Solana DEX Volume Hits Year-To-Date Low, SOL Under Pressure

Solana’s DEX activity has collapsed, putting SOL under heavy selling pressure. Can it hold key support, or is a further drop imminent?

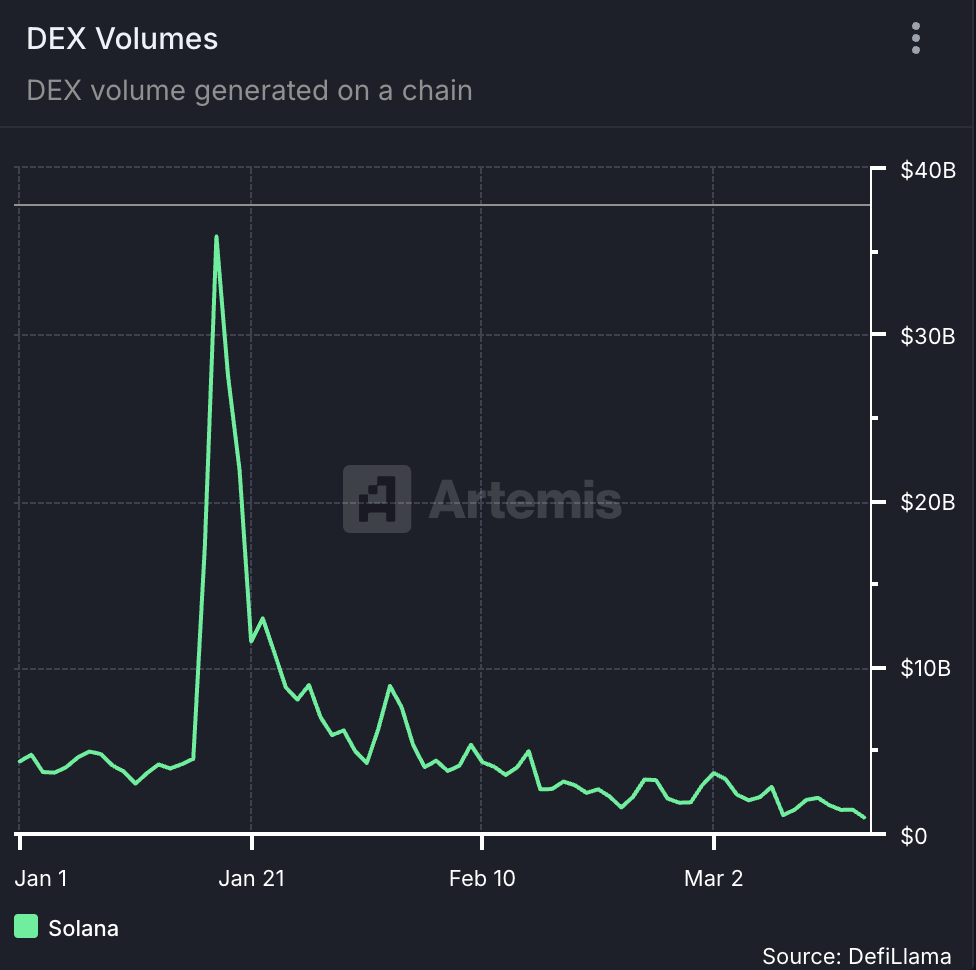

The trading volume across decentralized exchanges (DEXes) on the Solana blockchain has plunged to its lowest level since the beginning of the year.

This reflects a decline in network activity and weakening demand for its native token, SOL, whose value has plummeted over 30% in the past month.

Solana Faces Liquidity Crisis as DEX Volume Hits Yearly Low

According to on-chain data from Artemis, Solana’s total DEX trading volume sank to a new year-to-date (YTD) low yesterday, extending a downtrend that began on January 10.

Solana DEX Volume. Source:

Artemis

Solana DEX Volume. Source:

Artemis

That day, the network’s DEX activity surged to a yearly peak of $36 billion. However, the subsequent decline in Solana’s user demand has led to a drop in trading volumes across its DEXes.

By Sunday, the network’s daily DEX volume had fallen to just $988 million, a 97% drop from its peak. The dip in daily DEX activity on Solana suggests waning interest from traders and liquidity providers.

It has also coincided with a broader bearish sentiment surrounding SOL, which has put significant downward pressure on its price.

