such as insertion, deletion, or format change) and comply with predefined data structure schemas, ultimately generating zero-knowledge proofs bound to commitment schemes (such as Merkle roots).

Distributed Storage

Distributed storage consists of three core components:

1. Merkle DAG (Merkle Directed Acyclic Graph)

A hierarchical hash node structure that enables content-addressed storage. By linking data with cryptographic hashes, it ensures data integrity and efficient cross-system retrieval.

Each node can verify the correctness of its subtree, ensuring global consistency.

2. Commitment Schemes

Cryptographic tools such as Merkle trees or polynomial commitments are used to bind data to a single value (e.g., root hash). This allows provers to verify authenticity or membership without exposing the full dataset, establishing trust in a succinct form.

3. ZK-Data-Rollups

A scalability solution using zero-knowledge proofs (ZKP), compressing off-chain data updates into succinct on-chain proofs, efficiently verifying storage operations while maintaining privacy, and enabling high-throughput decentralized storage systems.

Succinct aBFT Consensus

Unlike traditional consensus mechanisms, Orochi Network's succinct asynchronous Byzantine Fault Tolerance (aBFT) consensus achieves fast finality through asynchronous mechanisms.

This mechanism can quickly confirm transactions while tolerating faults and uses zero-knowledge proofs (ZKP) to cryptographically verify the integrity of the entire blockchain state, ensuring evidence security in a succinct and verifiable form.

-

Gossip DAG

Used to record transactions and messages propagated between nodes. Information is spread via the Gossip protocol and organized into a tamper-proof directed acyclic graph structure, with each node hash linked to previous events, ensuring traceability and verifiability of network activity.

-

Orochi Consensus

Orochi Network's dedicated asynchronous Byzantine Fault Tolerance (aBFT) mechanism achieves consistency among distributed nodes even in adversarial network environments without synchronous timing assumptions, combining high resilience and speed.

-

Proof Composition

By aggregating multiple zero-knowledge proofs into a single succinct proof, it efficiently verifies the correctness of the entire consensus process and blockchain state, significantly reducing computational overhead for validators and users.

ZK-Centric Approach

Orochi Network positions itself as the first verifiable data infrastructure, emphasizing zero-knowledge proofs (ZKP) as the core to achieve efficient and verifiable data processing. This architecture is especially suitable for applications with extremely high privacy and trust requirements.

-

Proof-System Agnostic

Orochi Network supports multiple zero-knowledge proof systems, such as Halo2, ZK-STARK, Pickles, etc., allowing developers to freely choose the most suitable proof scheme according to the scenario, with high flexibility.

-

Blockchain Agnostic

The network is designed to be blockchain-agnostic, capable of integrating with different public chains for cross-ecosystem compatibility and scalability.

-

Succinct Hybrid aBFT Consensus

This consensus mechanism supports asynchronous finalization, which can significantly improve efficiency and throughput compared to synchronous architectures used by some competitors.

Tron Comments

The advantage of Orochi Network lies in its innovative combination of zero-knowledge proofs (ZKP), fully homomorphic encryption (FHE), and trusted execution environments (TEE) to build verifiable and privacy-protecting data infrastructure. Its verifiable data pipeline and ZK-Data-Rollups achieve full-process verifiability from data sampling, processing to storage, providing high security, transparency, and scalability for blockchain and decentralized applications.

The disadvantage is the high technical complexity, which sets a high bar for developers and node operators; at the same time, the computational cost and performance optimization of ZKP and FHE remain industry challenges. How to balance privacy and efficiency will determine the speed of ecosystem adoption and large-scale implementation.

III. Industry Data Analysis

1. Overall Market Performance

1.1. Spot BTC vs ETH Price Trends

BTC

ETH

2. Hot Sector Summary

IV. Macroeconomic Data Review and Key Data Release Points for Next Week

Last week, U.S. September inflation and employment data released on November 20 showed a complex situation of "sticky inflation and weak employment": September CPI year-on-year was about 3.0%, month-on-month 0.3%, core CPI also 3.0%. Although inflation was slightly lower than expected, it remained significantly above the Federal Reserve's 2% target; meanwhile, nonfarm payrolls increased by 119,000 in September, higher than market expectations, but the unemployment rate rose to 4.4%, reflecting weakening labor market resilience.

