News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Macro headwinds test Bitcoin price as $70K crumbles amid US market volatility2Trump filling Democratic seats at SEC, CFTC could advance crypto bill talks, TD Cowen says3Bitcoin price ignores $168M Strategy buy, and falls as Iran tensions escalate

Japan’s Top Brokerages Move Into Crypto As Regulators Draft New Rules

Cointurk·2026/02/20 01:21

Driven by Soaring Gold Prices, Newmont Mining's Q4 Sales Surge

新浪财经·2026/02/20 01:20

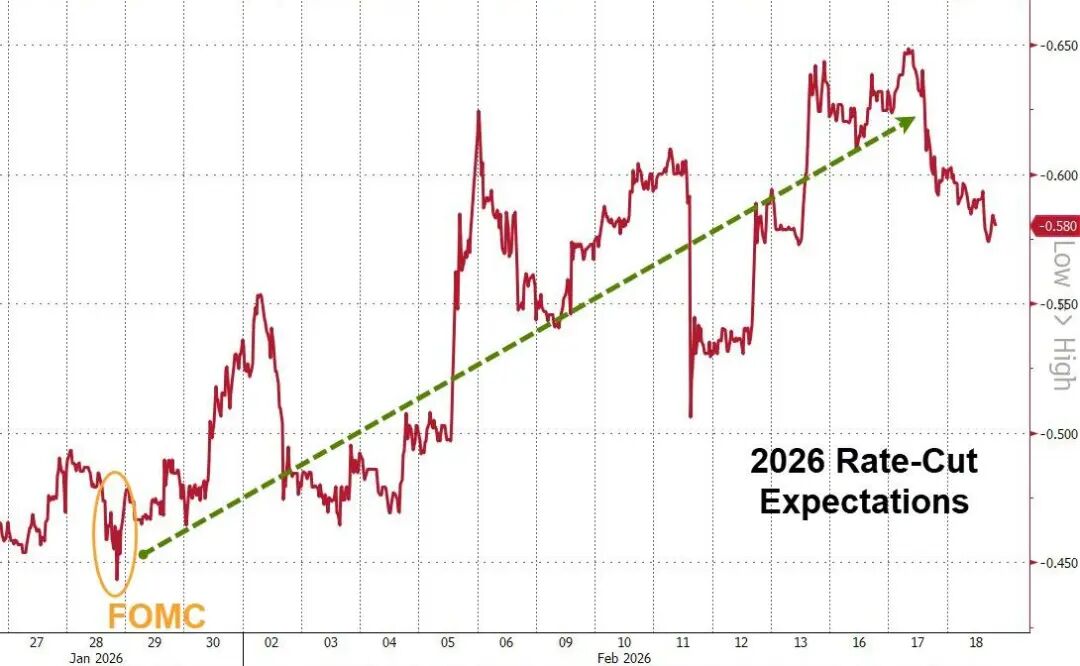

Federal Reserve Meeting Minutes Reveal Major Disagreements

金融界·2026/02/20 01:12

Ripple chief confirms White House crypto talks

Grafa·2026/02/20 01:09

Nvidia expands its initial involvement in India’s AI startup landscape

101 finance·2026/02/20 01:03

Nvidia expands its initial involvement in India’s AI startup landscape

101 finance·2026/02/20 00:57

EUR/USD, GBP/USD Outlook: Major levels intersect amid macroeconomic uncertainty

101 finance·2026/02/20 00:39

Flash

01:26

Automatic yield on stablecoin balances is expected to be banned, dealing another blow to crypto legislationBlockBeats News, February 20, according to crypto journalist Eleanor Terrett, the third meeting this morning on the "Cryptocurrency Market Structure Bill" (i.e., the CLARITY Act) regarding stablecoin yield issues was smaller in scale than last week. Attendees included representatives from an exchange, Ripple, a16z, and crypto industry associations, with no bank representatives attending individually; the voice of the banking industry was conveyed through industry associations. There was a significant difference in this meeting: the White House led the discussion, rather than allowing crypto companies and banks to lead as in previous meetings.Patrick Witt, Executive Director of the White House Crypto Committee, brought a draft text that became the focus of the discussion. The text acknowledged the concerns raised by banks last week in the "Yield and Interest Prohibition Principle" document, and at the same time made it clear that in stablecoin-related legislation, a key goal of the crypto industry—earning yield on idle stablecoin balances—will be prohibited (Earning yield on idle balances is effectively off the table). The focus of the debate has now narrowed to whether crypto companies can offer stablecoin rewards tied to specific activities.The concerns of banks seem to stem more from competitive pressure rather than the initially assumed worry about deposit outflows. Sources from the banking sector said they are still striving to include a deposit outflow study in the draft—this study would examine the growth of payment stablecoins and their potential impact on bank deposits. In addition, the banking industry is encouraged by the proposed anti-avoidance clause, which would grant the U.S. Securities and Exchange Commission, the Treasury Department, and the Commodity Futures Trading Commission the authority to enforce the ban on paying yields on idle balances, and impose a civil penalty of $500,000 per violation per day.Sources said there is a possibility that discussions could be finalized by the end of the month, and negotiations will continue in the coming days.

01:26

Matrixport: The crypto market is approaching a critical juncture, with continued liquidity outflows and volatility resettingPANews reported on February 20 that Matrixport released a research report on the X platform, pointing out that bitcoin has recently experienced a rapid decline, with option implied volatility once surging and then partially retreating. The price of bitcoin dropped from around $85,000 to a low near $60,000, before stabilizing at around $66,000. Meanwhile, the implied volatility for options expiring in March 2026 quickly rose from just above 40% to a panic high close to 65%, reflecting a strong demand for downside protection during the decline. Subsequently, implied volatility fell back to around 50%, indicating that some tail risk hedges are being unwound and short-term pressure has eased. The crypto market is approaching a critical inflection point: volatility remains high, sentiment hovers at extremely low levels, and market liquidity continues to flow out. Traders are gradually unwinding crash hedges, overall positions have become significantly lighter, and participation has also dropped markedly. Historically, this combination of characteristics often appears before major directional market moves. Although the macro environment has improved, crypto asset prices have yet to follow significantly, and such divergence is usually difficult to sustain for long.

01:22

Abundia Global Impact Group Inc. (AGIG) has officially finalized the terms for the direct registration offering of its common stock.The issuance size this time is $20 million, and the company will offer common shares to specific institutional investors. This registered direct offering is conducted pursuant to an effective registration statement with the U.S. Securities and Exchange Commission (SEC), utilizing a market-standard pricing mechanism. The company plans to use the proceeds for general working capital needs and strategic growth initiatives, aiming to further advance its global impact investment business. Through this financing, Abundia Global Impact Group will strengthen its capital structure and provide financial flexibility to execute its long-term strategy. The transaction is expected to close upon satisfaction of customary closing conditions.

News