Mastering Gold and Silver Grid Trading on Bitget

Since last year, the global macroeconomic landscape has become increasingly complex, leading to significant price volatility in traditional safe-haven assets like gold (XAUUSDT) and silver (XAGUSDT). Features such as range-bound oscillations, trend breakouts, and sharp rallies or pullbacks on news events make these assets a perfect match for grid trading strategies. As a leading derivatives trading platform, Bitget not only supports crypto grid trading but has also launched futures grid bots for gold (XAUUSDT) and silver (XAGUSDT). Users can now trade gold and silver futures grids 24/7 using USDT as margin.

Today, we'll break it down in plain language: What are gold and silver grids? How do you trade them on Bitget? What are the potential earnings? What are the key advantages?

1. What is gold and silver grid trading?

In simple terms, grid trading is an automated strategy that buys low and sells high within a preset price range at fixed intervals, repeatedly capturing profits from price fluctuations.

Let's use a real-life example (using gold):

● Assume the current gold price is $3050 per ounce.

● You believe the price will likely fluctuate between $3000 and $3150 in the short term.

● You set up your grid on Bitget's futures grid bot:

○ Lowest price: $3000

○ Highest price: $3150

○ Number of grids: 20 (approximately $7.5 per grid)

○ Direction: Neutral (two-way grid) or long

○ Leverage: 10–50x (allowing smaller capital to capture bigger swings)

→ The system automatically places buy orders at prices like $3000, $3007.5, $3015... up to $3142.5.

→ It places sell orders at prices like $3007.5, $3015... up to $3150.

As long as the price swings within this range, the bot continuously buys and sells for a profit after a slight rise, buys again when it dips, then sells again on the next rise. You don't have to do anything—just sit back and collect your volatility returns 24/7.

Silver tends to be more volatile (often with daily swings of 3%–6%), so grid profits can be more significant than those of gold, but this also requires wider price ranges or more robust capital management.

2. How to trade gold and silver grids on Bitget?

You can trade XAUUSDT / XAGUSDT via Bitget's futures grid bot in a few simple steps:

