News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin ETFs rebound with $166.5M inflows despite BTC price dip2Crypto Allocation in Asia: BlackRock’s Stunning $2 Trillion Prediction Reveals Institutional Shift3Solana Extends Losses Below $88 as Crypto Market Downturn Deepens

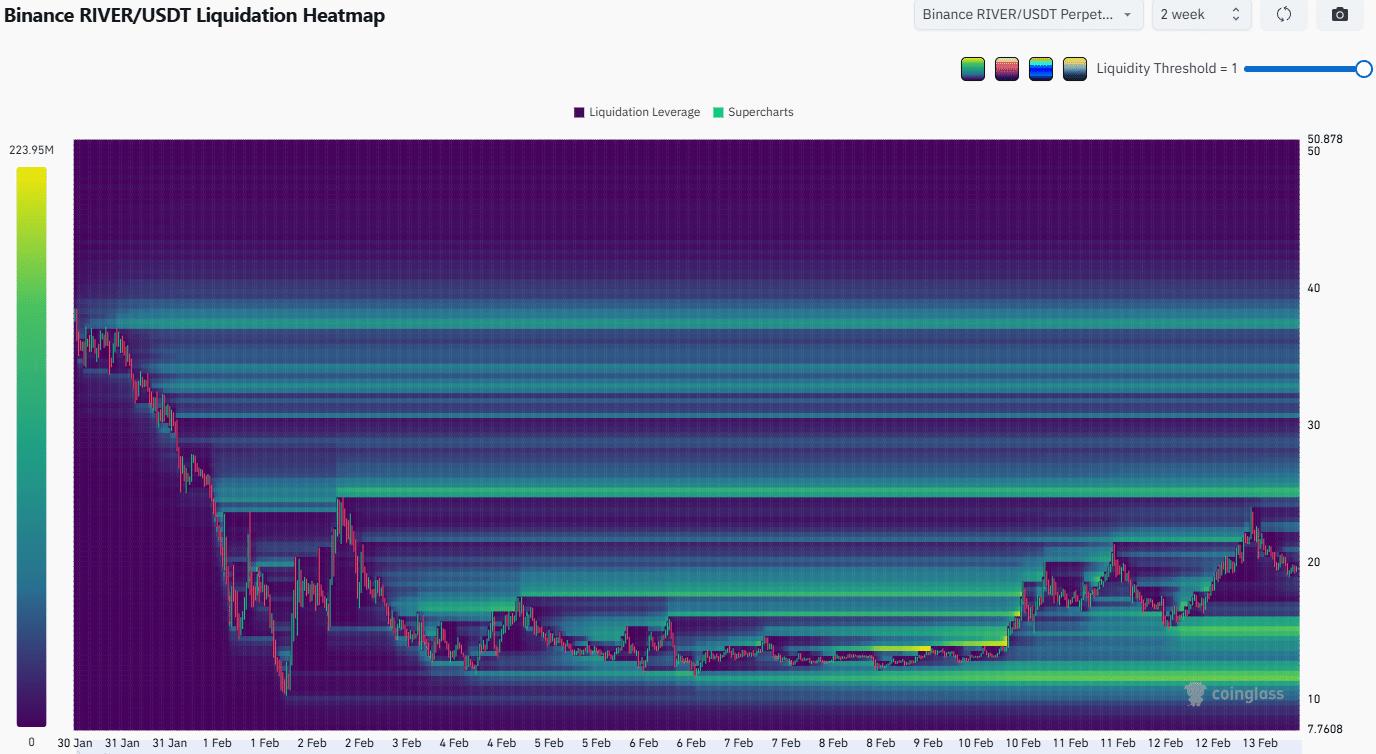

RIVER price prediction: Why its next move hinges on liquidity at $25

