Solana Holders Are Unconvinced Of 20% Price Rise; Major Selling Begins

Solana rallied nearly 20% to $230, but profit-taking by long-term holders and slowing network growth threaten its bullish momentum.

Solana (SOL) has surged more than 19% in the past week, lifting its price to $230. The rally comes as the altcoin attempts to recover from recent losses.

Despite this strong push, holders appear unconvinced of its sustainability, with selling pressure rising as investors move to secure profits.

Solana Investors Are Bearish

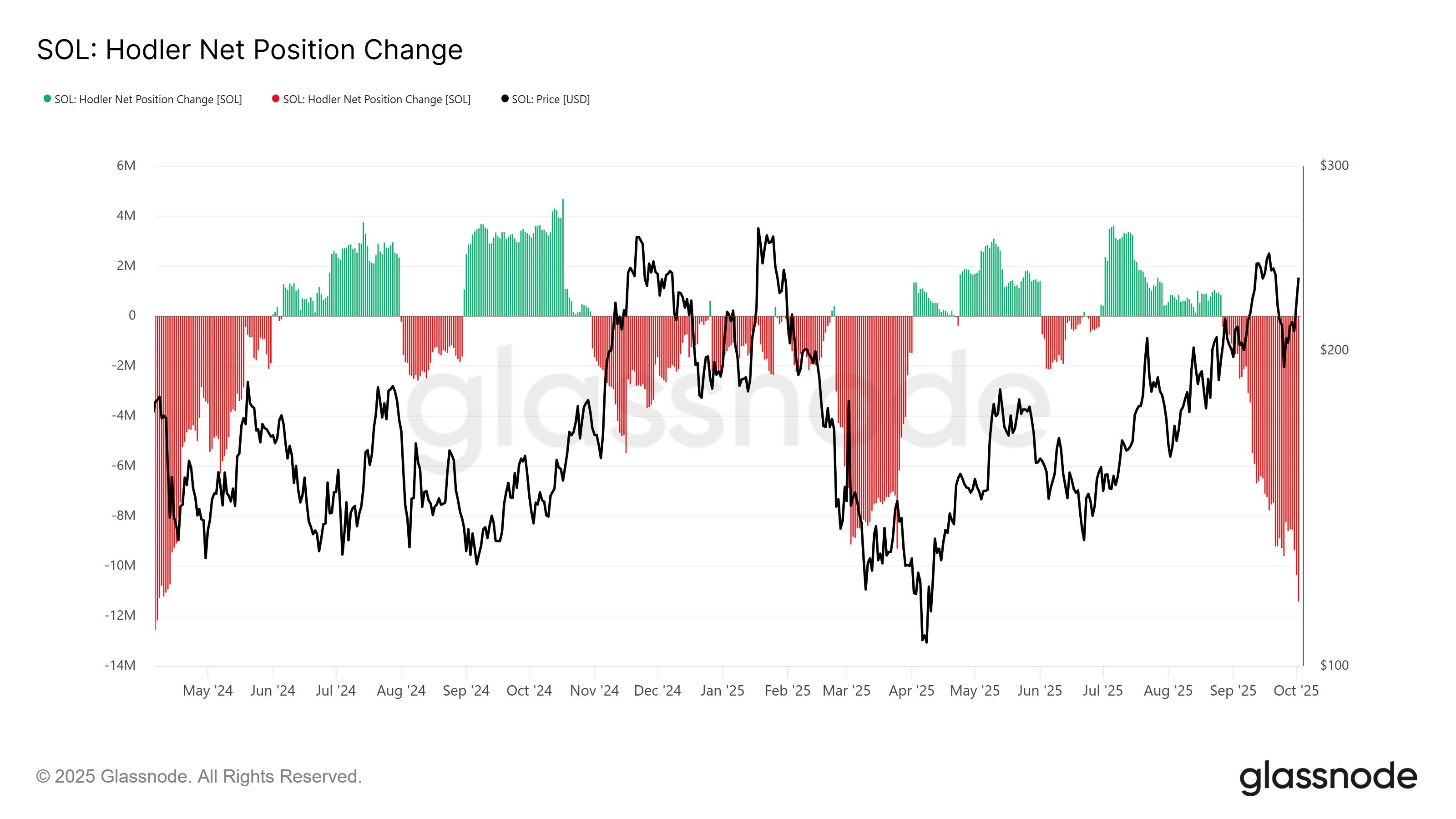

Data from the HODLer Net Position Change shows that long-term holders (LTHs) are heavily selling their SOL. Their activity is at a seven-month high, reflecting a sharp rise in profit booking. This trend indicates that many LTHs do not believe the rally will hold and are exiting while gains remain intact.

