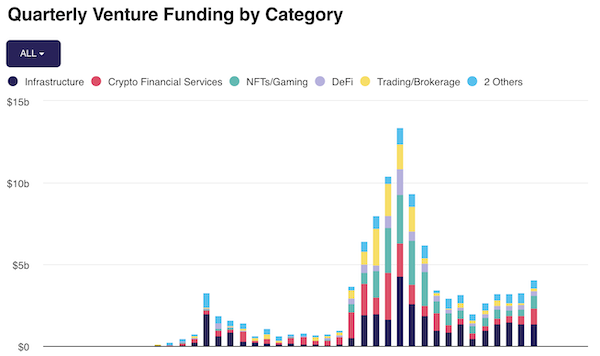

Crypto venture funding hits $4 billion in Q4 2024, led by infrastructure boom

Quick Take With 687 deals and infrastructure capturing the majority, Q4 marks the strongest quarter for crypto investment in two years. The following is an excerpt from The Block’s Data and Insights newsletter.

Venture funding in crypto reached $4 billion across 687 deals in the fourth quarter of 2024, marking the highest quarterly investment total since the fourth quarter of 2022.

Infrastructure investments led with $4 billion deployed, followed by financial services at $970 million. Web3 projects saw the highest number of deals at 141, followed by NFTs/Gaming at 132. Trading and brokerage investments declined from $320 million in the first quarter to $161 million in the fourth quarter.

Note: This chart is exclusive to The Block Pro subscribers

Deal distribution across sectors reveals shifting venture priorities:

- DeFi maintained steady interest with 125 deals.

- Infrastructure projects, despite fewer deals (111) than other categories, captured the lion's share of capital.

- Data and analytics remained selective, with only 10 deals, while enterprise solutions saw 18 deals.

A notable trend emerged with Echo.xyz, an angel syndicate platform by Cobie, which has been listed in at least nine investment rounds. The platform's success was highlighted by filling MegaETH's remarkable $10 million raise, completed in just three minutes.

Echo.xyz's model enables Key Opinion Leaders (KOLs) to create investment syndicates where followers can co-invest, potentially democratizing access to early-stage crypto investments.

The quarter's strong performance, particularly in infrastructure investments, suggests renewed confidence in the crypto sector as markets anticipate potential regulatory shifts under the incoming U.S. administration.

This is an excerpt from The Block's Data & Insights newsletter . Dig into the numbers making up the industry's most thought-provoking trends.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin due 2026 bottom as exchange volumes grind lower: Analysis

samczsun: The Key to Crypto Protocol Security Lies in Proactive Re-Auditing

Bug bounty programs are passive measures, while security protection requires proactive advancement.

Millennials with the most cryptocurrency holdings are reaching the peak of divorce, but the law is not yet prepared.

The biggest problem faced by most parties is that they have no idea their spouse holds cryptocurrency.

Using "zero fees" as a gimmick, is Lighter's actual cost 5–10 times higher?

What standard accounts receive from Lighter is not free trading, but rather slower transactions. This delay is turned into a source of profit by faster participants.