Using "zero fees" as a gimmick, is Lighter's actual cost 5–10 times higher?

What standard accounts receive from Lighter is not free trading, but rather slower transactions. This delay is turned into a source of profit by faster participants.

What Lighter standard accounts get is not free trading, but slower trading. This delay is turned into a source of profit by faster participants.

Written by: @PerpetualCow

Translated by: AididiaoJP, Foresight News

There is a truth in the marketplace: if a product is free, then you are the product.

Lighter DEX is promoting "zero fees" to retail traders. It sounds too good to be true, and in fact, it is.

But what Lighter doesn’t highlight in bold is the latency structure behind these "free" trades.

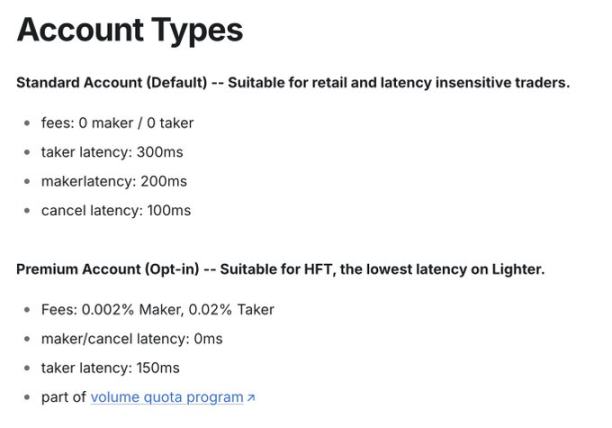

Lighter offers two types of accounts: once you understand how latency works, you’ll realize that 0% fees are actually the most expensive tier on the platform.

The 200–300 millisecond delay is their entire business model.

What does 300 milliseconds really mean?

The average human blink takes 100–150 milliseconds. In the time it takes you to blink twice, faster traders have already captured price fluctuations, adjusted their positions, and traded against you.

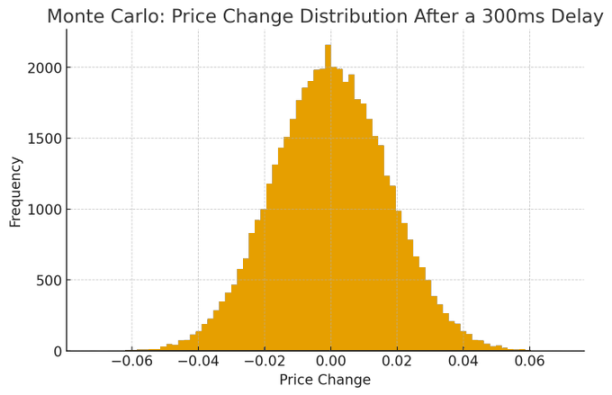

The crypto market is highly volatile. At typical volatility levels (annualized 50–80%), prices move about 0.5 to 1 basis point per second.

This means that in 300 milliseconds, random market fluctuations alone will cause prices to move an average of 0.15–0.30 basis points.

The real cost of "free"

If we quantify it:

Academic research on adverse selection costs (Glosten & Milgrom, Kyle's Lambda, etc.) shows that informed traders’ advantage is typically 2–5 times the magnitude of random price fluctuations.

If the random slippage in 300 milliseconds is about 0.2 basis points, then adverse selection adds another 0.4–1.0 basis points.

For active traders and market makers, the actual costs are roughly as follows:

- Standard account actual cost: 6–12 basis points per trade (0.06%–0.12%)

- Premium account actual cost: 0.2–2 basis points per trade (0.002%–0.02%)

The cost of a "free" account is 5–10 times higher than that of a paid account.

Zero fees are just a marketing number; the real cost is hidden in the latency.

Premium accounts are actually a better deal, no doubt

In any scenario, the standard account (0% fee) is not the better choice.

Whether you are a small retail trader, a whale, a scalper, a swing trader, or even a passive investor, it’s not. Especially not for market makers, and not for anyone.

