News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin ETFs rebound with $166.5M inflows despite BTC price dip2Crypto Allocation in Asia: BlackRock’s Stunning $2 Trillion Prediction Reveals Institutional Shift3Solana Extends Losses Below $88 as Crypto Market Downturn Deepens

London Stock Exchange Group Unveils Revolutionary On-Chain Settlement System for Institutional Investors

Bitcoinworld·2026/02/13 01:51

Altcoin Season Index Surges to 33, Sparking Crucial Momentum Shift in Cryptocurrency Markets

Bitcoinworld·2026/02/13 01:51

Pocket Network Deflation: Revolutionary Programmable Economics Transforms Web3 Infrastructure

Bitcoinworld·2026/02/13 01:51

South Korea’s Crucial Crypto Oversight: Limited Market Risk Spurs Tighter Regulations

Bitcoinworld·2026/02/13 01:51

Cryptoquant says Bitcoin bottom not in

Grafa·2026/02/13 01:24

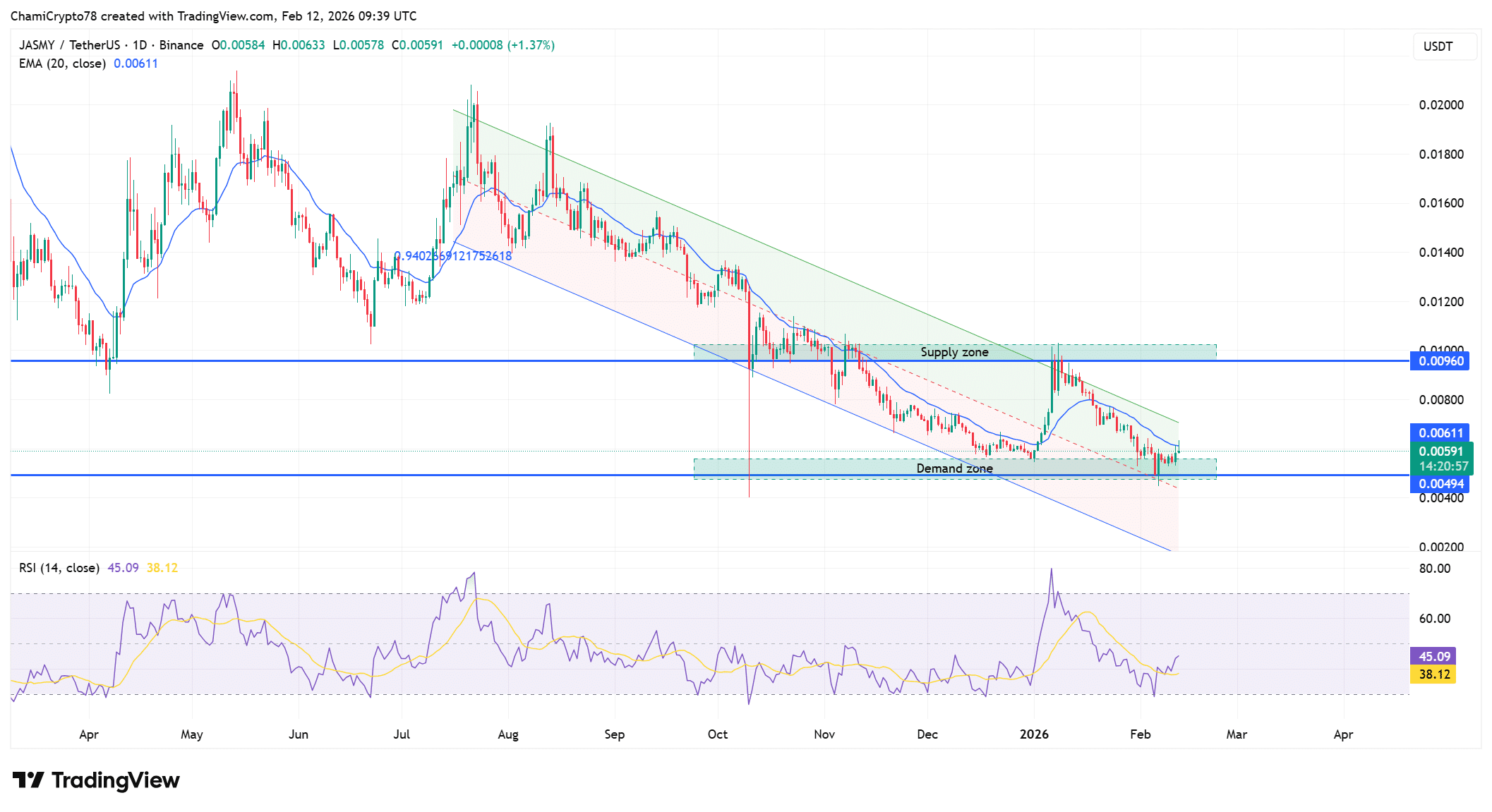

Decoding JASMY’s 204% volume surge – Is $0.0096 the next big test?

AMBCrypto·2026/02/13 01:03

AI Uncertainty Melts Away Market Gains

Finviz·2026/02/13 00:58

Here’s the Reason Behind Apple’s 5% Share Price Decline Today

101 finance·2026/02/13 00:51

Flash

01:46

JPMorgan: Singapore's budget is expected to benefit the stock marketGlonghui, February 13th|JPMorgan Securities maintained its positive outlook on the Singapore stock market after the country announced its annual budget plan. The government will inject an additional 1.5 billion Singapore dollars into the Financial Sector Development Fund. The bank pointed out that the government has also raised its estimated surplus for the 2025 fiscal year to more than double the previous forecast. Growth in the private sector is expected to be driven by a better-than-expected fiscal buffer and a strong macroeconomic backdrop. “We believe these favorable factors, in addition to the extended support from financial markets, should drive the Singapore stock market close to our target of 6,000 points,” analysts wrote in a report.

01:43

The total net outflow of US XRP spot ETFs in a single day was $6.42 million.According to Odaily, based on SoSoValue data, the total net outflow of XRP spot ETF was $6.4242 million yesterday (February 12, Eastern Time). Among them, Canary XRP ETF (XRPC) had a single-day net inflow of $1.4449 million, with the current historical total net inflow reaching $413 million. Grayscale XRP Trust ETF (GXRP) had a single-day net outflow of $8.9104 million, with the current historical total net inflow reaching $131 million. As of the time of publication, the total net asset value of XRP spot ETFs is $971 million, with an XRP net asset ratio of 1.18%, and the historical cumulative net inflow has reached $1.224 billion.

01:43

The long position holders who have accumulated 105,000 ETH added 3,000 more ETH long positions 5 hours ago.PANews, February 13th – According to on-chain analyst @ai_9684xtpa, ETH has once again fallen below $2,000, and the "bulls who have accumulated long positions of 105,000 ETH" have added back 3,000 ETH. Five hours ago, they increased their position by 3,000 ETH at the $1,919 level. The single address's long position has returned to 60,000 ETH, and the two addresses together hold a total of 105,000 ETH, with a total value of $204 million and an unrealized loss of $10.229 million. Address 0xa5B…01D41: Holding 60,000 ETH ($116 million), opening price $2,048.9, unrealized loss of $6.36 million. Address 0x6C8…D84F6: Holding 45,000 ETH ($87.34 million), opening price $2,029.38, unrealized loss of $3.869 million.

News