Aave freezes PYUSD markets after unprecedented 300T mint and burn

Blockchain data showed stablecoin issuer Paxos both minted and burned about $300 trillion worth of the PayPal USD stablecoin within 30 minutes, leaving many crypto users scratching their heads.

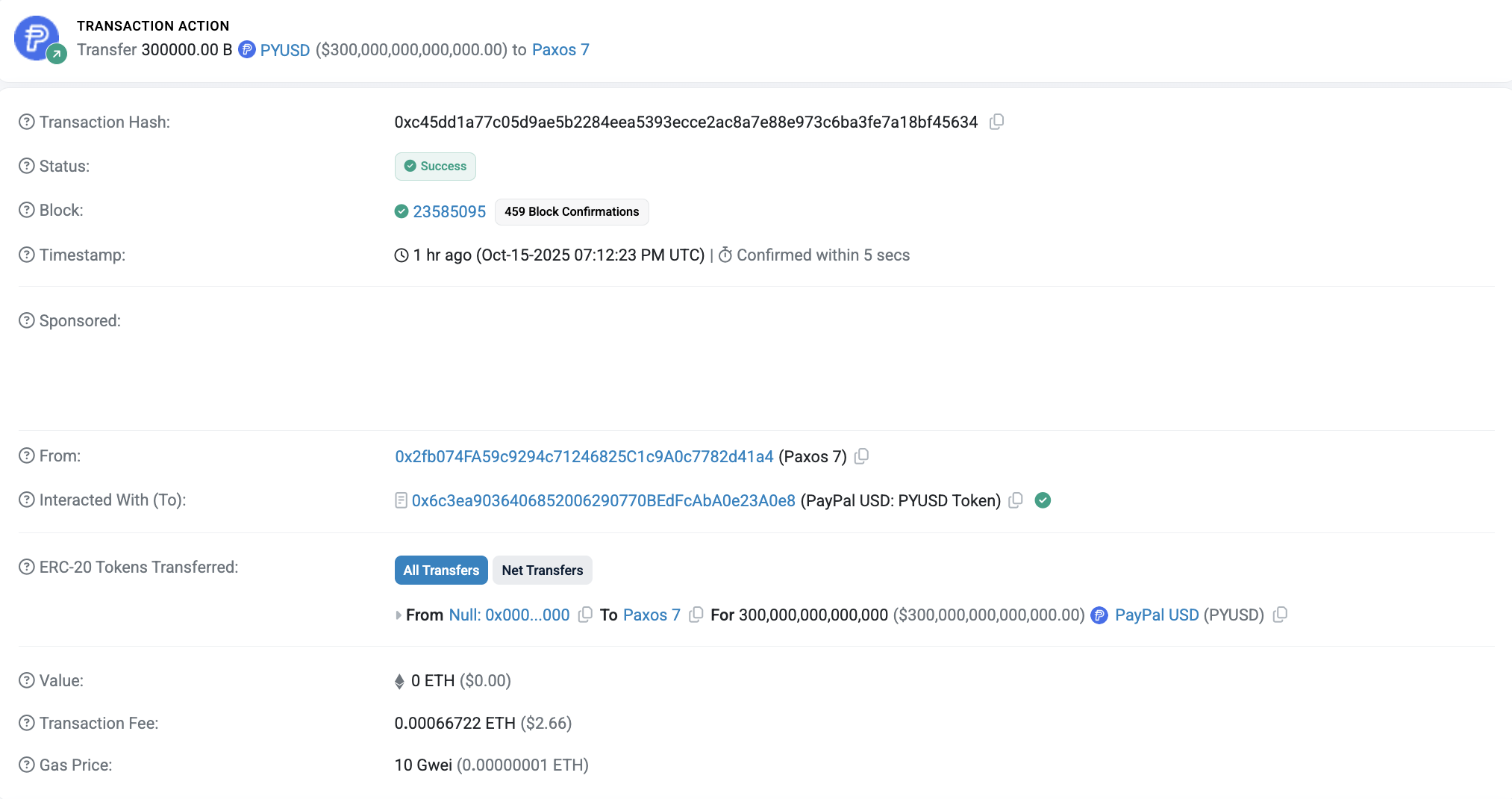

In a Wednesday X post following the mint and burn, Chaos Labs founder Omer Goldberg said Aave would be temporarily freezing trades for PayPal USD (PYUSD) after an “unexpected high-magnitude transaction” of minting and burning the stablecoin. Ethereum blockchain data showed Paxos minting 300 trillion of the US dollar-pegged stablecoin at 7:12 pm UTC and then burning the entire amount 22 minutes later by sending it to an inaccessible wallet.

Reporting from The Defiant suggested that it had been an “accidental mint” given the timing. Others online have speculated that such a large mint and burn may have been some kind of test or simulation authorized by Paxos.

Cointelegraph reached out to the stablecoin issuer for comment but had not received a response at the time of publication, nor had Paxos or PayPal publicly commented on the move.

$300 trillion is more than twice the Gross Domestic Product for every country on earth, according to data from the International Monetary Fund.

This is a developing story, and further information will be added as it becomes available.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zcash Halving 2025: Key Factors Investors Need to Monitor Today

- Zcash's 2025 halving reduced block rewards by 50%, cutting annual supply growth and reinforcing its deflationary model. - The event coincided with a 1,172% YTD price surge, driven by institutional adoption like Grayscale's 5% ZEC supply acquisition. - Privacy features (28% shielded transactions) and ZIP 1015's liquidity drain ($337K/day) amplified Zcash's scarcity-driven appeal. - Post-halving volatility saw ZEC peak at $641 before a 96% correction, highlighting liquidity risks despite institutional conf

Zcash (ZEC) Experiences Price Rally as Privacy Coins Gain Momentum: Privacy Tokens Serve as Safe Havens During Market Declines—Is ZEC Ready for Institutional Embrace?

- Zcash (ZEC) surged 919% in 2025 as privacy coins gained traction amid inflation and surveillance concerns. - Institutional adoption accelerated, with Grayscale's Zcash Trust growing 228% and regulators like the SEC engaging with privacy advocates. - Zcash's hybrid privacy model, combining shielded transactions with compliance-friendly transparency, attracted regulated investors and tech integrations. - Macroeconomic factors like Fed rate cuts and technological upgrades (e.g., ZK proofs) drove ZEC's outpe

Figma unveils innovative AI-driven features for removing objects and expanding images