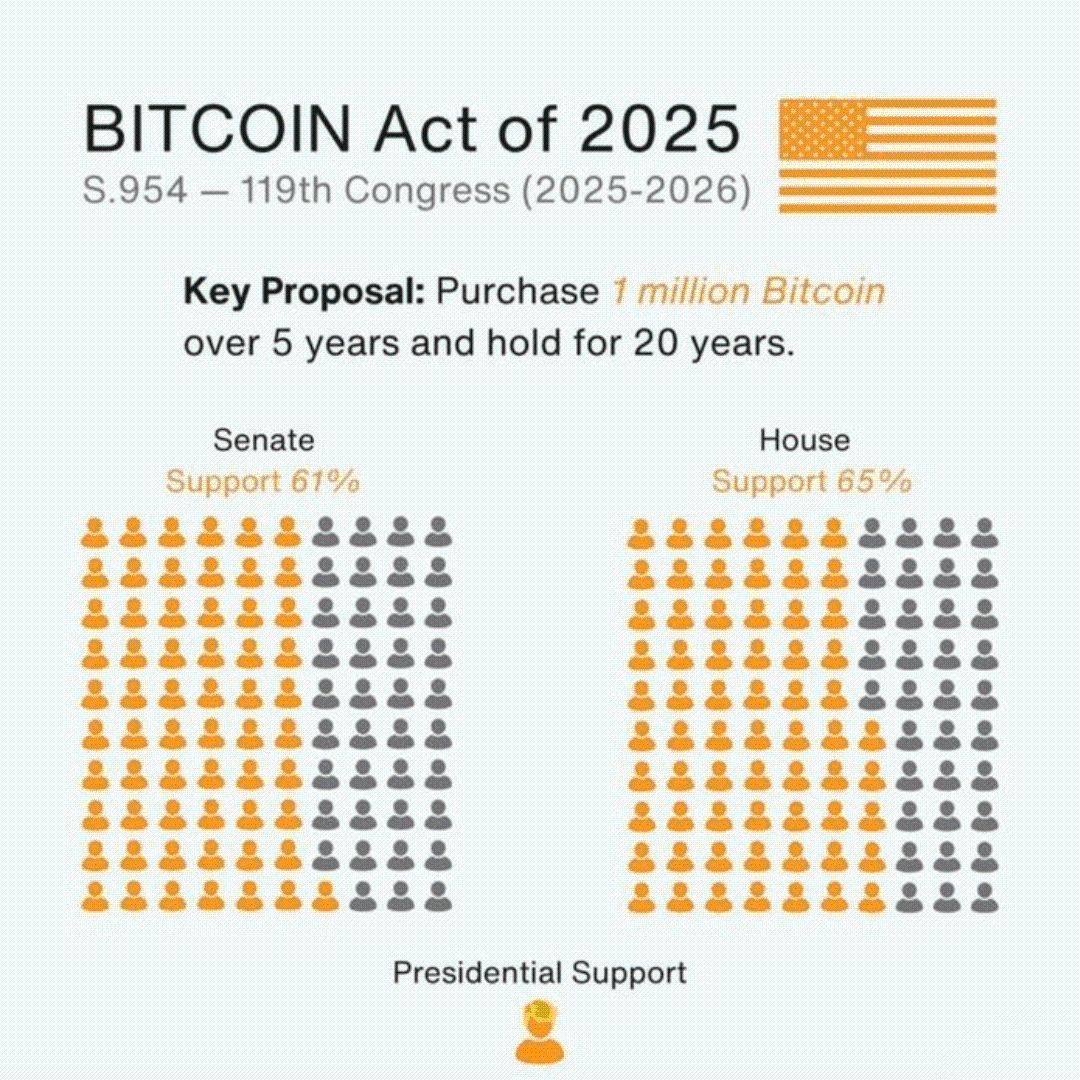

U.S. BITCOIN Act of 2025: Strategic Bitcoin Reserve Gains Majority Support in Congress

U.S. Moves Toward Bitcoin Accumulation

The United States is on the verge of making a groundbreaking shift in digital asset policy. The BITCOIN Act of 2025 (S.954), introduced in the 119th Congress (2025–2026), proposes the establishment of a Strategic Bitcoin Reserve —a first-of-its-kind national strategy for accumulating Bitcoin . With strong bipartisan support and momentum building, this act could reshape the role of Bitcoin in national economic and geopolitical strategy .

