AVNT Rallies 45% After Avantis Surpasses $100 Million in Total Value Locked

Avantis (AVNT) has skyrocketed alongside a record $100 million TVL milestone on Base, signaling strong investor confidence. With trading volumes soaring and bullish patterns emerging, momentum is building for the fast-growing platform.

Avantis (AVNT) surged nearly 45% in a single day, cementing its position among the top daily gainers in the crypto market.

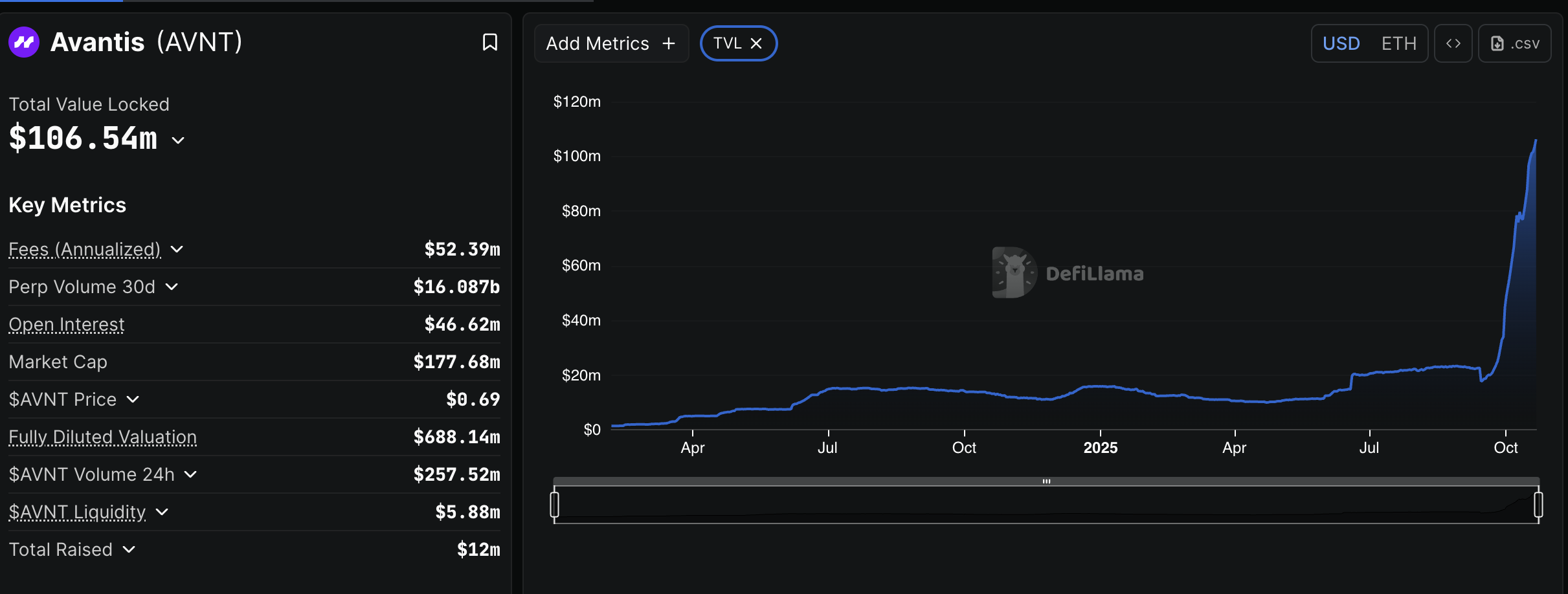

The price spike coincides with another major milestone for the network, as its Total Value Locked (TVL) reached a new all-time high (ATH) in October.

Avantis Sets New Record as TVL Climbs Past $100 Million on Base

Avantis is an on-chain perpetual derivatives and real-world asset (RWA) trading platform built on the Base network. Despite being a relatively new player in the market, the platform has seen notable growth.

In a post on X (formerly Twitter), Avnatis announced that its TVL has exceeded the $100 million threshold.

