Ondo’s Oasis Pro Acquisition Expands US Reach and Sparks ONDO Breakout Hopes

Ondo Finance’s Oasis Pro acquisition marks a pivotal shift toward regulatory compliance and institutional-grade RWA tokenization. While ONDO’s price gains momentum, its long-term breakout hinges on seamless integration and sustained investor confidence.

Ondo Finance has captured major attention after completing its acquisition of Oasis Pro, a firm holding several SEC-registered licenses.

This move marks a strategic milestone for Ondo in the rapidly growing Real World Assets (RWA) sector, yet the key question remains: Does ONDO have the momentum to break out?

From DeFi to TradFi: The Strategic Leap with Oasis Pro

Ondo Finance (ONDO) has officially completed the acquisition of Oasis Pro, including its broker-dealer, Alternative Trading System (ATS), and Transfer Agent (TA) licenses, which were approved by the US Securities and Exchange Commission (SEC).

“This acquisition enables Ondo to expand access as the tokenized securities market rapidly accelerates, predicted to exceed $18 trillion by 2033,” the announcement noted.

The acquisition represents a pivotal step that allows Ondo to deepen its presence in the regulated digital asset space, effectively bridging the gap between traditional finance (TradFi) and blockchain. What was once a DeFi protocol issuing RWA tokens is now evolving into an infrastructure player that can legally operate within US financial frameworks, a prerequisite for attracting institutional investors into on-chain assets.

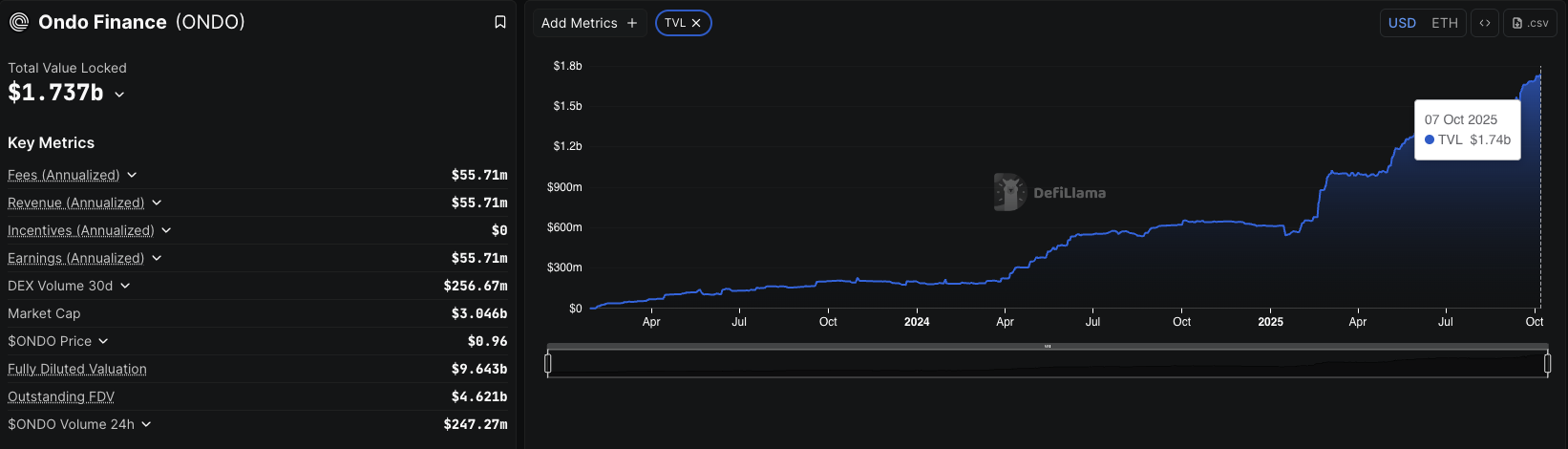

Within the DeFi ecosystem, Ondo’s Total Value Locked (TVL) recently reached an all-time high of $1.74 billion, with Q3 revenue and fees totaling around $13.7 million.

Ondo’s TVL. Source:

DefiLlama

Ondo’s TVL. Source:

DefiLlama

At the same time, BeInCrypto reported that Ondo Global Markets surpassed $300 million in tokenized assets, reflecting strong inflows into tokenized treasuries, stocks, and stablecoins.

This trend shows the surging demand for real-world on-chain products as investors seek yield-bearing, relatively secure alternatives amid persistently high real interest rates.