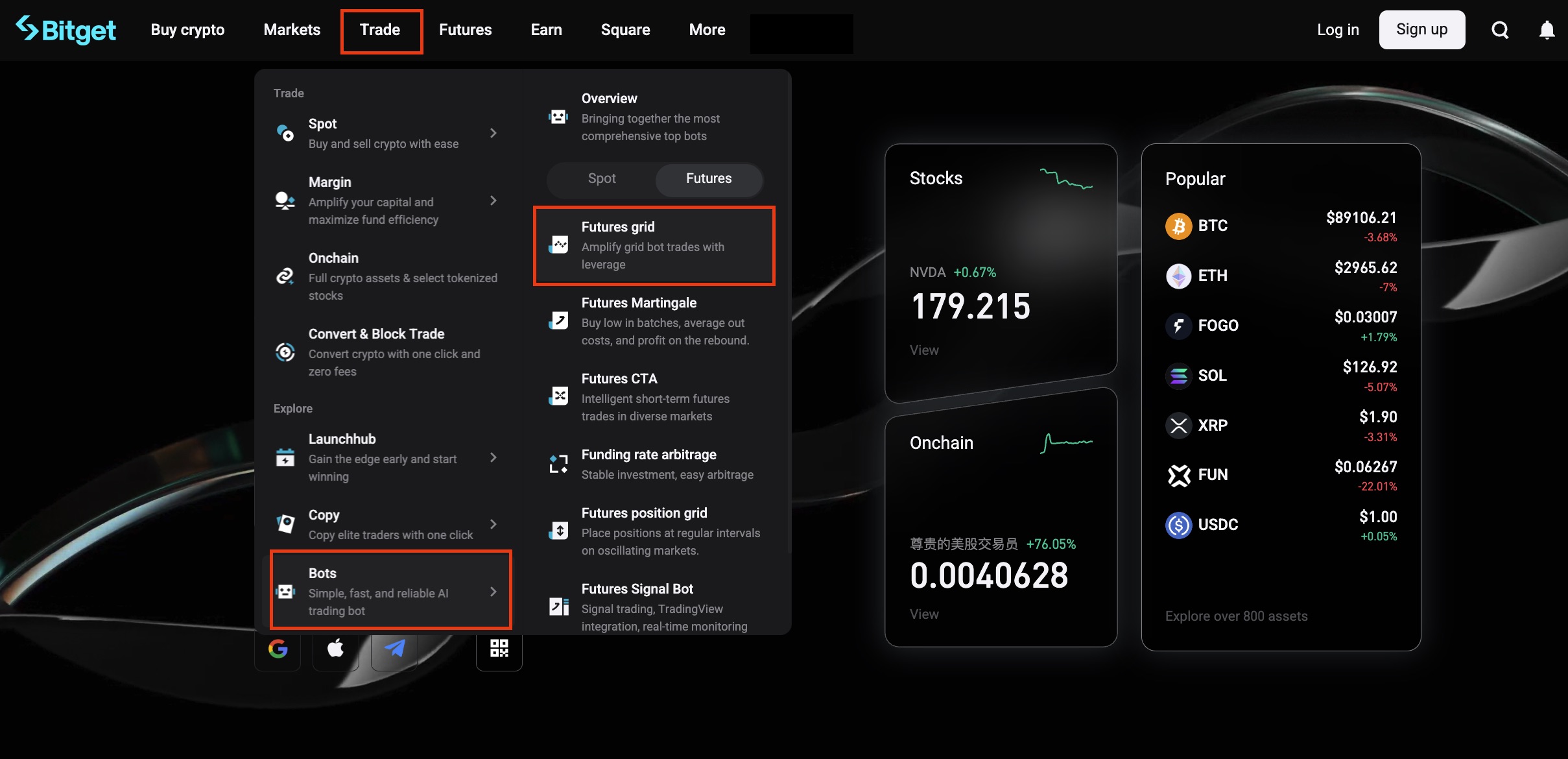

1. Log in to the Bitget app or Bitget website, go to Trade, select Bots, and then select Futures Grid.

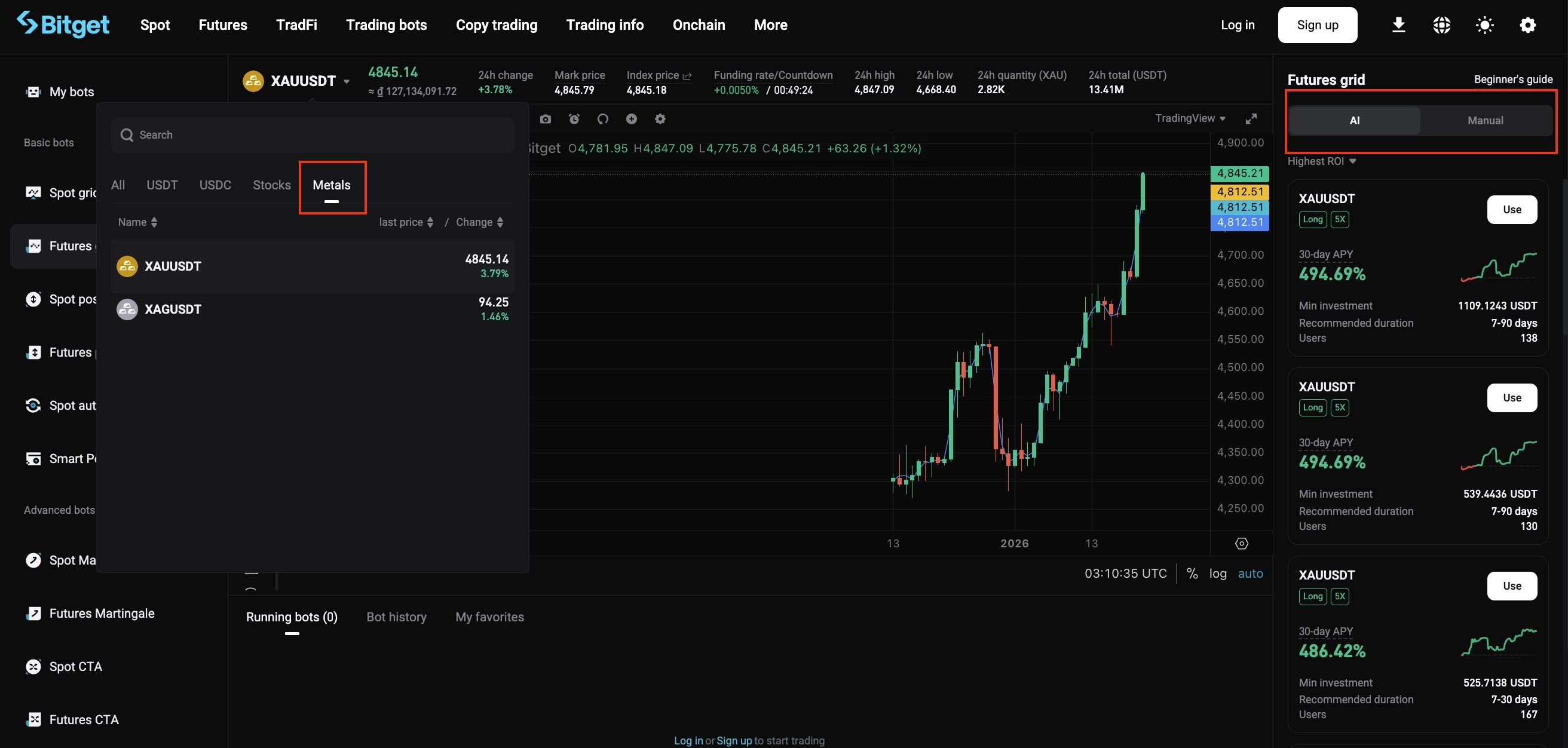

2. In the trading pair search bar, enter XAUUSDT or XAGUSDT (note that these are USDT-M perpetual futures).

3. Choose your setup method (AI is recommended for beginners):

○ AI mode: The system suggests parameters based on recent volatility (7/14/30 days) with three styles: Conservative / Balanced / Aggressive.

○ Manual mode: Set your own range, grid count, leverage, TP/SL, and others.

Common parameter suggestions:

● Gold (XAUUSDT): Range: Current price ±5%–10%. Grids: 15–40 (the more grids, the more frequent the trades). Leverage: 10x–30x (beginners ≤20x). Direction: Neutral (best for ranging markets) or long (when bullish).

● Silver (XAGUSDT) is roughly 3–4x more volatile than gold: Range: Current price ±8%–15% (needs wider range due to higher volatility). Grids: 20–60. Leverage: 5x–20x (be cautious, for higher volatility increases liquidation risk).

4. Allocate funds and confirm. The minimum investment can be as low as tens to hundreds of USDT (depending on leverage and range width).

5. Follow-up management (very important)

○ If the price breaks strongly out of the range → Adjust the range / take profit / rebuild the grid.

○ Profits can be withdrawn anytime (without stopping the bot).

○ Set overall TP/SL to protect against black swan events.

3. What are the advantages? How much can you earn?

Key advantages over traditional manual trading or simple holding:

● Profits from volatility, not just direction: Gold and Silver often trade in ranges for extended periods. Directional strategies can get stuck, while grids thrive on volatility.