Political Landscape: Majority Support Secured

According to recent data from Stand With Crypto, the bill has gained substantial traction:

✅ 61% of U.S. Senators (61 out of 100) support the legislation.

✅ 65% of the House of Representatives (285 out of 435) are in favor.

✅ The President has officially expressed support, further solidifying the bill’s viability.

With this level of cross-party consensus, the BITCOIN Act of 2025 is one of the most widely supported crypto initiatives in U.S. history.

What the BITCOIN Act Proposes

At the core of the bill is a Key Proposal:

The U.S. government will purchase 1 million Bitcoin over five years and hold it for 20 years.

This initiative would establish a Strategic Bitcoin Reserve, mirroring the logic behind the U.S. Strategic Petroleum Reserve but applied to digital assets. The aim is to position Bitcoin as a long-term store of value and national economic hedge, especially in the face of rising global inflation and fiat currency devaluation.

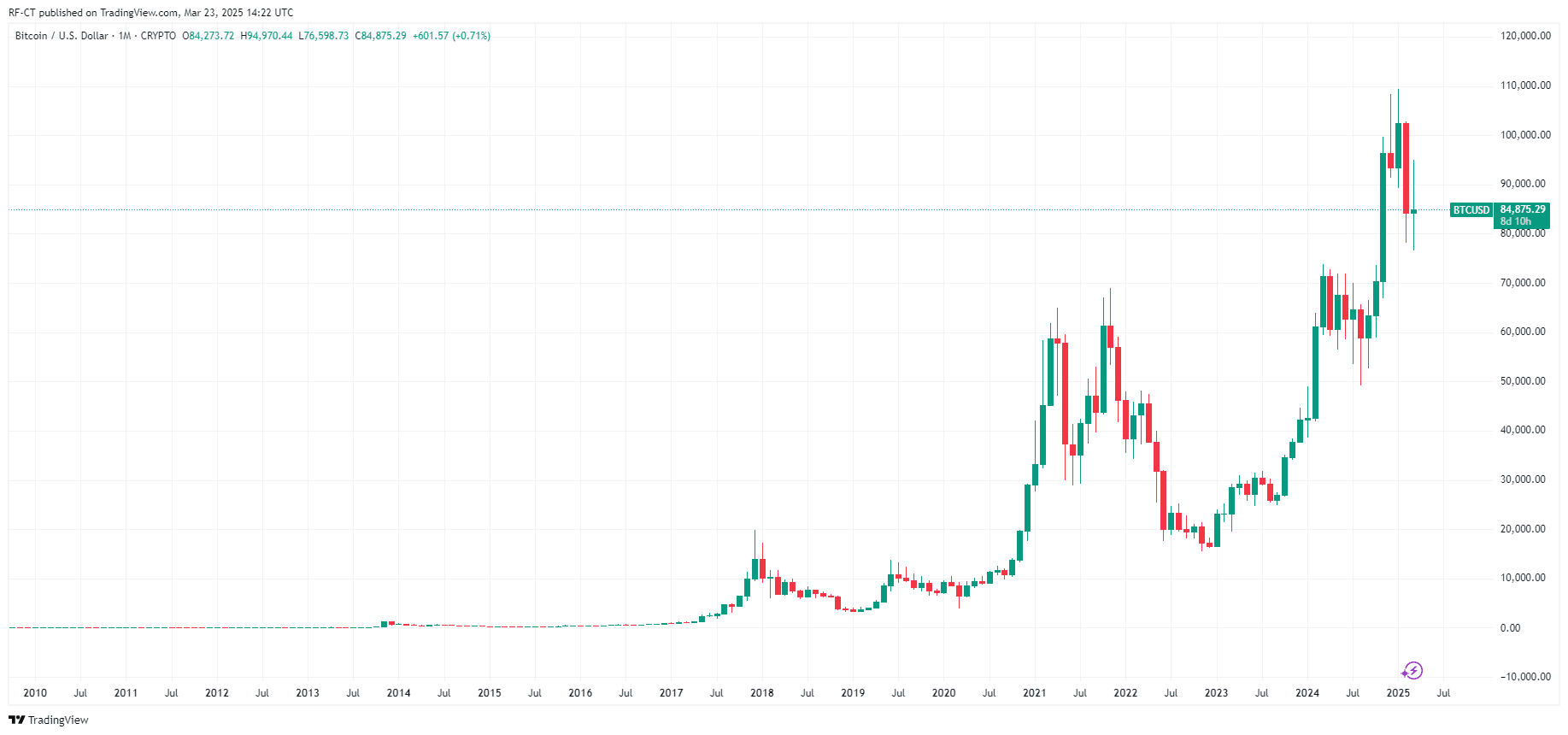

Why This Matters: A Historic Accumulation Event

If enacted, this bill could lead to one of the largest Bitcoin accumulation events in history, possibly triggering a domino effect among other nations . The idea of nation-state accumulation is central to what's known as Bitcoin game theory —once one major country starts stockpiling BTC, others are incentivized to follow to avoid being left behind.

This could:

- Increase Bitcoin’s scarcity dramatically.

- Drive institutional and global investor demand .

- Propel Bitcoin into new all-time highs.

- Redefine Bitcoin's role from digital gold to digital national reserve.

By TradingView - BTCUSD_2025-03-23 (All)

By TradingView - BTCUSD_2025-03-23 (All)

Strategic Implications: Geopolitics Meets Crypto

With the U.S. leading the charge, this move could pressure other global economies to react swiftly. The formation of a Strategic Bitcoin Reserve would make Bitcoin a geopolitical asset , not just a speculative investment.