AMBCrypto·2026/02/14 01:03

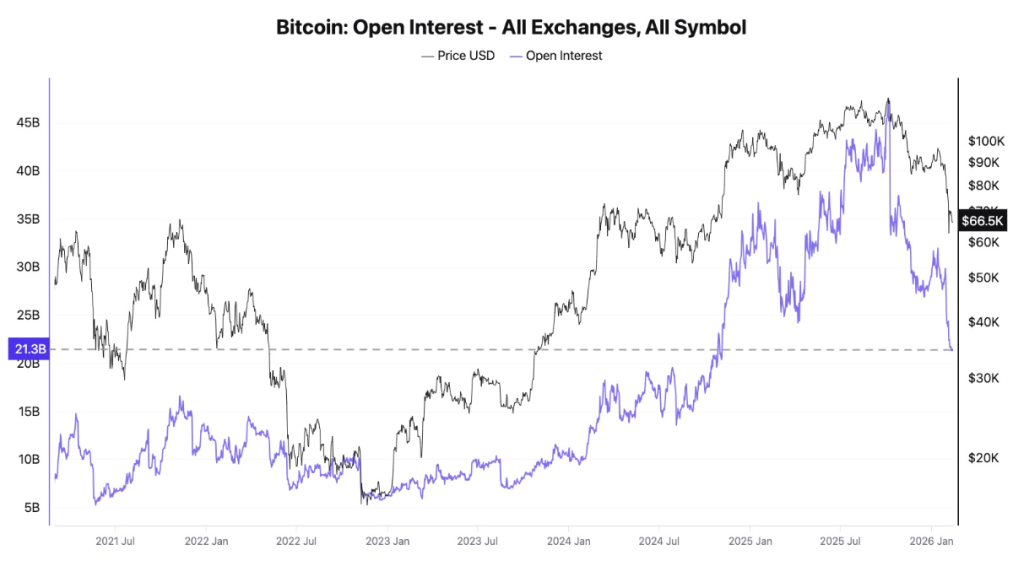

Bitcoin Price Bottom Not In Yet? Data Signals More Pain Ahead

Coinpedia·2026/02/14 00:30

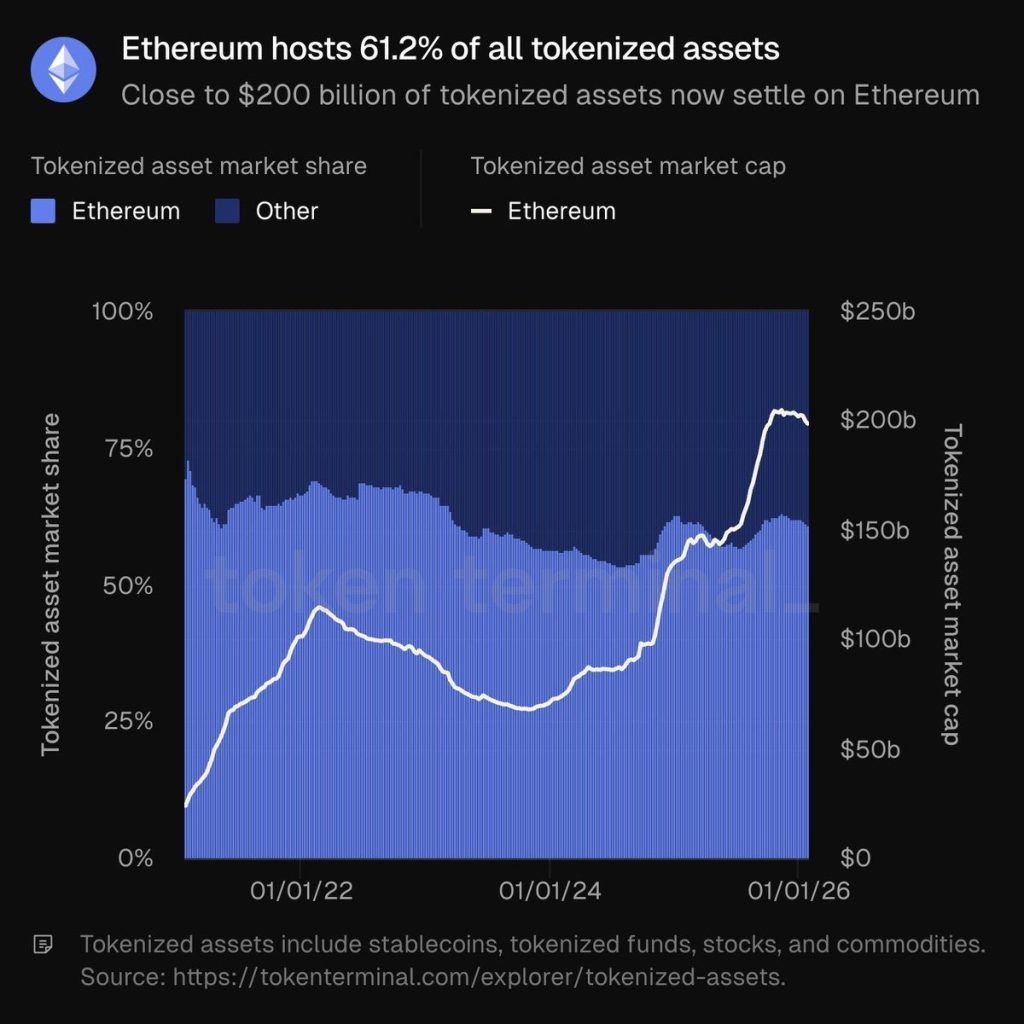

Ethereum’s Tokenization Boom Sparks $5,000 Speculation—Is an ETH Price Breakout Incoming?

Coinpedia·2026/02/14 00:30

MYX Finance Price Rebounds as Crypto Market Eases After CPI — Can It Rally 50%?