The mid-September dip seems to have spooked investors, leading to this lack of conviction. Such aggressive selling undermines confidence in Solana’s current rally. If profit-taking continues, it may place downward pressure on SOL’s price.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Solana HODLer Net Position Change. Source;

Glassnode

Solana HODLer Net Position Change. Source;

Glassnode

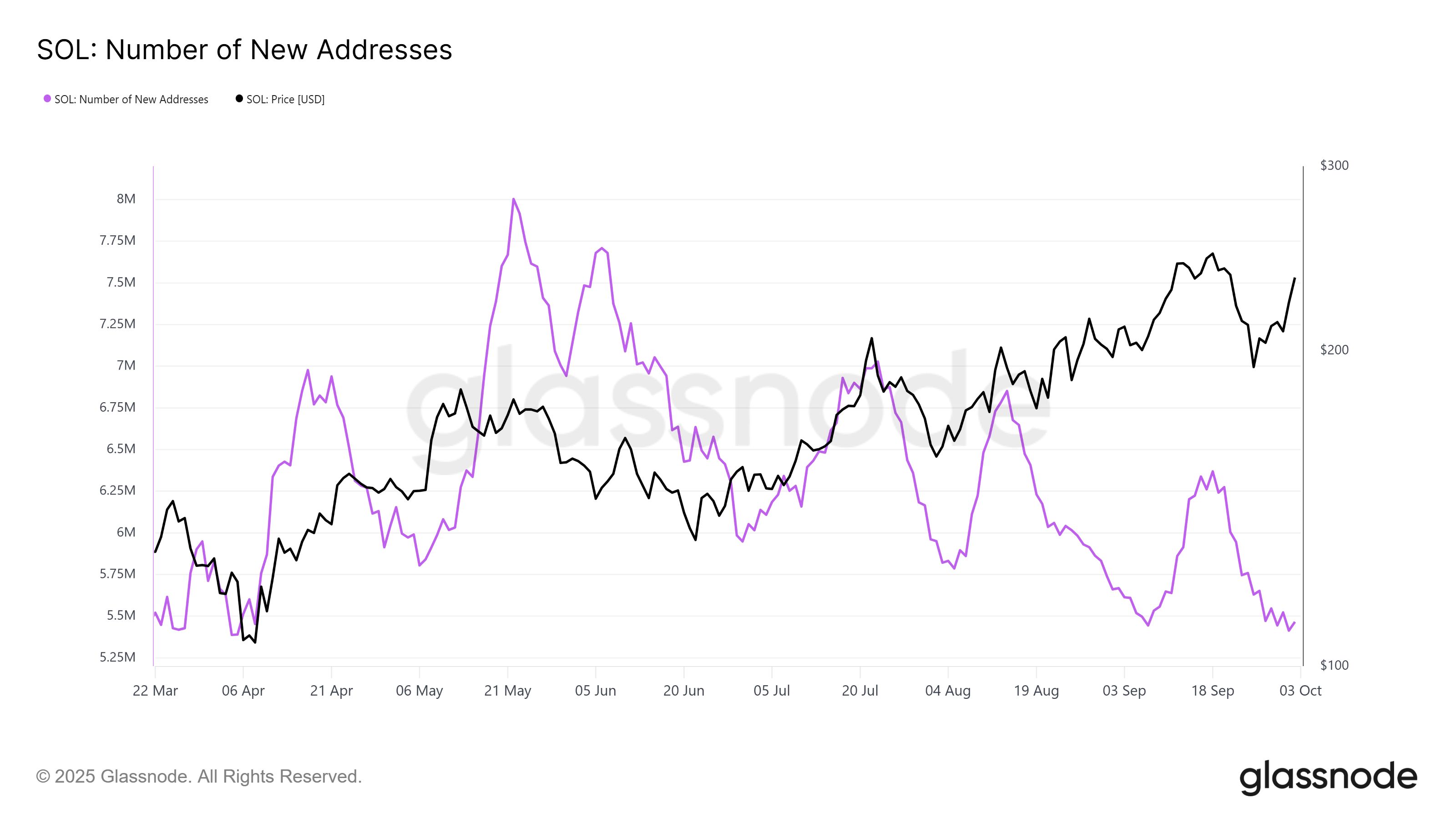

Beyond selling activity, network growth is showing weakness. The number of new addresses on the Solana blockchain has fallen to a six-month low. This decline signals that fewer new participants are entering the market, suggesting limited incentives for fresh investment in the asset.

Lack of new capital inflows is a concern for Solana’s long-term growth. Without new buyers, sustaining rallies becomes increasingly difficult. The drop in adoption metrics reflects waning traction.

Solana New Addresses. Source;

Glassnode

Solana New Addresses. Source;

