Bitcoin ( BTC ) briefly snapped higher before the Sept. 6 Wall Street open as United States employment data failed to meet expectations.

Bitcoin price dips to new 1-month low after $57K US jobs data 'fakeout'

Bitcoin fools traders up and down as BTC price volatility accompanies the week's final US employment data release.

Bitcoin dips below $55,000

Data from Cointelegraph Markets Pro and TradingView showed BTC price action targeting $57,000 before fully retracing after the US trading session began.

New one-month lows followed, these reaching $54,919 on Bitstamp.

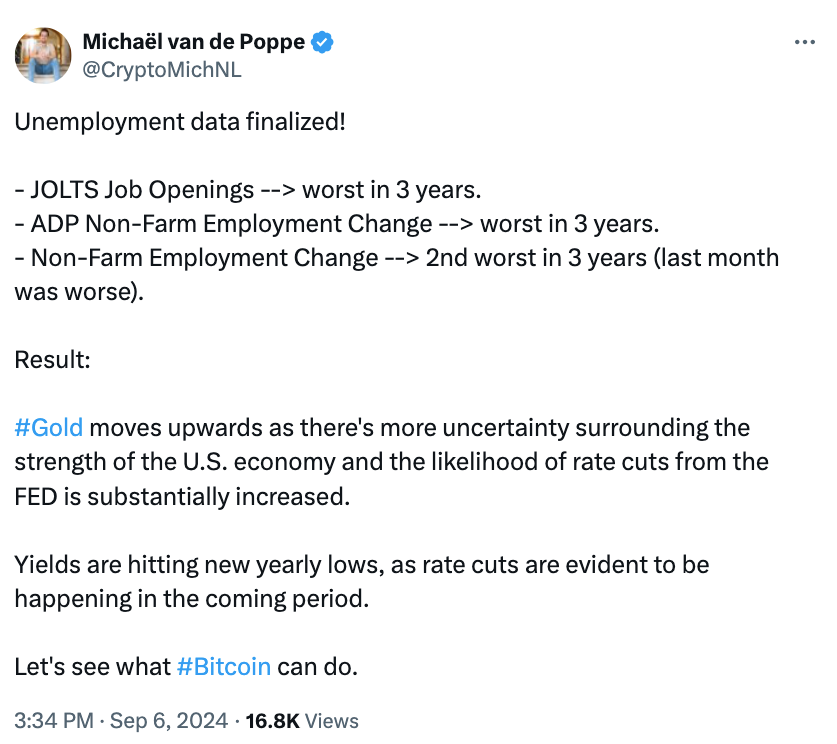

Nonfarm payrolls figures for August came in lower than forecast, adding to concerns over labor market strength.

At the same time, a senior Federal Reserve official argued that the time had come to reduce interest rates, with the decision to do so due on Sept. 18.

“The current restrictive stance of monetary policy has been effective in restoring balance to the economy and bringing inflation down,” New York Fed President John Williams said in a speech at the Council on Foreign Relations.

“With the economy now in equipoise and inflation on a path to 2 percent, it is now appropriate to dial down the degree of restrictiveness in the stance of policy by reducing the target range for the federal funds rate.”

