Why Ripple’s RLUSD Growth Highlights Ethereum, Not XRPL, as the Real Winner

Ripple’s RLUSD stablecoin hit $789M in market cap, but 88% lives on Ethereum. The growth raises doubts about XRPL’s role and XRP utility.

Ripple’s RLUSD surged to a market capitalization of nearly $789 million, cementing itself as one of the fastest-growing assets in 2025. Launched in late 2024 to power cross-border payments, tokenization, and DeFi applications, the US dollar stablecoin has attracted major institutional players like DBS and Franklin Templeton.

Yet beneath the headline growth lies the overlooked reality that most of RLUSD’s supply lives on Ethereum, not the XRP Ledger (XRPL).

Ethereum Dominates RLUSD Supply

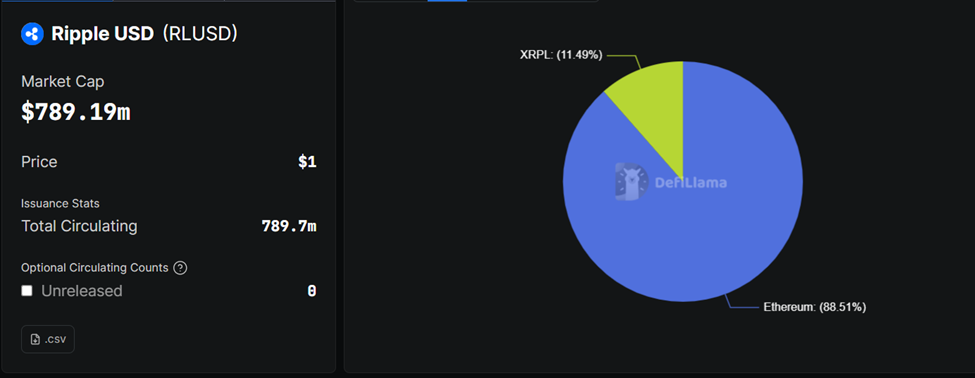

According to DefiLlama, more than $700 million of RLUSD or about 88% of its total supply, sits on Ethereum. Meanwhile, less than $90 million circulates on XRPL, Ripple’s native blockchain.

Ripple’s RLUSD on Ethereum vs. XRPL. Source:

DefiLlama

Ripple’s RLUSD on Ethereum vs. XRPL. Source:

DefiLlama

Despite Ripple’s framing of XRPL as the core infrastructure for RLUSD, new issuances since early 2025 have almost exclusively launched on Ethereum.

This shift has sparked unease among XRP holders who long believed that stablecoin adoption would directly translate into higher demand for XRP.

Since every transaction on XRPL requires fees in XRP, investors expected RLUSD growth to drive burns and enhance token utility. Instead, the bulk of activity bypasses XRPL altogether.

RLUSD adoption, such as by renewable energy firm VivoPower, may only have a limited effect on XRP. Why? XRP plays no role in RLUSD transactions on Ethereum.

“Although Ripple issues RLUSD on both the XRP Ledger (XRPL) and Ethereum, the majority of its supply has been minted on Ethereum,” wrote a popular account on X (Twitter).

Chainlink community liaison Zach Rynes echoed the sentiment, indicating that XRP’s burn rate from RLUSD transactions is minuscule compared to total supply.

“RLUSD largely displaces the need for XRP for cross-border transactions. Over 80% of RLUSD is on Ethereum. Ethereum doesn’t use XRP. XRP holders don’t receive revenue from RLUSD,” wrote Rynes.

Ripple’s Strategic Dilemma Amid RLUSD’s Limited Impact on XRP

Ripple has pitched RLUSD as a bridge between traditional and decentralized finance (TradFi and DeFi), with use cases expanding into tokenized money market funds and repo trades.

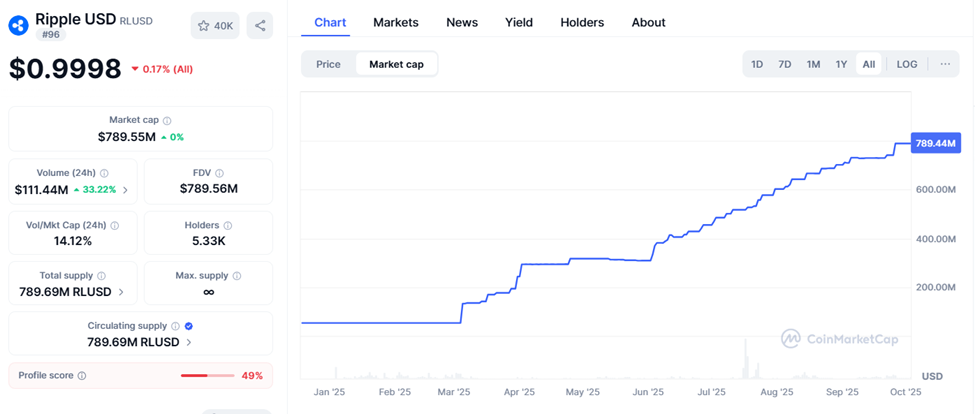

Its partnerships with DBS, Franklin Templeton, SBI Holdings, and African fintechs have boosted adoption, pushing the stablecoin’s market cap up tenfold in 2025 to $789.44 million as of this writing.