Coinpedia·2026/02/14 00:30

Top Altcoins to Stack for Possible 500x Gains

Coinpedia·2026/02/14 00:30

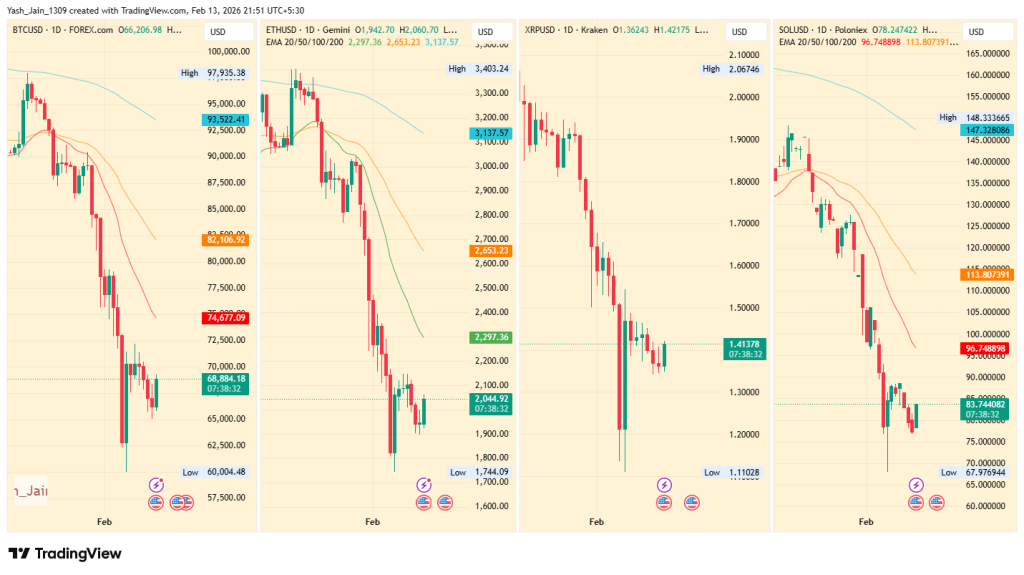

Why is the Crypto Market Up Today? BTC, ETH, XRP, SOL is Up as Inflation Cools

Coinpedia·2026/02/14 00:30

Crypto Rally Alert: Why Bitcoin and Ethereum Prices Are Moving Higher Today

Coinpedia·2026/02/14 00:30

Disney’s Stock Has Remained Stagnant During Iger’s Tenure: Will D'Amaro Bring a Shift?

101 finance·2026/02/14 00:27

FedEx (FDX) Outpaces Stock Market Gains: What You Should Know

Finviz·2026/02/14 00:18

Lennar (LEN) Exceeds Market Returns: Some Facts to Consider

Finviz·2026/02/14 00:18

Flash

01:29

Grayscale plans to convert its AAVE Trust into a spot ETFBlockBeats News, February 14, according to The Block, Grayscale has submitted an application to the US Securities and Exchange Commission (SEC), planning to convert its closed-end AAVE Trust into an ETF, which is intended to be listed on NYSE Arca. This ETF will charge a 2.5% NAV sponsor fee (payable in AAVE), and a certain exchange will serve as the custodian and primary broker.

01:26

US Treasury Secretary Besant: If Democrats control the House after the midterm elections, the prospects for passing the CLARITY Act will be completely dashedJinse Finance reported that U.S. Treasury Secretary Scott Bessent stated that in the context of the current prolonged market downturn, promoting the passage of the CLARITY Act could help improve market sentiment. In an interview with CNBC on Friday, Bessent said that the advancement of the CLARITY Act has been hindered due to concerns from crypto industry executives, which has had a negative impact on the industry. He stated: "During this period of historic sell-offs, I believe that if we can clarify the direction on the CLARITY Act, it will bring great confidence to the market, and we can move forward on that basis." However, Bessent added: "If the Democrats take the House, which is not what I hope for, then the prospect of reaching an agreement will be completely dashed." Bessent said that considering the 2026 midterm elections may lead to a shift in the balance of power, it is crucial to push the bill through "as soon as possible" and have it sent to President Trump for signing before the U.S. spring (late March to late June). According to data from the U.S. House of Representatives, the Republicans currently hold a narrow majority with 218 seats to 214. On Polymarket, 47% of traders believe that the 2026 midterm elections will result in a "split Congress," with each party ultimately controlling one chamber.

01:24

Polymarket official shares and quickly deletes image, suggesting POLY token airdrop may be linked to platform feesAccording to Odaily, Polymarket official Mustafa (@mustafap0ly) posted a picture on X last night and quickly deleted it. The image showed a screenshot of coding operations using Claude Code, with the task instruction: "Migrate the fee collection mechanism on the CLOB (Central Limit Order Book) from USDC.e to POLY. The relevant code is currently located in the staging branch."

News