"I’m just a small retail trader, I don’t need a premium setup."

Wrong.

Small retail traders can least afford slippage. If you trade with $1,000 and lose 10 basis points per trade, that’s $1 lost each time. After 50 trades, 5% of your account is gone without a trace.

"I don’t trade often, so latency doesn’t affect me."

Also wrong.

If you don’t trade often, the cost of a premium account is negligible anyway.

But even in just a few trades, you’ll still get worse execution prices. Since the cost to avoid this loss is almost zero, why accept any disadvantage at all?

Just upgrade to a premium account.

This model has precedent

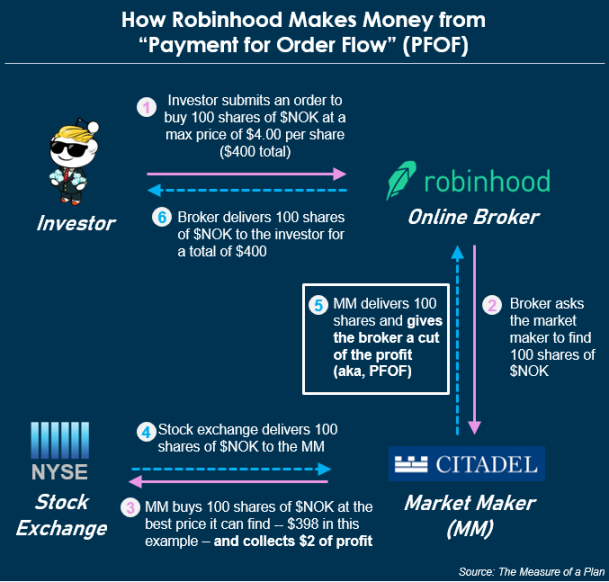

The traditional financial markets have long seen this tactic, known as payment for order flow.

@RobinhoodApp once attracted retail traders with "free trading," then routed orders to market makers who profited by trading against uninformed retail orders, popularizing this model.

Lighter’s model is structurally similar. What standard accounts get is not free trading, but slower trading. This delay is turned into profit by faster participants.

Exchanges don’t need to charge you fees, because you’re actually paying with execution quality.

What Lighter gets right and wrong

Lighter does not hide the latency data—it’s written in the documentation, after all.

But transparency is not the same as clarity.

Highlighting "0% fees" in the headline but hiding "300ms latency" in the fine print is a strategy aimed at conversion rates, not user understanding.

Most retail traders don’t understand what latency means, nor do they know what adverse selection is, so they can’t calculate the equivalent actual cost.

And Lighter knows this.

Premium accounts are a better deal than "zero-fee" standard accounts in every way, and that’s not up for debate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A decade-long tug-of-war ends: "Crypto Market Structure Bill" sprints to the Senate

At the Blockchain Association Policy Summit, U.S. Senators Gillibrand and Lummis stated that the "Crypto Market Structure Bill" is expected to have its draft released by the end of this week, with revisions and hearings scheduled for next week. The bill aims to establish clear boundaries for digital assets by adopting a classification-based regulatory framework, clearly distinguishing between digital commodities and digital securities, and providing a pathway for exemptions for mature blockchains to ensure that regulation does not stifle technological progress. The bill also requires digital commodity trading platforms to register with the CFTC and establishes a joint advisory committee to prevent regulatory gaps or overlapping oversight. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, is still being iteratively updated.

Gold surpasses the $4,310 mark—Is the "bull frenzy" returning?

Boosted by expectations of further easing from the Federal Reserve, gold has risen for four consecutive days. Technical indicators show strong bullish signals, but there remains one more hurdle before reaching a new all-time high.

Trend Research: Why Are We Still Bullish on ETH?

Against the backdrop of relatively accommodative expectations in both China and the US, which suppress asset downside volatility, and with extreme fear and capital sentiment not yet fully recovered, ETH remains in a favorable "buy zone."