Ripple’s RLUSD Market Cap. Source:

CoinMarketCap

Ripple’s RLUSD Market Cap. Source:

CoinMarketCap

However, RLUSD’s Ethereum-heavy footprint challenges Ripple’s narrative that XRPL remains the backbone of its ecosystem.

“A long-time XRP holder discovered that RLUSD lives on Ethereum. He was in awe and wondered what the point of Ripple was. He later swapped his XRP for LINK and ETH,” wrote user jfab.eth.

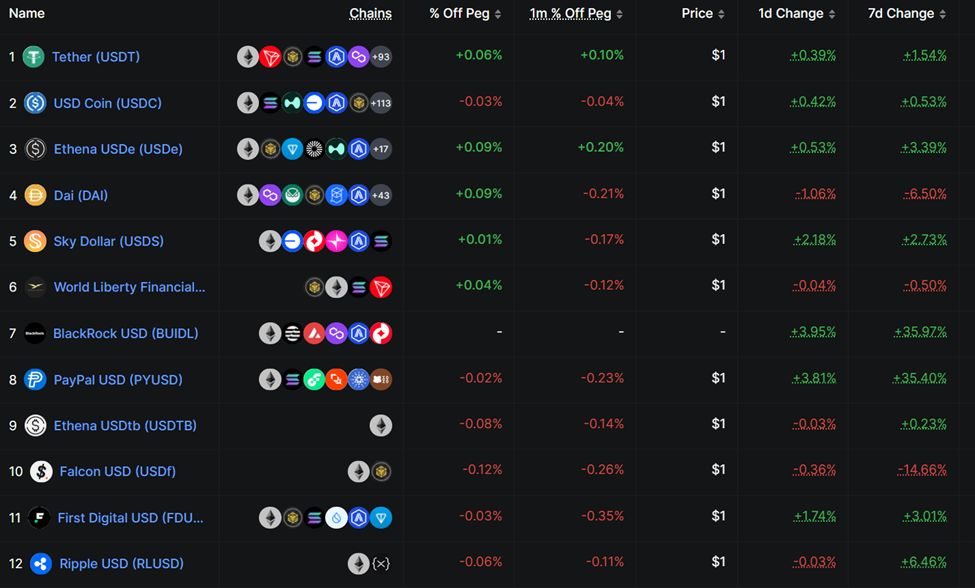

Ripple also faces stiff competition. Despite its rise, RLUSD still trails rivals like PayPal’s PYUSD, BlackRock’s BUIDL, and the WLF stablecoin in market capitalization.

Stablecoin chains. Source:

DefiLlama

Stablecoin chains. Source:

DefiLlama

While Ethereum integration unlocks DeFi liquidity, it also means Ripple’s flagship product grows in ways that do not directly support XRP holders.

For a community that has long anticipated XRP utility gains from Ripple’s innovations, the revelation that 88% of RLUSD is on Ethereum sparks equal parts disillusionment and debate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Timeless Investment Strategies: Why Insights from 1927 Continue to Shape Today’s Investors

- McNeel's 1927 "Beating the Market" prefigured Buffett's value investing and modern behavioral finance principles. - He advocated emotional discipline and long-term faith in U.S. economic resilience, echoed by Buffett's "margin of safety" strategy. - Modern behavioral finance (2020–2025) validates these insights, showing disciplined investors outperforming during crises like 2008 and 2020. - Algorithmic trading and meme stocks highlight the enduring relevance of McNeel's principles in countering speculati

ICP Network Expansion and Its Impact on Web3 Infrastructure Investments

- ICP Protocol's 2025 growth highlights its role as a hybrid cloud/Web3 infrastructure leader through cross-chain integration and enterprise partnerships. - Unverified 10M node claims contrast with 1.2M wallets, creating transparency concerns for investors assessing network legitimacy. - 22.5% TVL growth and 2,000 new developers signal institutional confidence, yet Q3 dApp usage fell 22.4%, exposing adoption gaps. - Regulatory risks and Web3's user experience challenges question ICP's long-term viability d

SOL Price Forecast and Solana's Market Strength in Late 2025: A Two-Factor Assessment

- Solana (SOL) faces pivotal 2025 juncture with Fed easing and blockchain upgrades driving price resilience. - Fed rate cuts and $421M institutional inflows via ETFs (e.g., REX-Osprey) boost crypto adoption amid low yields. - Firedancer/Alpenglow upgrades cut validator costs by 80%, enabling 100-150ms finality and $10.2B DeFi TVL growth. - $133 support level and bullish TD Sequential signals suggest $150-$165 target by year-end despite inflation risks.

The Federal Reserve's Change in Policy and Its Effects on Rapidly Growing Cryptocurrencies Such as Solana

- Fed's 2025 rate cut and QT halt injected $72.35B liquidity, briefly boosting crypto markets and Solana (+3.01%) amid easing monetary policy. - Prolonged US government shutdown and $19B October liquidation event exposed crypto's liquidity risks, despite Fed support for speculative assets. - Solana saw $3.65B trading volume but 6.1% price drop in November, with TVL falling 4.7% as regulatory pressures and macro volatility offset institutional inflows. - SIMD-0411 proposal aims to reduce Solana issuance by