News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

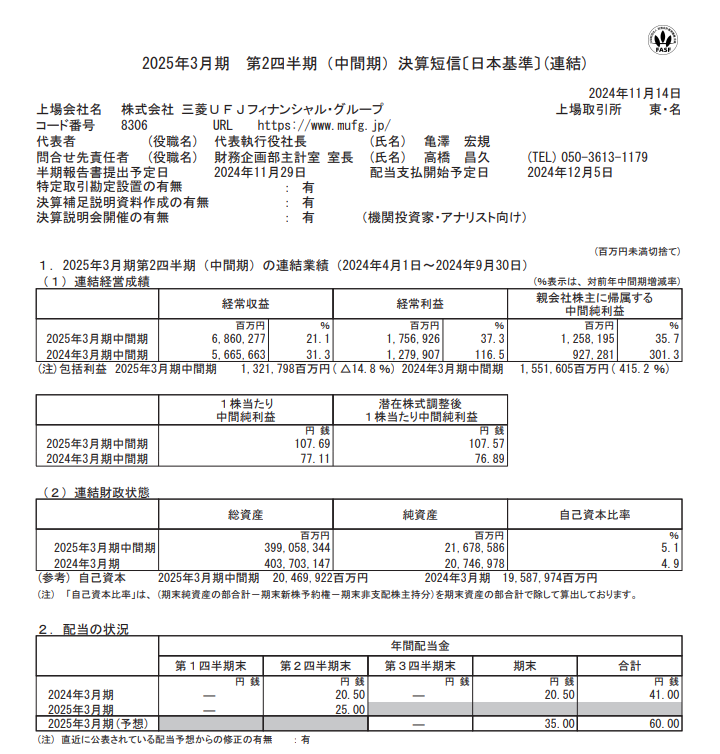

三菱日联金融:上半财年净利润1.26万亿日元,同比增长35.7%

moomoo-证劵·2026/02/28 09:06

Nansen Boosts User Engagement with AI-Led DeFi Rewards via UnifAI

BlockchainReporter·2026/02/28 09:03

The Boeing Company (BA) Builds Momentum with Wide-Body and 737 MAX Orders from Vietnam

Finviz·2026/02/28 09:03

Caterpillar Inc. (CAT) Strengthens Data Mining Technology Portfolio After Record Sales

Finviz·2026/02/28 09:00

River Oaks Capital: A Broad Overview of the Micro-Cap Exploration Platform

101 finance·2026/02/28 08:45

The Decreasing Convenience Yield and the Impact of Quantitative Tightening

101 finance·2026/02/28 08:21

Pundit: $50–$100 XRP Is Inevitable By Christmas If Trump Makes This Move

TimesTabloid·2026/02/28 08:09

Evaluating the Strategic and Financial Consequences of the US-Israel Attack on Iran

101 finance·2026/02/28 08:06

Instacart: A Conviction Buy for Quality Growth Portfolios?

101 finance·2026/02/28 08:01

Flash

15:42

Bloomberg: Bitcoin’s 24/7 trading makes it the most liquid asset for expressing macro views when other markets are closedBlockBeats News, February 28, according to Bloomberg, as tensions escalate between the United States, Israel, and Iran, traders are turning to crypto trading platforms for round-the-clock hedging. On Hyperliquid, oil-linked perpetual contracts rose by about 6.2% to $70.6 per barrel, while gold and silver perpetual contracts increased by over 5% and 8% respectively, reaching $5,464 and $97.5 per ounce. The trading volume of silver perpetual contracts exceeded $400 million in the past 24 hours, while gold contracts saw nearly $140 million in volume. US stock index contracts on the platform fell by 1% to 2%. The Iran conflict triggered safe-haven sell-offs in the crypto market, with bitcoin dropping as much as 3.8% to $63,038 before stabilizing near $64,000; ETH fell as much as 4.5% to $1,836. According to CoinGecko data, the total market capitalization of digital assets evaporated by about $12.8 billion after the outbreak of the conflict. Jake Ostrovskis, Head of OTC Trading at Wintermute, stated that because bitcoin trades around the clock, it has become the most liquid asset for traders to express macro views when other markets are closed, and more asset classes are moving toward 24/7 trading. Felix co-founder Charlie Ambrose said this is yet another weekend of 24/7 price discovery through perpetual contracts on Hyperliquid, which is expected to drive a macro shift in how global markets operate.

15:32

Data: In the past 24 hours, total liquidations across the network reached $503 millions, mainly long positions.ChainCatcher News, according to CoinGlass data, the total amount of liquidations in the cryptocurrency market over the past 24 hours reached $503 million, of which long positions accounted for $363 million and short positions accounted for $140 million.

15:03

A certain whale sold 500 PAXG in the past 6 hours, with an estimated profit of $217,000.PANews reported on February 28 that, according to monitoring by Lookonchain, the whale 0x6Afa, who bought 1,343 PAXG (worth $7.08 million) at an average price of $5,269 one month ago, has started selling to take profits. In the past 6 hours, he sold 500 PAXG (worth $2.74 million) at an average price of $5,480, and still holds 843 PAXG (worth $4.55 million), earning a profit of $217,000.