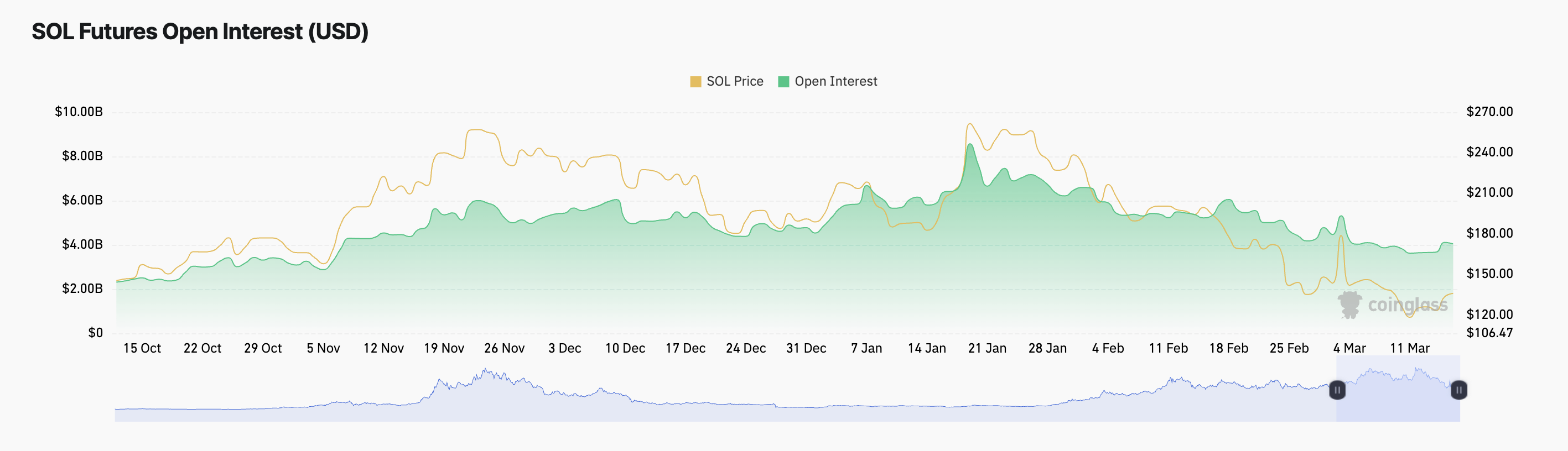

As of this writing, the altcoin trades at $133.20, noting a 33% decrease in the past month amid falling demand. Its falling open interest in the futures market highlights the weakening buying pressure. It currently stands at $4.04 billion, dropping 24% in the past month.

SOL Open Interest. Source:

Coinglass

SOL Open Interest. Source:

Coinglass

Open interest refers to the total number of outstanding derivative contracts, such as futures or options, that have not yet been settled. When it declines like this, traders are closing their positions without opening new ones.

This trend signals a weak market conviction around SOL and hints at the possibility of an extended decline period.

SOL Price Teeters Above Critical Support—Is a Drop to $108 Coming?

At press time, SOL trades at $134.67, resting above the support formed at $120.72. If bearish pressure climbs, the coin’s price could fall below this level. In this case, additional selling pressure could be triggered, causing SOL’s price to drop to $108.23.

SOL Price Analysis. Source:

TradingView

SOL Price Analysis. Source:

TradingView

On the other hand, a resurgence in SOL demand could prompt a rally toward $136.62. A successful breach of this level could push the coin’s price to $182.64.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

This Week's Preview: Macro "Flood Release" Week—Delayed CPI and the Bank of Japan's "Rate Hike Pursuit"

Key global market data will be released this week, including the U.S. non-farm payroll report, CPI inflation data, and the Bank of Japan's interest rate decision, all of which will significantly impact market liquidity. Bitcoin prices are fluctuating due to macroeconomic factors, while institutions such as Coinbase and HashKey are striving to break through via innovation and public listings. Summary generated by Mars AI This summary was generated by the Mars AI model. Its accuracy and completeness are still being iteratively improved.

Weekly Hot Picks: The Fed Cuts Rates and Indirectly "Injects Liquidity"! Silver Replaces Gold as the New Favorite?

The Federal Reserve is cutting interest rates and starting bond purchases, while Japan and other regions may turn to rate hikes. Silver repeatedly hits record highs, SpaceX is set for a 1.5 trillion IPO, and Oracle becomes the litmus test for the AI bubble. The Russia-Ukraine peace process is stuck on territorial issues, the US seizes a Venezuelan oil tanker... What exciting market events did you miss this week?

Key Highlights to Watch at Solana Breakpoint 2025

How does Solana seize market share in an increasingly competitive landscape?

Crucial Alert: ZRO Leads This Week’s $100M+ Token Unlocks – What Investors Must Know