“We’ve surpassed $100 million in TVL: A massive milestone in Avantis’ journey. Avantis USDC (avUSDC) simplifies access to perpetual yields, enabling anyone to become a passive market maker. Next up: Composable yield integrations for avUSDC. The road to $500 million TVL continues,” the post read.

According to the latest data from DefiLlama, the network’s TVL has surged 431% over the past month. At press time, it stood at $106.5 million, marking a new record high.

Avantis’ Record High TVL. Source: DefiLlama

Avantis’ Record High TVL. Source: DefiLlama

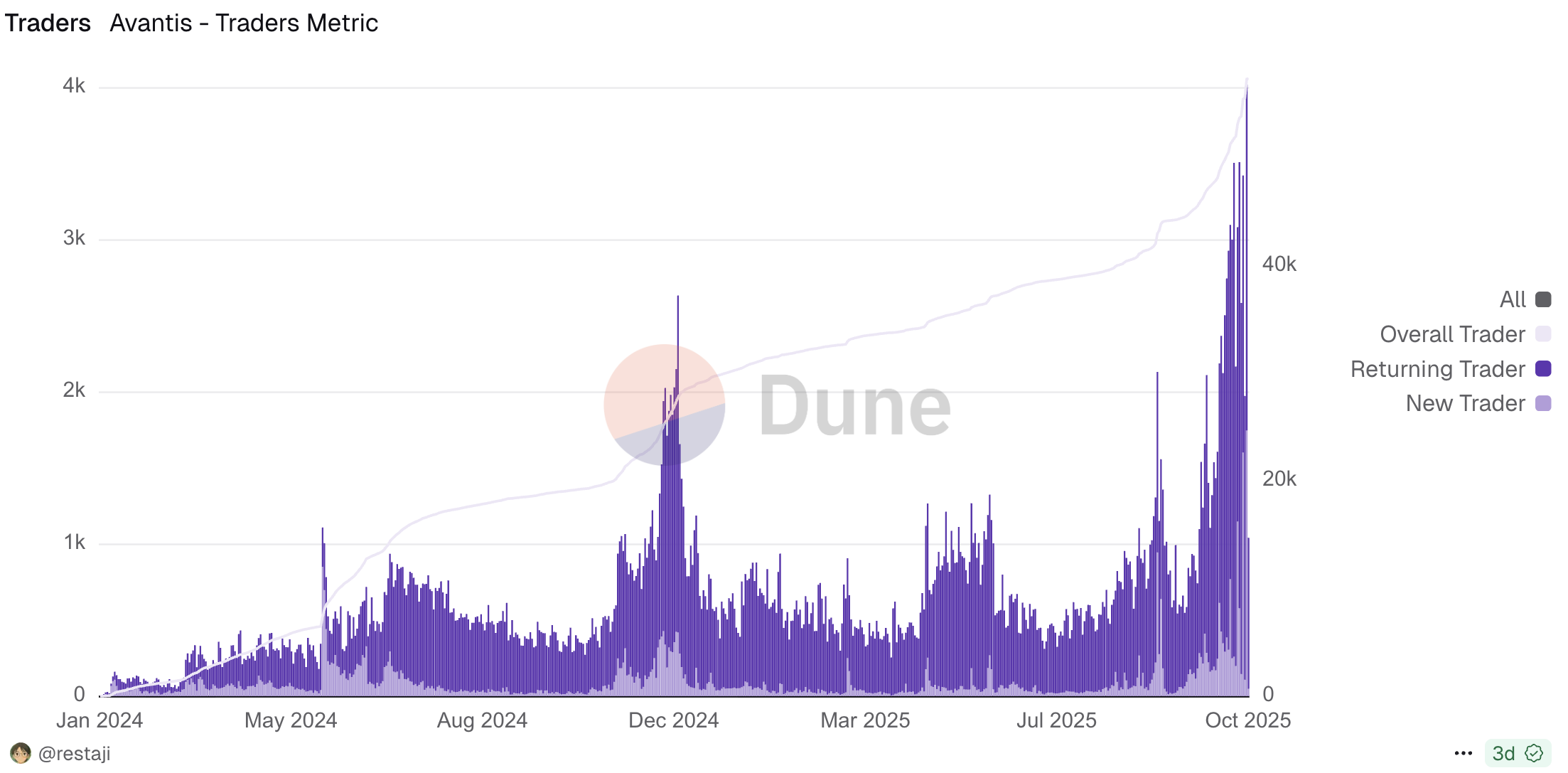

The network’s growth is further highlighted by its rising user adoption. Despite a broader market downturn, Avantis has continued to attract and retain traders.

