Here’s Where Bitcoin (BTC) Might Be by Mid-2025

Bitcoin's recent surge to over $60,000 sets the stage for a potentially historic rally, with forecasts pointing to a target of $150,000 by mid-2025.

This forecast is based on analysis provided by analyst TradingShot, which uses a one-month time frame and examines the bullish Moving Average Convergence Divergence (MACD) cross, an indicator of bullish market momentum.

The analysis highlights Bitcoin’s recovery at around the 0.786 Fib retracement level of the 2021 all-time high—a significant support zone that often signals bullish reversals.

Historical data shows that MACD bullish crosses, where the MACD line exceeds the signal line, have preceded major rallies in the past, including patterns seen in November 2019 and December 2015.

Additionally, the “Channel Up” pattern, reflecting a series of higher highs and lows since 2014, supports a potential top between $200,000 and $300,000.

READ MORE:

Analyst Predicts Altcoins May Challenge Bitcoin’s DominanceA more conservative estimate, however, suggests that Bitcoin could reach $150,000 by mid-2025. Key levels to watch include the $24,000 support zone and the $100,000 resistance zone, which could guide BTC’s path toward the $150,000 target.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Does DeFi's security dilemma have to compromise with "unlimited authorization" and "trusted third parties"?

The security challenges faced by DeFi have never been unsolvable problems.

TRON Industry Weekly: "Increased Probability of a December Rate Cut?" Could This Ease Market Downturn? Detailed Analysis of the Privacy DA ZK Engine Orochi Network

TRON Industry Weekly Report Summary

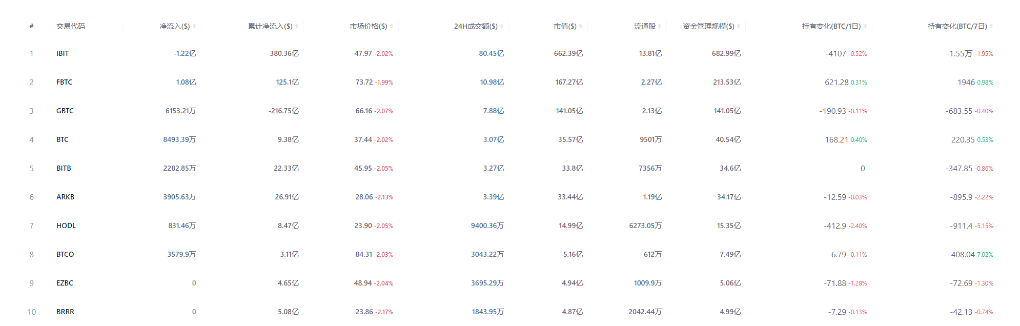

Crypto ETF Weekly Report | Last week, US Bitcoin spot ETFs saw a net outflow of $1.216 billion; US Ethereum spot ETFs saw a net outflow of $500 million

BlackRock has registered the iShares Ethereum Staking ETF in Delaware.

CEX suffers massive outflows: Who is draining the liquidity?