Glassnode

SOL Price Is Rallying

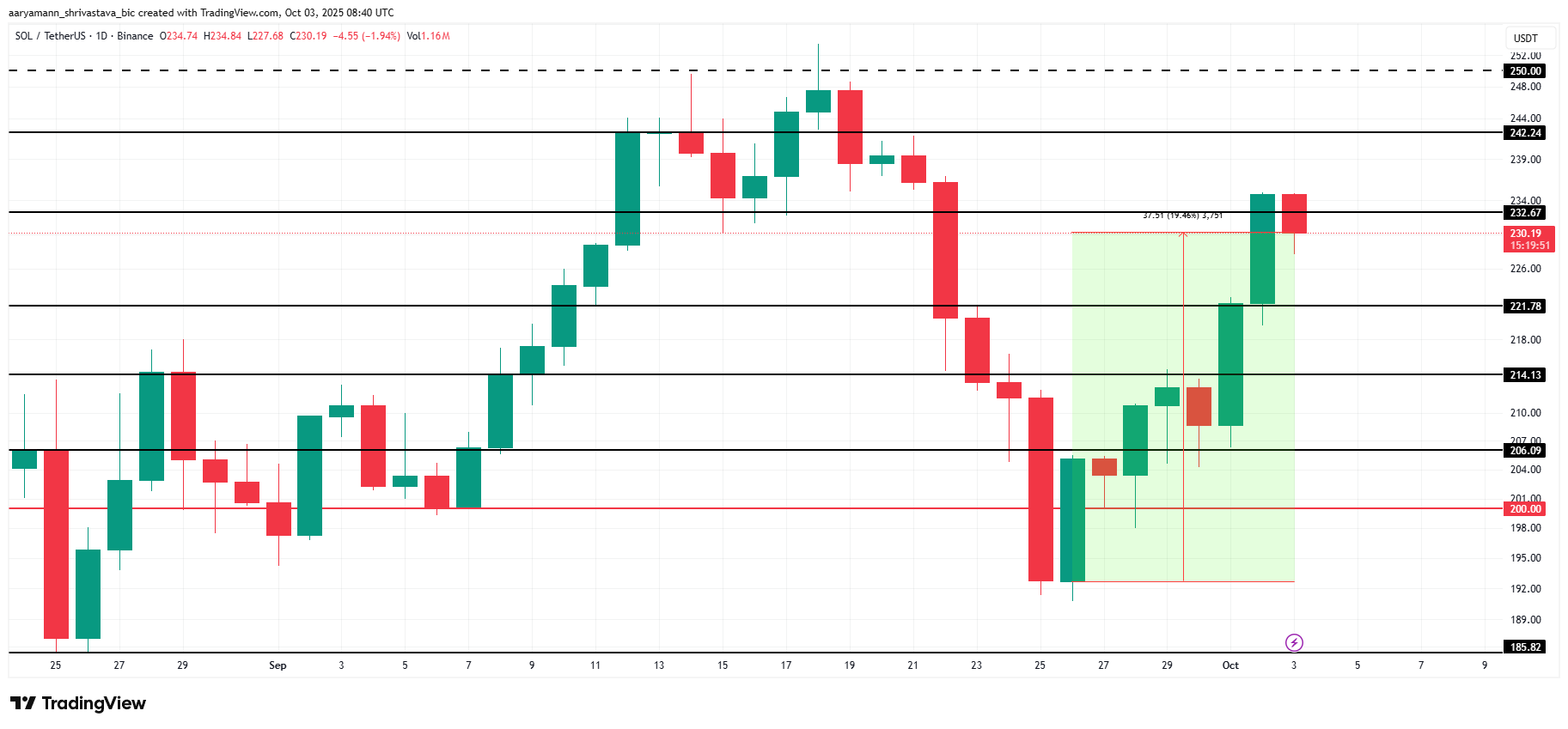

At the time of writing, Solana is trading at $230, just under the key $232 resistance. The 19% weekly rise has brought attention back to the altcoin. However, overcoming this resistance is critical for the rally’s continuation.

If Solana flips $232 into a support floor, the token could push higher. Securing this level would open the path toward $242 in the coming days. This would reinforce bullish momentum and signal investor confidence in a stronger uptrend.

Solana Price Analysis. Source:

TradingView

Solana Price Analysis. Source:

TradingView

If bearish signals take hold, however, Solana risks slipping back to $221 or even $214. A fall to these levels would invalidate the bullish thesis and wipe out a chunk of the recent gains.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Castle Island Ventures partner: I don’t regret spending eight years in the cryptocurrency industry

A cryptocurrency practitioner who once held libertarian ideals became disillusioned after reflecting on a career spent building "financial casinos," sparking a profound reflection on the divergence between the original aspirations and the current reality of the crypto space.

Powell: Employment is weakening, inflation remains high, and no one is talking about rate hikes now

Powell pointed out that the U.S. labor market is cooling, with hiring and layoffs slowing down and the unemployment rate rising to 4.4%. Core PCE inflation remains above the 2% target, but service inflation is slowing. The Federal Reserve has cut interest rates by 25 basis points and started purchasing short-term Treasury bonds, emphasizing that the policy path needs to balance risks between employment and inflation. Future policies will be adjusted based on data. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its generated content are still in the process of iterative improvement.

$RAVE TGE Countdown: When Clubbing Becomes an On-Chain Economic Activity, the True Web3 Breakthrough Moment Arrives

RaveDAO is rapidly growing into an open cultural ecosystem driven by entertainment, becoming a key infrastructure for Web3 to achieve real-world adoption and mainstream breakthrough.

A "hawkish rate cut" that's not so "hawkish," and balance sheet expansion that's "not QE"

The Federal Reserve has cut interest rates by another 25 basis points as expected, still projecting one rate cut next year, and has launched an RMP to purchase $40 billion in short-term bonds.