On-chain data from Dune indicated an increase in new users, with the number of returning traders reaching an all-time high, highlighting the platform’s strong community engagement and sustained demand.

Returning and New Users on Avantis. Source: Dune

Returning and New Users on Avantis. Source: Dune

Why is Avantis (AVNT) Token’s Price Surging?

Meanwhile, the network’s continued expansion has also fueled AVNT’s price momentum. Following the TVL milestone, the token recorded a sharp uptick in value.

According to BeInCrypto Markets data, AVNT has climbed 44.69% over the past 24 hours. At the time of writing, it traded at $0.70.

Avantis (AVNT) Price Performance. Source: BeInCrypto Markets

Avantis (AVNT) Price Performance. Source: BeInCrypto Markets

The altcoin’s 24-hour trading volume also soared to $298 million, marking a 613% increase and signaling heightened liquidity and growing market participation around the token.

In addition, market watchers are projecting higher valuations for AVNT going forward. An analyst pointed out that AVNT recently broke out of a falling wedge pattern. This is a bullish technical setup that often signals the end of a downtrend.

AVNT Price Prediction. Source: VipRoseTr

AVNT Price Prediction. Source: VipRoseTr

According to the analyst, the token has bounced off a key demand zone and is now showing signs of bottom formation with strong bullish momentum building. The analyst set short- and mid-term targets at $0.8739 and $1.1849, respectively, suggesting further upside potential if market sentiment remains positive. Others also share a similar outlook.

For now, AVNT’s outlook appears favorable, supported by strong technical signals and growing on-chain activity. However, whether the token can sustain its upward momentum or faces another correction remains to be seen.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The ZK Transformation: Evaluating How Zero-Knowledge Technology Influences the Future Development of Blockchain

- ZK-rollups scale blockchain networks by bundling transactions, achieving 43,000 TPS and 30% lower gas fees, attracting institutions like Goldman Sachs and JPMorgan . - ZK technology resolves privacy-scalability paradox by enabling verifiable transactions without data exposure, adopted by EU regulators and enterprises like Nike and Sony . - Challenges persist: ZK-SNARKs require heavy computation, trusted setup risks exist, and privacy conflicts with AML regulations in some jurisdictions. - $725M+ VC inves

The Influence of Vitalik Buterin's Support for ZKsync on the Advancement of Scalable Blockchain Technologies: Evaluating the Prospects for Long-Term Investment in Pr

- Vitalik Buterin's 2025 endorsement of ZKsync accelerated its rise as a scalable Ethereum Layer-2 solution with 30,000 TPS and $3.3B TVL. - ZKsync's EVM compatibility and institutional partnerships contrast with StarkNet's quantum-resistant STARK proofs and Aztec's privacy-first architecture. - Analysts project ZK token prices at $0.40–$0.60 by 2025, while StarkNet faces adoption barriers and Aztec navigates regulatory challenges in privacy-focused DeFi. - The $7.59B ZKP market (2033 forecast) hinges on b

ZK Atlas Enhancement: Transforming Blockchain Scalability and Paving the Way for Institutional Integration

- ZKsync’s 2025 Atlas Upgrade achieves 15,000–43,000 TPS with $0.0001/transaction costs, boosting blockchain scalability for institutions. - Deutsche Bank , Sony , and Citi adopt ZKsync for tokenized assets and privacy-driven transactions, citing compliance and efficiency gains. - Market forecasts predict 60.7% CAGR for ZK Layer-2 solutions through 2031, with Fusaka upgrade targeting 30,000 TPS to solidify ZKsync’s leadership.

Hinge’s latest AI tool assists singles in skipping dull introductory conversations