This set of data overall signals "prices are not coming down, and employment is not strong," narrowing the Federal Reserve's policy space and suggesting that the path of rate cuts may be more cautious than previously expected by the market.

V. Regulatory Policy

Global Collaboration

-

G20 Group: At the 2025 summit, G20 leaders reached a declaration aimed at coordinating global cryptocurrency regulation, focusing on standard-setting for stablecoins and decentralized finance (DeFi) to balance innovation and systemic risk mitigation.

United States

This week, the United States released multi-level signals in the field of cryptocurrency regulation.

-

Federal Regulatory Progress:

-

Office of the Comptroller of the Currency (OCC): Issued new guidelines allowing national banks to hold and use cryptocurrencies when necessary (such as for paying blockchain network fees) to support legitimate banking activities. This is seen as a relaxation of restrictions on banks' direct participation in cryptocurrency activities.

-

Commodity Futures Trading Commission (CFTC): Chairman nominee Michael Selig pledged at a Senate hearing that, if authorized, he would establish a clear, principles-based regulatory framework for the digital asset spot market.

-

Securities and Exchange Commission (SEC): In its 2026 fiscal year review priorities, it no longer mentions cryptocurrencies, unlike the previous two years, possibly reflecting a shift in regulatory focus.

-

State-Level Policy Innovation:

-

New Hampshire: Approved the first bitcoin-backed municipal pipeline bond, with a size of $100 million. This structure allows borrowers to finance with over-collateralized bitcoin, protects investors through liquidation mechanisms, and isolates related risks from taxpayers.

Asia

Major Asian countries and regions continue to refine their crypto asset regulatory frameworks.

-

Japan: The Financial Services Agency (FSA) proposes to classify 105 cryptocurrencies such as bitcoin and ethereum as financial products, making them subject to the same regulatory framework as stocks and bonds, and plans to amend tax laws to fix the tax rate on crypto gains at 20%.

-

Hong Kong: On the basis of the stablecoin framework launched in June, the Hong Kong Monetary Authority (HKMA) is considering extending anti-money laundering and anti-terrorist financing controls to self-custody wallets.

-

Singapore: The Monetary Authority of Singapore has made it clear that only fully regulated, reserve-backed stablecoins are eligible as settlement assets.

-

Thailand & Malaysia:

-

Thailand lifted the ban on "conflict of interest tokens" used internally by exchanges, but requires strict disclosure and monitoring requirements.

-

Malaysia launched a new "liberalized listing framework," allowing exchanges to list tokens without prior approval, provided they comply with enhanced governance and capital requirements.

-

South Korea: Is incorporating virtual asset companies into its venture ecosystem, enabling them to access venture financing and tax incentives.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Does DeFi's security dilemma have to compromise with "unlimited authorization" and "trusted third parties"?

The security challenges faced by DeFi have never been unsolvable problems.

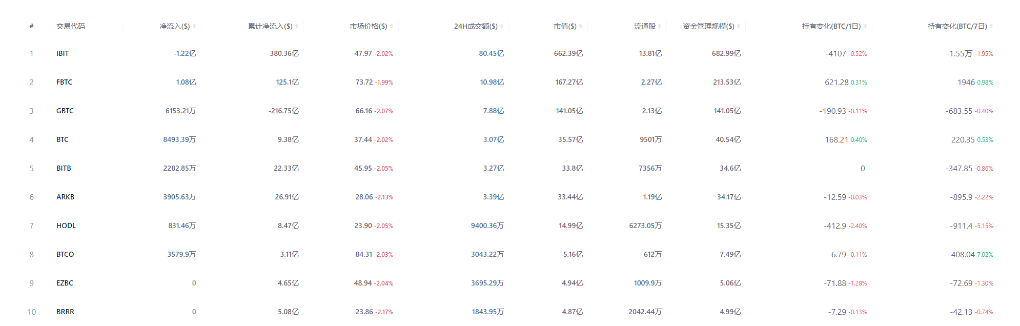

Crypto ETF Weekly Report | Last week, US Bitcoin spot ETFs saw a net outflow of $1.216 billion; US Ethereum spot ETFs saw a net outflow of $500 million

BlackRock has registered the iShares Ethereum Staking ETF in Delaware.

CEX suffers massive outflows: Who is draining the liquidity?