YGG +193.75% 24H Due to Volatile Market Dynamics

- YGG surged 193.75% in 24 hours to $0.1572 on Aug 28, 2025, amid volatile market dynamics. - This followed a 561.34% 7-day drop, highlighting extreme short-term investor sentiment shifts. - A 660.13% monthly gain contrasts with a 6672.11% annual decline, underscoring unstable market conditions. - The rebound lacks clear fundamentals, raising doubts about sustainability amid broader bearish trends.

On AUG 28 2025, YGG rose by 193.75% within 24 hours to reach $0.1572, YGG dropped by 561.34% within 7 days, rose by 660.13% within 1 month, and dropped by 6672.11% within 1 year.

The sudden 24-hour surge of 193.75% indicates heightened market activity and potential short-term momentum. The price spike to $0.1572 is notable given the broader context of a 561.34% drop over the previous 7 days, highlighting a dramatic reversal in investor sentiment or a specific catalyst triggering buying interest. The movement suggests a strong short-term rebound, although it remains to be seen whether this momentum will be sustained or dissipate quickly amid broader bearish trends.

Over the past month, YGG has posted a 660.13% increase, a stark contrast to its annual performance of a 6672.11% decline. This divergence indicates a complex interplay of short-term factors influencing the asset, potentially driven by isolated events such as protocol updates, market manipulation, or liquidity injections. Despite the significant monthly increase, the asset remains significantly below its historical levels, suggesting that the broader bear market has yet to be reversed.

The price trajectory, while volatile, underscores the high risk associated with speculative assets in the current market environment. Investors are likely reacting to either on-chain developments or news that hasn't been explicitly detailed in the provided data. However, the absence of clear fundamentals or structural changes in the underlying asset makes it challenging to determine the sustainability of this rebound.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Brown-Forman's Trade War Hangover: A Historical Lens on the Jack Daniel's Decline

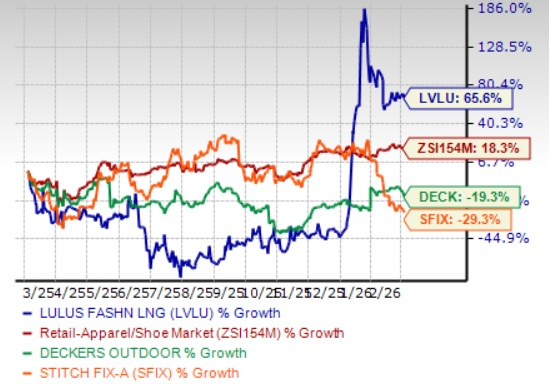

Lulus Stock Surges 66% Over the Past Year: Is Now the Time to Invest?

A $2 Billion Motive to Invest in Lumentum Shares Today

SHIB Surges +5% as Meme Coins Catch a Bid: What’s Next for Shiba Inu?