Key Market Insights for March 27th, how much did you miss?

1. Max Price Change: $ZETA, $ORCA, $ARC 2. Top News: QCP: Crypto Market Sentiment Remains Gloomy, Short-Term Upside Limited

Featured News

1.QCP: Crypto Market Sentiment Remains Gloomy, Limited Upside in the Short Term

2.Walrus (WAL) Opens at $0.385

3.Binance Wallet KiloEx TGE Now Open for Investment

4.Yescoin Founder: Currently, all 4 implicated team members have been released on bail

5.BlackRock Plans to Expand Its Digital Asset Team, Announces 4 New Senior Positions

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

HYPE: Today's discussion on Hyperliquid revolves around a significant event involving the delisting of the JELLY token following suspicious market activity. A trader's self-liquidation led to Hyperliquid's insurance pool taking significant short positions on JELLY, resulting in substantial unrealized losses. With major exchanges like Binance and OKX accused of market manipulation, the situation escalated further, leading Hyperliquid to settle at a favorable price. This event sparked debates on decentralization, risk management, and the competitive landscape between centralized and decentralized exchanges.

JELLY: Today's discussions about JELLYJELLY focused on Hyperliquid's delisting post-listing on Binance and OKX, causing a severe short squeeze. A trader's self-liquidation resulted in Hyperliquid holding significant short positions, potentially triggering a community-driven price surge that could liquidate Hyperliquid's treasury. This scenario drew parallels to the GameStop event, with speculation that Binance took strategic action against its competitors. This event highlighted the risks of low liquidity tokens and the necessity for robust risk control in decentralized exchanges.

BNKR: Today, the discussion about BNKR on Twitter has highlighted a significant increase in its visibility, thanks to its innovative integration with social platforms and AI agents like @bankrbot. The token's recent fee-sharing update, allowing users to earn profits through token deployment, has piqued people's interest. Furthermore, despite being in an adjustment phase, BNKR's stable market cap and price indicate its growth potential. The community is actively engaging with BNKR through various token deployment requests and discussing its role in the evolving DeFAI landscape.

PEPE: PEPE is the focus of today's discussion, with people particularly interested in its price recovery and further upside potential. The cryptocurrency's market activity has seen a significant uptick, with mentions of its performance on major exchanges like Binance and its leadership potential in the memecoin market. The discussion also highlights PEPE's role in the broader memecoin rebound, alongside other popular tokens like DOGE and SHIB. Additionally, people are keen on PEPE's trading strategies and its market impact, with some users expressing optimism about its future prospects.

Featured Articles

1. "$Ghibli 100x in Half a Day, New Feature of GPT-4o Sweeps the Internet with 'Miyazaki Style'"

From last night to this morning, a large number of meme images with styles highly similar to Studio Ghibli's film works suddenly emerged on social media platforms like X, such as the popular "super versatile" meme below, which remains highly popular on the Internet. Rendered in Miyazaki's "Ghibli style," it has gained a new charm and vitality.

2. "VCs Find a New Marketing Approach for 'VC Coins'"

Recently, the well-known blockchain venture capital firm HackVC announced the launch of a community investment group on Echo. As one of the first regulated major US crypto fund management companies to launch a "community round" on Echo, they hope to make HackVC a truly community-driven VC. As the Crypto market gradually loses trust in VCs, VCs seem to be seeking transformation, aiming to be more closely aligned with the market.

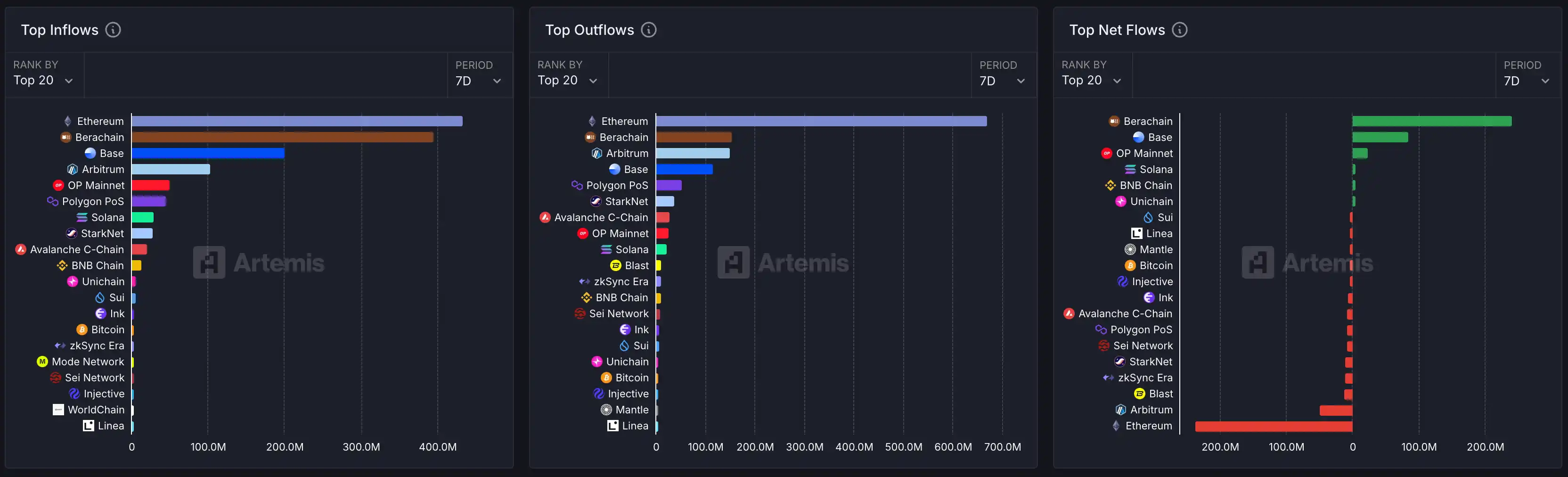

On-chain Data

On-chain Fund Flow in the Past 7 Days

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From yen rate hikes to mining farms shutting down, why is bitcoin still falling?

The recent decline in bitcoin prices is primarily driven by expectations of a rate hike by the Bank of Japan, uncertainty regarding the US Federal Reserve's rate cut trajectory, and systemic de-risking by market participants. Japan's potential rate hike may trigger the unwinding of global arbitrage trades, leading to a sell-off in risk assets. At the same time, increased uncertainty over US rate cuts has intensified market volatility. In addition, selling by long-term holders, miners, and market makers has further amplified the price drop. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

The Economist: The Real Threat of Cryptocurrency to Traditional Banks

The crypto industry is replacing Wall Street's privileged status within the American right-wing camp.

Grayscale's Top 10 Crypto Predictions: Key Trends for 2026 You Can't Miss

The market is transitioning from an emotion-driven cycle of speculation to a phase of structural differentiation driven by regulatory channels, long-term capital, and fundamental-based pricing.

From Yen Interest Rate Hike to Mining Farm Shutdown, Why Is Bitcoin Still Falling

The market is down again, but this may not be a good buying opportunity this time.