● Fully automated 24/7: Earn while you sleep, eat, or travel.

● Strong compound effect: Small, frequent gains add up—annualized returns of 30%–150% or even higher are common (depending on volatility, leverage, and range settings).

● High capital efficiency: Leverage and grid allow small capital to control larger positions.

● Zero emotional interference: No panic, no greed, no chasing pumps or selling in fear.

● Silver offers higher yield potential: With the same capital, silver grid profits per trade are often 2.5–4x higher than gold's (but the risk is proportionally higher).

In a nutshell:

Gold and silver grids aren't for those seeking overnight riches, but they are ideal for mid-to-high-frequency quant traders looking to steadily profit from volatility and let time work in their favor.

4. Risk disclaimer

Grid trading is not a magic bullet. Key risks include getting stuck or selling out prematurely during strong trending markets, increased liquidation risk from high leverage, and improper parameter settings (grid spacing, price range, insufficient margin), leading to losses or poor capital efficiency. Other risks include grid failure during one-sided market conditions, high transaction fees due to frequent trades, the limitations of automated setups, and improper margin management. Continuous monitoring and adjustments are necessary to mitigate these risks.

For beginners, start with small amounts (100–500 USDT) to practice. Increase your position size only after you're comfortable. Use neutral grids in ranging markets, and combine with manual adjustments or switch directions in trending markets. Take action now. Open your Bitget app, search for XAUUSDT / XAGUSDT futures grid bot, try the AI quick setup, and experience the satisfaction of having the market pay you automatically.