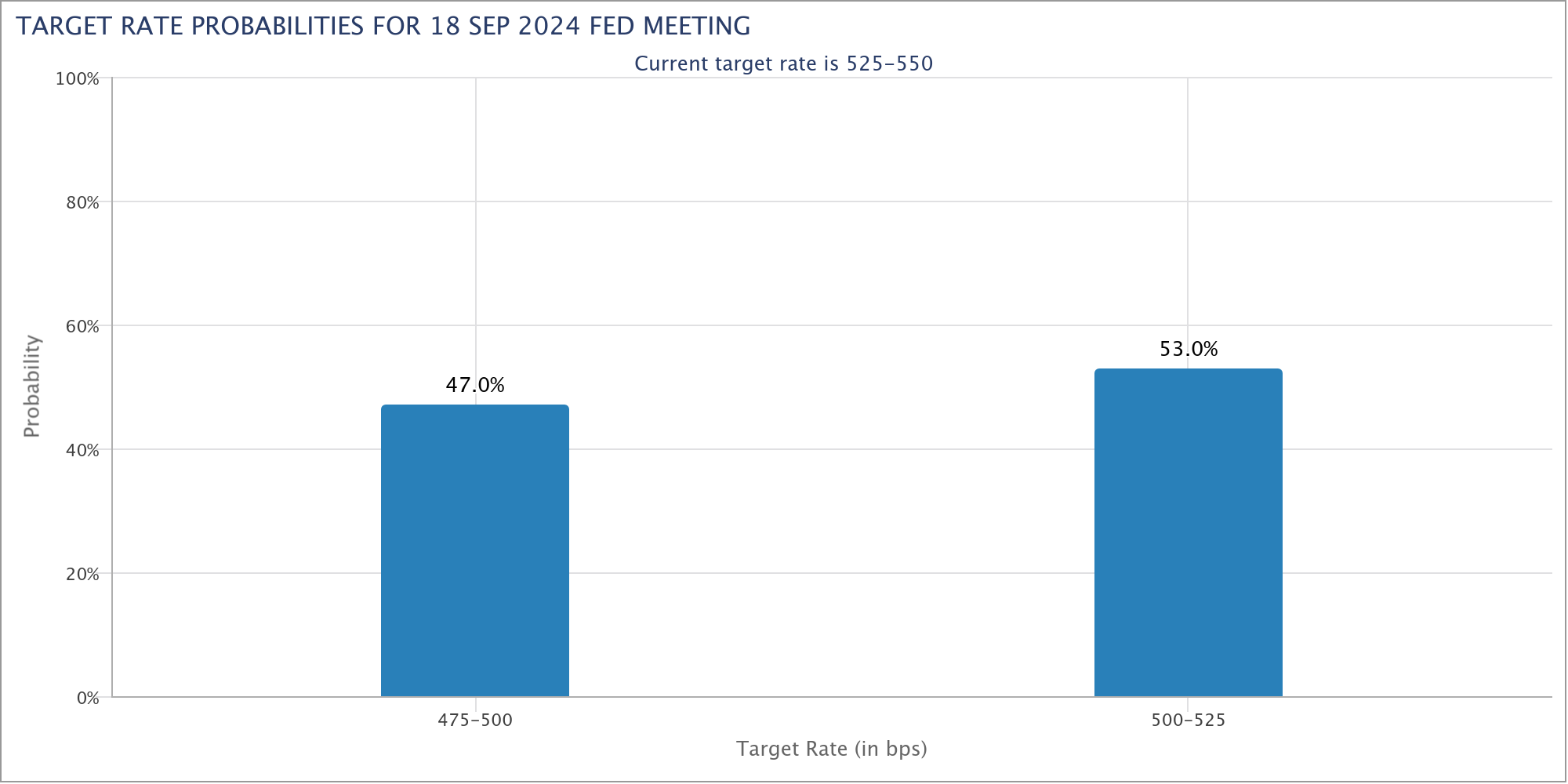

Estimates from CME Group’s FedWatch Tool after the data print showed market odds for a 25-basis-point and 50-basis-point rate cut becoming roughly equal — at 53% and 47%, respectively.

US dollar strength saw its own uptick at the open, jumping a full 0.3% as Bitcoin canceled out its macro data reaction.

Commenting on the broader picture, however, popular trader Daan Crypto Trades saw enduring long-term dollar weakness.

“$DXY Remains very weak and is sitting on the ~101 support level,” he told X followers about the US dollar index (DXY).

“I think it's a matter of time before this breaks lower to the 99.5 level and beyond. This should generally help risk assets.”

BTC price chart spells out bulls' dilemma

Focusing on short-term BTC price moves, meanwhile, trader and analyst Rekt Capital captured frustrating conditions for bulls.

Related: Arthur Hayes sees sub-$50K BTC price as Bitcoin risks 'stark' trend shift

“Bitcoin is forming a 4-hour downtrending channel, with a Bullish Divergence developing as well,” part of various X posts explained .

An accompanying chart showed relative strength index (RSI) values increasing against declining price on 4-hour timeframes.

A further post confirmed that price was continuing to reject off a diagonal trendline within the channel structure.

“That's why 4-hr candle bodies above resistance are so important to confirm the next trend,” he commented.

“Upside wicks into/above the diagonal precede rejections.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A World Beyond SWIFT (II): Moscow's Underground Ledger—Garantex, Cryptex, and the Shadow Settlement System

Three years after being cut off from SWIFT by the West, Russia is attempting a new financial trade channel.

Crypto tycoons spend eight-figure security fees annually, fearing encounters like BlueZhanfei's experience.

No one understands security better than crypto industry leaders.

With a valuation of $1 billion, why hasn’t Farcaster managed to become a “decentralized” Twitter?

Farcaster acknowledges the difficulty of scaling decentralized social networks and is abandoning its "social-first" strategy to focus on the wallet business.

If AI agents start hoarding Bitcoin, what will happen to this monetary system originally designed for ordinary people?

The underlying logic of Bitcoin assumes that users will eventually die, and the entire network is not yet prepared to accommodate holders who “never sell.”