Technical Signals Worth Watching

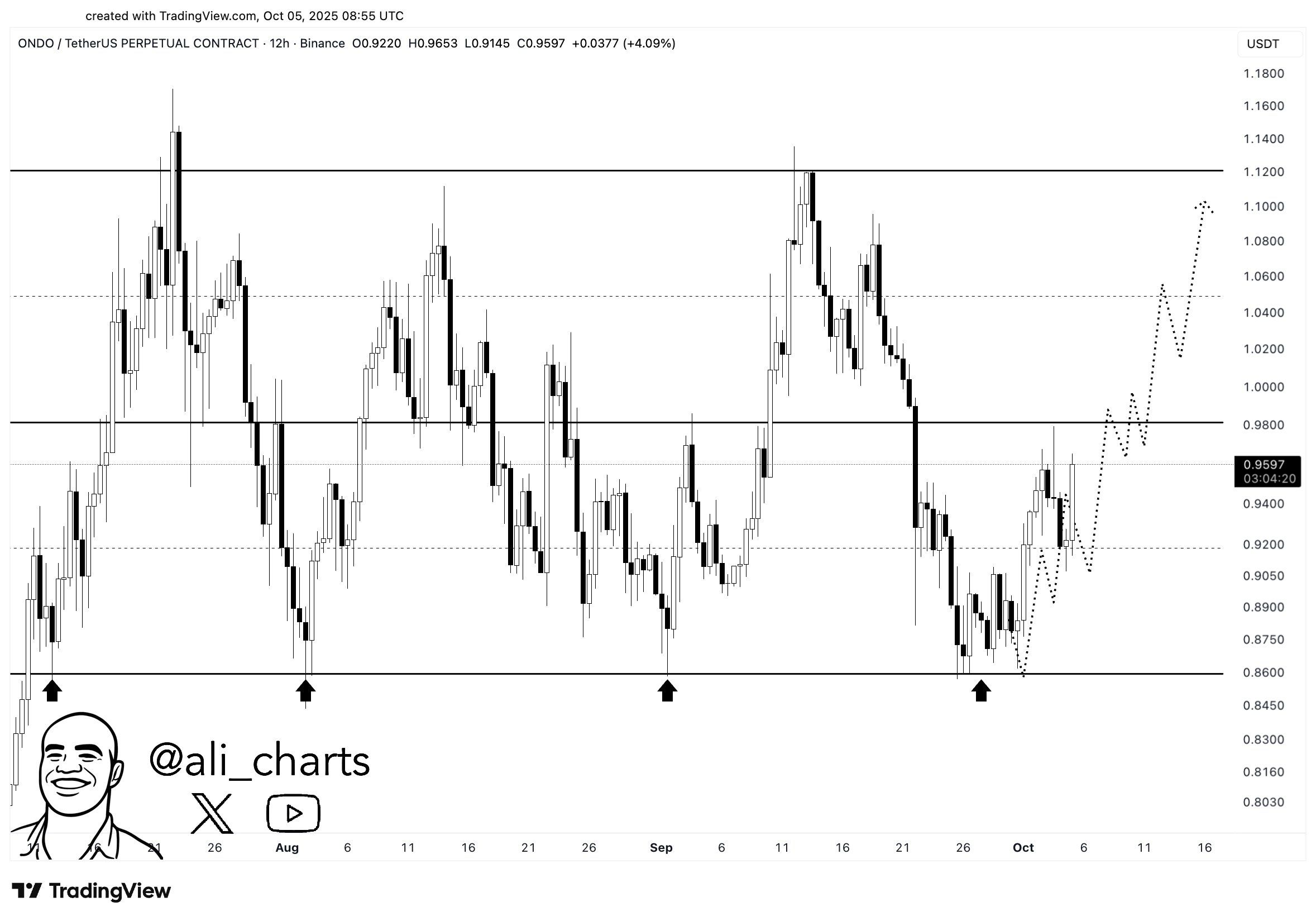

When writing, BeInCrypto data shows that ONDO is trading at $0.94, up 2.84% in the past 24 hours. From a technical perspective, crypto analyst Ali highlights a solid support zone around $0.86, with the next upside target at $1.12 if bullish momentum continues.

ONDO/USDT 12H chart. Source:

Ali on X

ONDO/USDT 12H chart. Source:

Ali on X

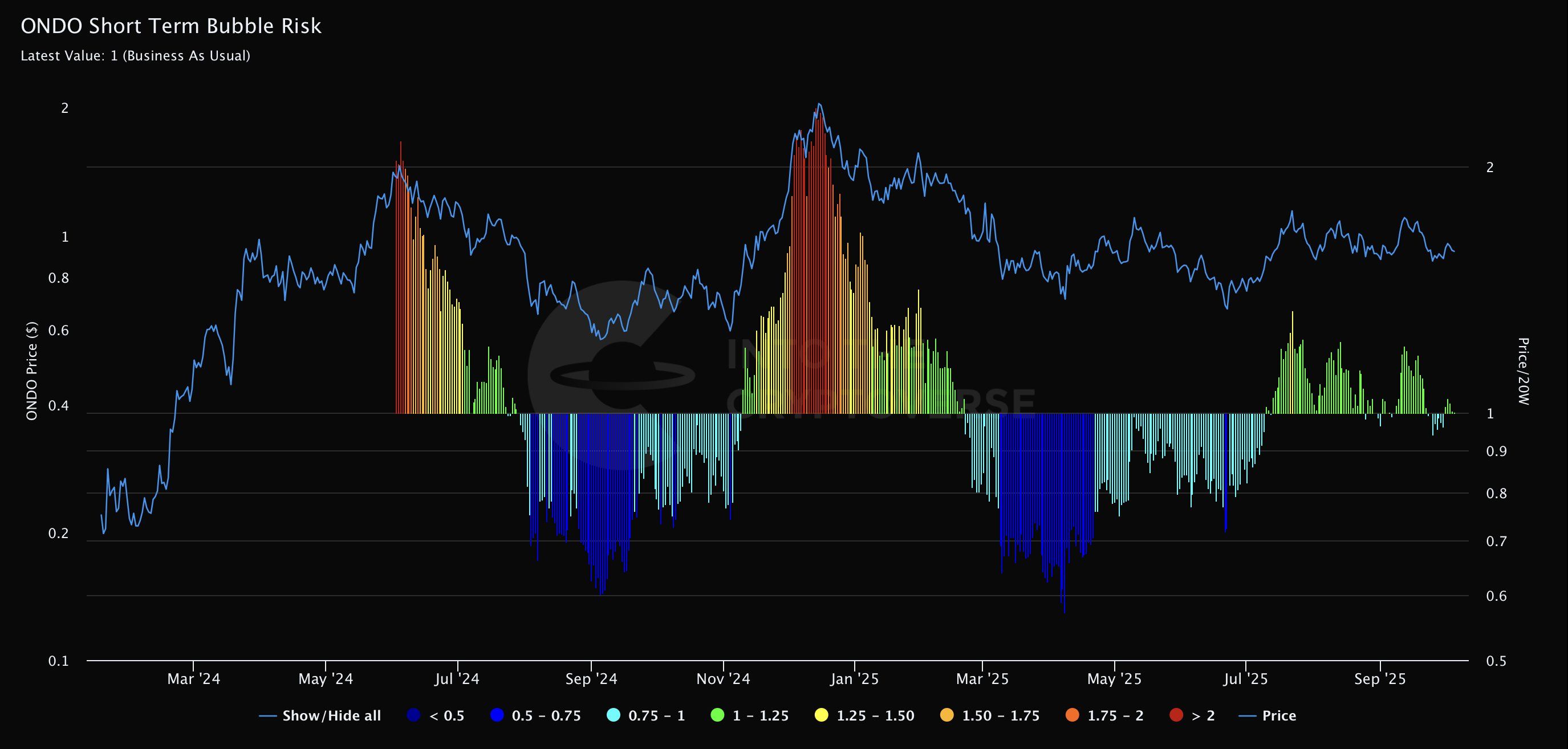

On-chain metrics further add context. The ONDO Short Term Bubble Risk (STBR) indicator, the ratio between price and the 20-week simple moving average (20W SMA), helps identify overextension levels.

An STBR value below 1 signals a bearish phase, while readings between 1.25 and 1.5 indicate growing momentum, and above 1.75 suggest high bubble risk. When the ratio exceeds 2.0, it implies that the asset is trading at twice its 20W SMA — a level historically followed by corrections.

Data shows that ONDO has already completed a full market cycle, from its bubble top to a capitulation phase, and has stabilized. As of late September 2025, the market appears balanced, but analysts warn of potential overheating if volume spikes further.

ONDO Short Term Bubble Risk (STBR). Source:

Into The Cryptoverse

ONDO Short Term Bubble Risk (STBR). Source:

Into The Cryptoverse

From a fundamental standpoint, the SEC licensing is the true catalyst — legitimizing Ondo’s tokenization model within the U.S. regulatory framework. This reduces compliance risks and opens the door for institutional capital, which has historically avoided non-regulated DeFi protocols.

However, for ONDO to achieve a sustainable breakout, three key conditions must align: successfully integrating Oasis Pro’s infrastructure, continued capital inflows into tokenized products, and stability among large holders (whales) to prevent sell pressure.

If these factors falter, the rally could remain short-lived before reverting to consolidation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$8.8 billion outflow countdown: MSTR is becoming the abandoned child of global index funds

The final result will be revealed on January 15, 2026, and the market has already started to vote with its feet.

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.

Aster CEO explains in detail the vision of Aster privacy L1 chain, reshaping the decentralized trading experience

Aster is set to launch a privacy-focused Layer 1 (L1) public chain, along with detailed plans for token empowerment, global market expansion, and liquidity strategies.