Countries that are slow to adapt could face strategic disadvantages in wealth preservation, monetary policy, and economic independence. Meanwhile, nations that follow suit may benefit from early-stage accumulation and increased global influence.

Is This the Start of a New Financial Era?

The BITCOIN Act of 2025 is more than a bill—it's a declaration. A declaration that Bitcoin is no longer just a fringe asset but a strategic reserve capable of shaping the future of finance and geopolitics. As bipartisan support builds and the proposal inches closer to becoming law, investors and institutions are watching closely.

Are you ready for what comes next in the Bitcoin revolution ?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Powell: Employment is weakening, inflation remains high, and no one is talking about rate hikes now

Powell pointed out that the U.S. labor market is cooling, with hiring and layoffs slowing down and the unemployment rate rising to 4.4%. Core PCE inflation remains above the 2% target, but service inflation is slowing. The Federal Reserve has cut interest rates by 25 basis points and started purchasing short-term Treasury bonds, emphasizing that the policy path needs to balance risks between employment and inflation. Future policies will be adjusted based on data. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its generated content are still in the process of iterative improvement.

$RAVE TGE Countdown: When Clubbing Becomes an On-Chain Economic Activity, the True Web3 Breakthrough Moment Arrives

RaveDAO is rapidly growing into an open cultural ecosystem driven by entertainment, becoming a key infrastructure for Web3 to achieve real-world adoption and mainstream breakthrough.

A "hawkish rate cut" that's not so "hawkish," and balance sheet expansion that's "not QE"

The Federal Reserve has cut interest rates by another 25 basis points as expected, still projecting one rate cut next year, and has launched an RMP to purchase $40 billion in short-term bonds.